This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4609

for the current year.

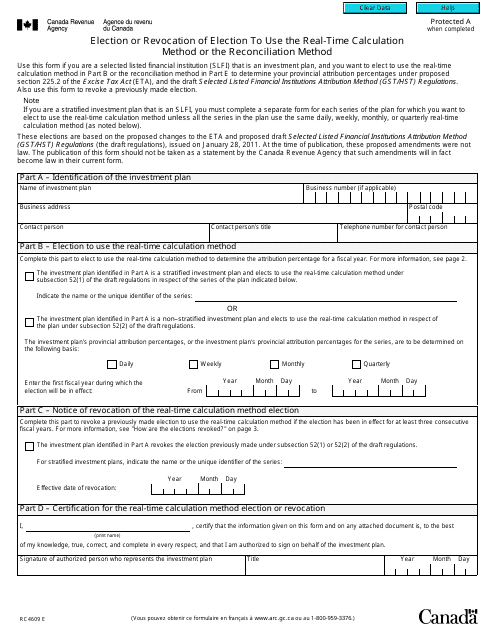

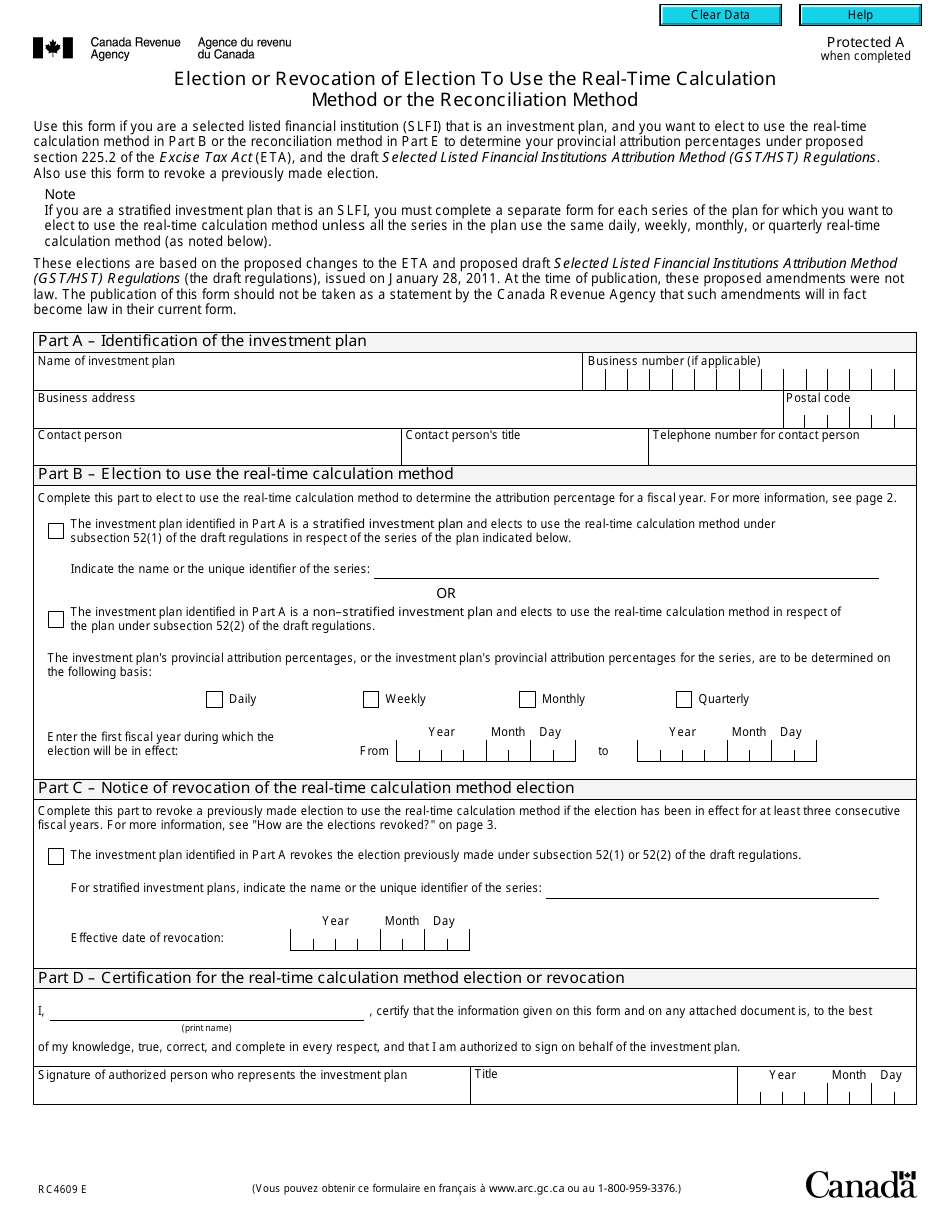

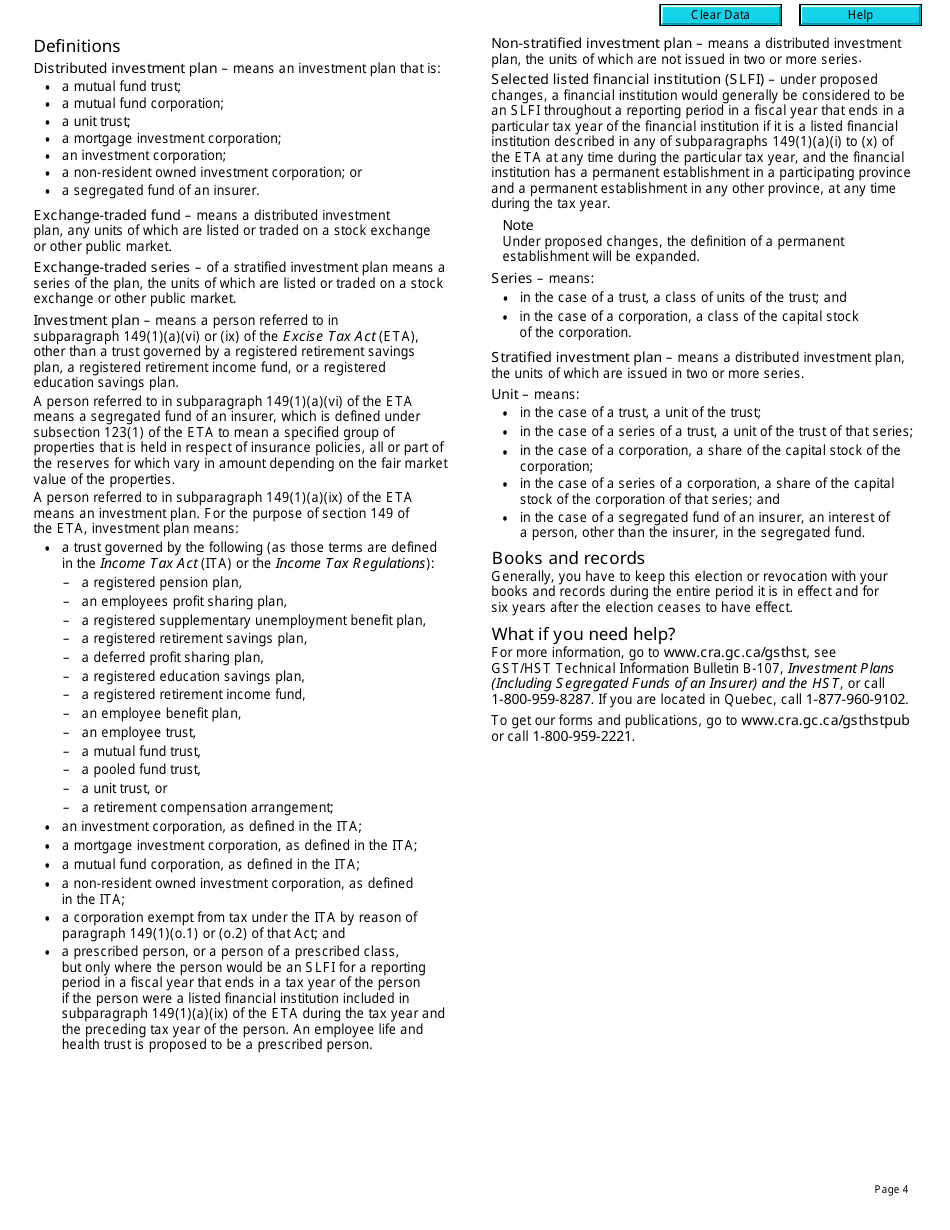

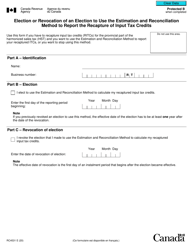

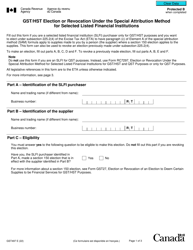

Form RC4609 Election or Revocation of Election to Use the Real-Time Calculation Method or the Reconciliation Method - Canada

Form RC4609 is used in Canada to elect or revoke the election to use either the Real-Time Calculation Method or the Reconciliation Method for calculating the employer's CPP contributions. These methods are used to determine the amounts of Canada Pension Plan (CPP) contributions that an employer needs to deduct from their employees' remuneration.

The employer files the Form RC4609 Election or Revocation of Election to Use the Real-Time Calculation Method or the Reconciliation Method in Canada.

FAQ

Q: What is Form RC4609?

A: Form RC4609 is used in Canada to make an election or revoke an election to use the real-time calculation method or the reconciliation method.

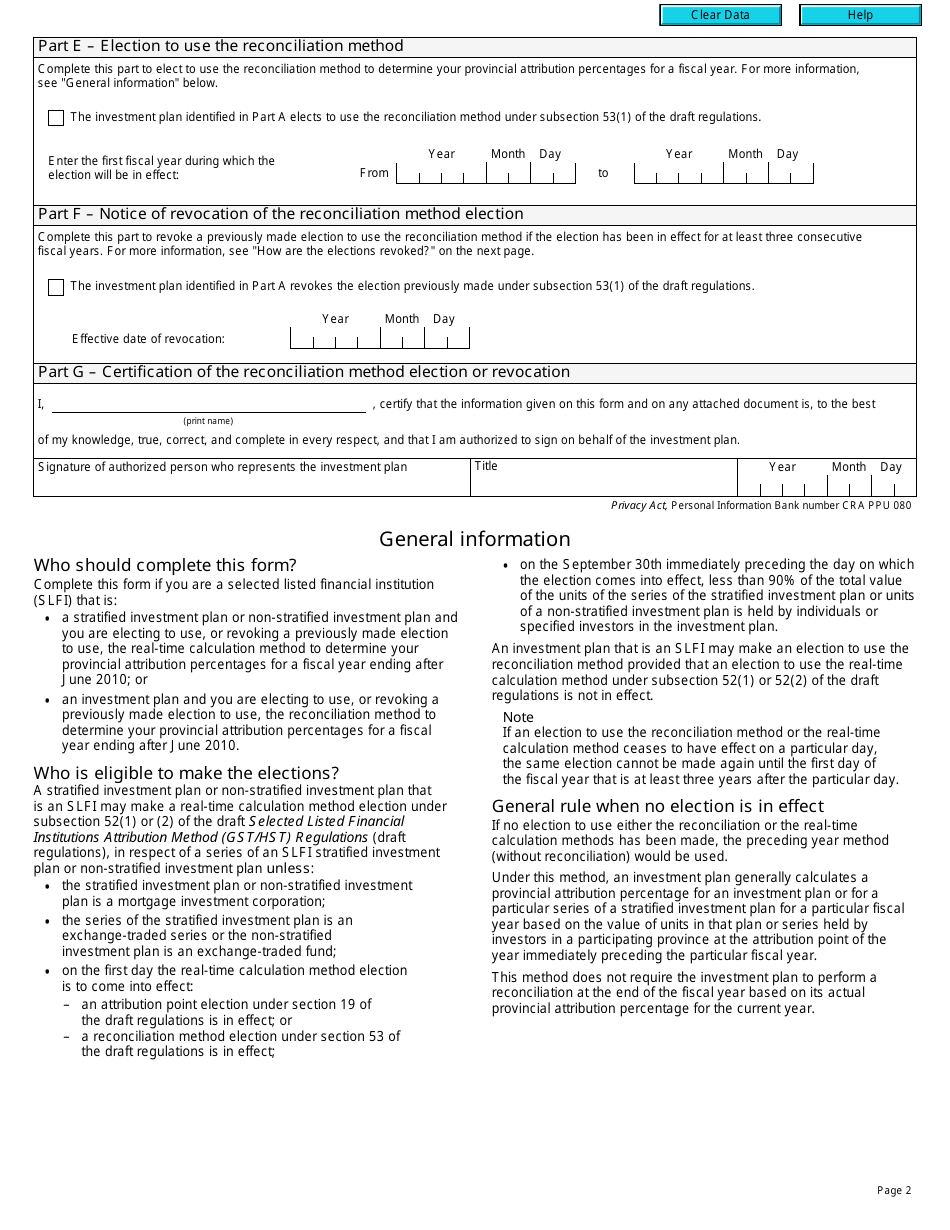

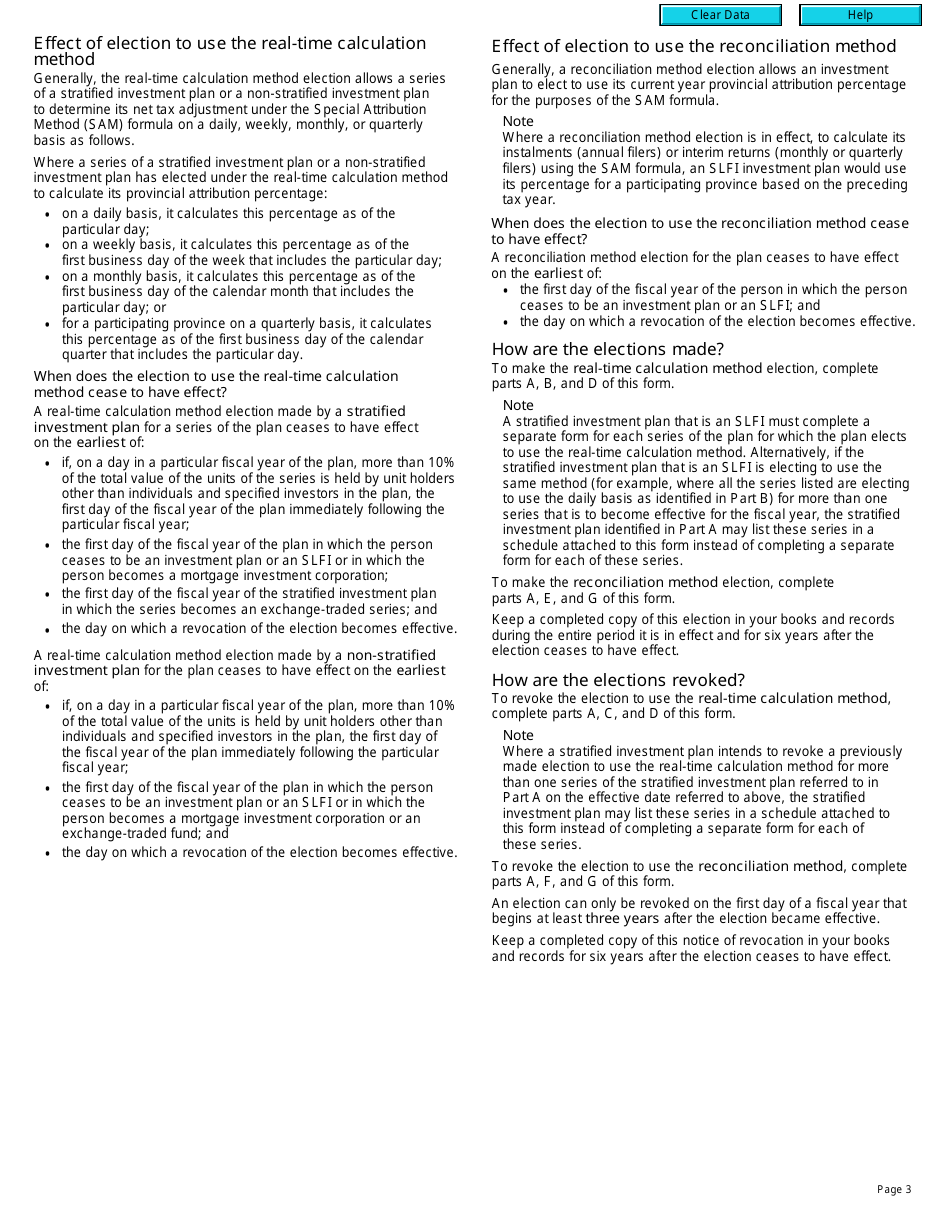

Q: What is the real-time calculation method?

A: The real-time calculation method is a way to calculate and remit your goods and services tax/harmonized sales tax (GST/HST) based on the immediate or concurrent collection and remittance of the tax.

Q: What is the reconciliation method?

A: The reconciliation method is a way to calculate and remit your GST/HST based on the periodic reconciliation and remittance of the tax.

Q: When should I use Form RC4609?

A: You should use Form RC4609 when you want to elect or revoke the election to use either the real-time calculation method or the reconciliation method for your GST/HST.

Q: How do I complete Form RC4609?

A: To complete Form RC4609, you will need to provide your business information, indicate your election or revocation of election, and provide any additional supporting documents as required.

Q: Is there a deadline for submitting Form RC4609?

A: There is no specific deadline for submitting Form RC4609, but you should submit it before the start of your reporting period if you want the election or revocation of election to be effective for that period.

Q: Can I change my election method after submitting Form RC4609?

A: Yes, you can change your election method after submitting Form RC4609, but you will need to submit a new form to make the change.

Q: Are there any penalties for not submitting Form RC4609?

A: Failure to submit Form RC4609 when required may result in penalties or interest charges imposed by the CRA.