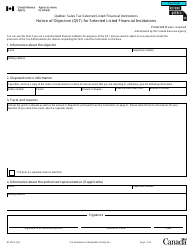

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC375

for the current year.

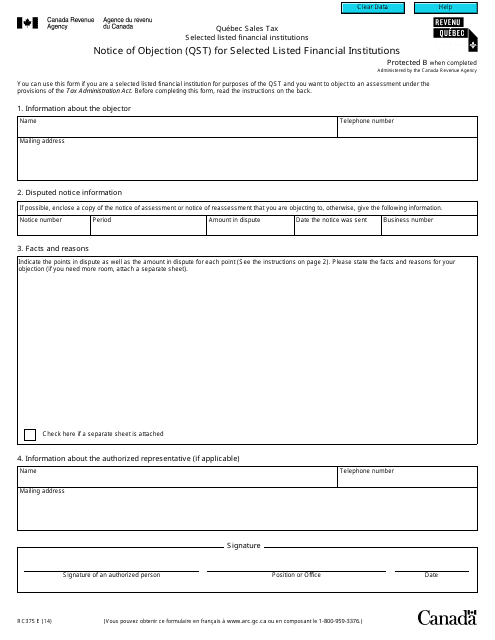

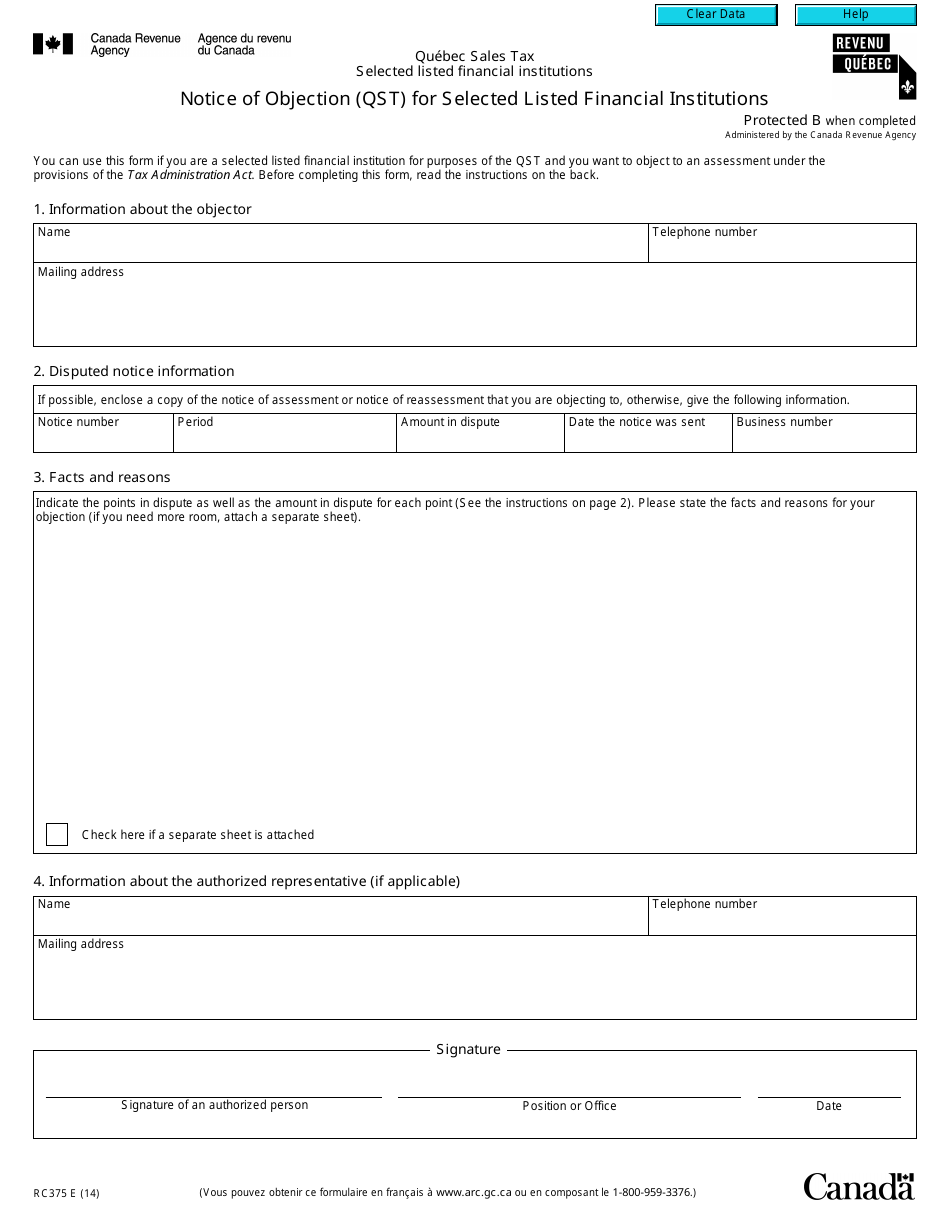

Form RC375 Notice of Objection (Qst) for Selected Listed Financial Institutions - Canada

Form RC375 Notice of Objection (Qst) for Selected Listed Financial Institutions is used in Canada to file an objection against the Quebec Sales Tax (QST) for certain financial institutions that are listed. The form allows these institutions to dispute any discrepancies or issues related to the QST.

The Form RC375 Notice of Objection (Qst) for Selected Listed Financial Institutions in Canada is filed by the selected listed financial institutions themselves.

FAQ

Q: What is Form RC375?

A: Form RC375 is a Notice of Objection (QST) for Selected Listed Financial Institutions in Canada.

Q: Who should use Form RC375?

A: Form RC375 should be used by selected listed financial institutions in Canada when notifying Canada Revenue Agency (CRA) of an objection regarding Quebec Sales Tax (QST) assessments.

Q: What is the purpose of Form RC375?

A: The purpose of Form RC375 is to formally notify CRA about the objection raised by selected listed financial institutions regarding QST assessments.

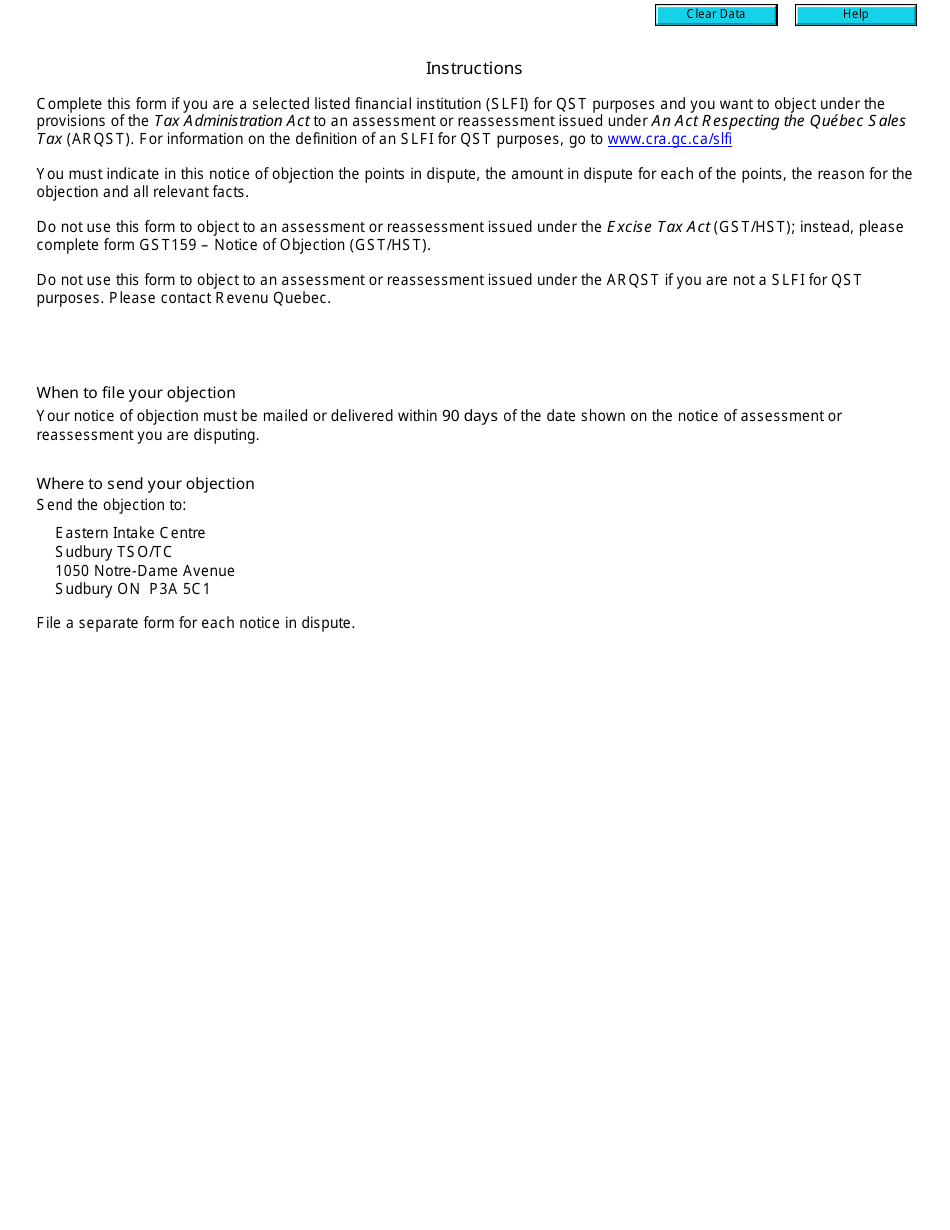

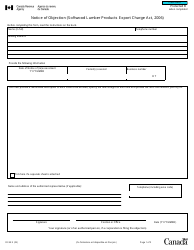

Q: How should Form RC375 be submitted?

A: Form RC375 should be submitted to the CRA by mail or fax as indicated on the form.

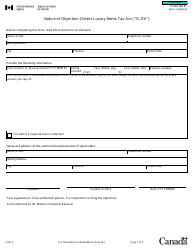

Q: What information should be included in Form RC375?

A: Form RC375 should include relevant details about the financial institution, the assessments being objected to, and the reasons for the objection.

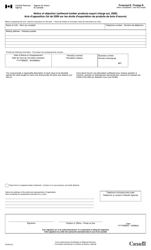

Q: When should Form RC375 be submitted?

A: Form RC375 should be submitted within the time period specified by CRA, which is generally within 90 days from the date of the assessment notice.

Q: Is there a fee for submitting Form RC375?

A: There is generally no fee for submitting Form RC375, but it is always best to check with the CRA for any potential changes in fees.

Q: What happens after submitting Form RC375?

A: After submitting Form RC375, the CRA will review the objection and communicate with the financial institution regarding further steps or resolutions.

Q: Can I appeal a decision made by the CRA after submitting Form RC375?

A: Yes, if the financial institution is not satisfied with the CRA's decision, they can appeal to the Tax Court of Canada within the specified timeframes.