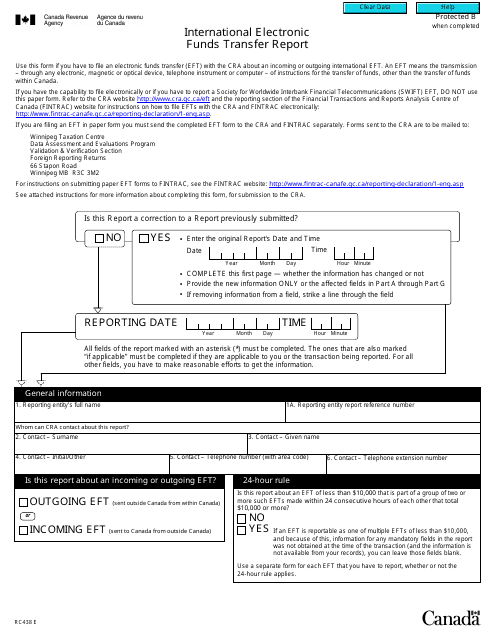

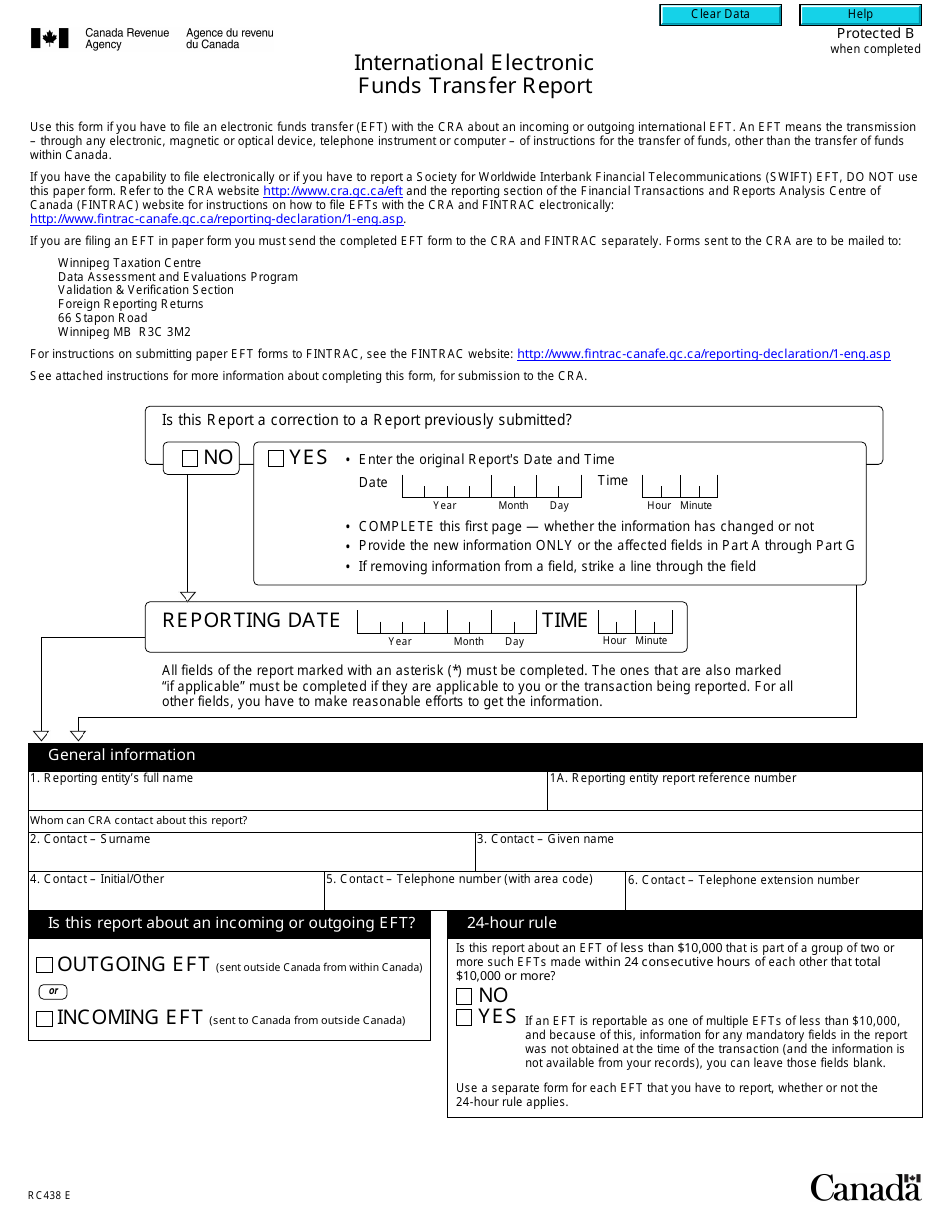

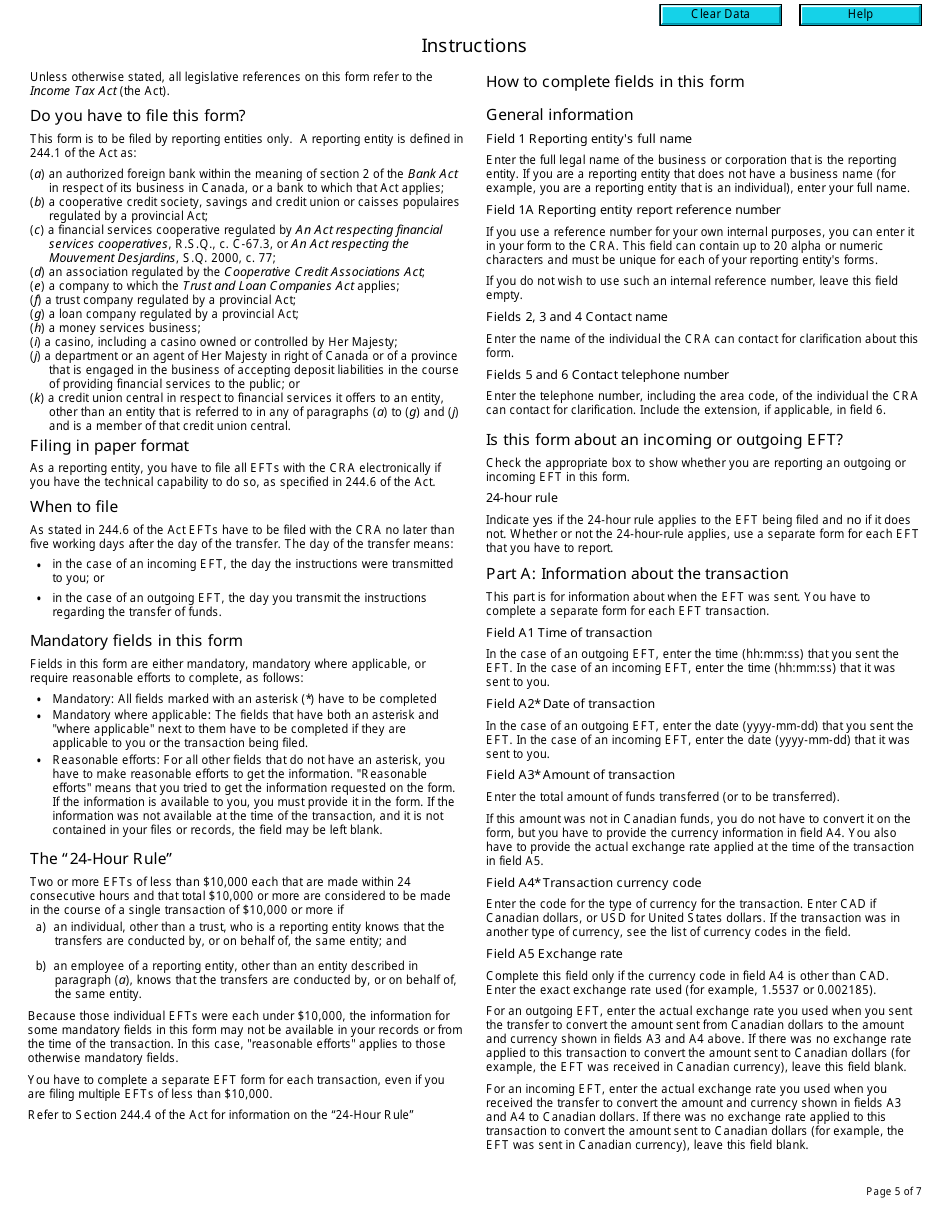

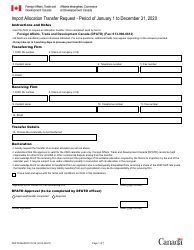

Form RC438 International Electronic Funds Transfer Report - Canada

Form RC438 International Electronic Funds Transfer Report is used by the Canada Revenue Agency (CRA) to collect information about electronic funds transfers (EFTs) sent or received by Canadian residents or entities. It helps the CRA track and prevent illegal activities such as money laundering and terrorist financing.

The Form RC438 International Electronic Funds Transfer Report is filed by certain financial institutions in Canada.

FAQ

Q: What is Form RC438?

A: Form RC438 is the International Electronic Funds Transfer Report used in Canada.

Q: Who needs to file Form RC438?

A: Any individual or business in Canada who receives or sends international electronic funds transfers (EFTs) of $10,000 CAD or more in a 24-hour period needs to file this form.

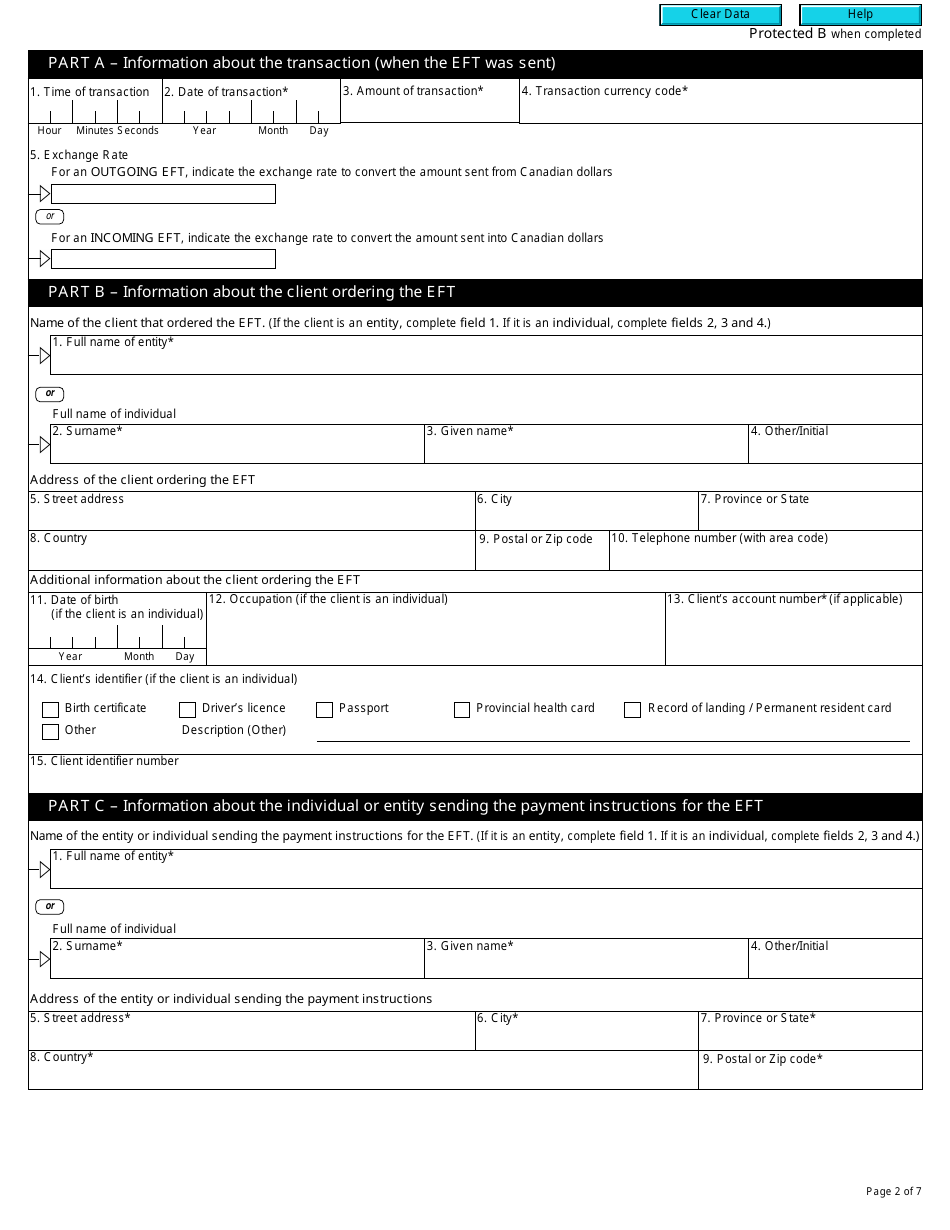

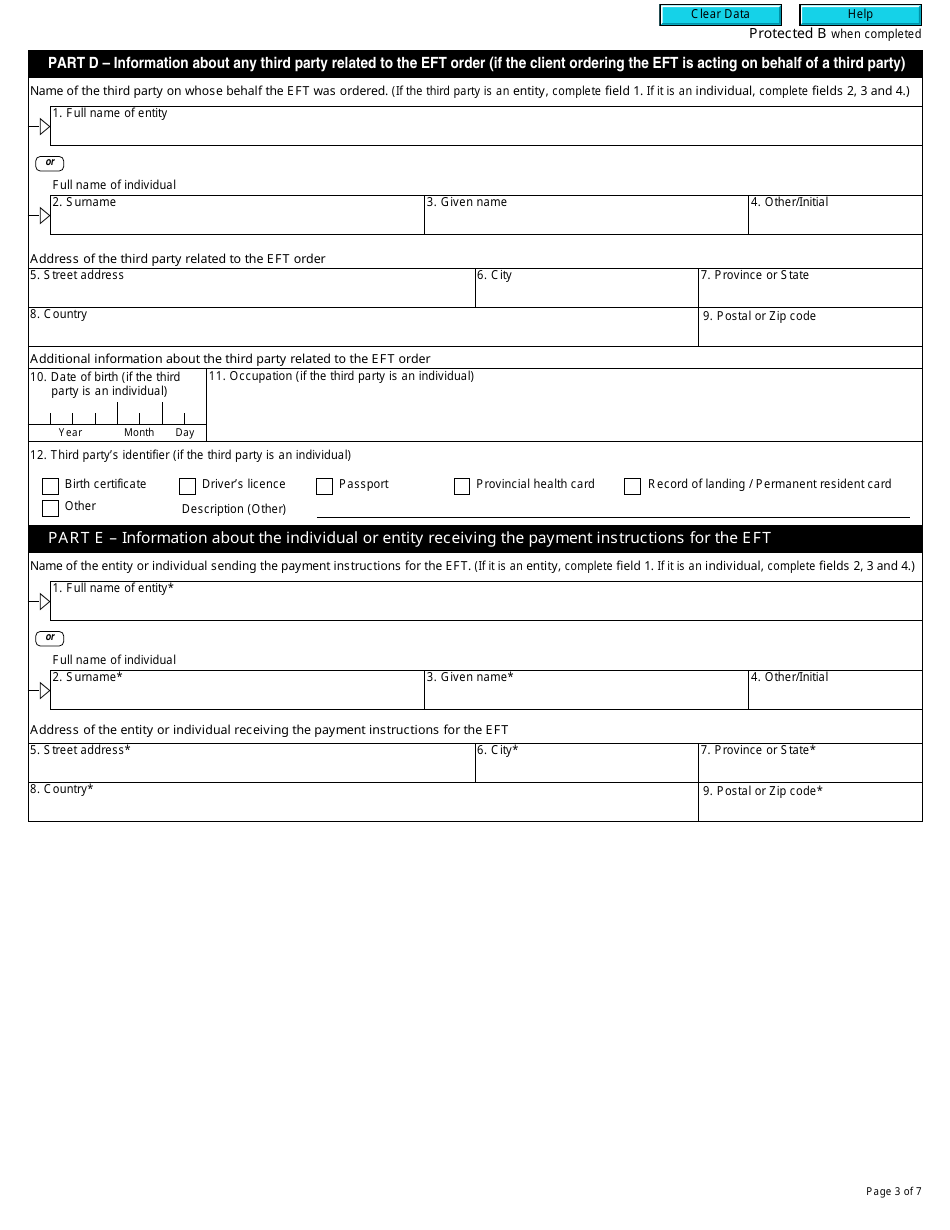

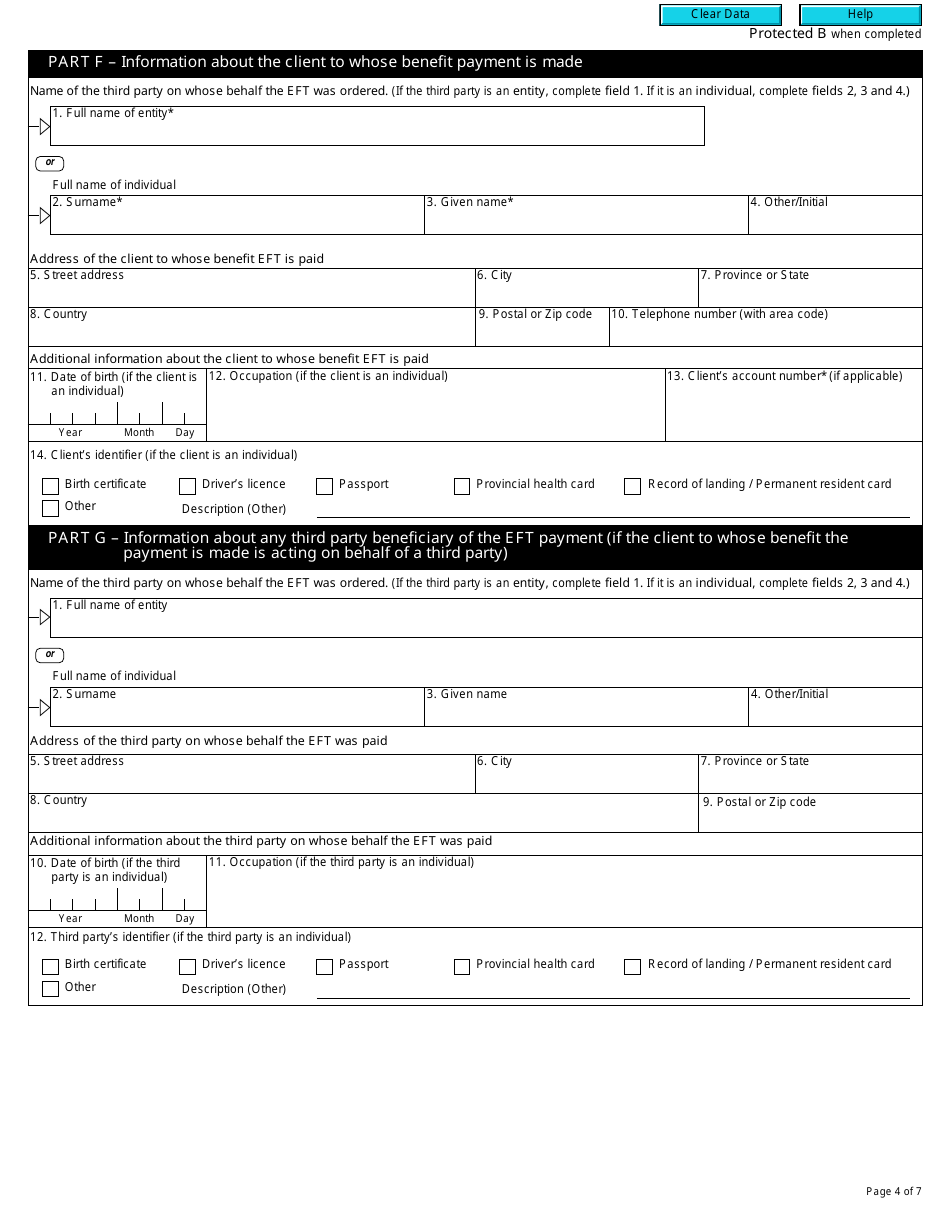

Q: What information is required on Form RC438?

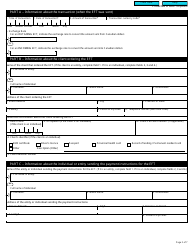

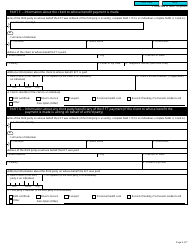

A: Form RC438 requires information such as the sender's and receiver's identification, the amount and purpose of the transfer, and relevant banking details.

Q: When should Form RC438 be filed?

A: Form RC438 must be filed within five business days of the EFT transaction. It should be submitted to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Q: Are there any penalties for not filing Form RC438?

A: Yes, there are penalties for not filing Form RC438 as required. These penalties can include fines and potential criminal charges.

Q: Can Form RC438 be filed electronically?

A: Yes, Form RC438 can be filed electronically using the FINTRAC reporting system.

Q: What happens after filing Form RC438?

A: After filing Form RC438, the information provided will be used by FINTRAC to monitor and detect any potential money laundering or terrorist financing activities.