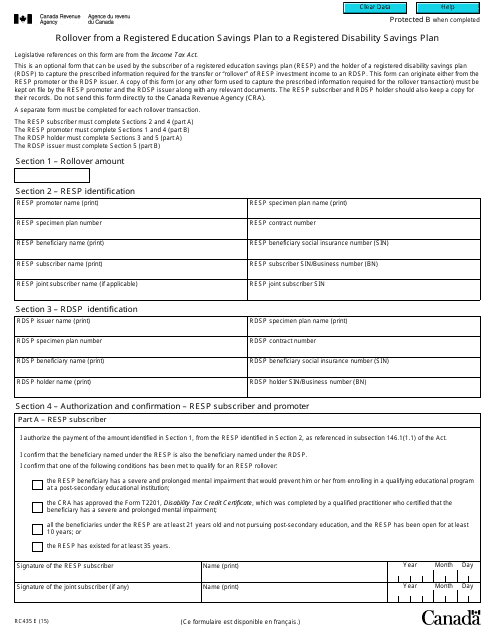

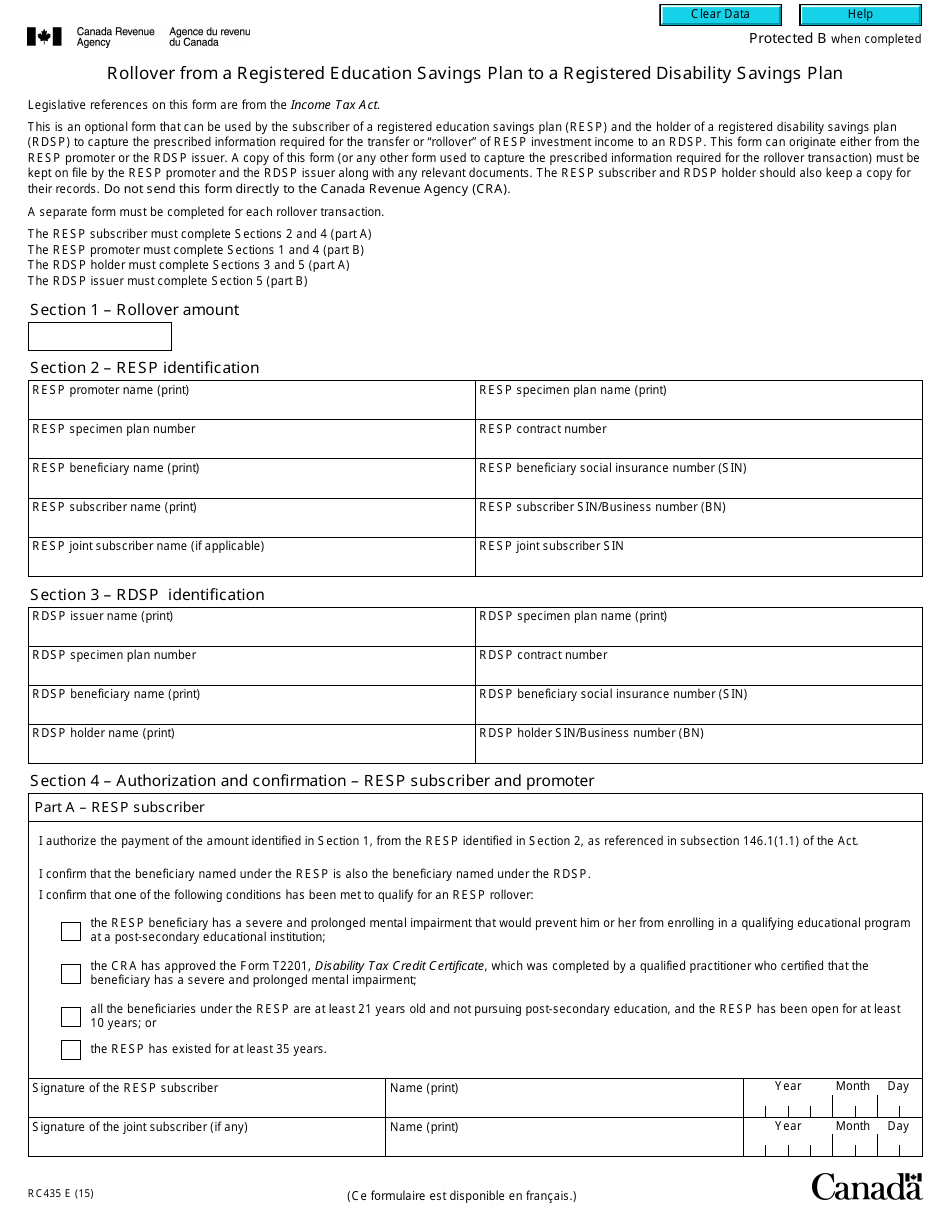

Form RC435 Rollover From a Registered Education Savings Plan to a Registered Disability Savings Plan - Canada

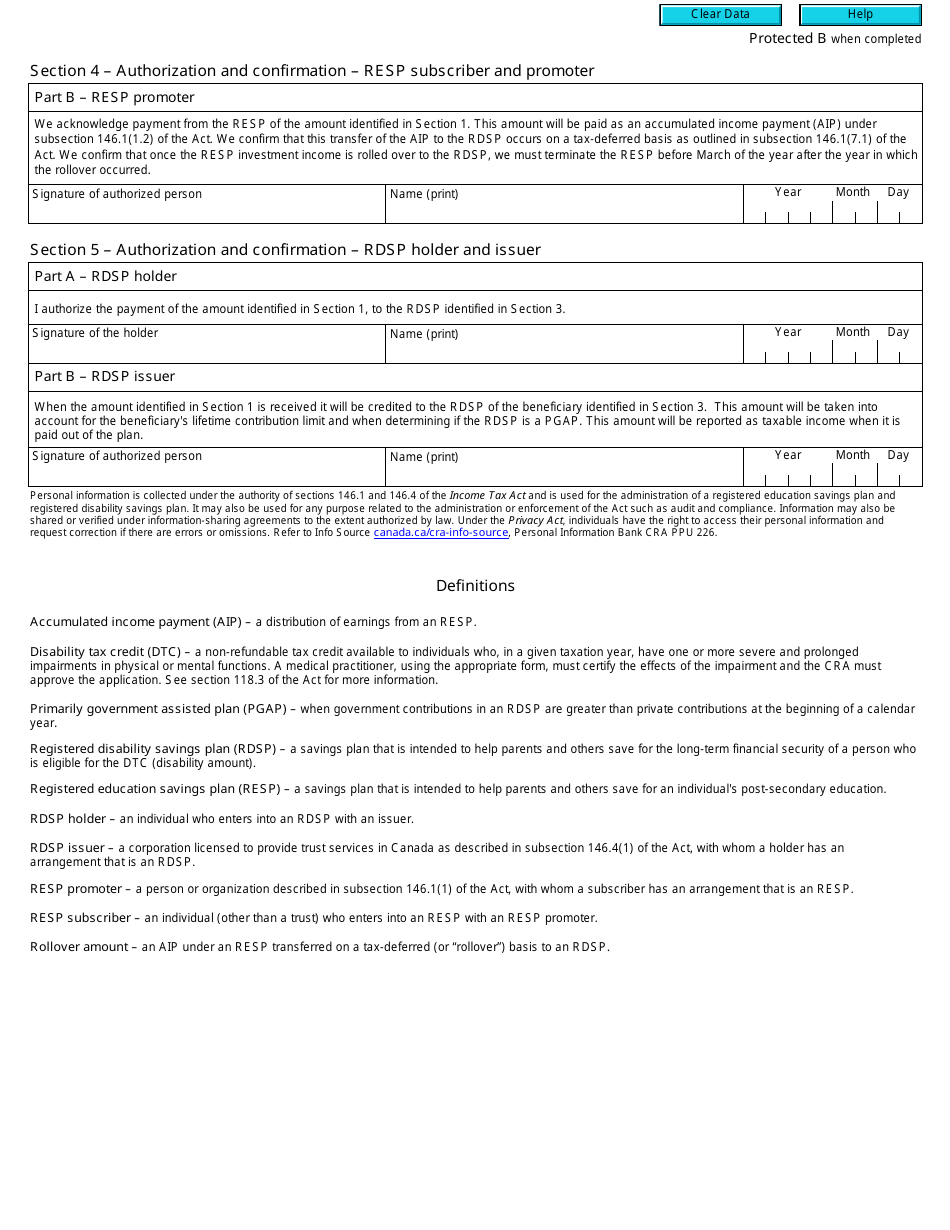

Form RC435 is used in Canada to transfer funds from a Registered Education Savings Plan (RESP) to a Registered Disability Savings Plan (RDSP). It allows individuals to save for their education and later transfer funds to support their disability-related expenses.

The individual who is the plan holder of the Registered Education Savings Plan (RESP) files the Form RC435 to apply for a rollover from an RESP to a Registered Disability Savings Plan (RDSP) in Canada.

FAQ

Q: What is Form RC435?

A: Form RC435 is a form used in Canada to rollover funds from a Registered Education Savings Plan (RESP) to a Registered Disability Savings Plan (RDSP).

Q: What is a Registered Education Savings Plan (RESP)?

A: A Registered Education Savings Plan (RESP) is a tax-advantaged savings account in Canada that helps parents save for their children's post-secondary education.

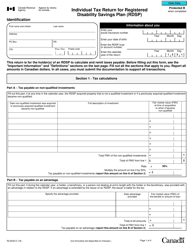

Q: What is a Registered Disability Savings Plan (RDSP)?

A: A Registered Disability Savings Plan (RDSP) is a long-term savings plan in Canada designed to help individuals with disabilities save for their future financial needs.

Q: Who can use Form RC435?

A: Parents or legal guardians who have a child with a disability can use Form RC435 to transfer funds from an RESP to an RDSP.

Q: What are the benefits of using Form RC435?

A: Using Form RC435 allows eligible individuals to transfer funds from an RESP to an RDSP without triggering a taxable event and potentially accessing additional government grants and bonds.

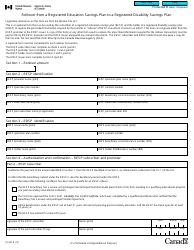

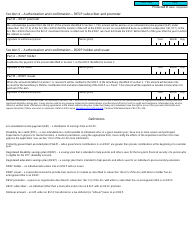

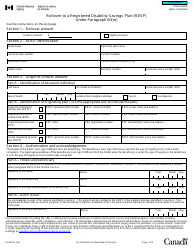

Q: How do I fill out Form RC435?

A: To fill out Form RC435, you need to provide information about the RESP account, the RDSP account, and the beneficiary. It is recommended to consult the instructions provided with the form or seek professional assistance.

Q: Are there any deadlines for using Form RC435?

A: Yes, there are certain deadlines and eligibility requirements for using Form RC435. It is advisable to consult the CRA or a financial advisor to ensure compliance with the rules.

Q: Can I make multiple transfers using Form RC435?

A: Yes, you can make multiple transfers from an RESP to an RDSP using Form RC435, as long as the eligibility criteria are met.

Q: Is there any cost associated with using Form RC435?

A: There is no specific cost associated with using Form RC435. However, there may be fees involved in setting up and managing an RDSP, as well as potential tax implications. Consult with a financial advisor for personalized advice.