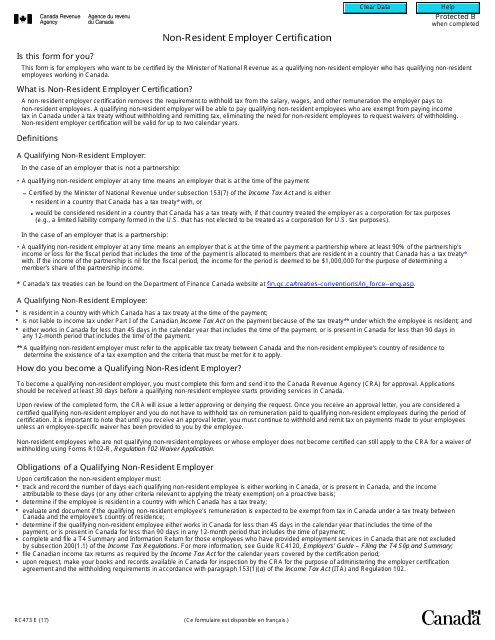

Form RC473 Non-resident Employer Certification - Canada

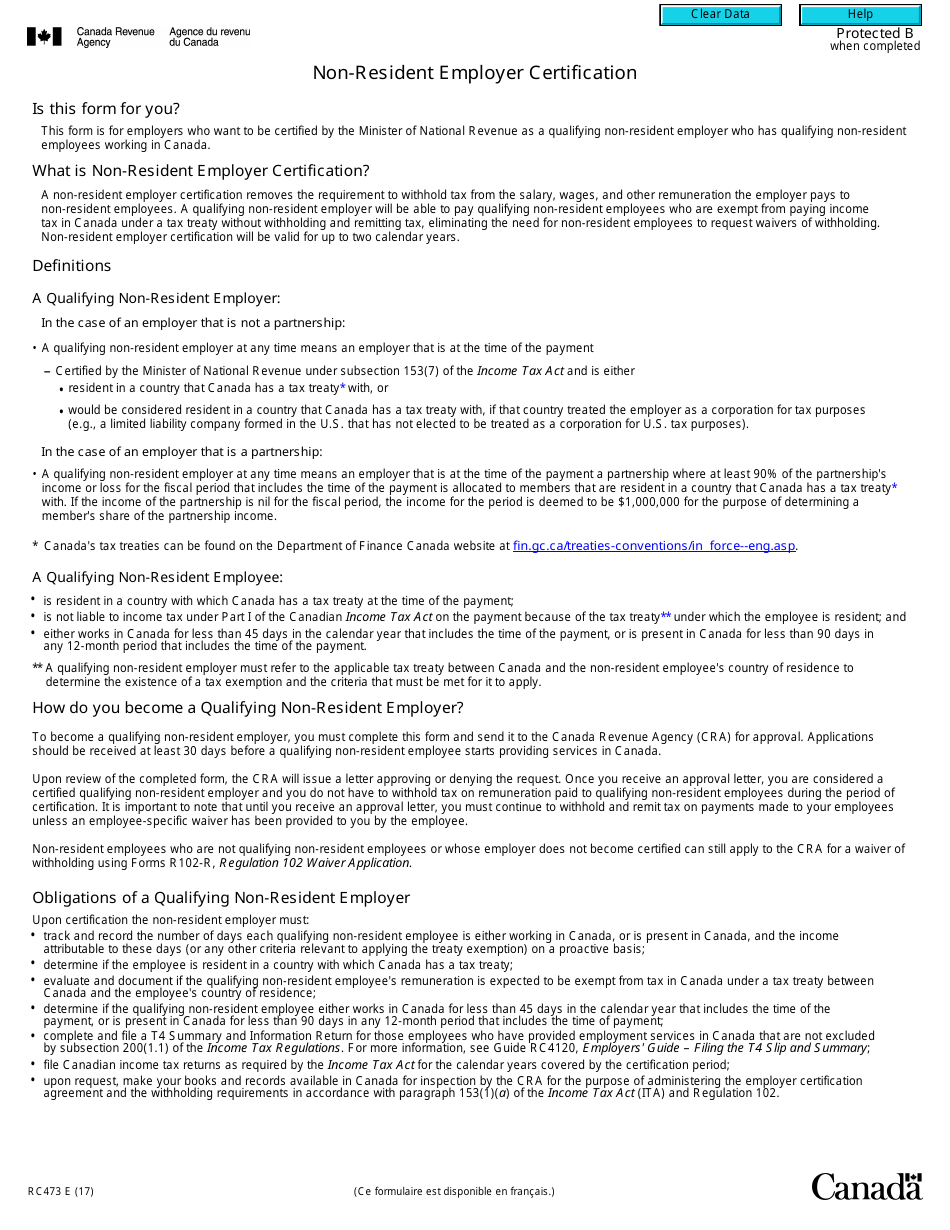

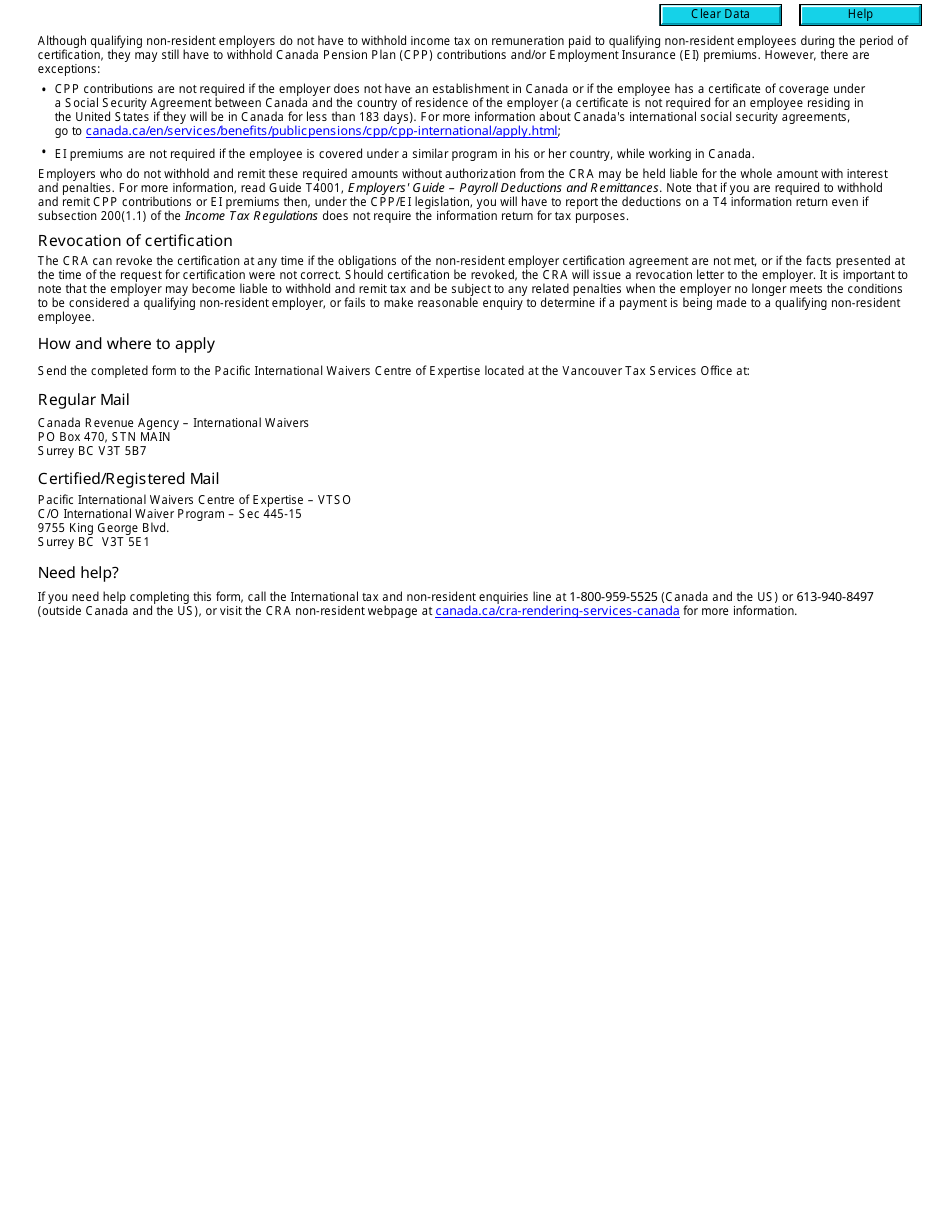

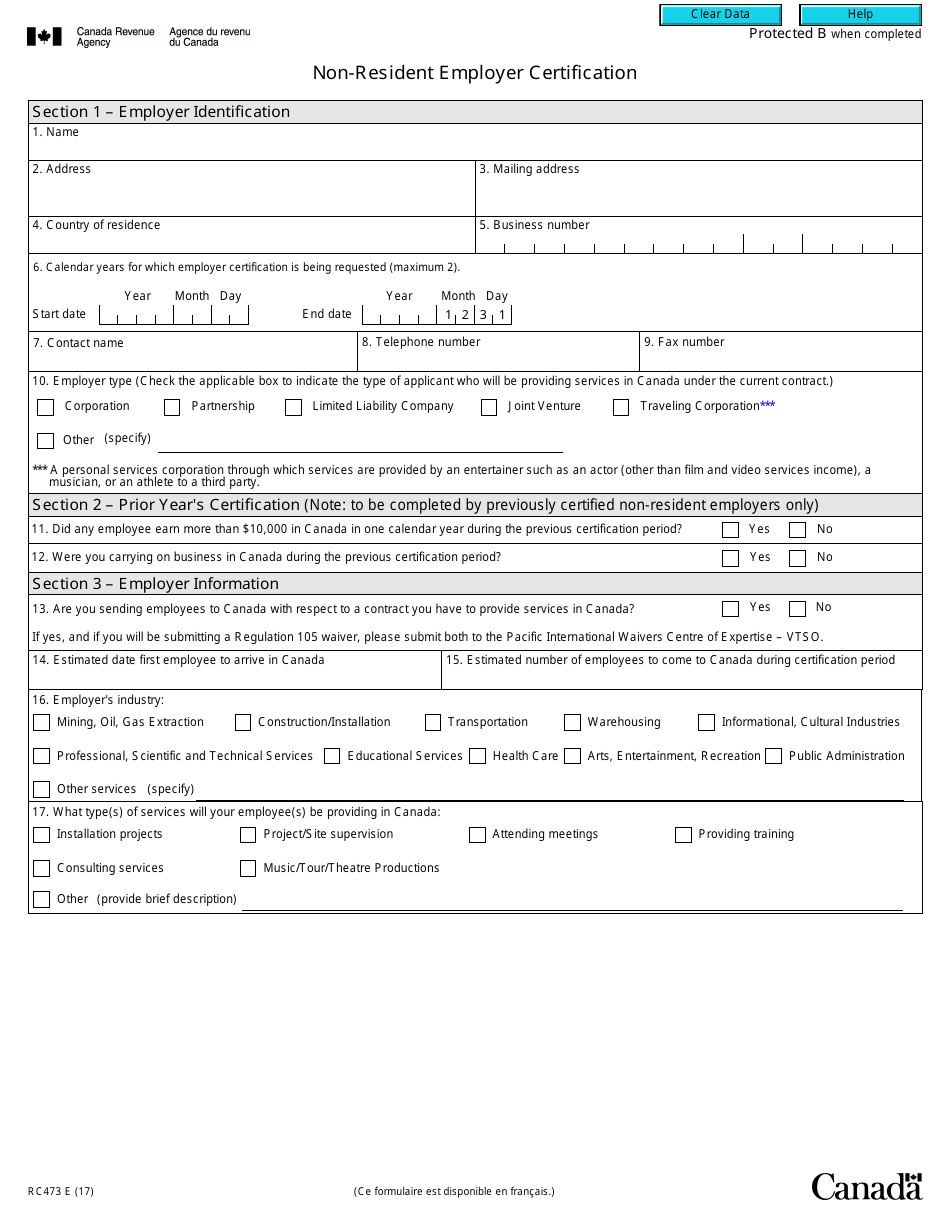

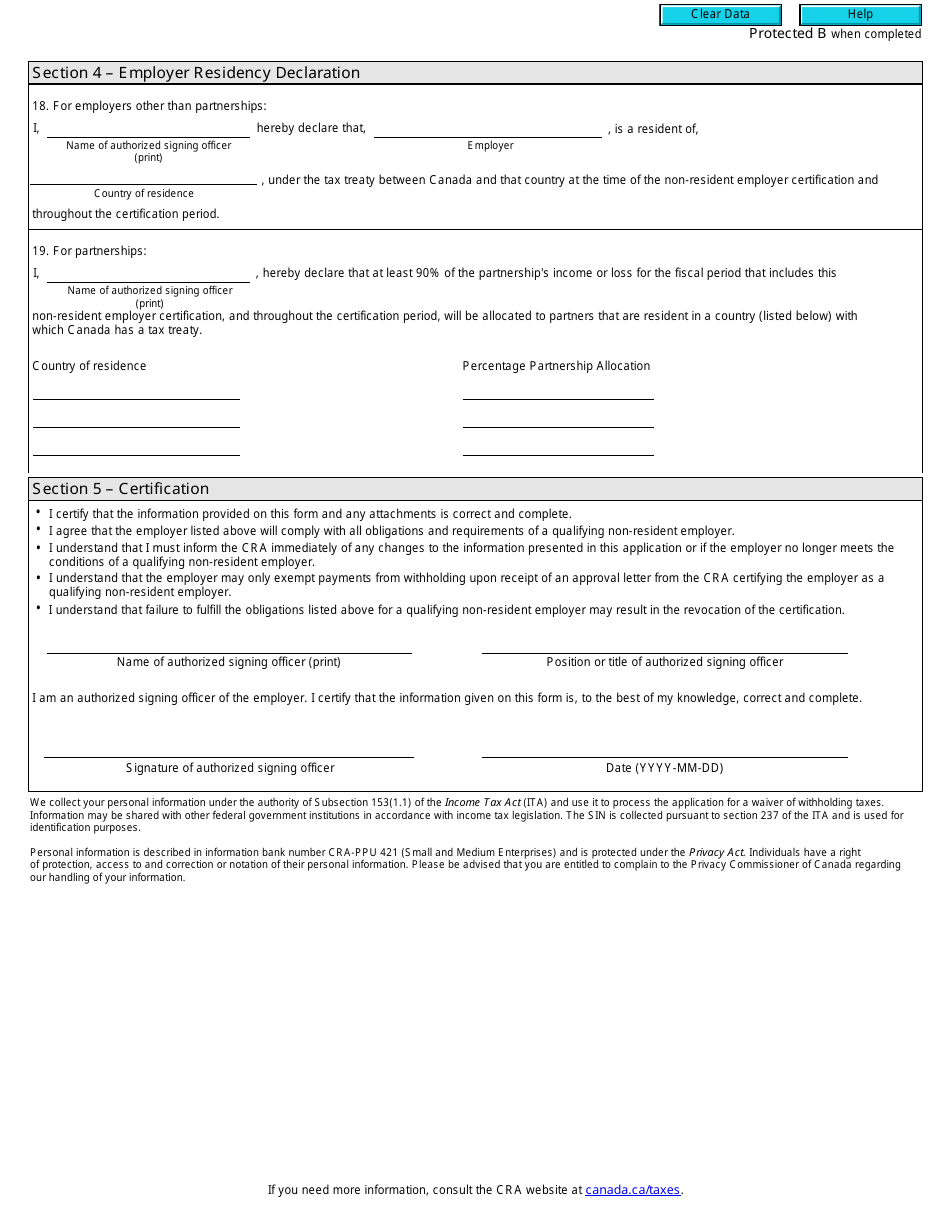

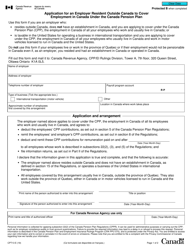

Form RC473 Non-resident Employer Certification is for employers who are not resident in Canada but have employees working in Canada. This form is used to certify their status and ensure compliance with Canadian tax regulations.

The Form RC473 Non-resident Employer Certification in Canada is typically filed by non-resident employers who have employees working in Canada.

FAQ

Q: What is Form RC473?

A: Form RC473 is the Non-resident Employer Certification form in Canada.

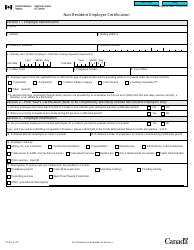

Q: Who needs to fill out Form RC473?

A: Non-resident employers who have Canadian employees or who pay employment income in Canada need to fill out Form RC473.

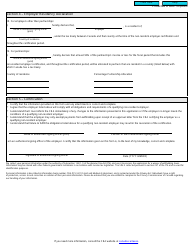

Q: What is the purpose of Form RC473?

A: Form RC473 is used to certify that the non-resident employer is exempt from withholding or remitting Canadian income tax on certain types of income.

Q: Is Form RC473 mandatory?

A: Yes, if you are a non-resident employer with Canadian employees or pay employment income in Canada, filling out Form RC473 is mandatory.

Q: Are there any penalties for not filling out Form RC473?

A: Yes, if you are required to fill out Form RC473 and fail to do so, you may be subject to penalties and interest.

Q: Is Form RC473 specific to any industry?

A: No, Form RC473 is applicable to all non-resident employers regardless of industry or sector.