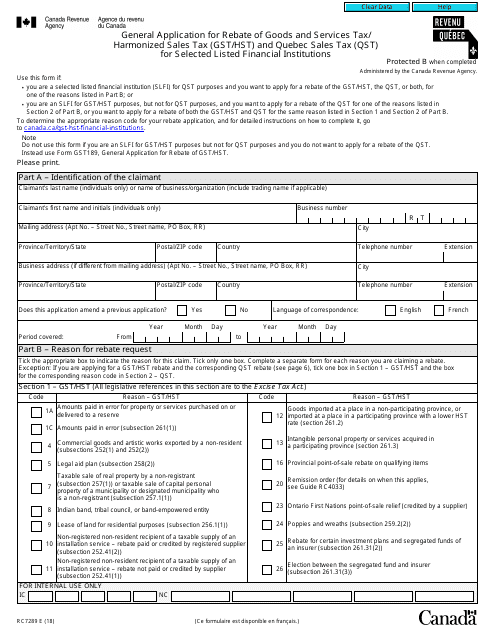

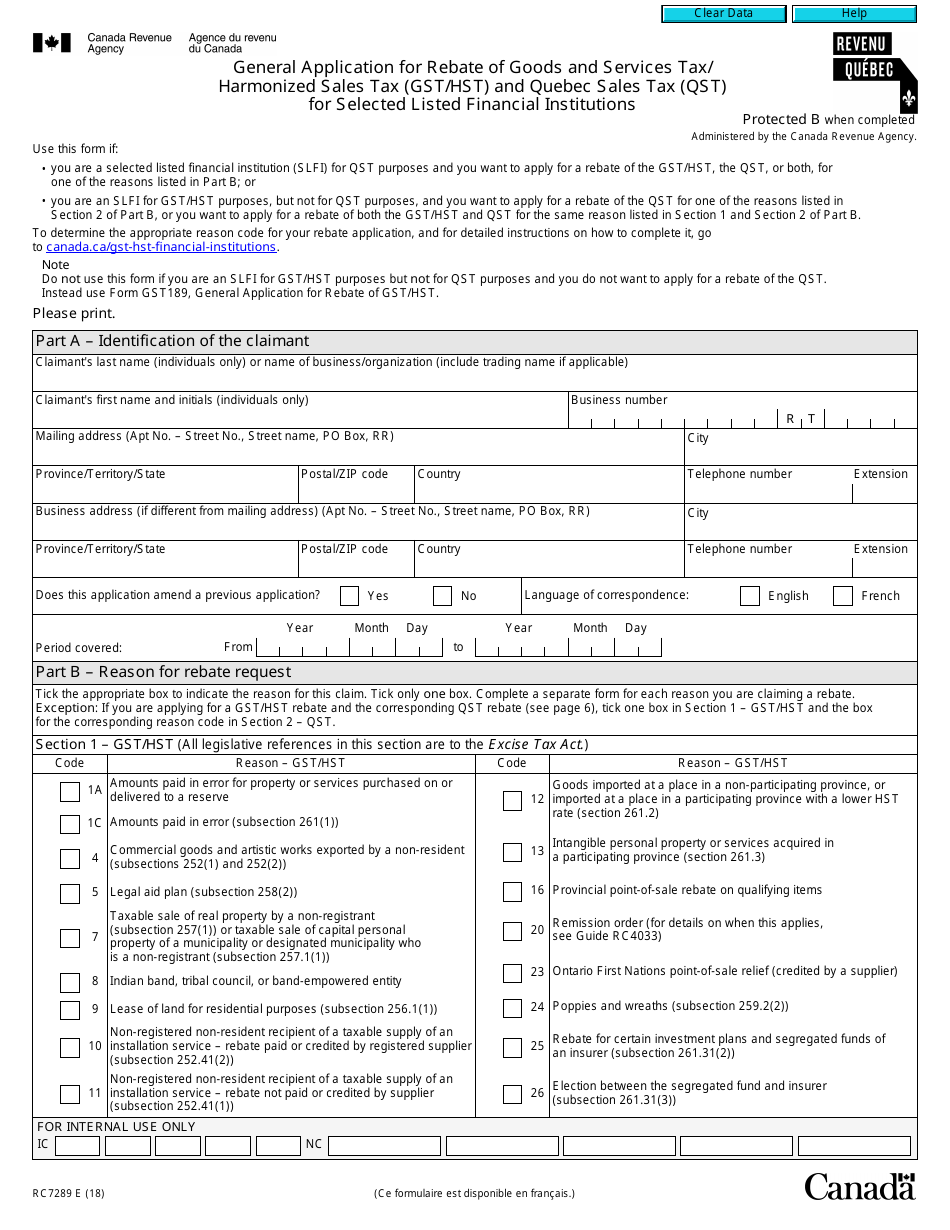

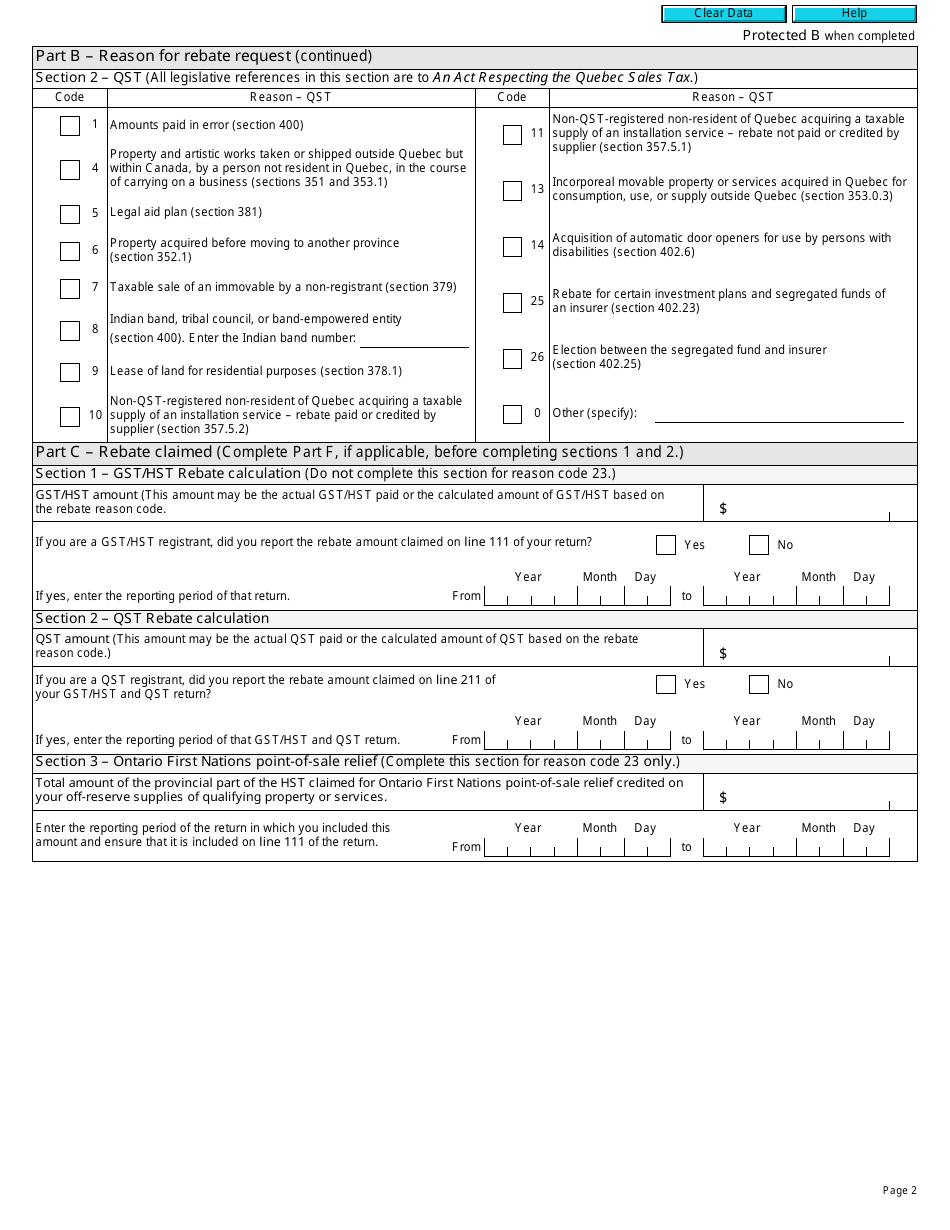

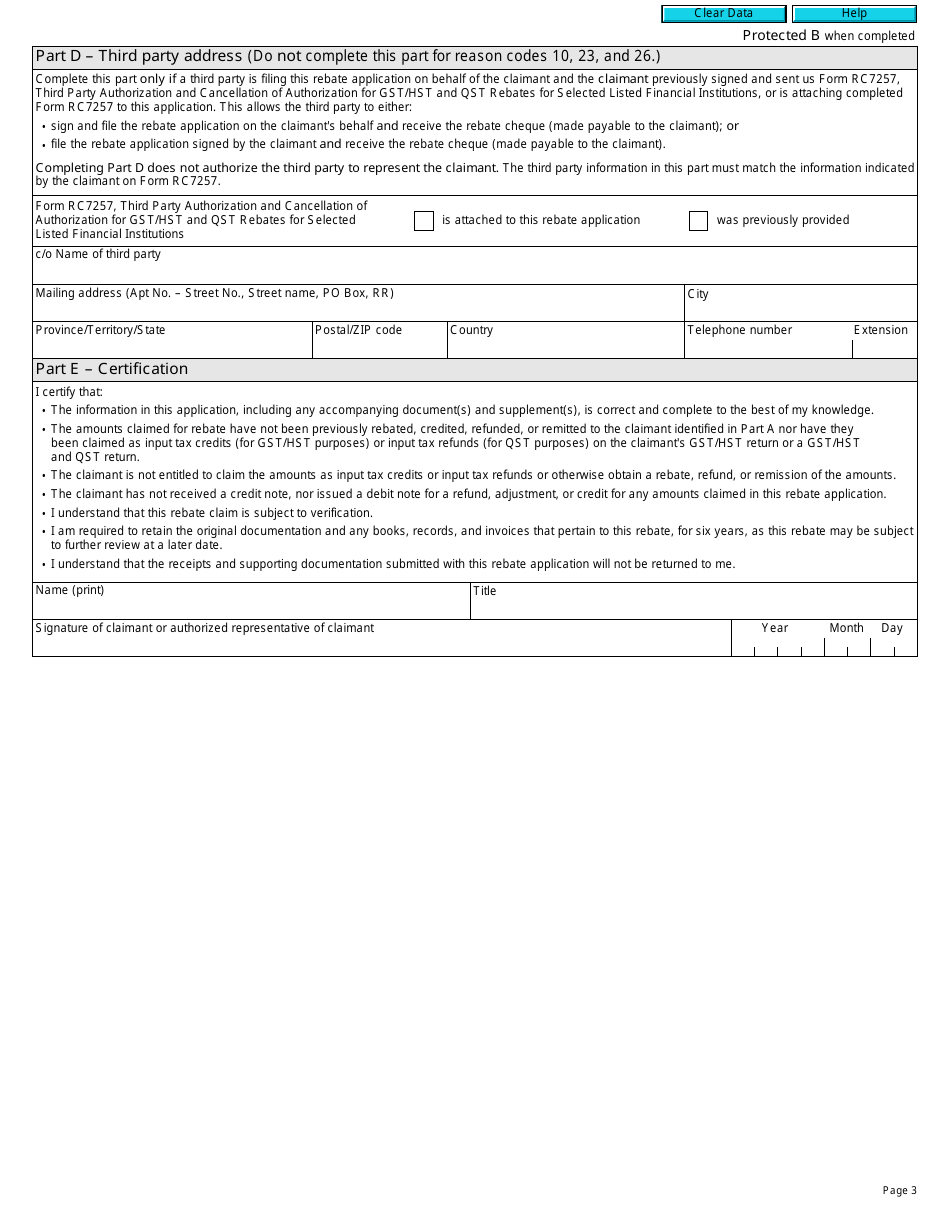

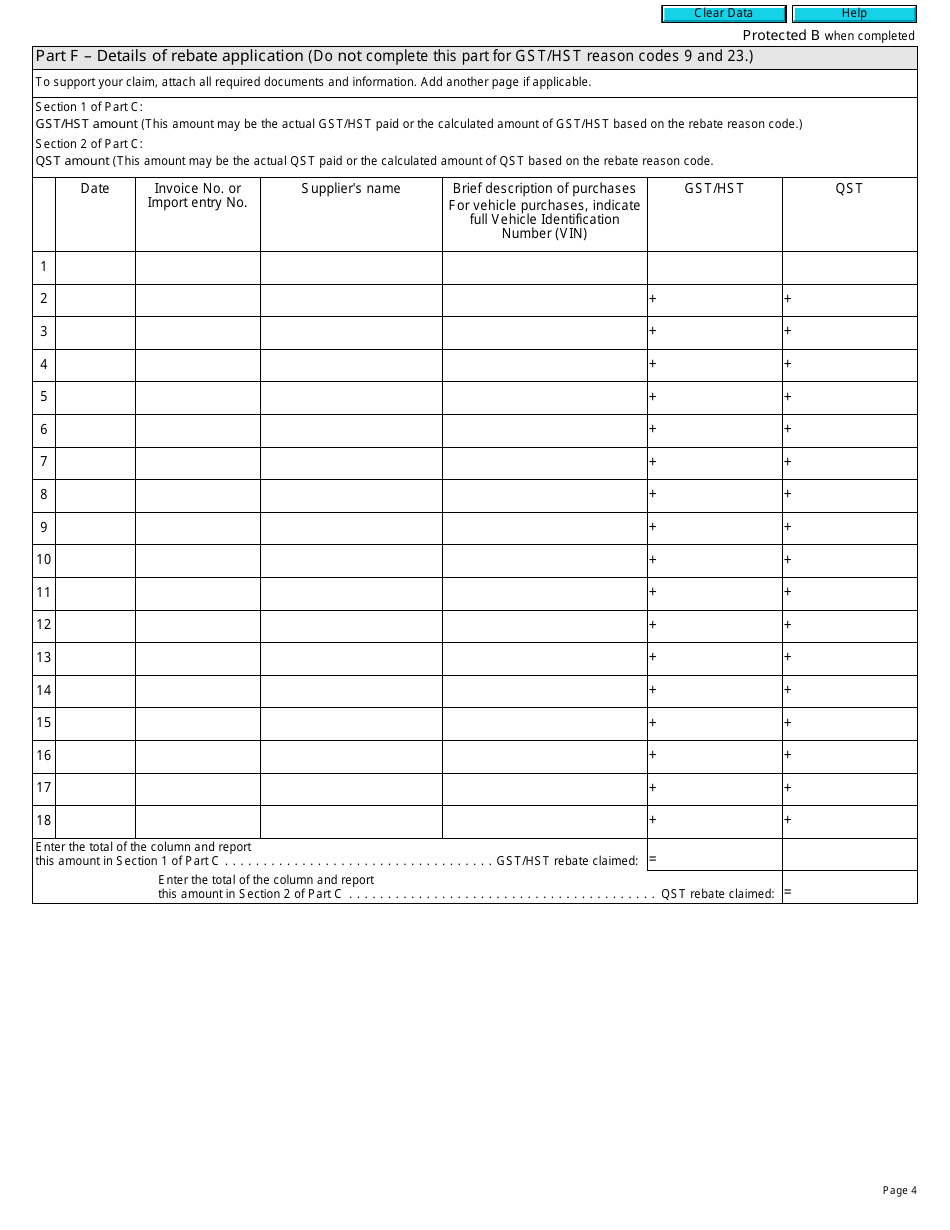

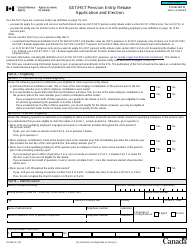

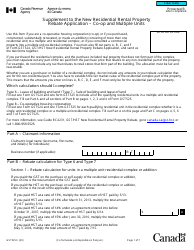

Form RC7289 General Application for Rebate of Goods and Services Tax / Harmonized Sales Tax (Gst / Hst) and Quebec Sales Tax (Qst) for Selected Listed Financial Institutions - Canada

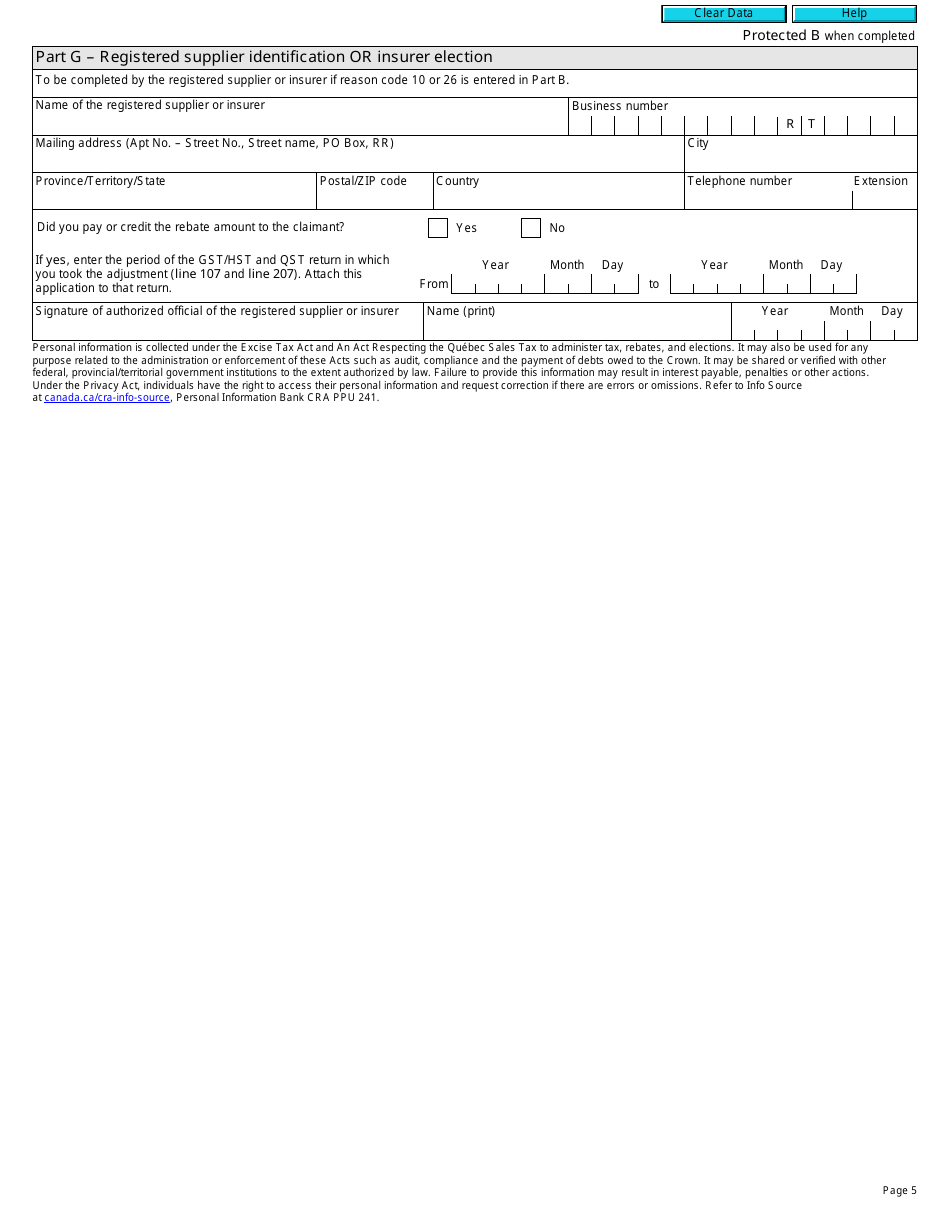

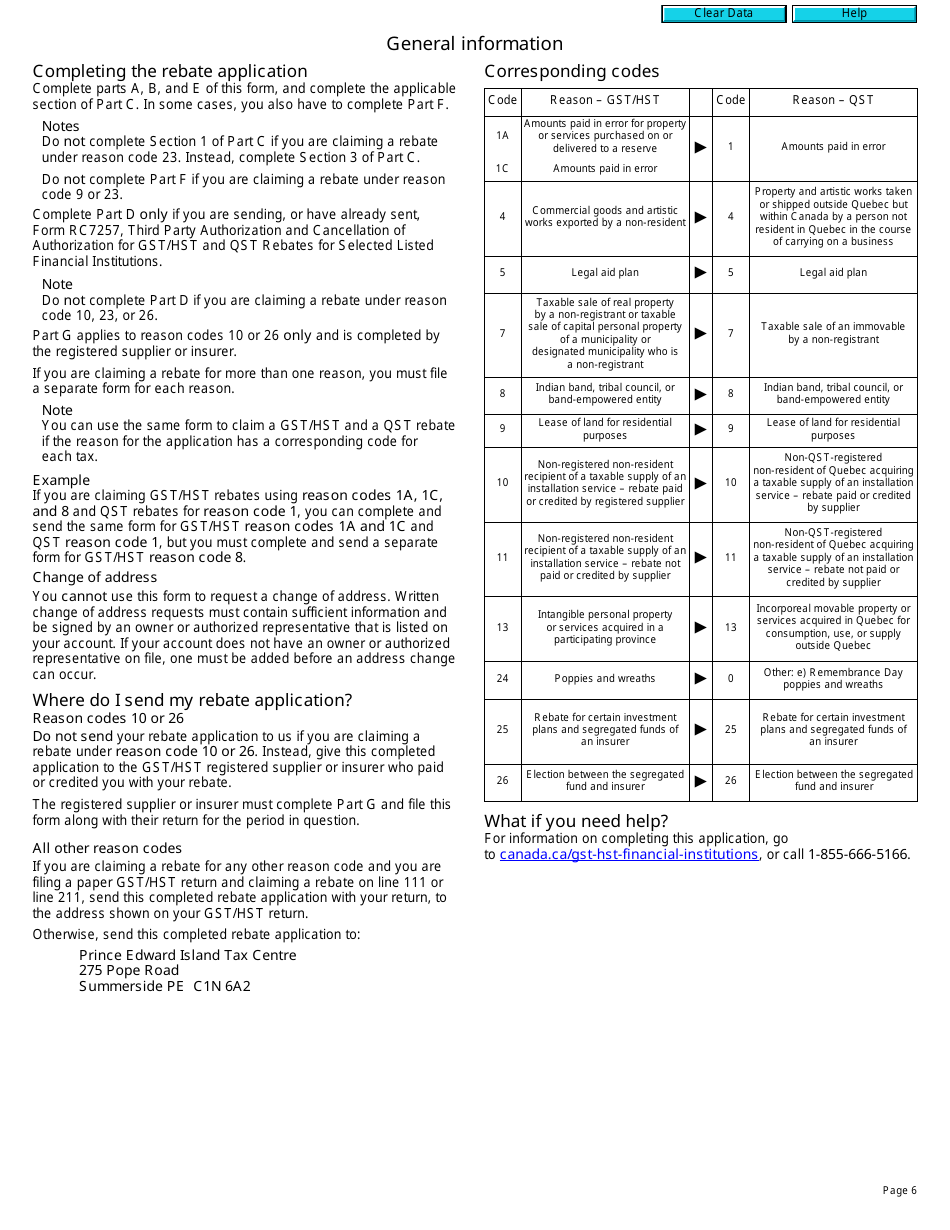

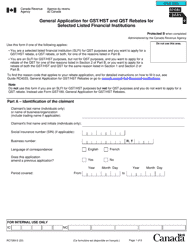

Form RC7289 is used by selected listed financial institutions in Canada to apply for a rebate of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and Quebec Sales Tax (QST).

Financial institutions in Canada file the Form RC7289 for the General Application for Rebate of Goods and Services Tax/Harmonized Sales Tax (GST/HST) and Quebec Sales Tax (QST).

FAQ

Q: What is Form RC7289?

A: Form RC7289 is the General Application for Rebate of Goods and Services Tax/Harmonized Sales Tax (GST/HST) and Quebec Sales Tax (QST) for Selected Listed Financial Institutions in Canada.

Q: Who can use Form RC7289?

A: Selected Listed Financial Institutions in Canada can use Form RC7289 to apply for a rebate of GST/HST and QST.

Q: What is GST/HST?

A: GST/HST stands for Goods and Services Tax/Harmonized Sales Tax. It is a tax on most goods and services in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a tax imposed by the province of Quebec on most goods and services sold in Quebec.

Q: Why would a financial institution apply for a rebate of GST/HST and QST?

A: Financial institutions may be eligible for a rebate of GST/HST and QST on certain transactions, and they can apply for the rebate using Form RC7289.

Q: Are there any deadlines for submitting Form RC7289?

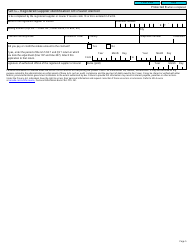

A: Yes, there are specific deadlines for submitting Form RC7289. It is important to check the instructions on the form or consult the CRA for the deadline information.