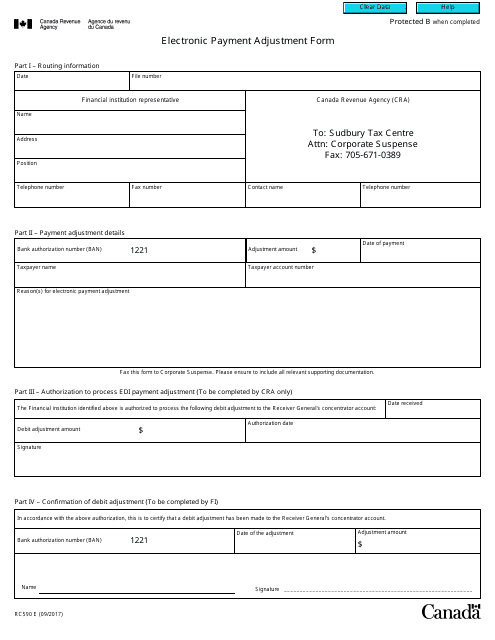

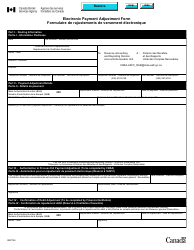

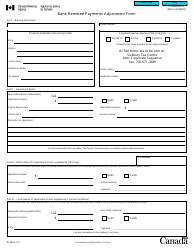

Form RC590 Electronic Payment Adjustment Form - Canada

Form RC590, also known as the Electronic Payment Adjustment form, is used in Canada to make adjustments to electronic payments that have been made to the Canada Revenue Agency (CRA). It is used when you need to correct or change information related to a previous electronic payment made to the CRA.

The Form RC590 Electronic Payment Adjustment Form in Canada is filed by individuals or businesses who need to make adjustments to their electronic payments made to the Canada Revenue Agency.

FAQ

Q: What is Form RC590?

A: Form RC590 is the Electronic Payment Adjustment Form in Canada.

Q: What is the purpose of Form RC590?

A: The purpose of Form RC590 is to request adjustments to electronic payments made to the Canada Revenue Agency (CRA).

Q: When should Form RC590 be used?

A: Form RC590 should be used when there is a need to make adjustments to electronic payments made to the CRA.

Q: Are there any specific requirements for completing Form RC590?

A: Yes, there are specific requirements for completing Form RC590, including providing accurate and detailed information about the adjustments being requested.

Q: What should be done after submitting Form RC590?

A: After submitting Form RC590, it is important to keep a copy of the form for your records and follow up with the CRA if necessary.

Q: Is there a deadline for submitting Form RC590?

A: There is no specific deadline for submitting Form RC590, but it is recommended to submit the form as soon as possible after discovering the need for adjustments to electronic payments.