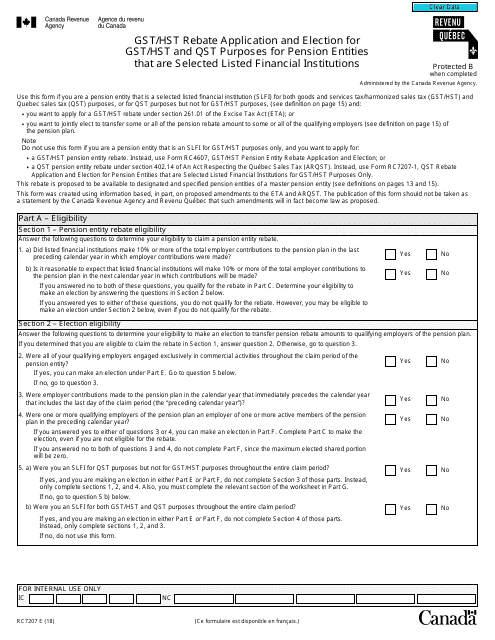

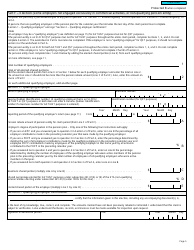

Form R7207 Gst / Hst Rebate Application and Election for Gst / Hst and Qst Purposes for Pension Entities That Are Selected Listed Financial Institutions - Canada

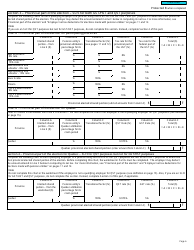

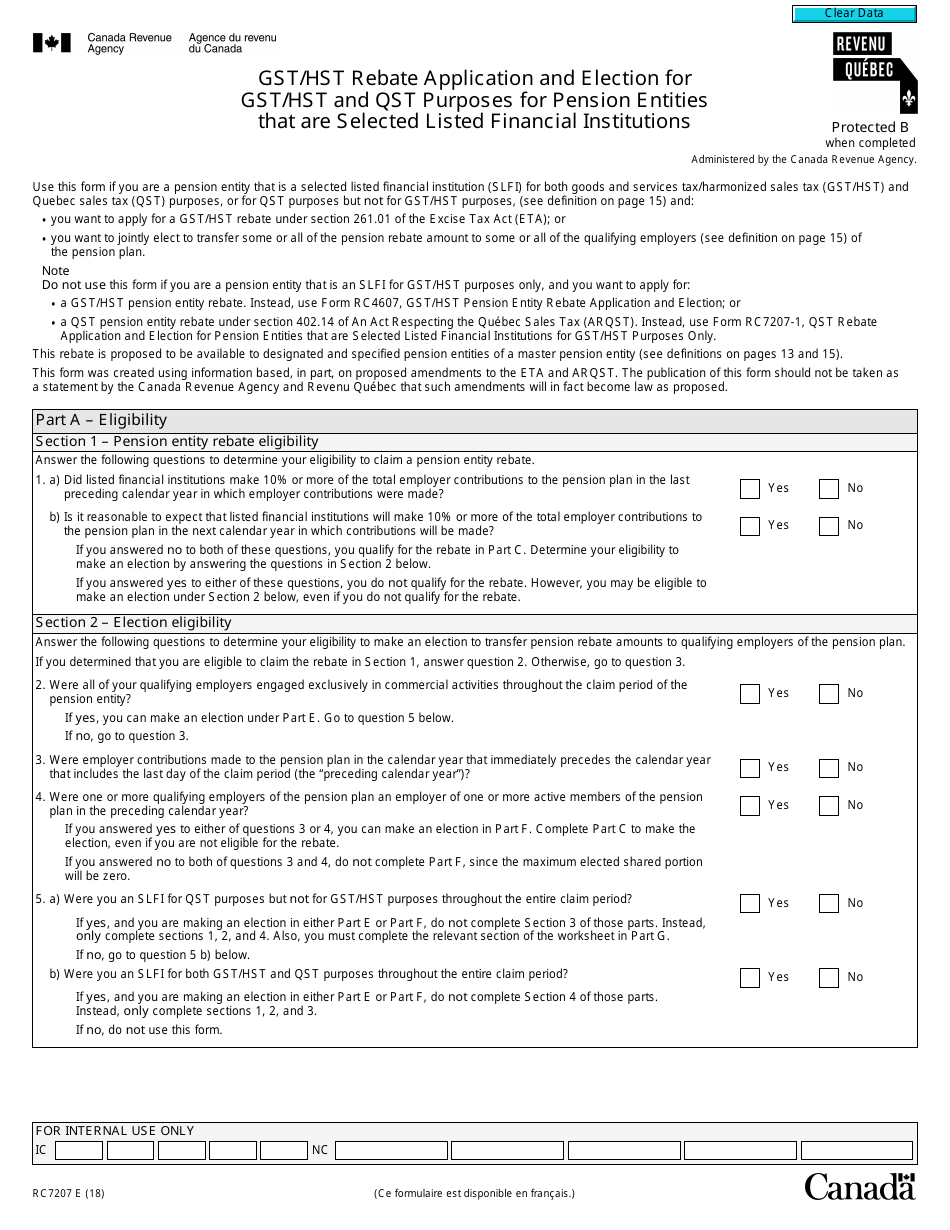

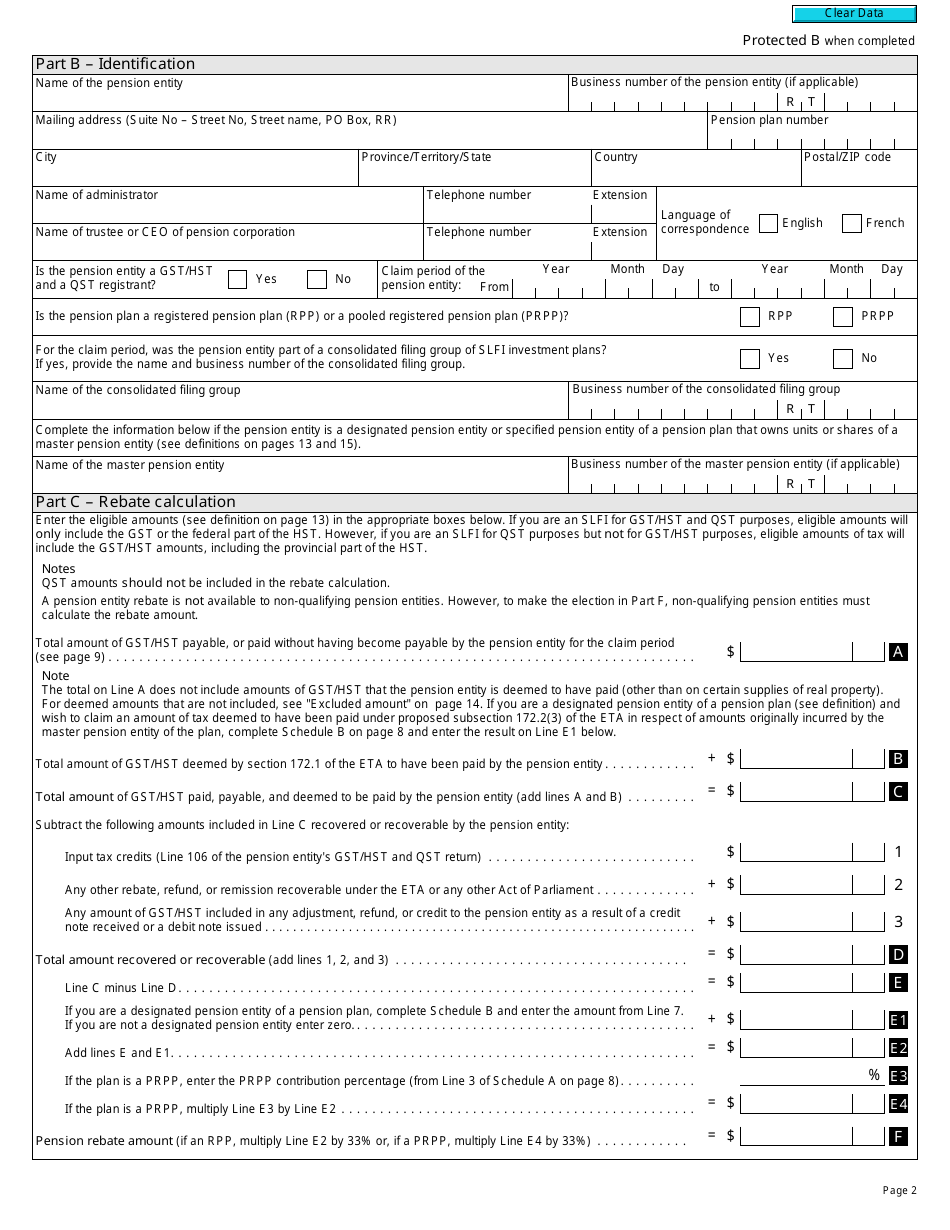

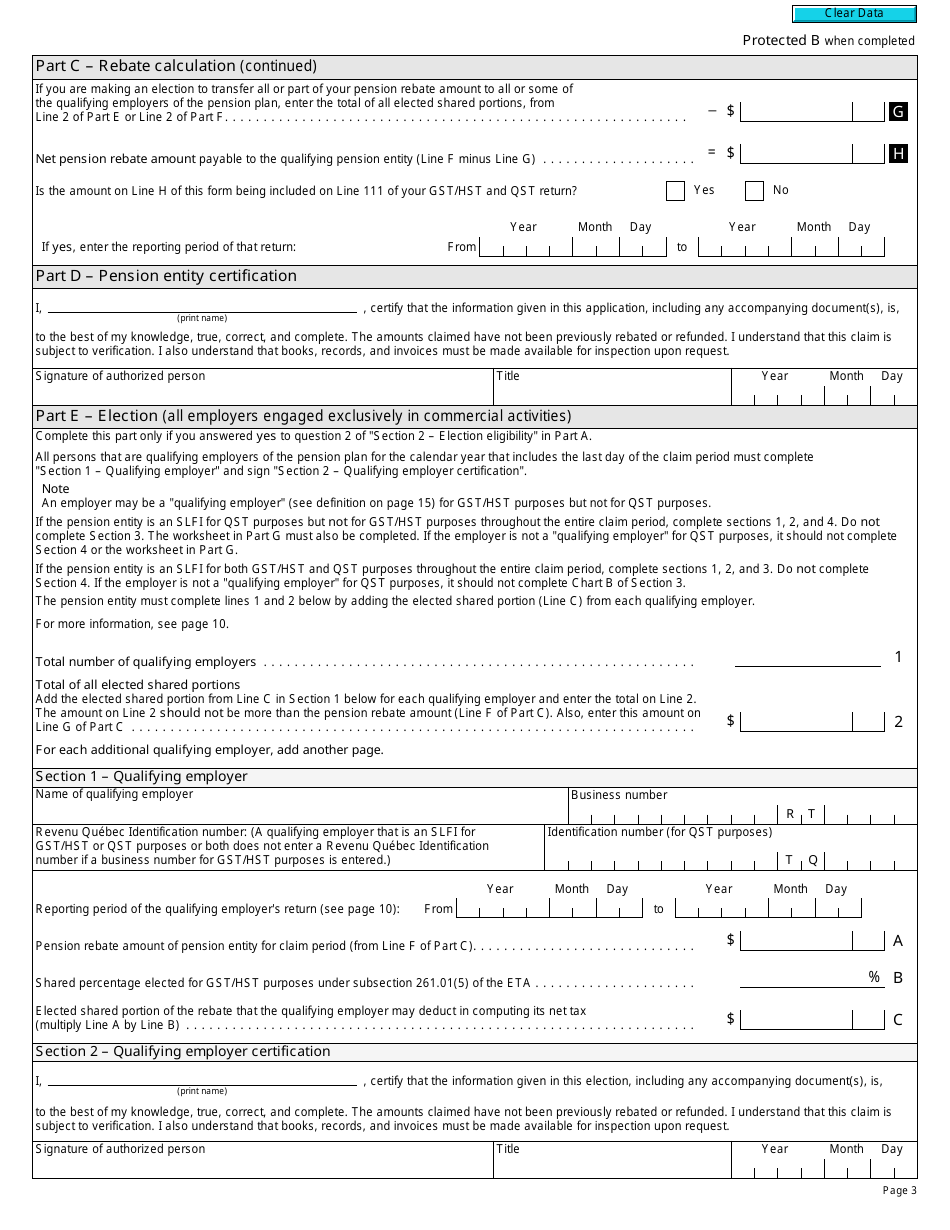

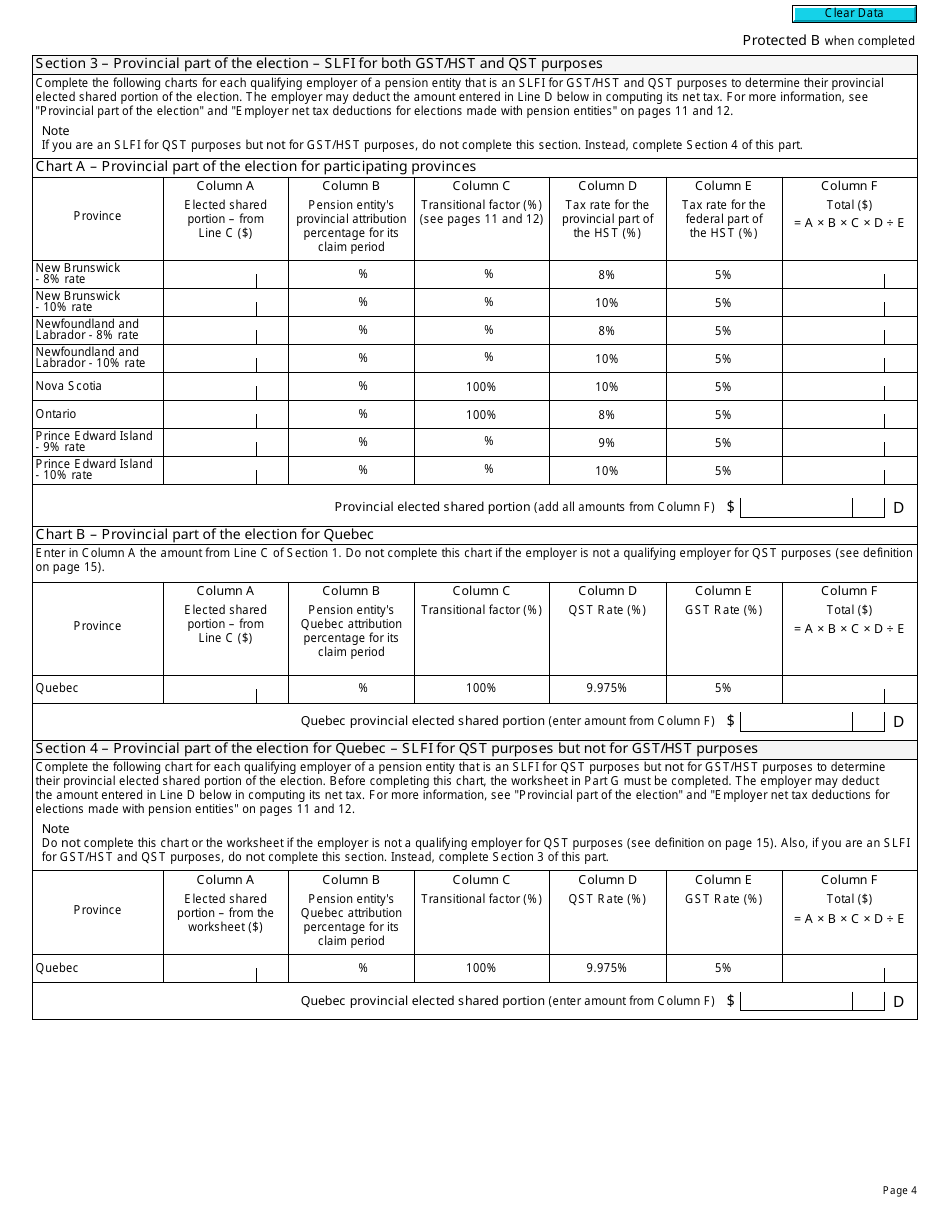

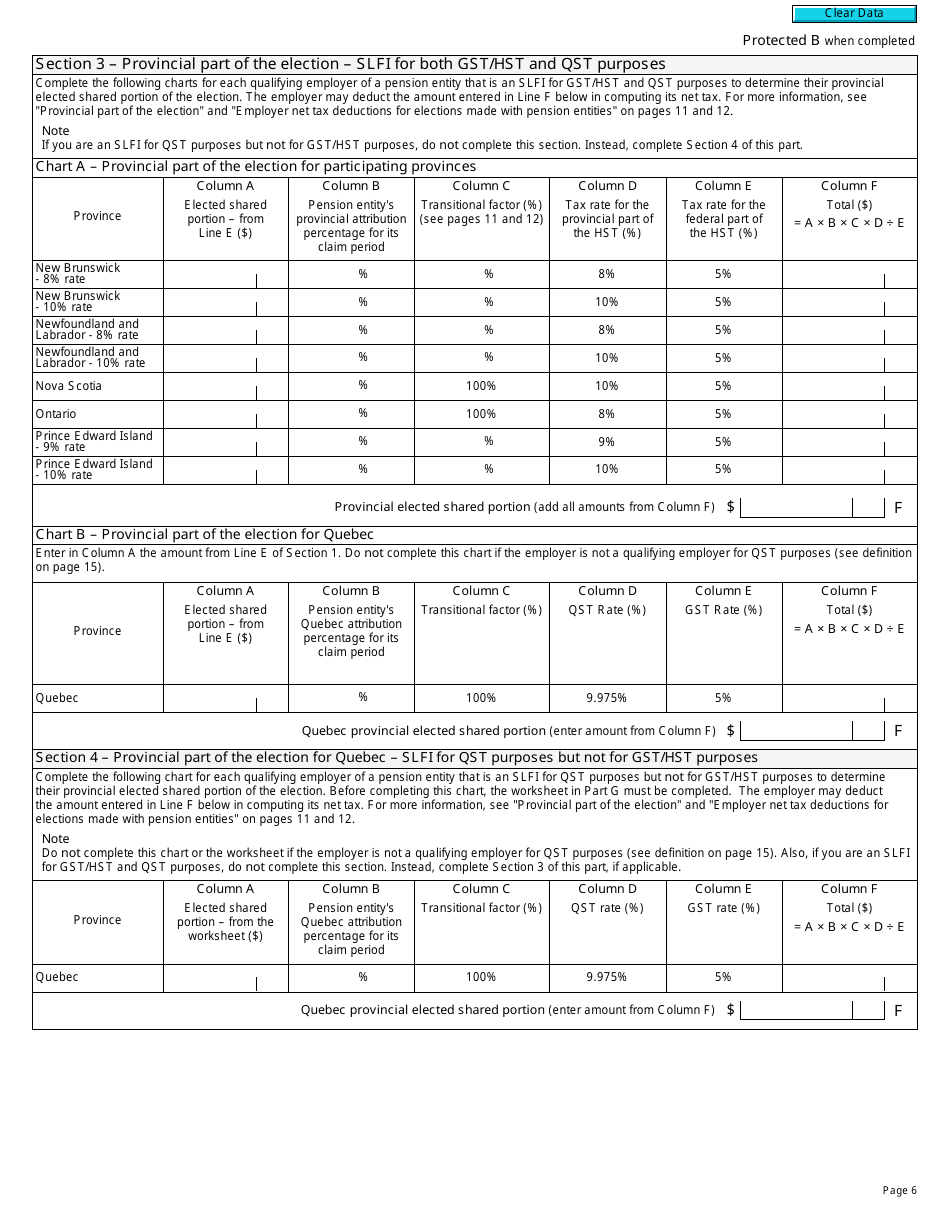

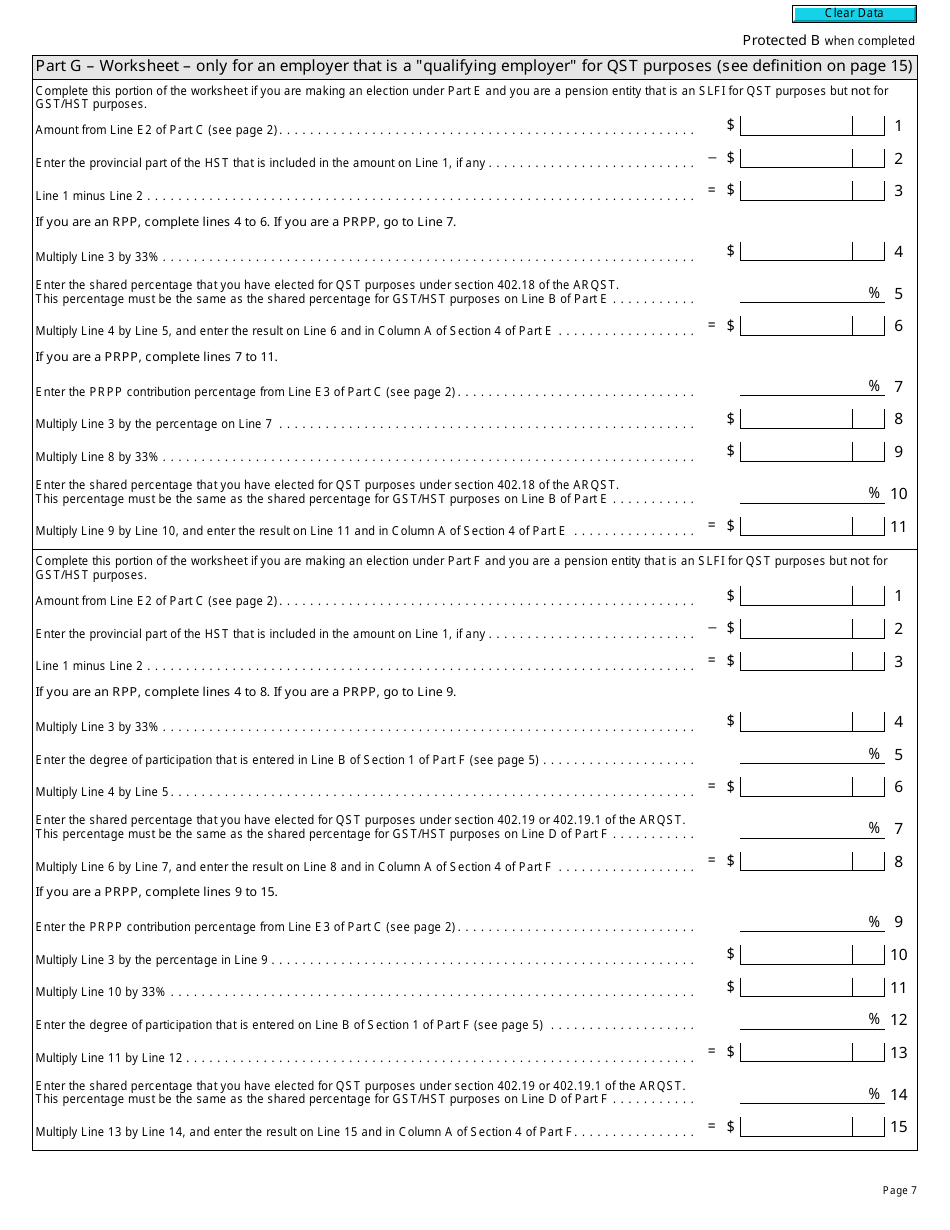

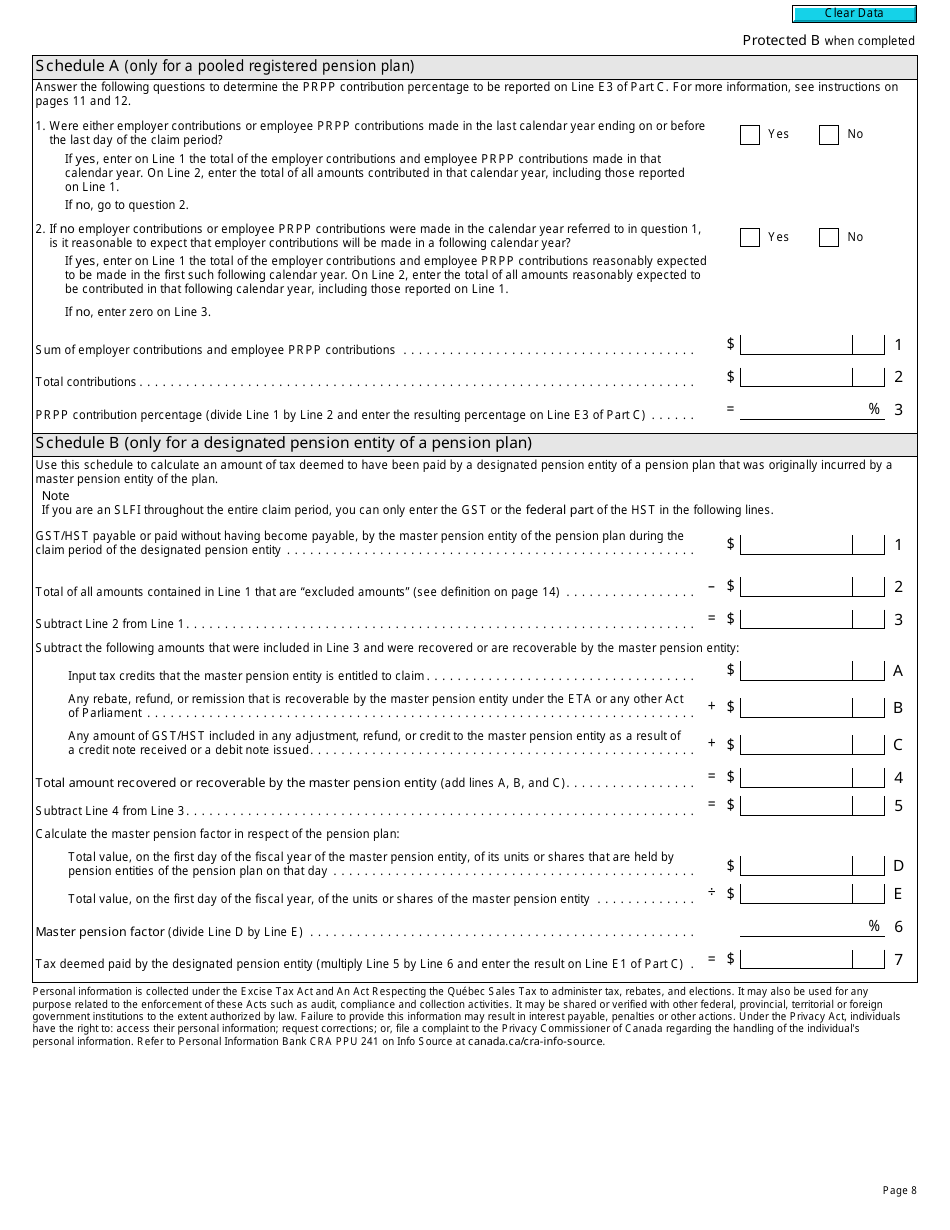

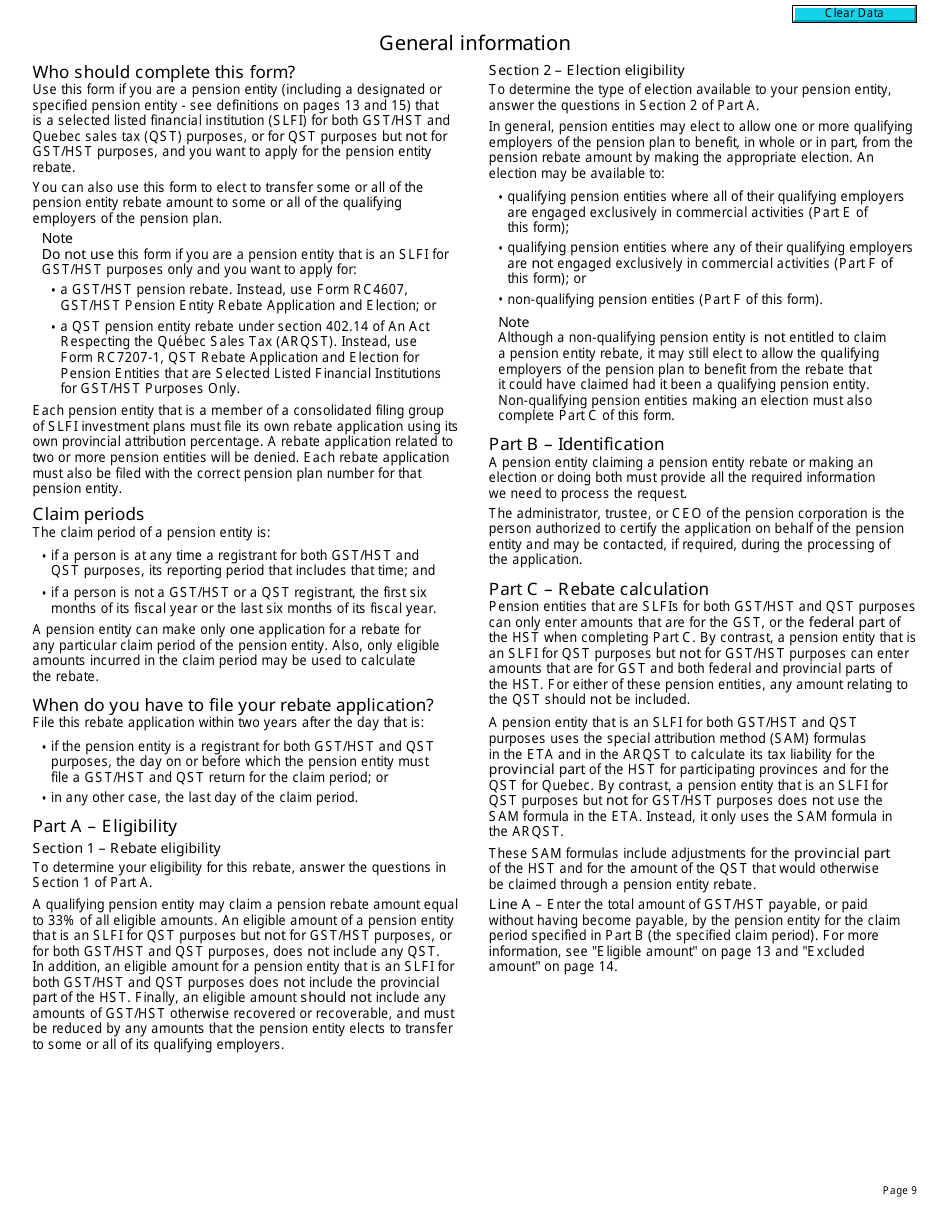

The Form R7207 GST/HST Rebate Application and Election for GST/HST and QST Purposes for Pension Entities that are Selected Listed Financial Institutions is a form used in Canada. It is specifically designed for pension entities that are selected listed financial institutions to apply for a rebate of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and the Quebec Sales Tax (QST). The form allows these entities to claim a refund of the tax paid on eligible expenses.

The Form R7207 GST/HST Rebate Application and Election for GST/HST and QST purposes for pension entities that are selected listed financial institutions in Canada is filed by the pension entity itself.

FAQ

Q: What is Form R7207?

A: Form R7207 is the Gst/Hst Rebate Application and Election for Gst/Hst and Qst Purposes for Pension Entities That Are Selected Listed Financial Institutions in Canada.

Q: Who can use Form R7207?

A: Form R7207 is specifically for pension entities that are selected listed financial institutions in Canada.

Q: What is the purpose of Form R7207?

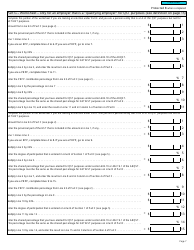

A: The purpose of Form R7207 is to apply for a Goods and Services Tax/Harmonized Sales Tax (Gst/Hst) rebate and make an election for Gst/Hst and Qst purposes.

Q: What is a Gst/Hst rebate?

A: A Gst/Hst rebate is a refund of the Goods and Services Tax/Harmonized Sales Tax paid on eligible expenses.

Q: What is a selected listed financial institution?

A: A selected listed financial institution is a financial entity that is designated by the Minister of Finance and listed in Schedule VI of the Excise Tax Act.

Q: What is Qst?

A: Qst stands for Quebec Sales Tax, which is the provincial sales tax imposed by the Quebec government.

Q: Who needs to make an election for Gst/Hst and Qst purposes?

A: Pension entities that are selected listed financial institutions need to make an election for Gst/Hst and Qst purposes.

Q: What is the deadline to submit Form R7207?

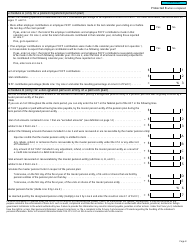

A: The deadline to submit Form R7207 is generally within two years after the end of the calendar year to which the application relates.

Q: Are there any other forms or documents required along with Form R7207?

A: Yes, additional supporting documents and information may be required depending on the specific circumstances and nature of the application. It is recommended to refer to the instructions provided with Form R7207 or consult with the Canada Revenue Agency (CRA) for detailed requirements.