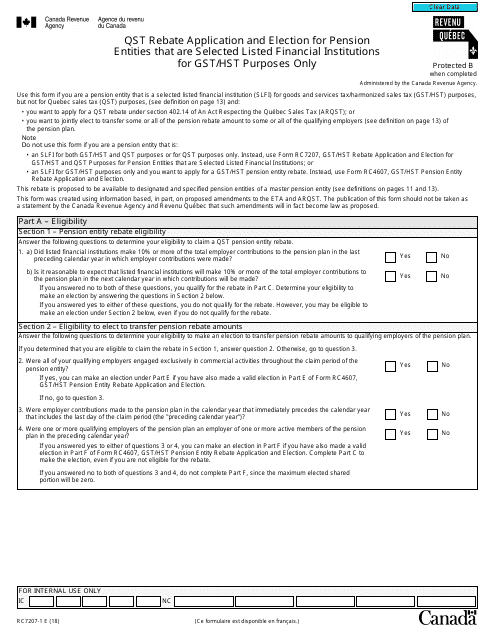

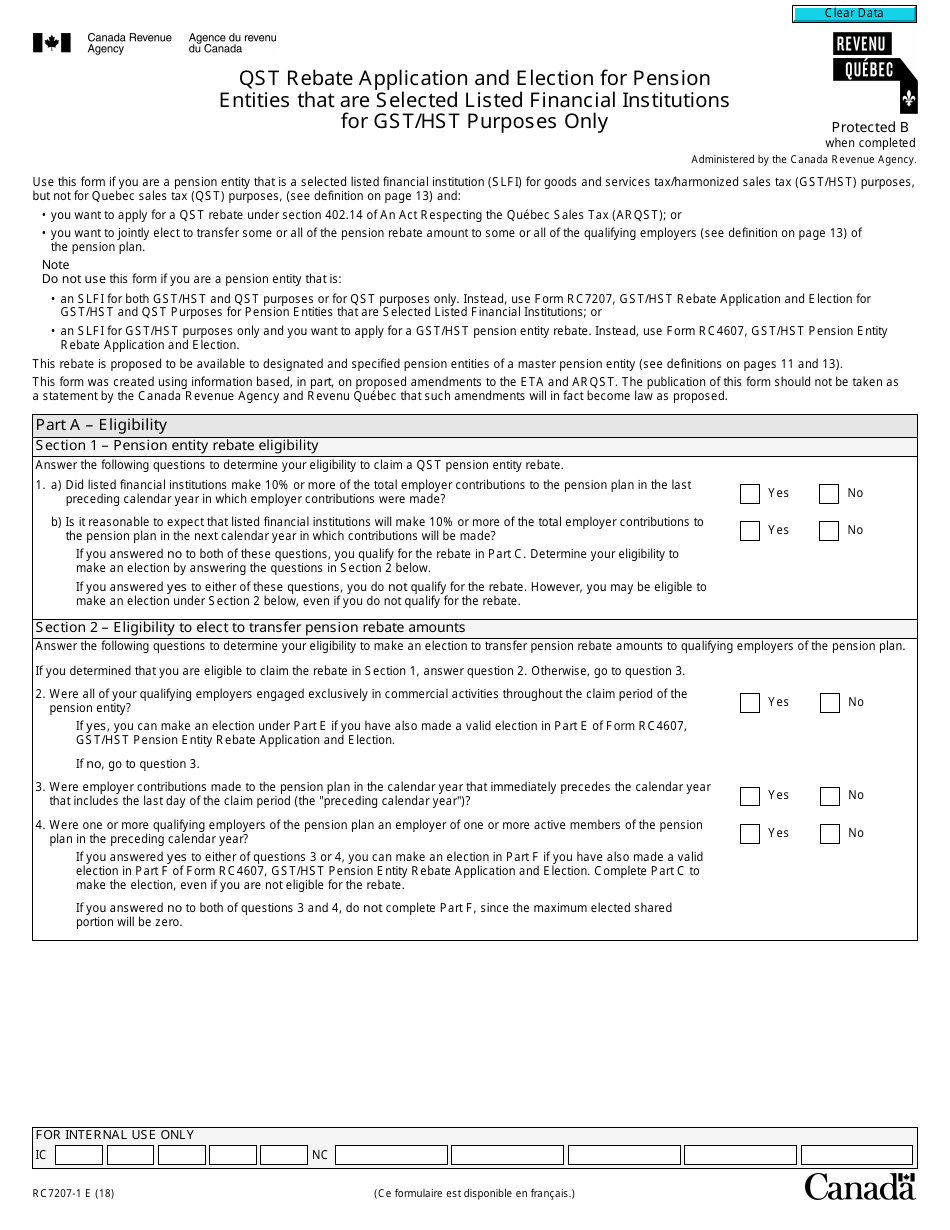

Form RC7207-1 Qst Rebate Application and Election for Pension Entities That Are Selected Listed Financial Institutions for Gst / Hst Purposes Only - Canada

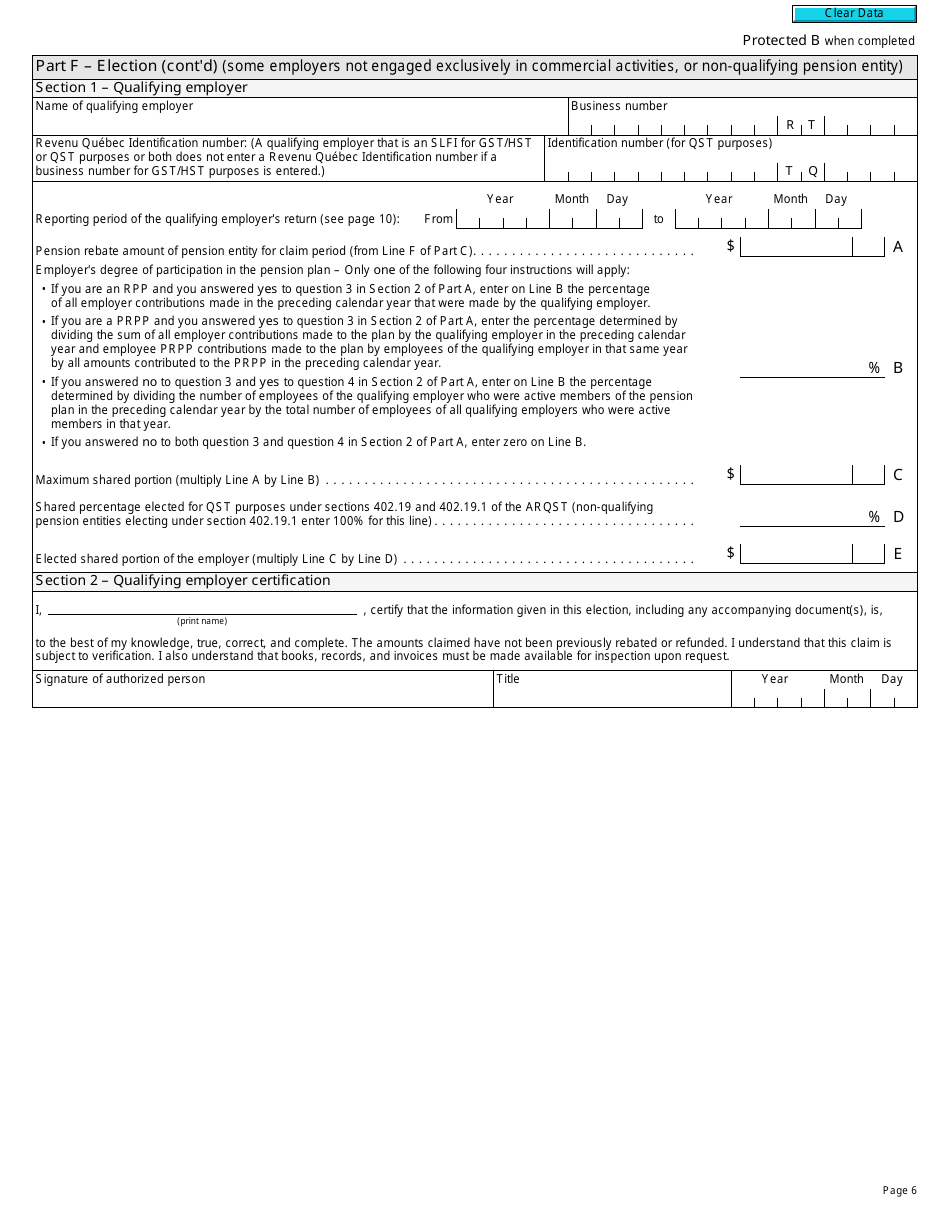

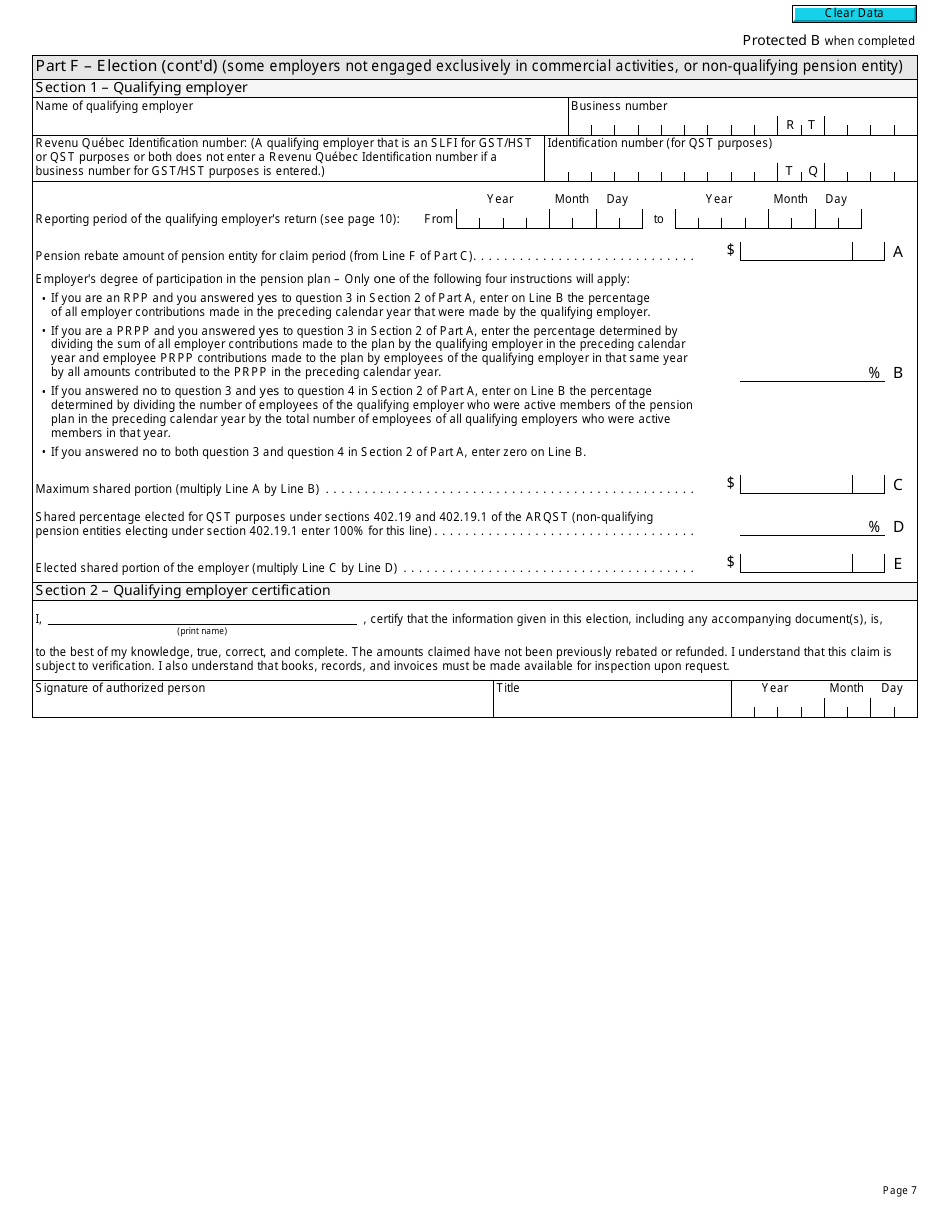

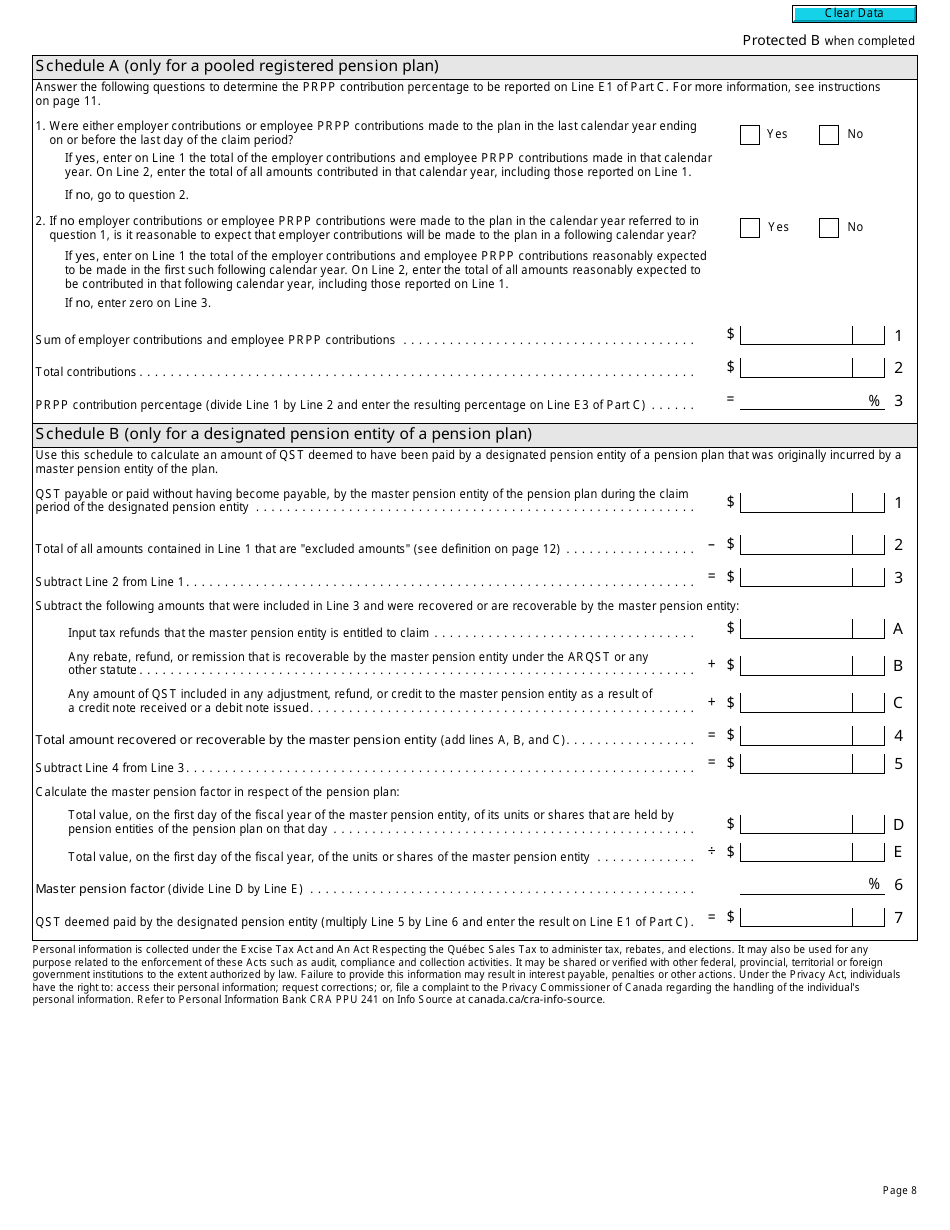

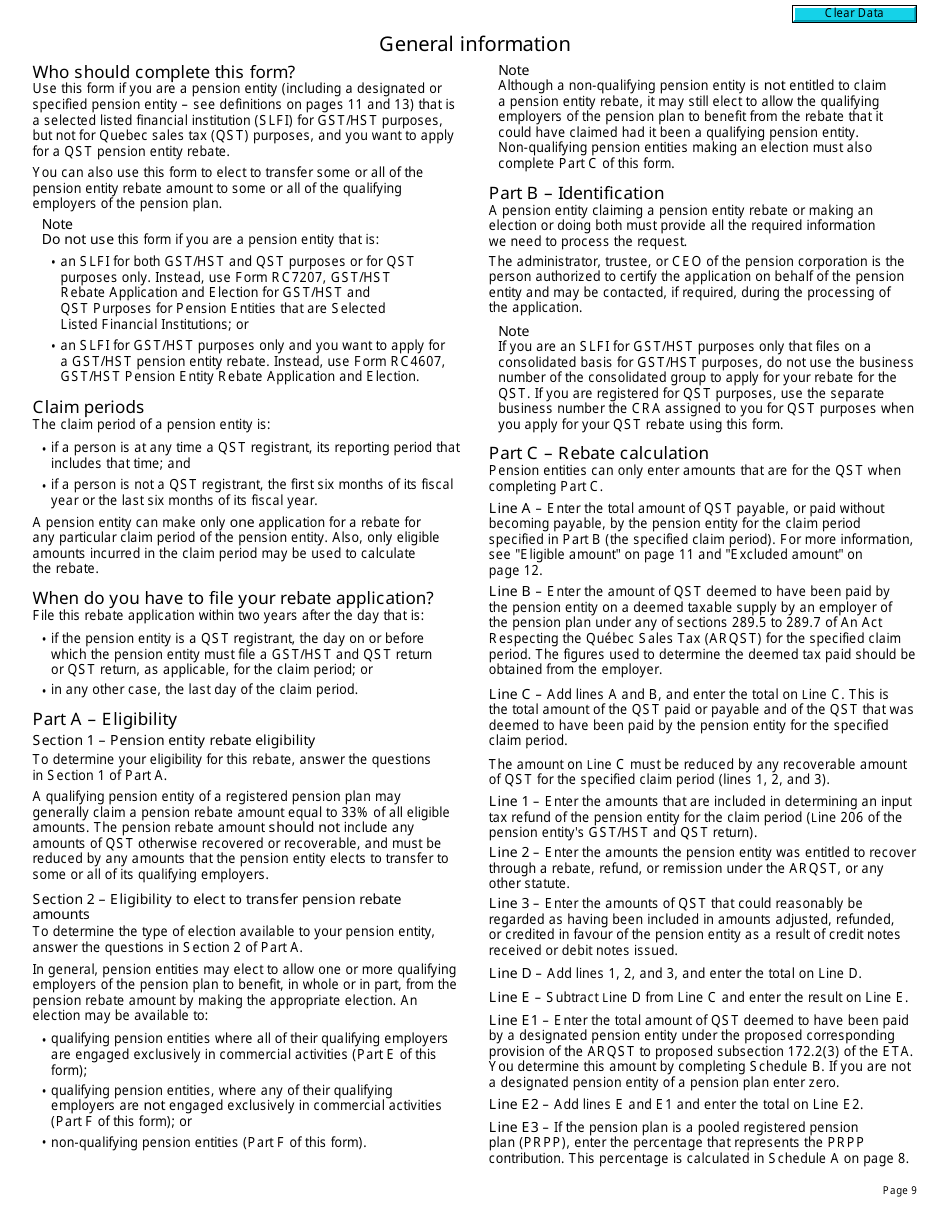

Form RC7207-1 QST Rebate Application and Election for Pension Entities That Are Selected Listed Financial Institutions for GST/HST Purposes Only - Canada is used for claiming a rebate of the Québec Sales Tax (QST) paid or payable on certain property or services acquired by pension entities that are selected listed financial institutions for GST/HST purposes. It allows them to recover the QST paid and reduce their overall tax liability.

The Form RC7207-1 QST Rebate Application and Election for Pension Entities that are Selected Listed Financial Institutions for GST/HST Purposes Only in Canada is filed by the pension entity itself.

FAQ

Q: What is Form RC7207-1?

A: Form RC7207-1 is the QST Rebate Application and Election for Pension Entities that are Selected Listed Financial Institutions for GST/HST purposes only in Canada.

Q: Who can use Form RC7207-1?

A: Pension entities that are selected listed financial institutions for GST/HST purposes in Canada can use Form RC7207-1.

Q: What is the purpose of Form RC7207-1?

A: The purpose of Form RC7207-1 is to apply for the Quebec sales tax (QST) rebate, and to make an election to determine the specified listed financial institution (SLFI) status for GST/HST purposes.

Q: How do I complete Form RC7207-1?

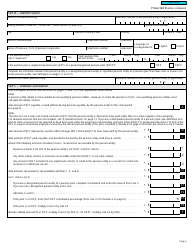

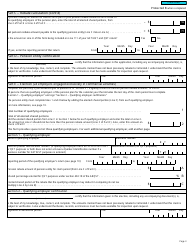

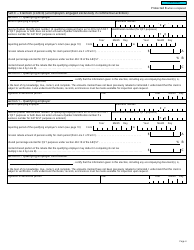

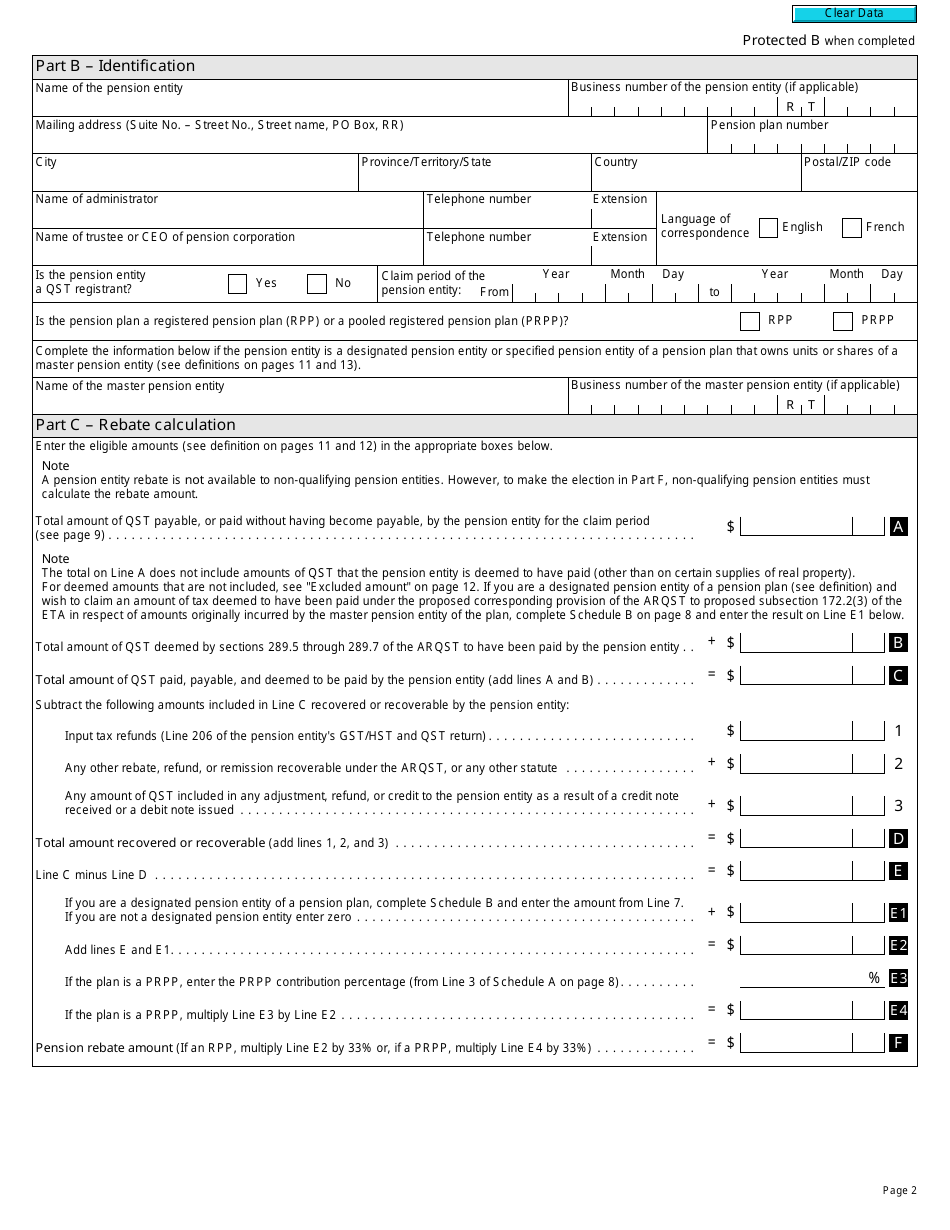

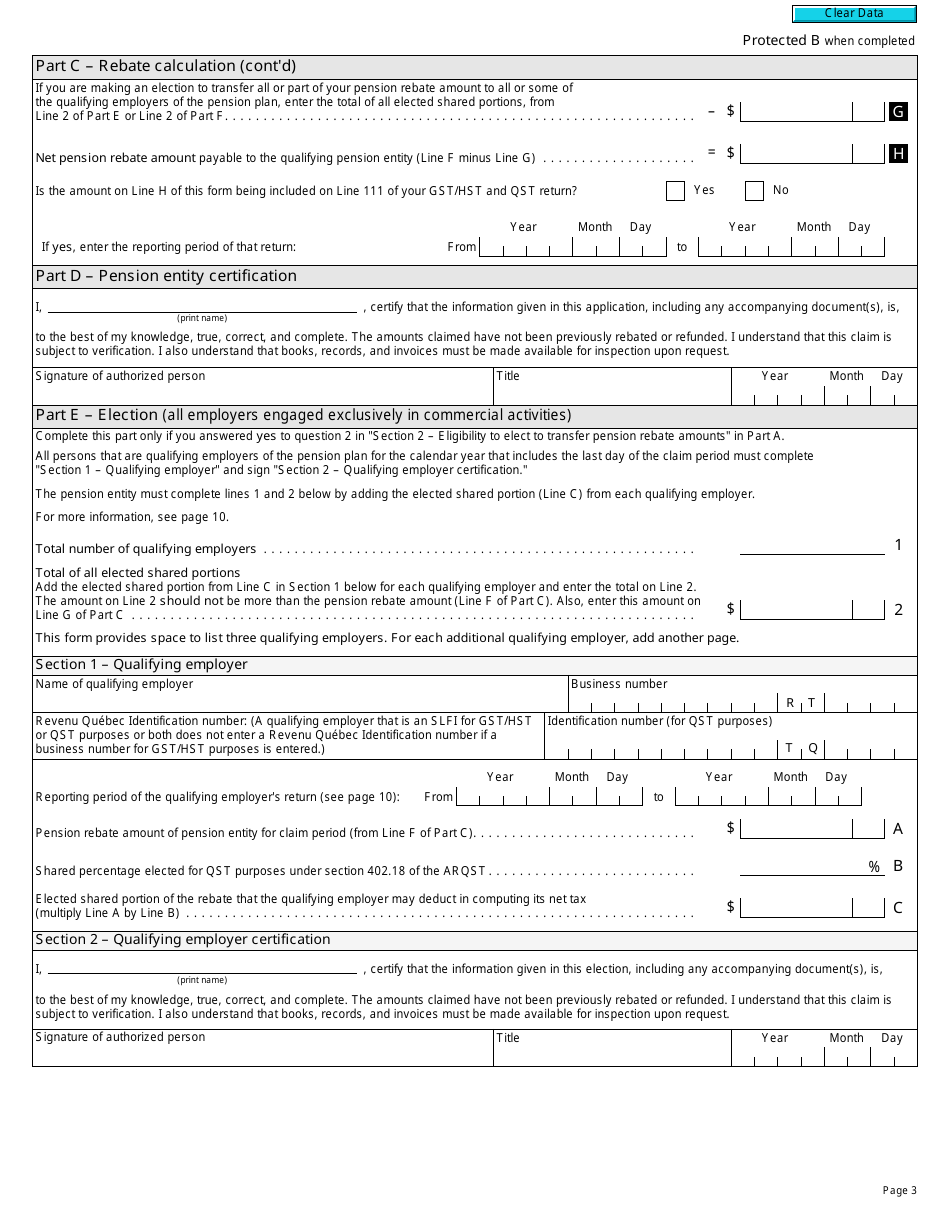

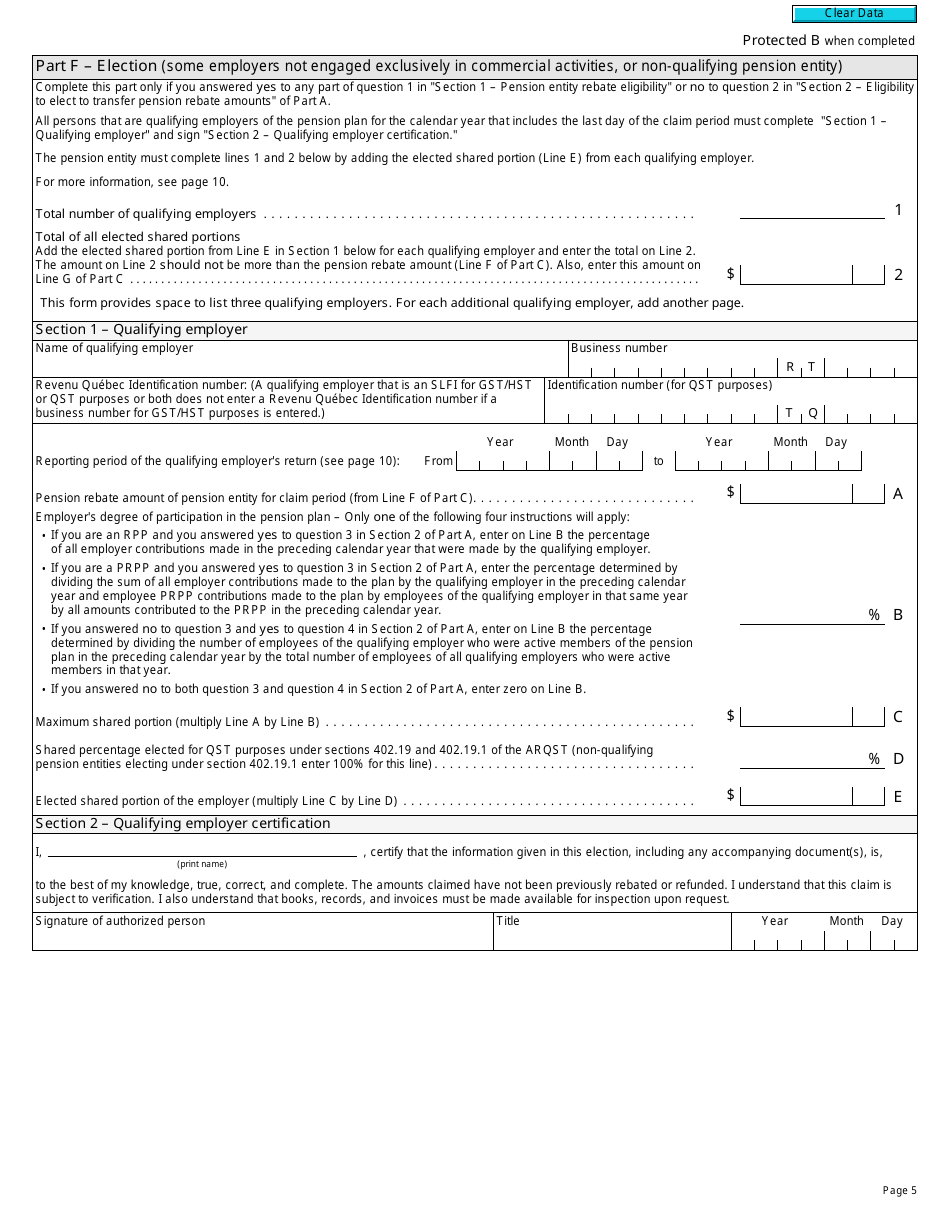

A: You need to fill in the required information on the form, including your pension entity's details, QST rebate amount, and election information. It is recommended to consult the instructions provided with the form or seek professional advice to ensure proper completion.

Q: When should I submit Form RC7207-1?

A: Form RC7207-1 should be submitted by the due date specified by the CRA. It is important to submit the form within the specified timeframe to avoid any penalties or delays.

Q: What should I do if I need assistance with Form RC7207-1?

A: If you need assistance with Form RC7207-1, you can contact the Canada Revenue Agency or consult a tax professional for guidance.

Q: Are there any fees associated with submitting Form RC7207-1?

A: There are no fees associated with submitting Form RC7207-1.

Q: What happens after I submit Form RC7207-1?

A: After you submit Form RC7207-1, the CRA will review your application and process the QST rebate accordingly. If your election for SLFI status is approved, the CRA will consider your pension entity as a selected listed financial institution for GST/HST purposes.