This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7246

for the current year.

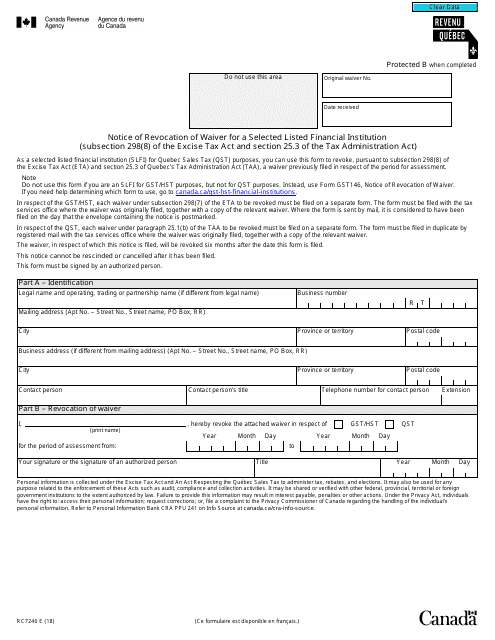

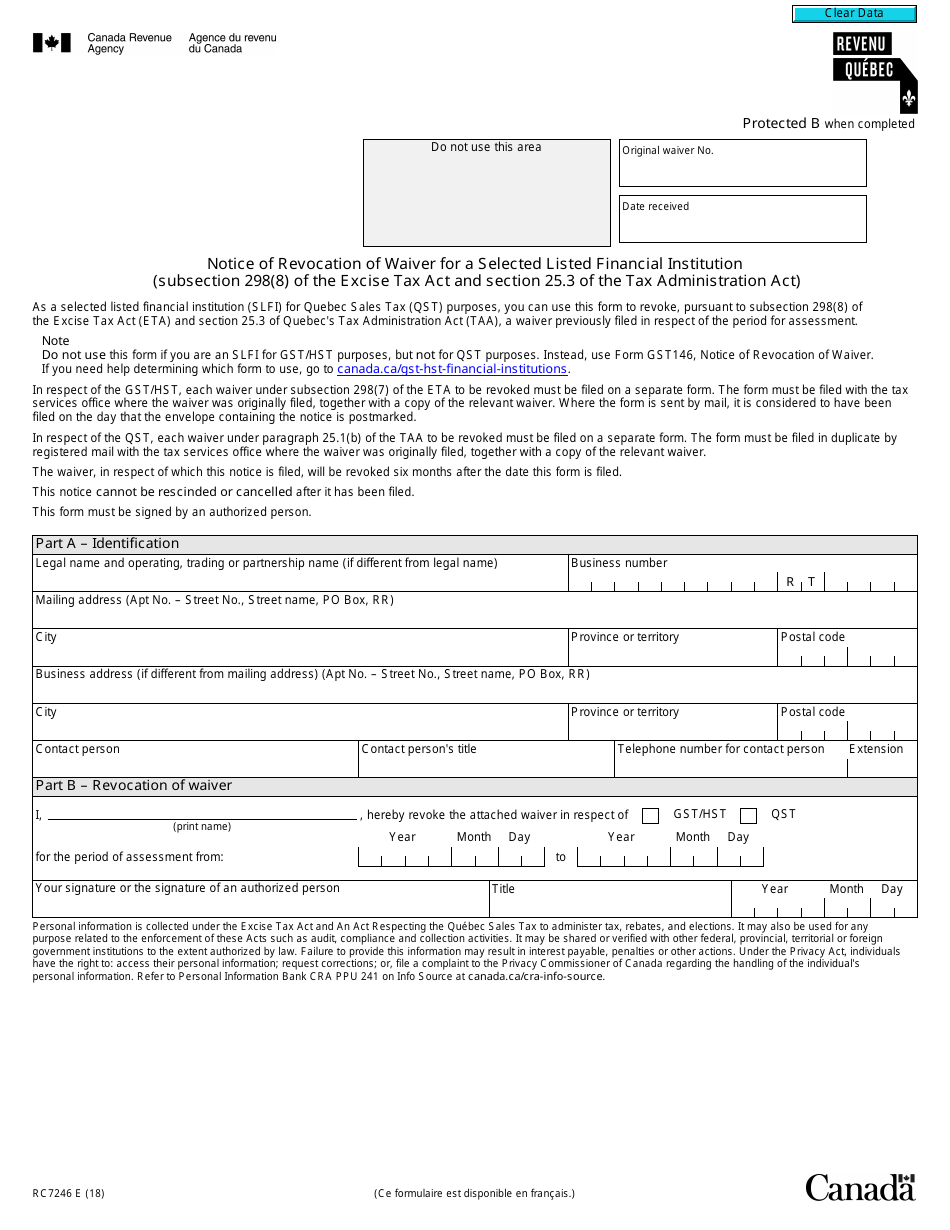

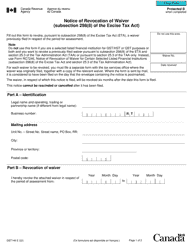

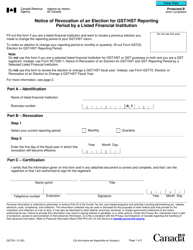

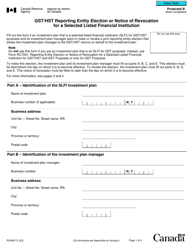

Form RC7246 Notice of Revocation of Waiver for Selected Listed Financial Institution (Subsection 298(8) of the Excise Tax Act and Section 25.3 of the Tax Administration Act) - Canada

Form RC7246, Notice of Revocation of Waiver for a Selected Listed Financial Institution, is used in Canada to revoke a previously granted waiver for a financial institution. This form is specifically designed for situations that fall under subsection 298(8) of the Excise Tax Act and Section 25.3 of the Tax Administration Act. The purpose of this form is to notify the relevant authorities that the waiver previously granted to the financial institution is being revoked.

Only financial institutions selected by the Canada Revenue Agency (CRA) can file the Form RC7246 Notice of Revocation of Waiver for Selected Listed Financial Institution. This form is used when a financial institution wants to revoke the waiver it previously obtained under Subsection 298(8) of the Excise Tax Act and Section 25.3 of the Tax Administration Act.

FAQ

Q: What is Form RC7246?

A: Form RC7246 is a notice of revocation of waiver for a selected listed financial institution in Canada. It is used to inform the institution that their waiver has been revoked.

Q: What does the revocation of waiver mean?

A: Revocation of waiver means that the selected listed financial institution no longer has the exemption or special treatment previously granted.

Q: What is a selected listed financial institution?

A: A selected listed financial institution refers to specific institutions that are subject to certain tax provisions under the Excise Tax Act and Tax Administration Act in Canada.

Q: Why would a waiver be revoked?

A: A waiver may be revoked if the financial institution no longer meets the eligibility criteria or fails to comply with the required obligations.

Q: How does the revocation affect the institution?

A: The revocation of waiver means that the financial institution will no longer enjoy the benefits or exemptions they previously had, and they will be subject to the regular tax provisions.

Q: What should the institution do upon receiving Form RC7246?

A: Upon receiving Form RC7246, the institution should review the reasons for revocation, assess their compliance status, and take appropriate actions to address any issues.

Q: Are there any potential penalties for non-compliance?

A: Yes, if a financial institution fails to comply with the tax provisions after the revocation of waiver, they may face penalties and consequences imposed by the Canada Revenue Agency.

Q: Can the revocation of waiver be appealed?

A: Yes, the financial institution has the right to appeal the revocation of waiver to the appropriate authorities within a specified time frame.

Q: Is there any additional documentation required with Form RC7246?

A: Depending on the circumstances, additional documentation or supporting evidence may be required to accompany Form RC7246. It is recommended to consult with the Canada Revenue Agency for specific requirements.