This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7215

for the current year.

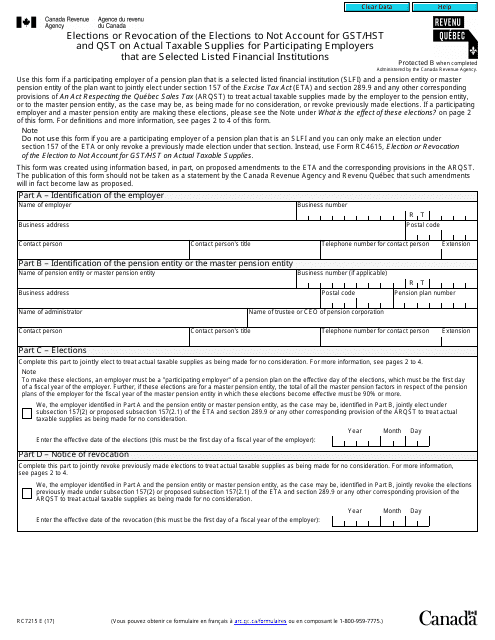

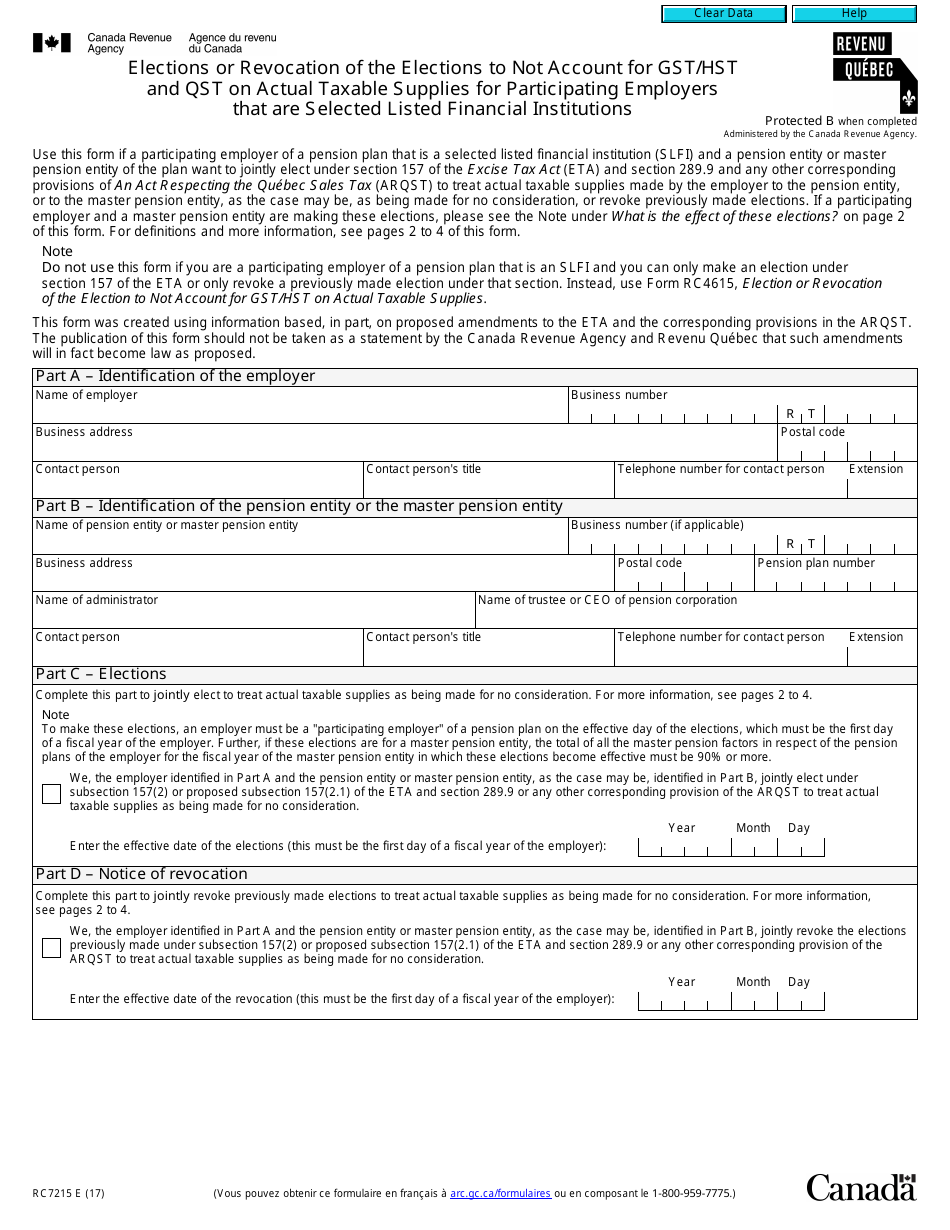

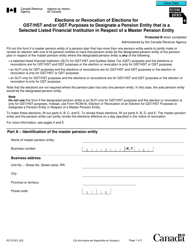

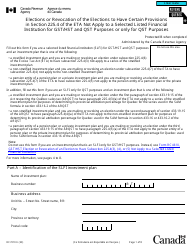

Form RC7215 Elections or Revocation of the Elections to Not Account for Gst / Hst and Qst on Actual Taxable Supplies for Participating Employers That Are Selected Listed Financial Institutions - Canada

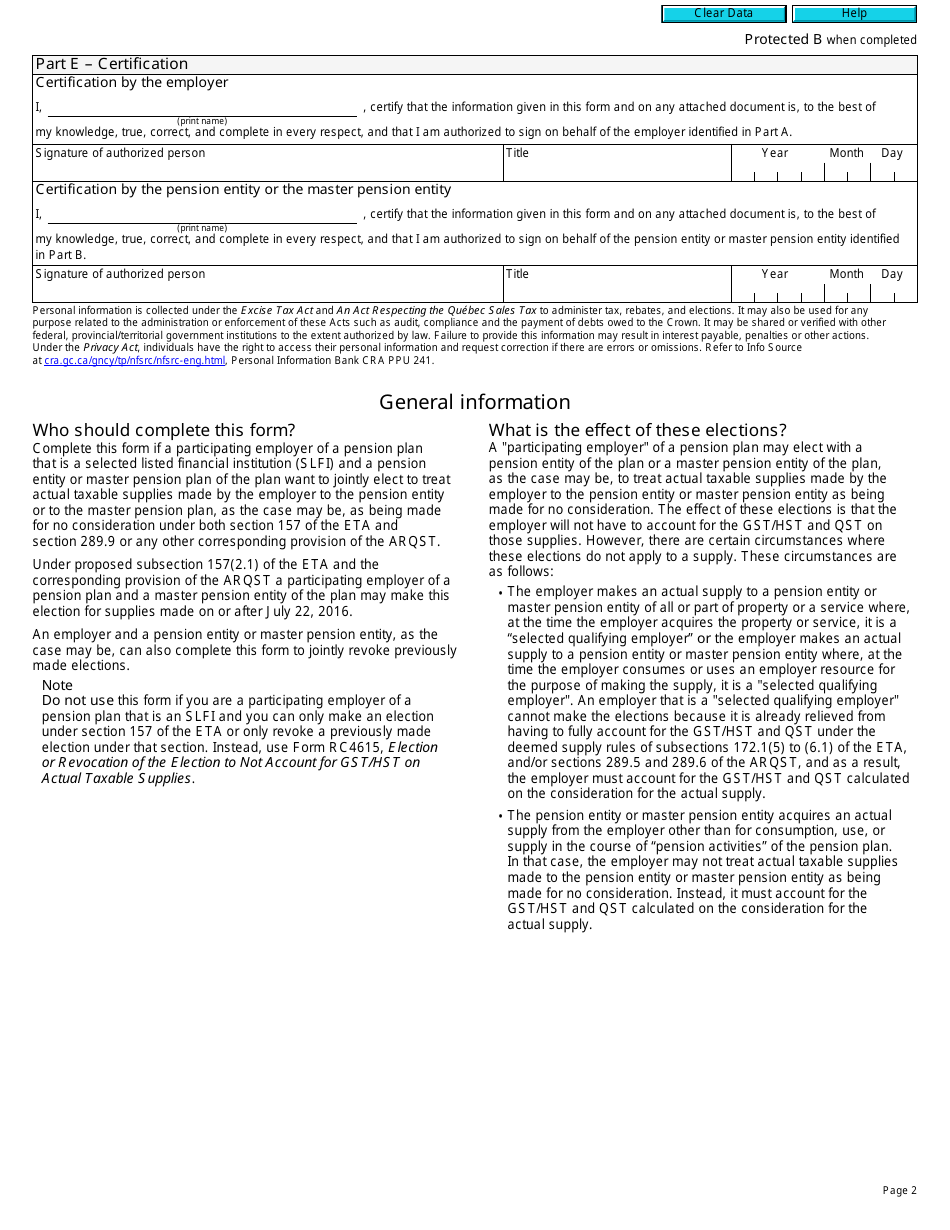

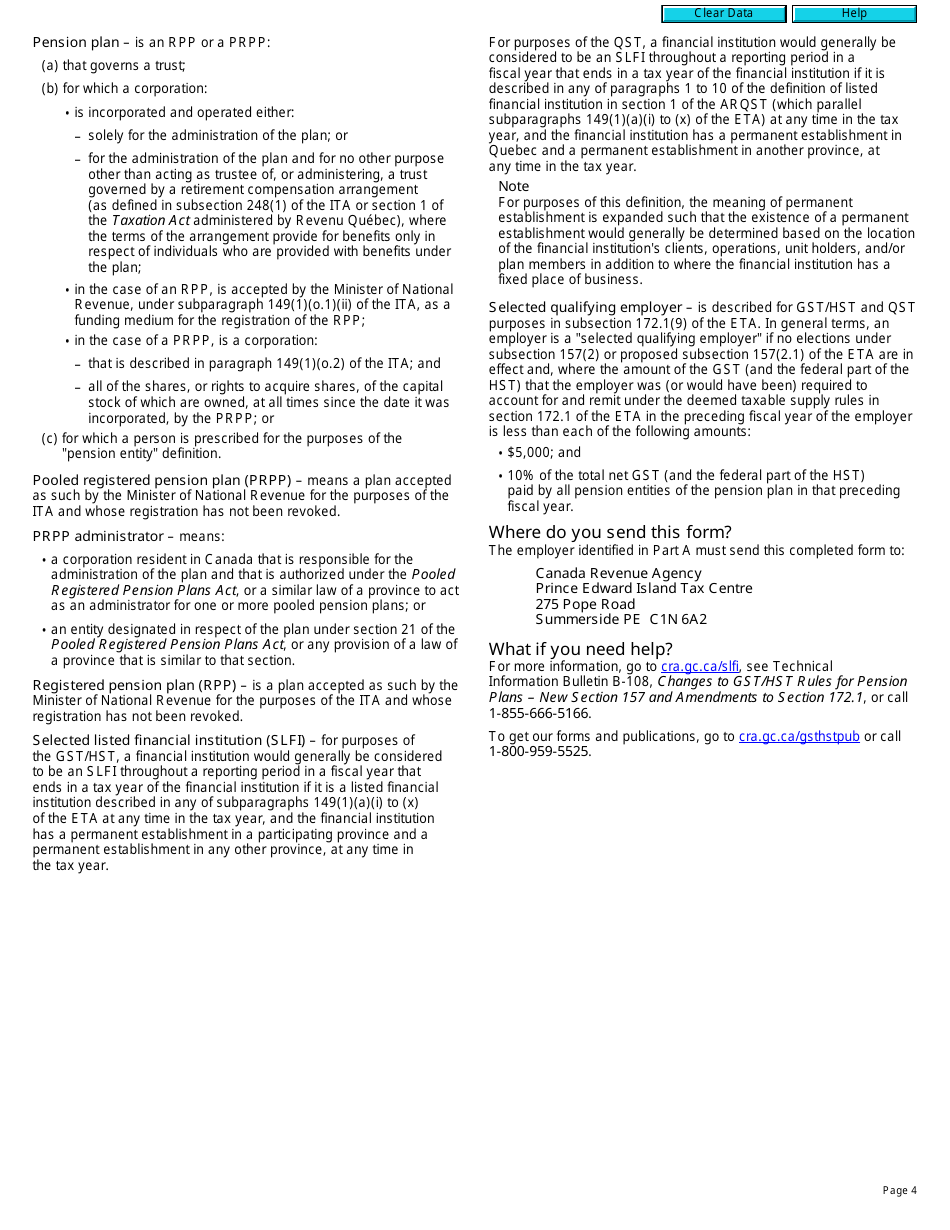

Form RC7215 Elections or Revocation of the Elections to Not Account for GST/HST and QST on Actual Taxable Supplies for Participating Employers That Are Selected Listed Financial Institutions in Canada is used for making elections or revoking elections to not account for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and Quebec Sales Tax (QST) on actual taxable supplies. This form is specifically for participating employers who are selected listed financial institutions. It allows them to choose whether or not to include the GST/HST and QST amounts in their taxable supplies.

The Form RC7215 is filed by participating employers who are selected listed financial institutions in Canada. It is used for elections or revocation of the elections to not account for GST/HST and QST on actual taxable supplies.

FAQ

Q: What is Form RC7215?

A: Form RC7215 is a tax form used in Canada for the elections or revocation of elections to not account for GST/HST and QST on actual taxable supplies for participating employers that are selected listed financial institutions.

Q: Who uses Form RC7215?

A: Form RC7215 is used by participating employers that are selected listed financial institutions in Canada.

Q: What is the purpose of Form RC7215?

A: The purpose of Form RC7215 is to allow participating employers that are selected listed financial institutions to elect or revoke the election to not account for GST/HST and QST on actual taxable supplies.

Q: What are GST and HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. They are consumption taxes in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a provincial sales tax in Quebec, Canada.