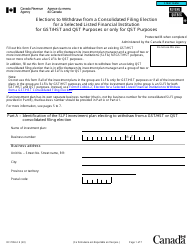

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7244

for the current year.

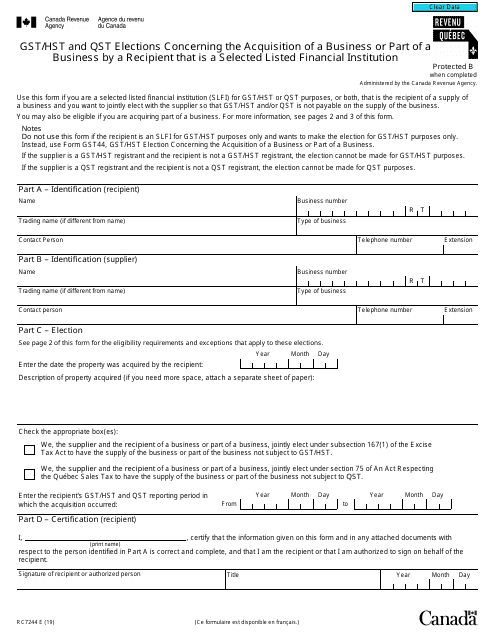

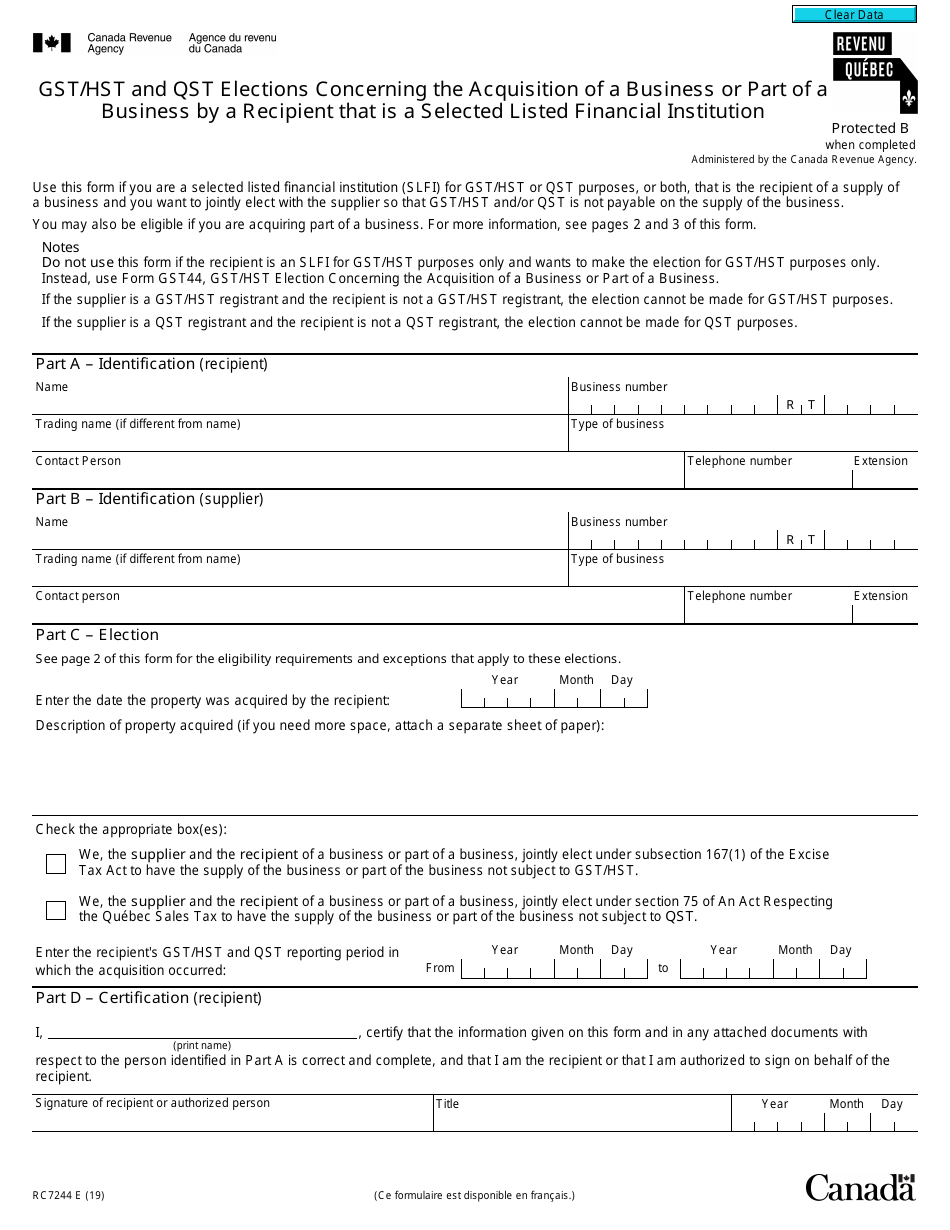

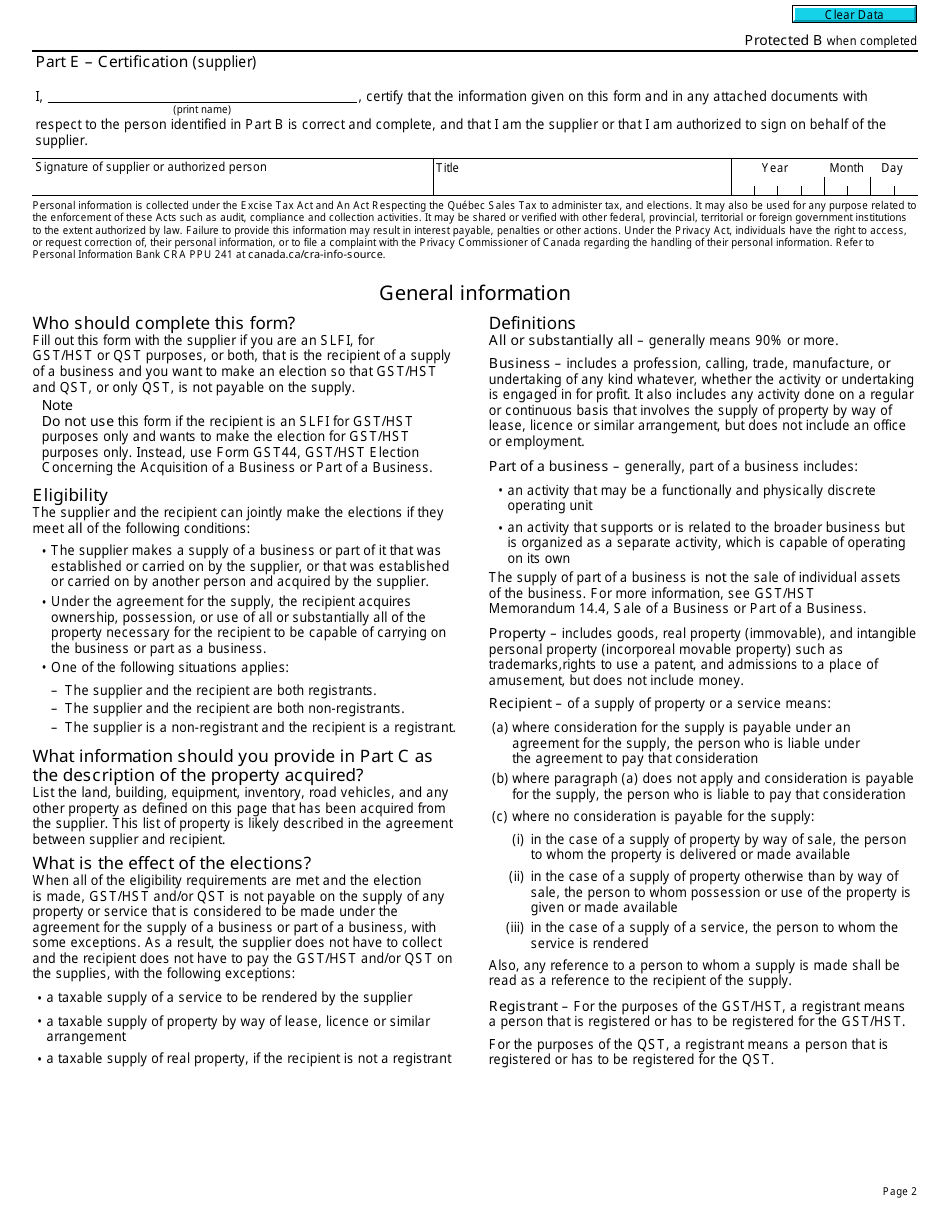

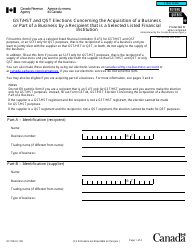

Form RC7244 Gst / Hst and Qst Elections Concerning the Acquisition of a Business or Part of a Business by a Recipient That Is a Selected Listed Financial Institution - Canada

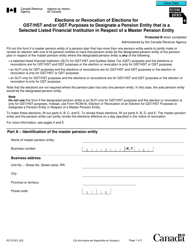

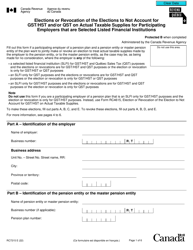

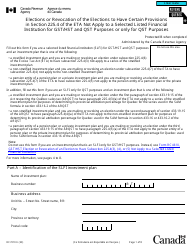

Form RC7244 GST/HST and QST Elections Concerning the Acquisition of a Business or Part of a Business by a Recipient That Is a Selected Listed Financial Institution is a form used in Canada to make elections related to the acquisition of a business or part of a business by a selected listed financial institution. The form is used for GST/HST (Goods and Services Tax/Harmonized Sales Tax) and QST (Quebec Sales Tax) purposes. It allows the recipient of the business or part of the business to make specific tax-related elections.

The form RC7244 GST/HST and QST Elections concerning the acquisition of a business or part of a business by a recipient that is a selected listed financial institution is filed by the recipient of the business.

FAQ

Q: What is RC7244?

A: RC7244 is a form used in Canada for GST/HST and QST elections concerning the acquisition of a business or part of a business by a recipient that is a selected listed financial institution.

Q: What is GST?

A: GST stands for Goods and Services Tax, which is a tax on most goods and services sold or provided in Canada.

Q: What is HST?

A: HST stands for Harmonized Sales Tax, which is a combined federal and provincial tax applicable in some provinces in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax, which is a tax on most goods and services sold or provided in Quebec.

Q: Who uses RC7244?

A: The form RC7244 is used by recipients that are selected listed financial institutions in Canada.

Q: What is a selected listed financial institution?

A: A selected listed financial institution refers to specific types of financial institutions that are eligible to use this election form.

Q: What is the purpose of the election?

A: The election is used to determine the GST/HST and QST treatment for the acquisition of a business or part of a business by a selected listed financial institution.

Q: Are there any deadlines for submitting RC7244?

A: Specific deadlines for submitting RC7244 may vary. It is recommended to check with the Canada Revenue Agency (CRA) for the applicable deadlines.