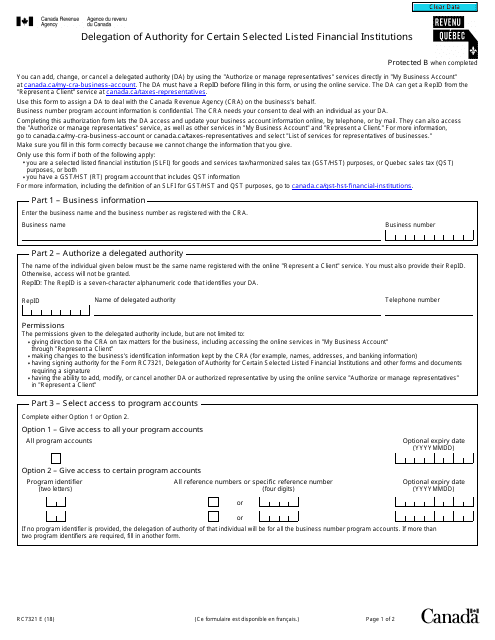

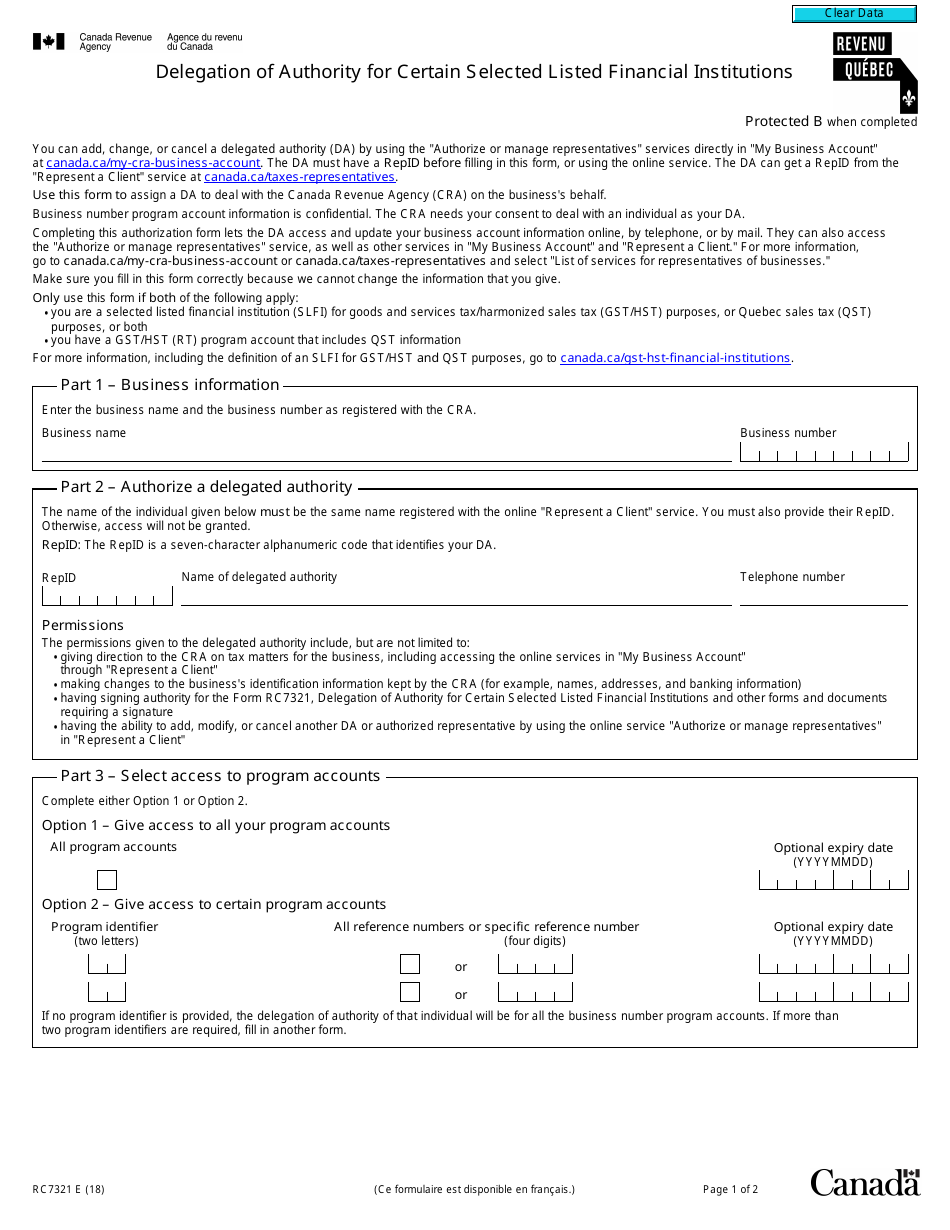

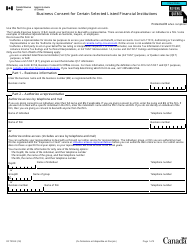

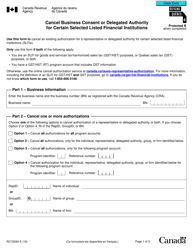

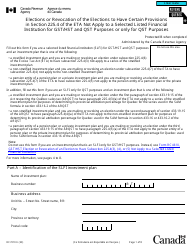

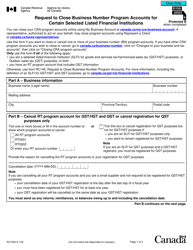

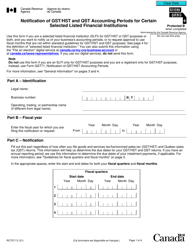

Form RC7321 Delegation of Authority for Certain Selected Listed Financial Institutions - Canada

Form RC7321 is a document used in Canada for the purpose of delegating authority to certain selected listed financial institutions. It specifies the scope of authority that these institutions have in regard to specific tax matters.

The Form RC7321 Delegation of Authority for Certain Selected Listed Financial Institutions in Canada is filed by the financial institutions themselves.

FAQ

Q: What is Form RC7321?

A: Form RC7321 is a document used in Canada for the delegation of authority for certain selected listed financial institutions.

Q: What does Form RC7321 delegate?

A: Form RC7321 delegates authority to certain selected listed financial institutions.

Q: Who uses Form RC7321?

A: Certain selected listed financial institutions in Canada use Form RC7321.

Q: What is the purpose of Form RC7321?

A: The purpose of Form RC7321 is to delegate authority to certain selected listed financial institutions.

Q: What does Form RC7321 apply to?

A: Form RC7321 applies to certain selected listed financial institutions in Canada.

Q: Is Form RC7321 mandatory?

A: The use of Form RC7321 is mandatory for certain selected listed financial institutions in Canada.

Q: What are the consequences of not using Form RC7321?

A: Failure to use Form RC7321 when required may result in penalties or other legal consequences.

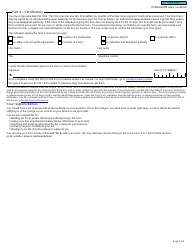

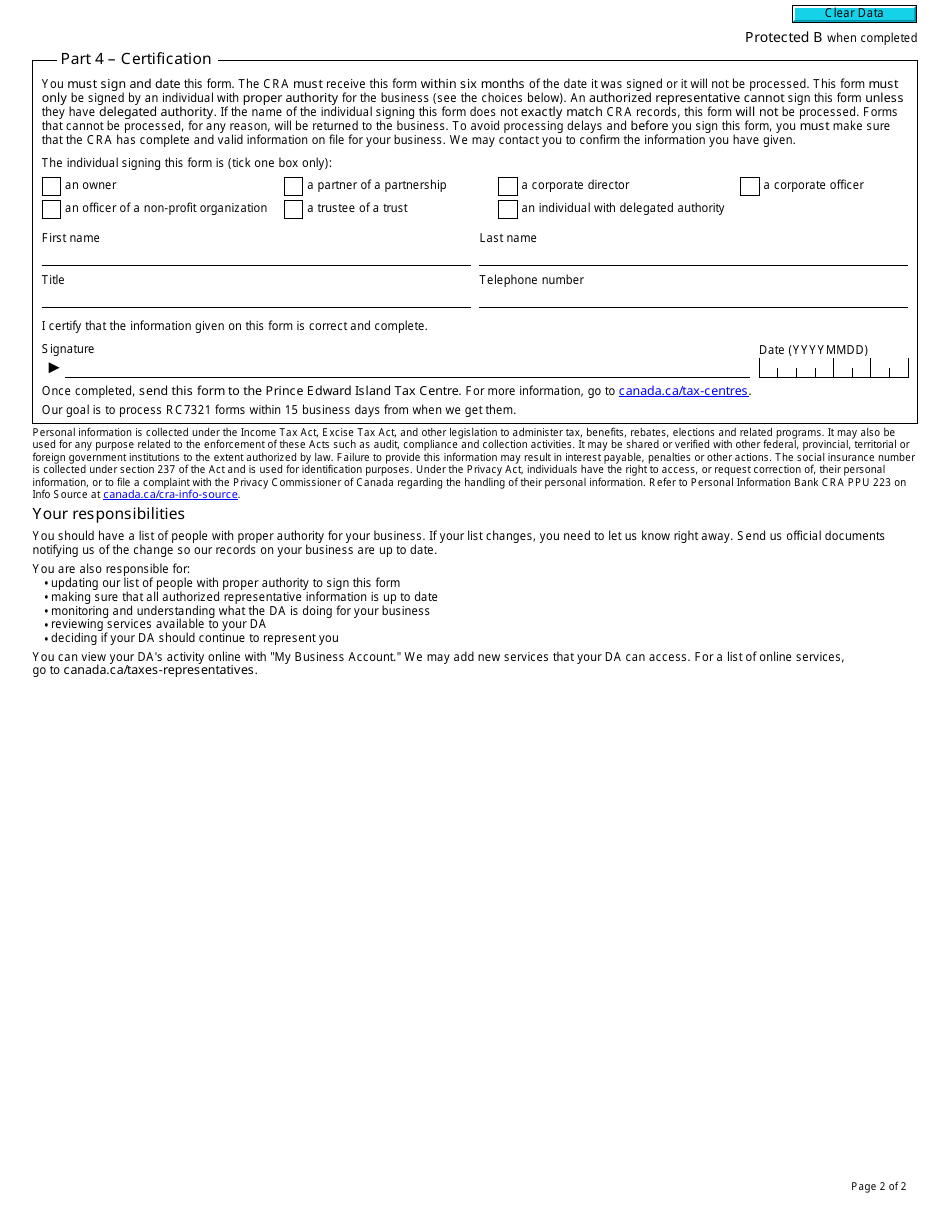

Q: Are there any special instructions for completing Form RC7321?

A: Yes, there are instructions provided with Form RC7321 to guide you in completing the form correctly.

Q: Can Form RC7321 be submitted electronically?

A: Yes, Form RC7321 can be submitted electronically to the CRA.