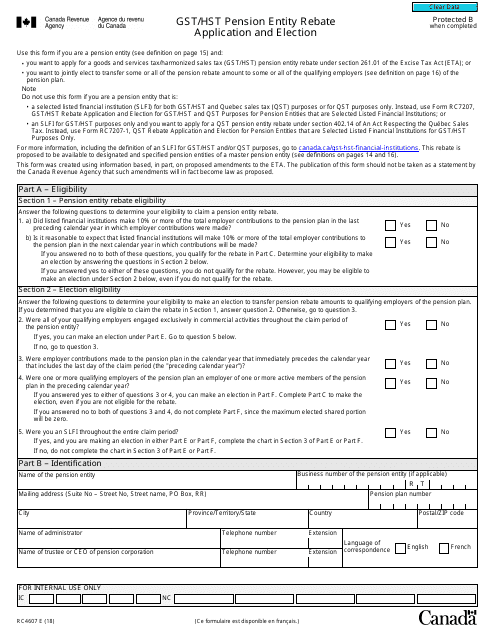

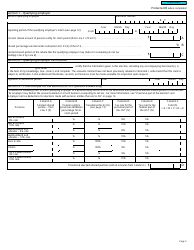

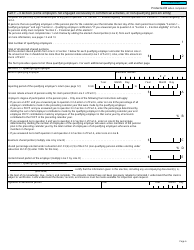

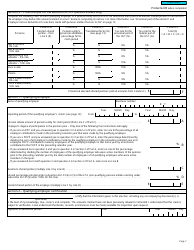

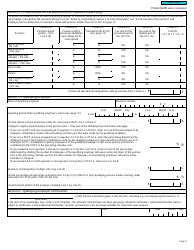

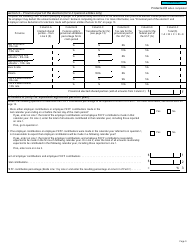

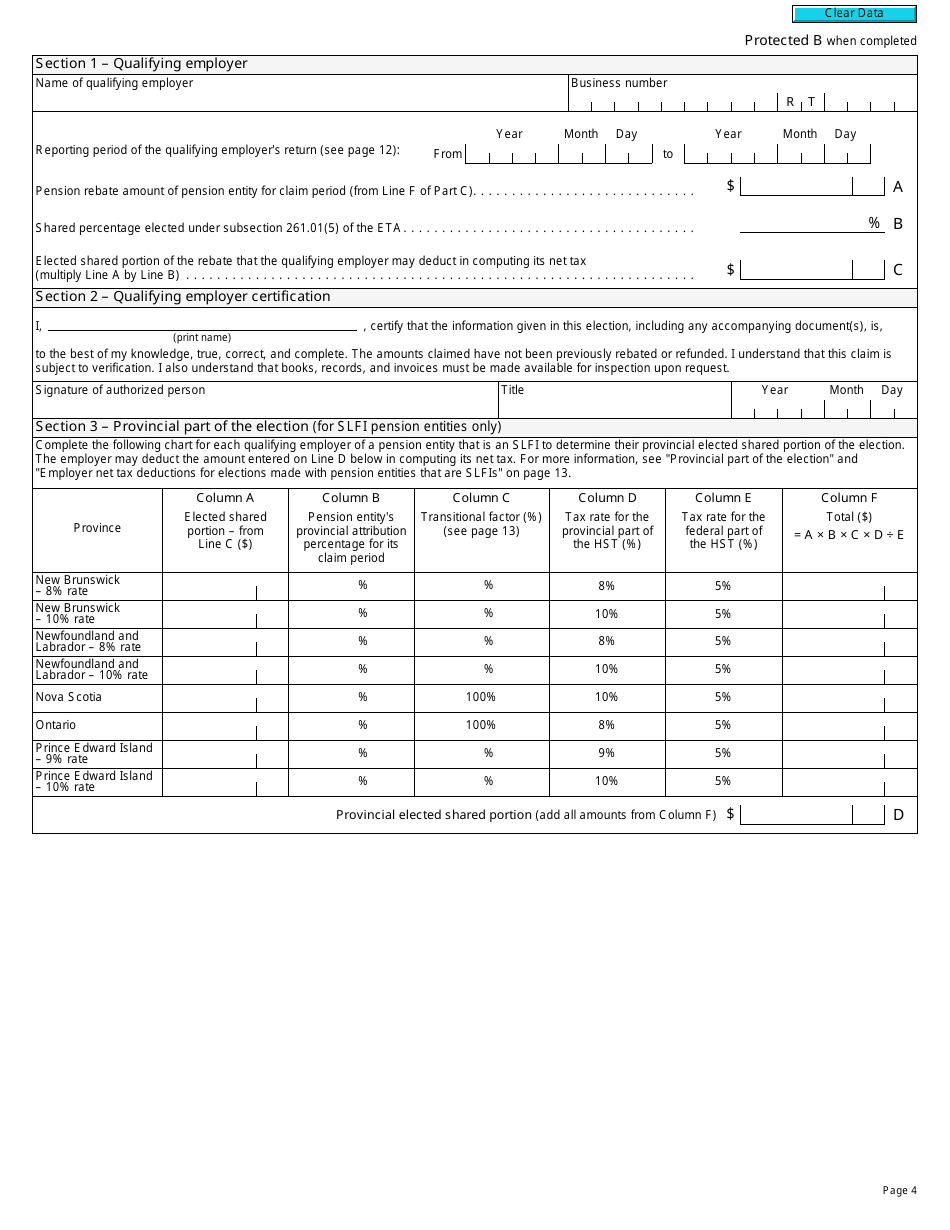

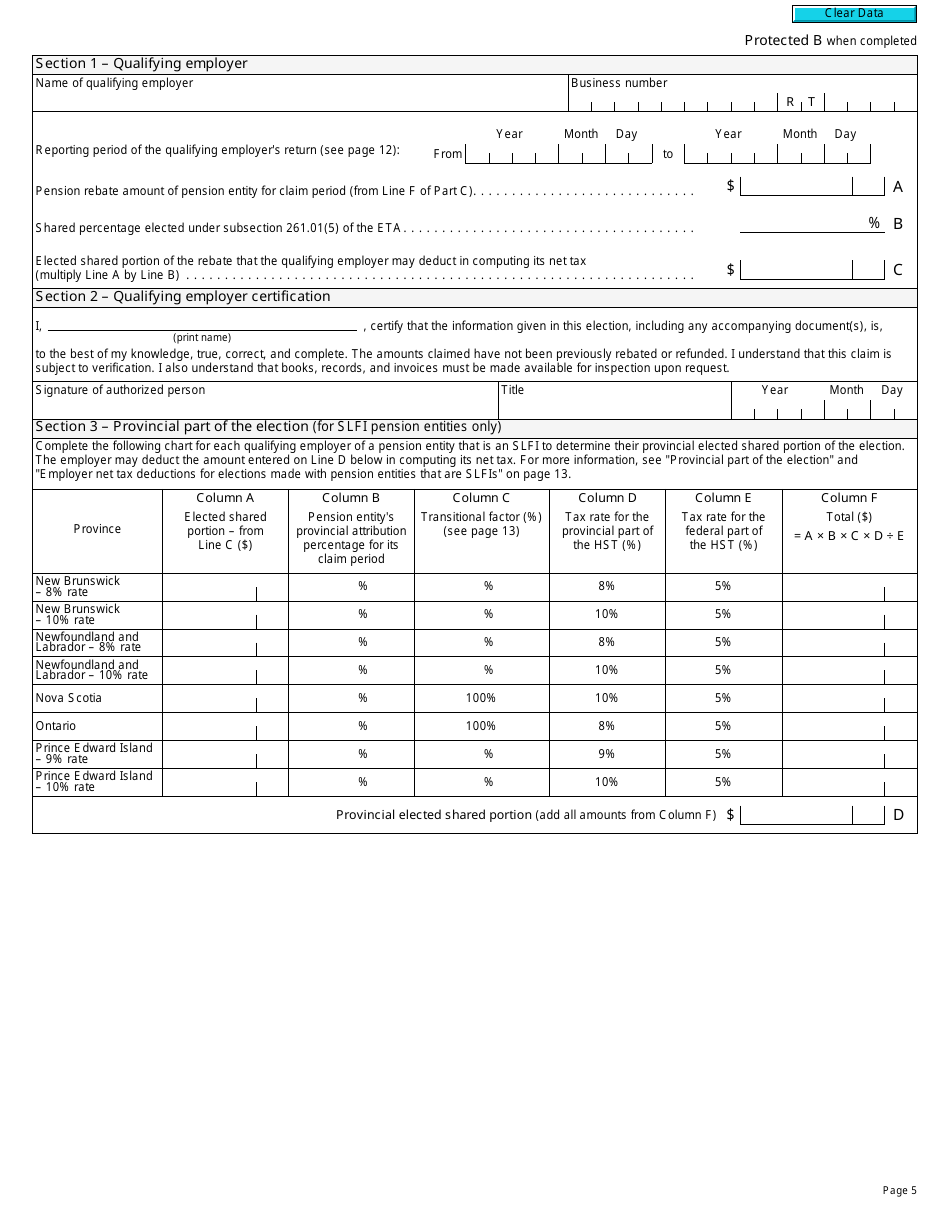

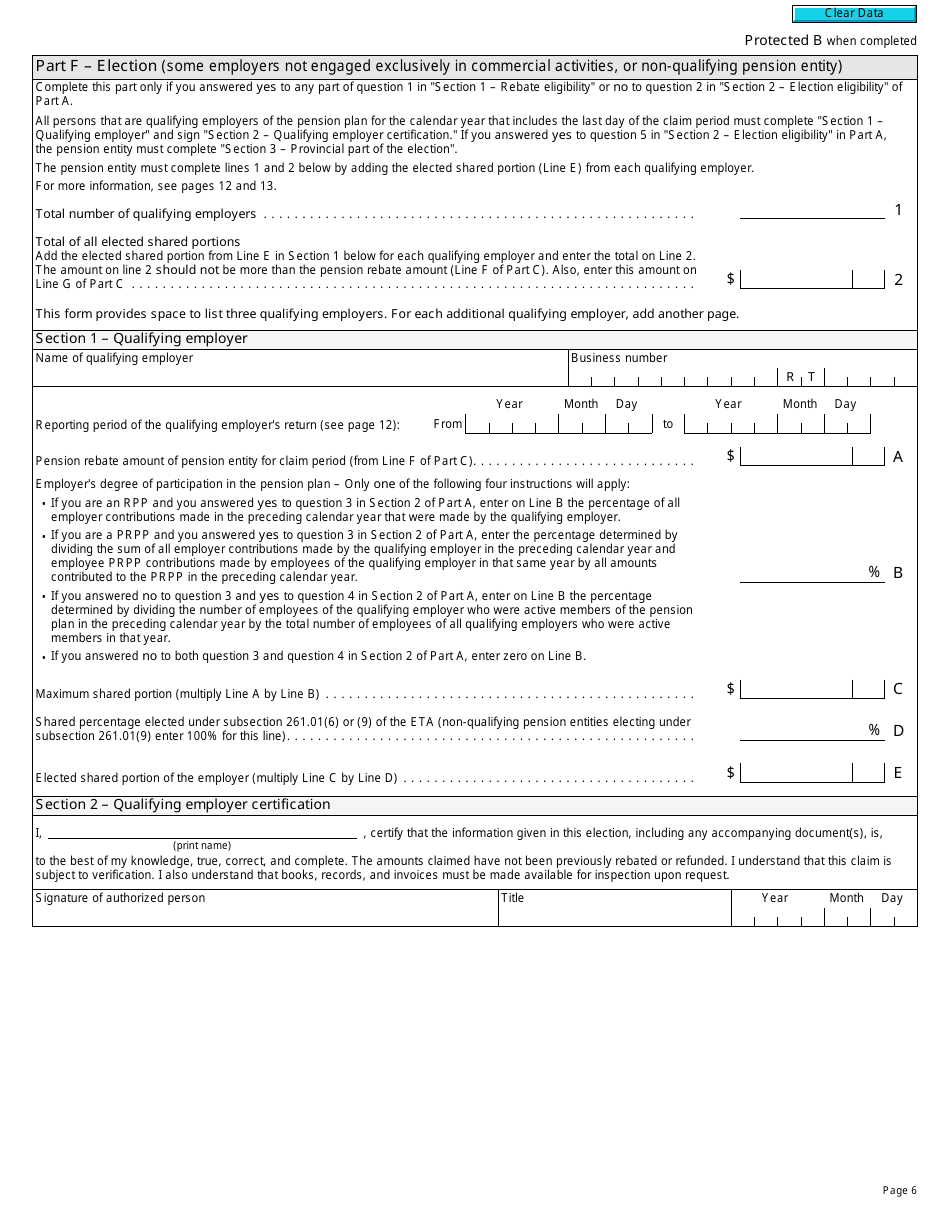

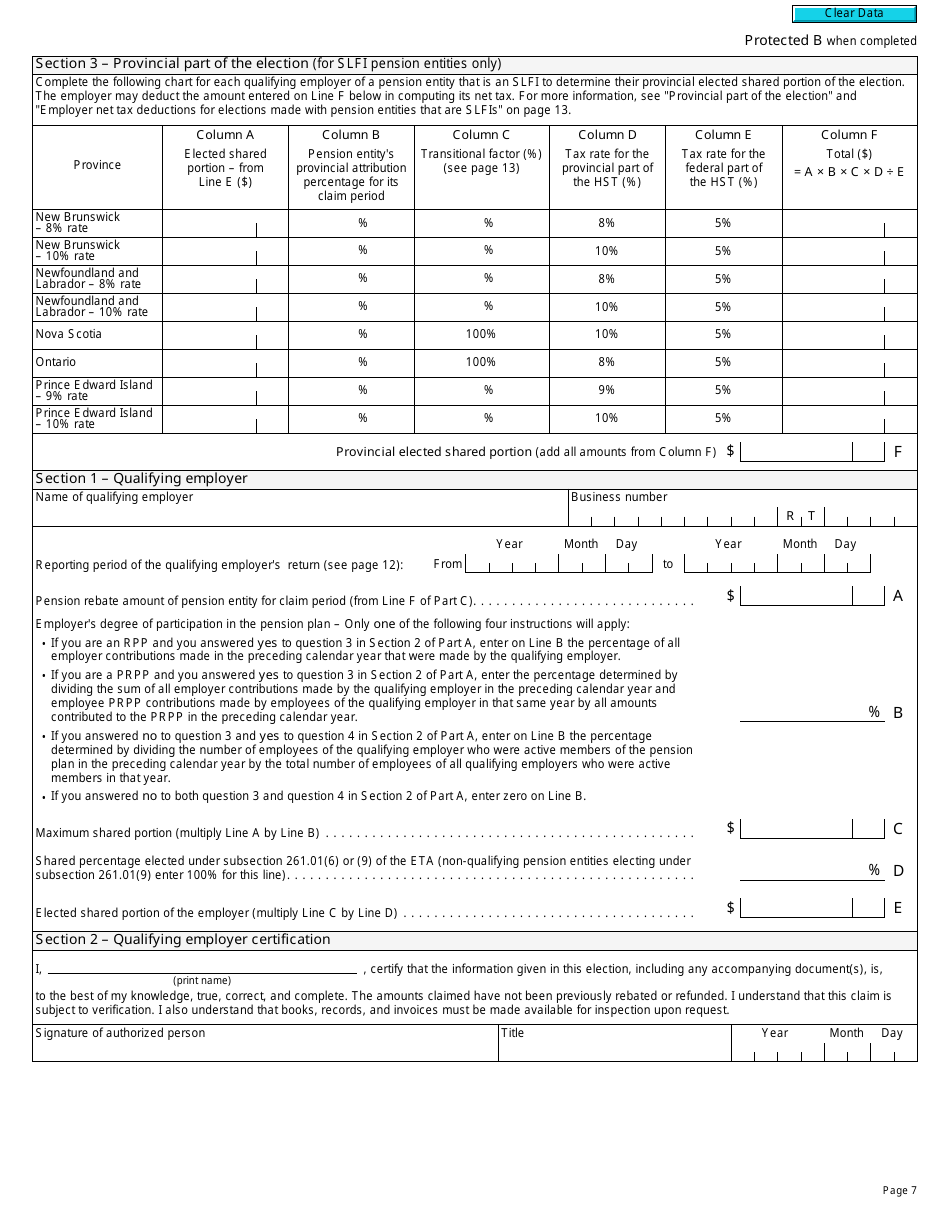

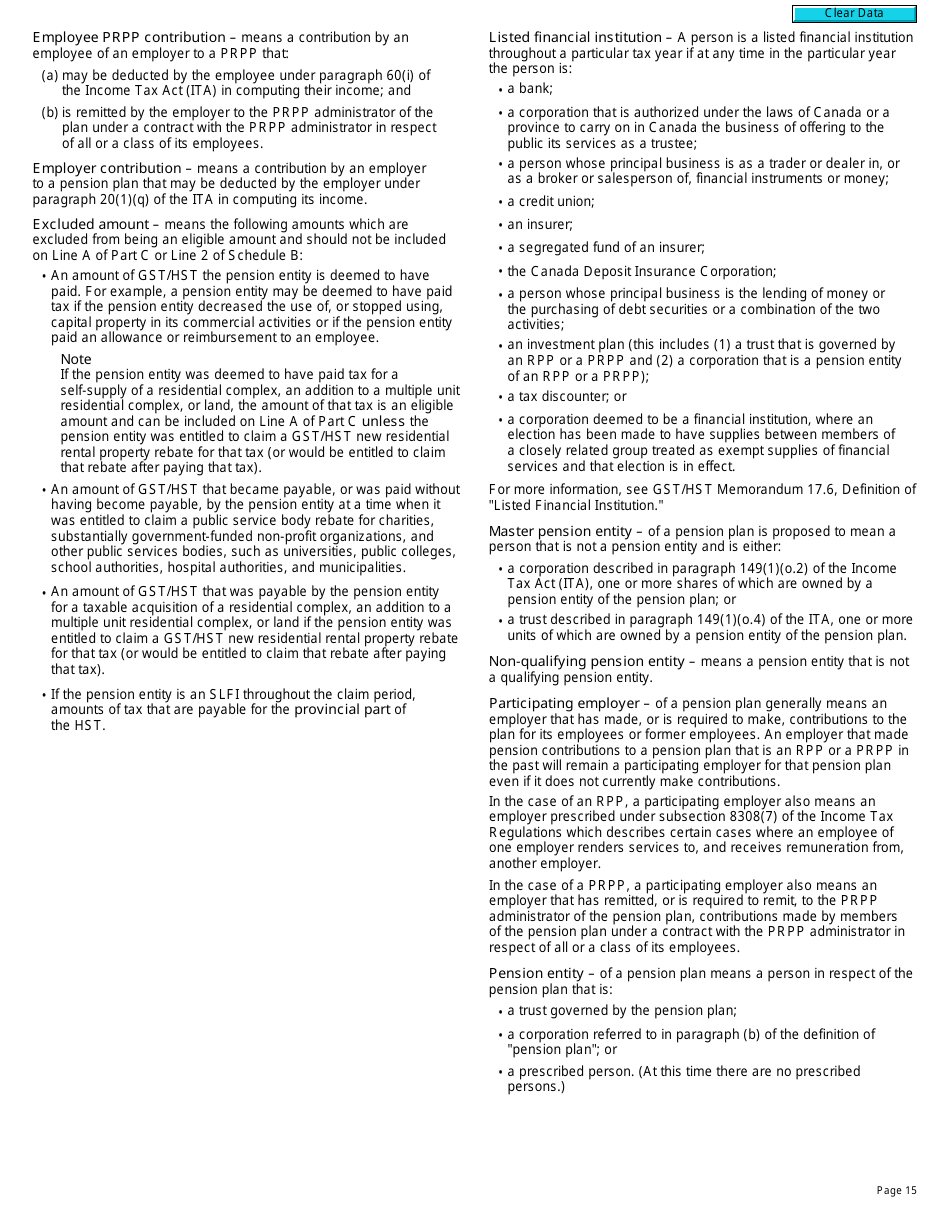

Form RC4607 Gst / Hst Pension Entity Rebate Application and Election - Canada

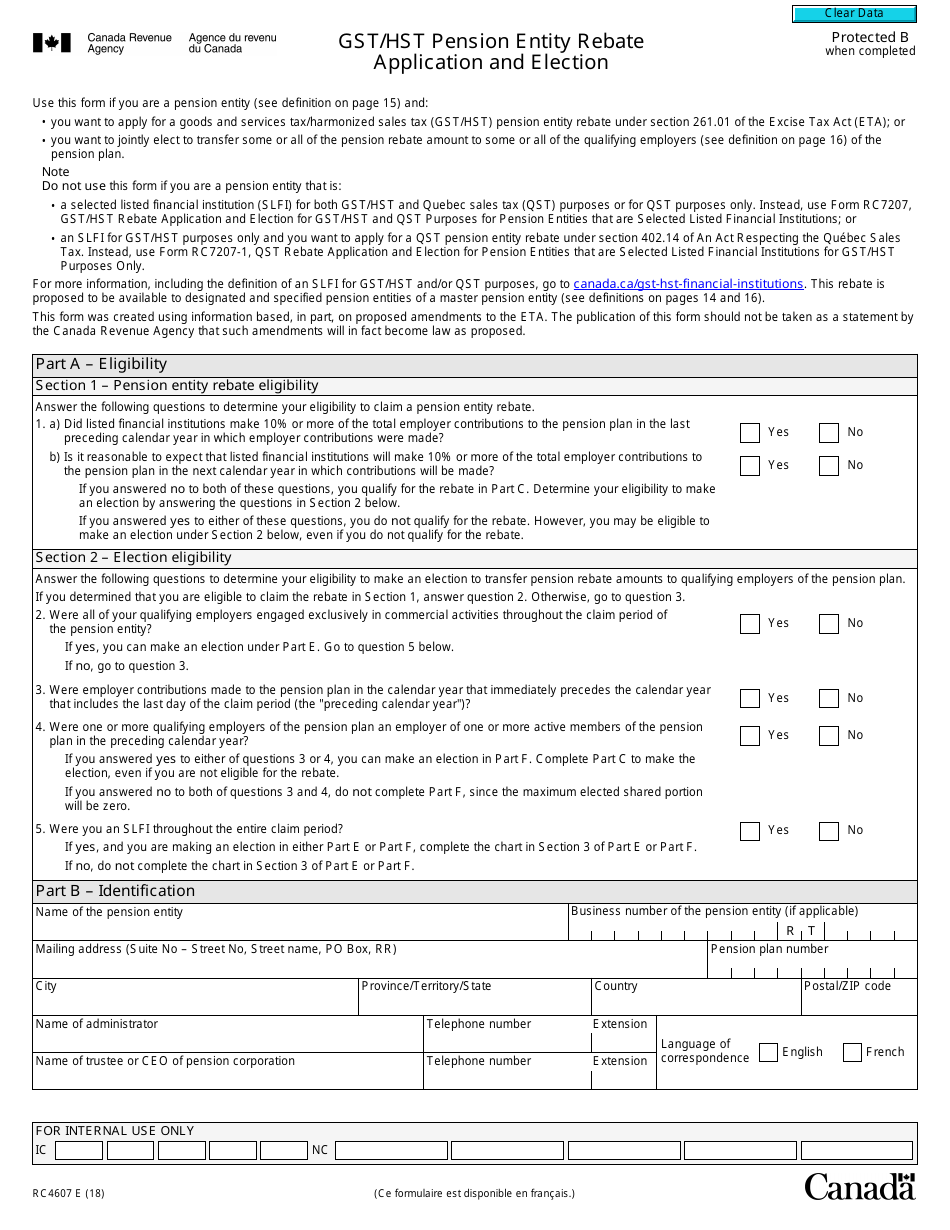

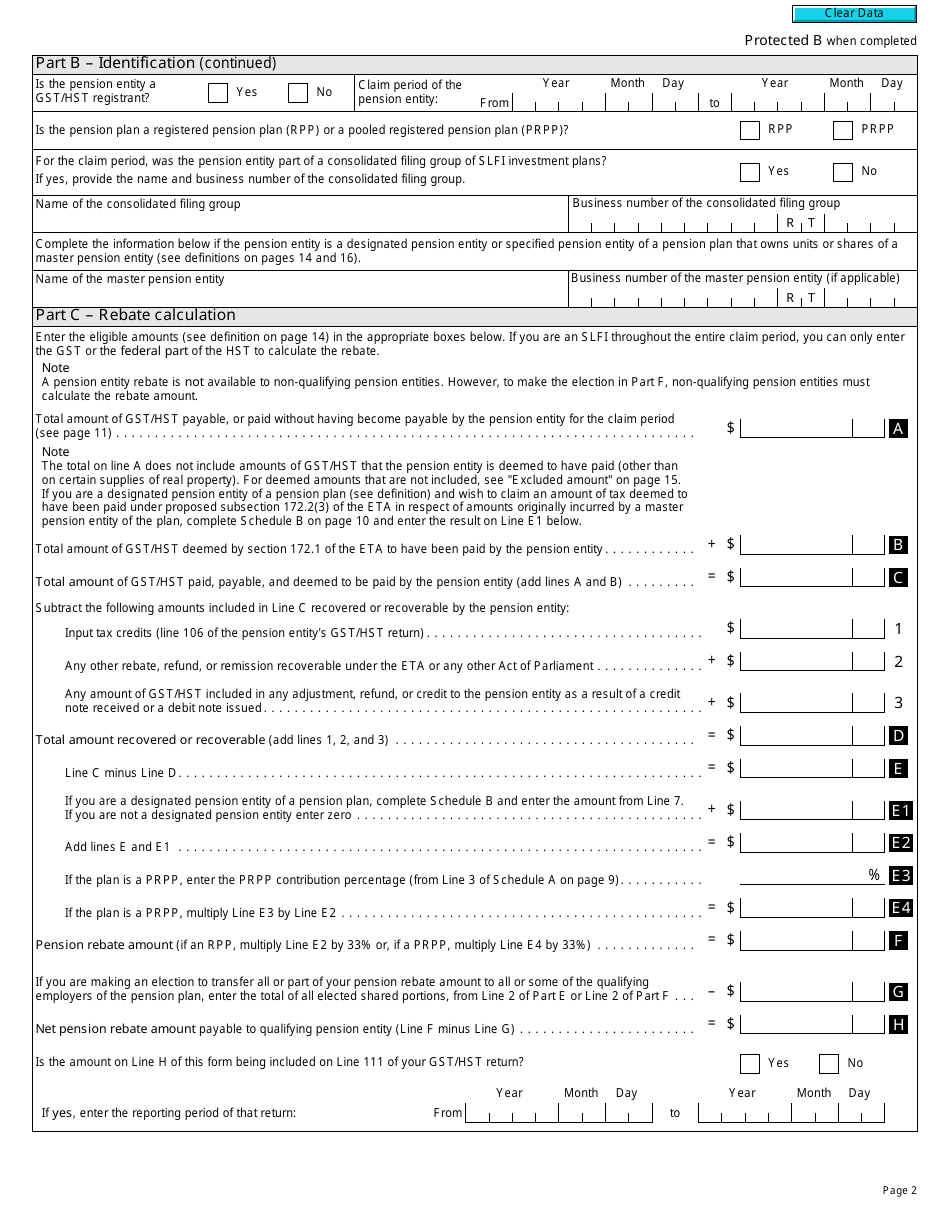

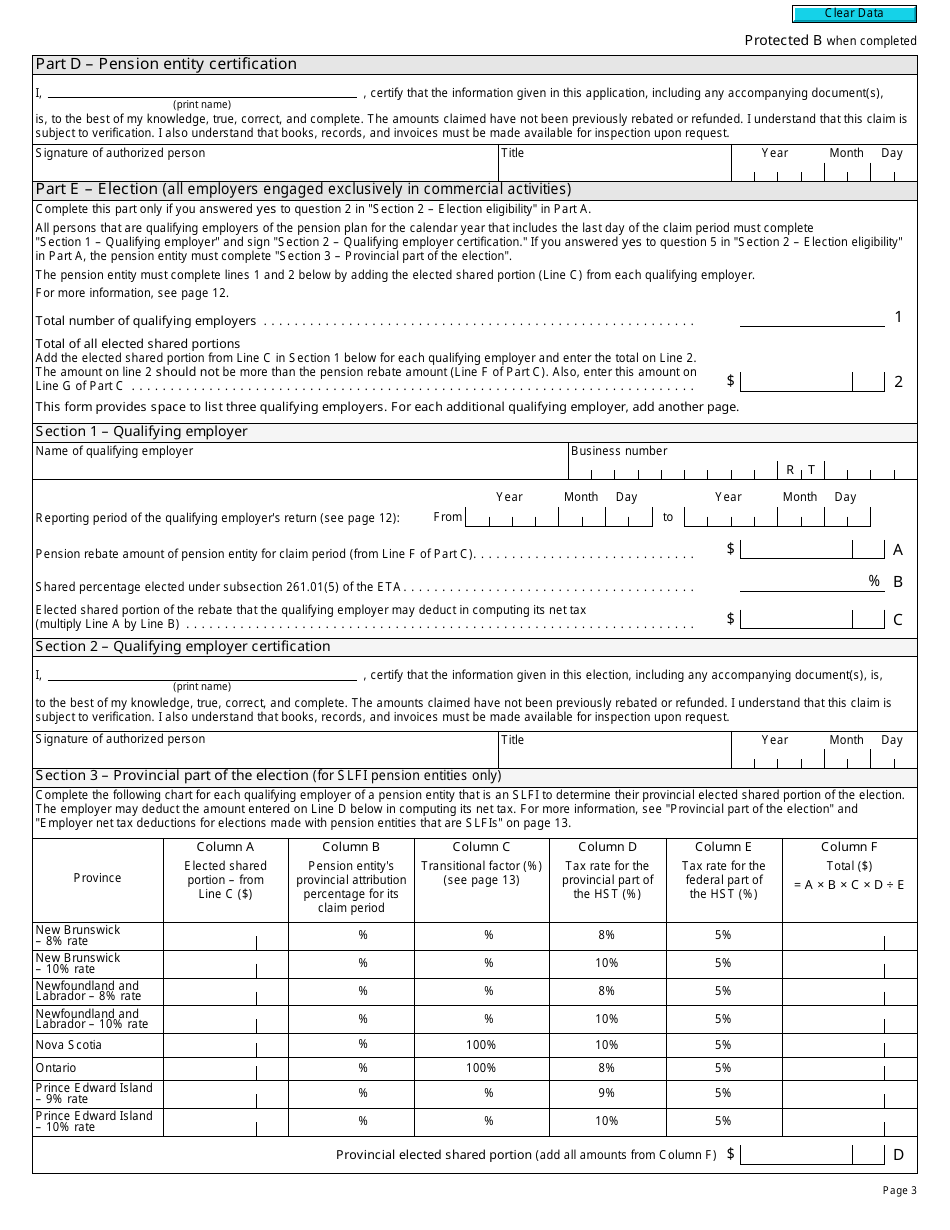

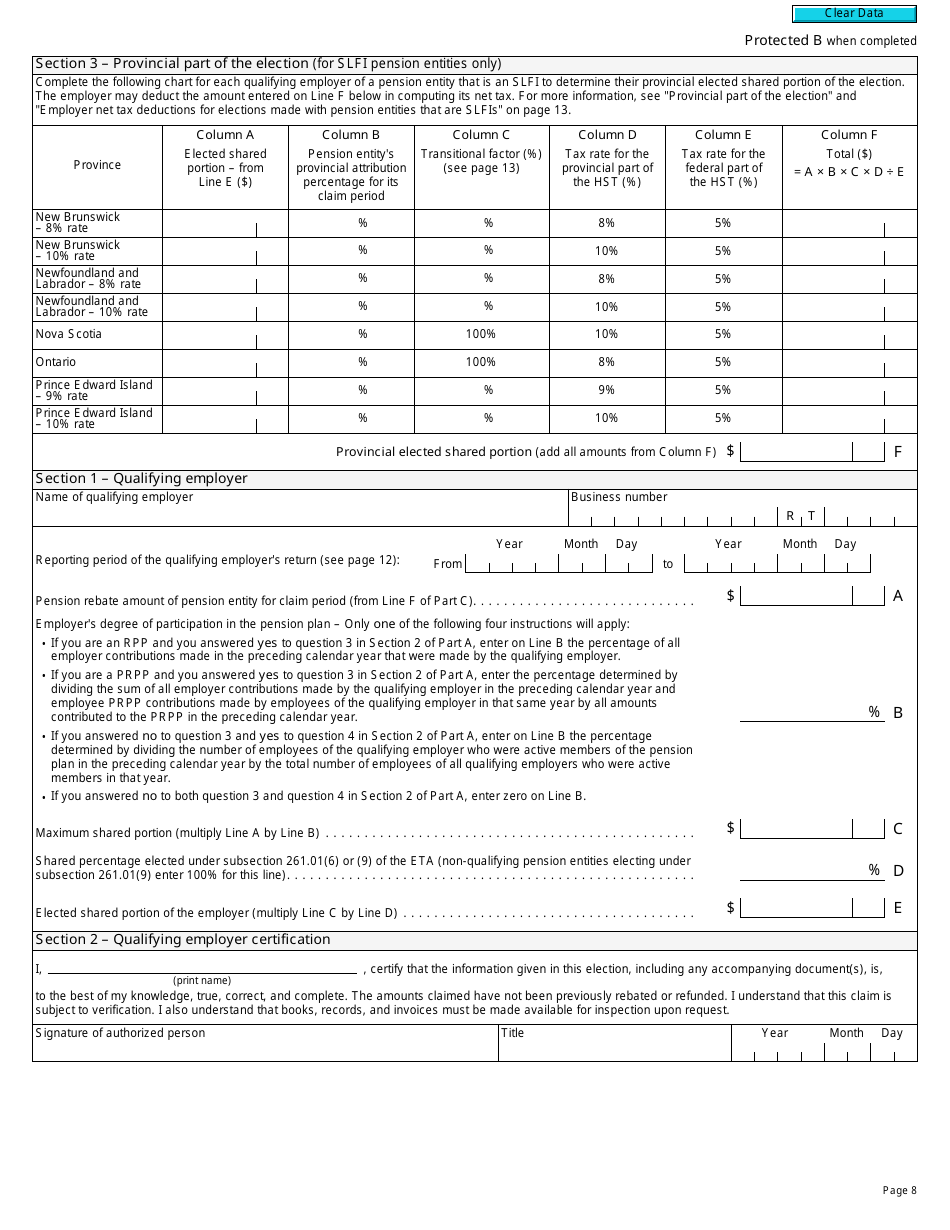

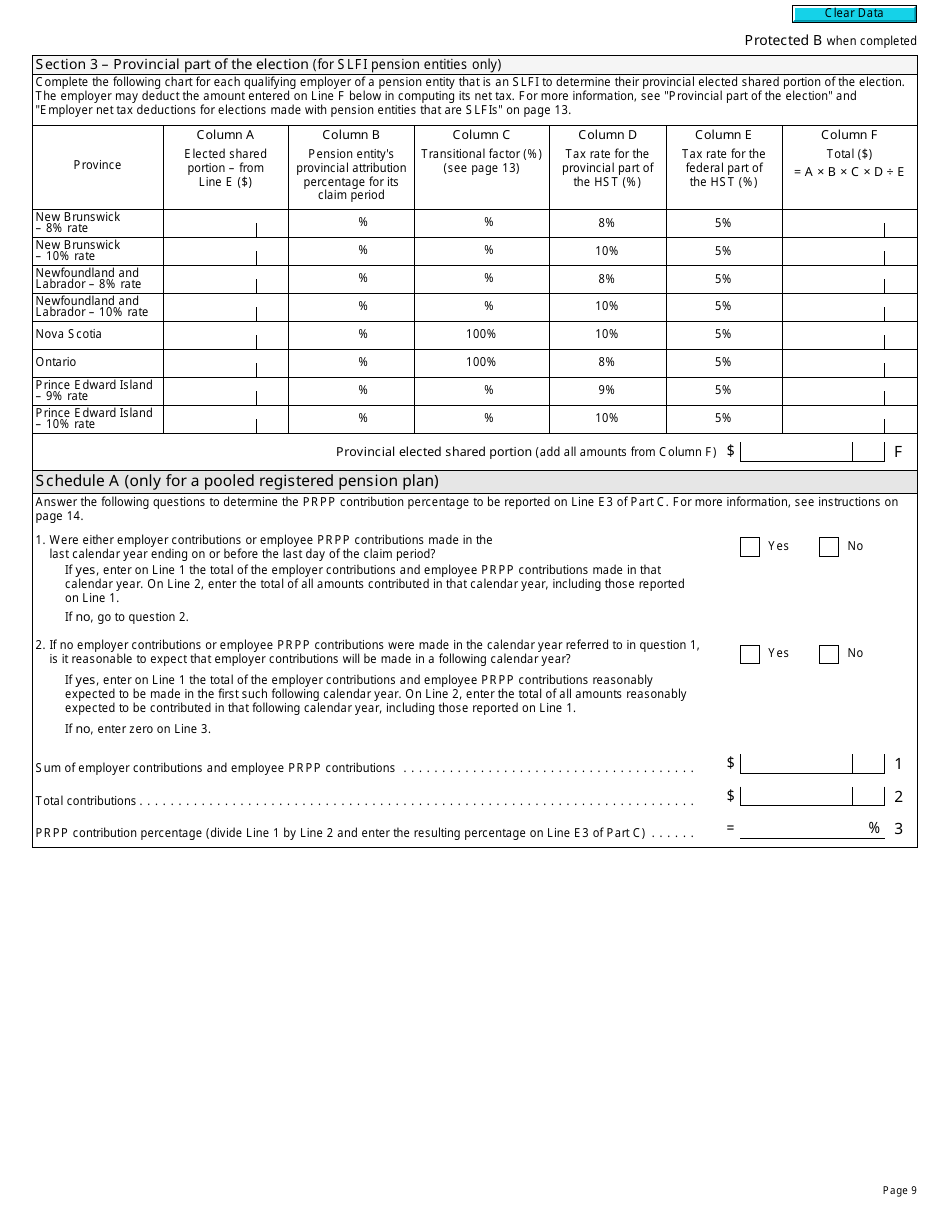

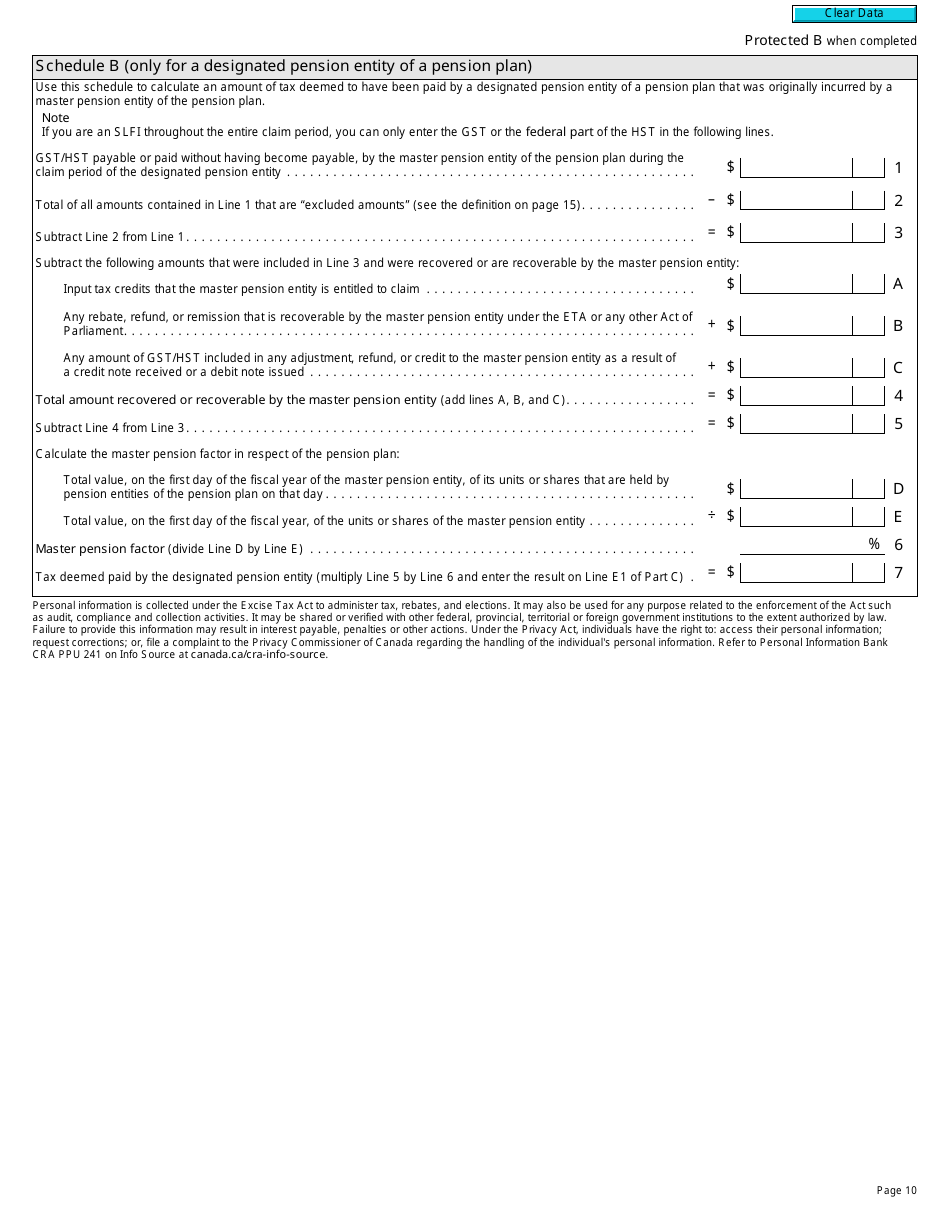

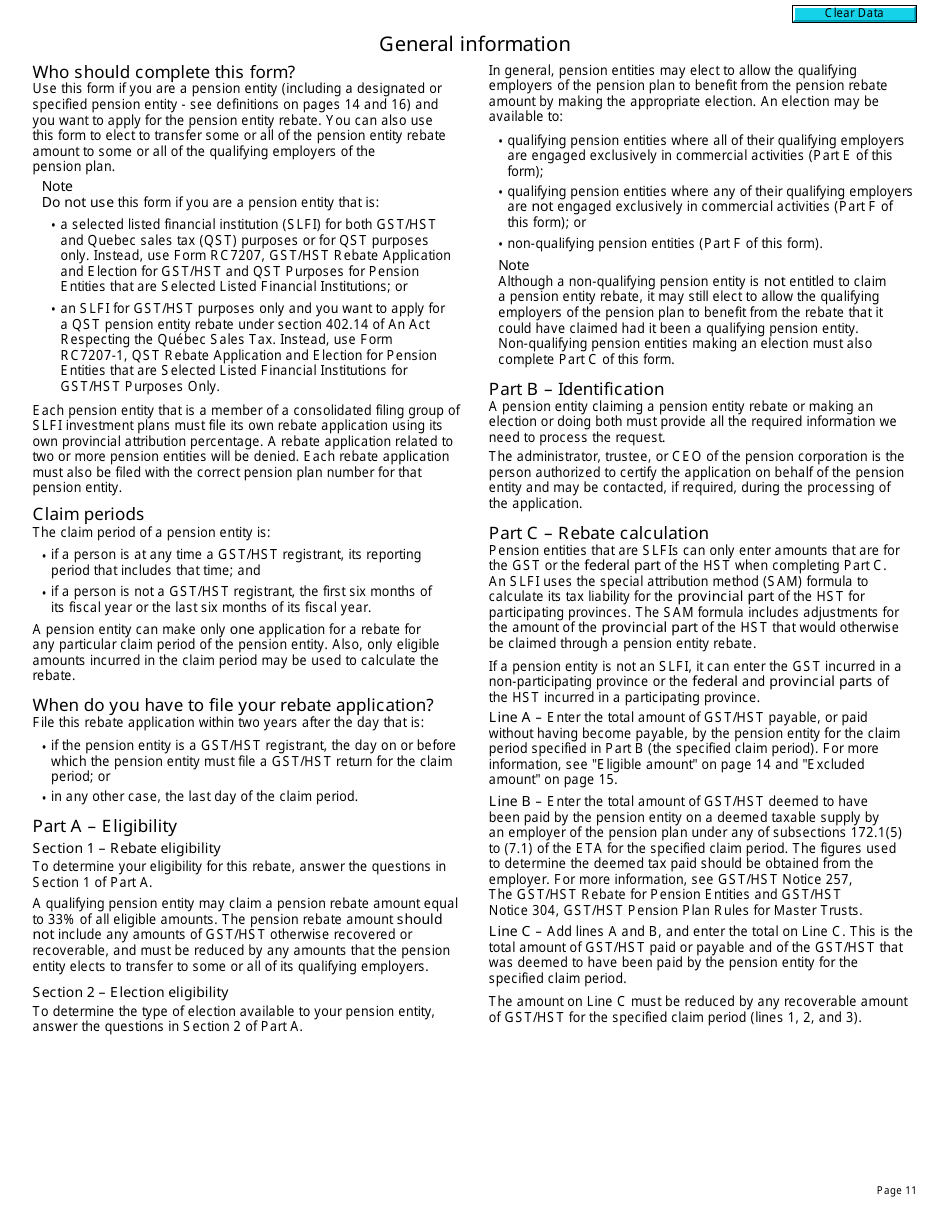

Form RC4607 GST/HST Pension Entity Rebate Application and Election in Canada is used by eligible pension entities to apply for a rebate of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on certain expenses. It allows pension entities to claim a refund for the tax they have paid, thereby reducing their tax liability.

The form RC4607 GST/HST Pension Entity Rebate Application and Election can be filed by eligible pension entities in Canada.

FAQ

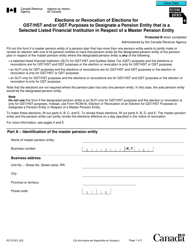

Q: What is the RC4607 GST/HST Pension Entity Rebate Application and Election?

A: The RC4607 GST/HST Pension Entity Rebate Application and Election is a form used in Canada to apply for a rebate of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) for pension entities.

Q: Who can use the RC4607 form?

A: This form can be used by pension entities in Canada who are eligible for the GST/HST rebate.

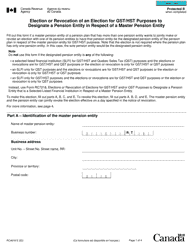

Q: What is the purpose of the rebate?

A: The rebate is provided to help pension entities recover some of the GST/HST paid on their expenses.

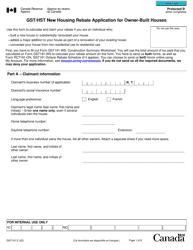

Q: How do I complete the RC4607 form?

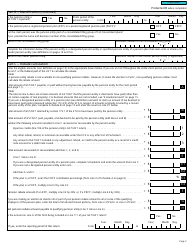

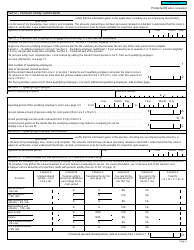

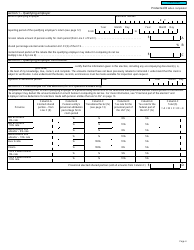

A: The form has instructions on how to complete it. You will need to provide information about your pension entity, the expenses incurred, and any GST/HST paid.

Q: When should I submit the RC4607 form?

A: The RC4607 form should be submitted to the CRA within four years from the end of the reporting period in which the expenses were incurred.