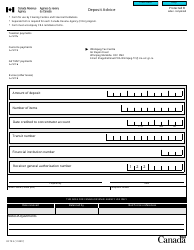

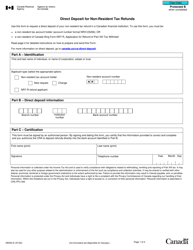

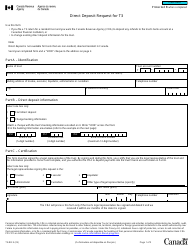

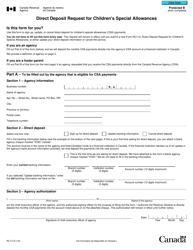

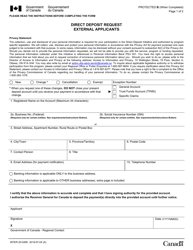

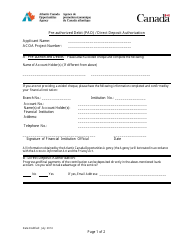

Form RC79 Deposit Advice - Canada

Form RC79 Deposit Advice is used in Canada to provide information about any deposits made to the Canada Revenue Agency (CRA) for various taxes, such as income tax, goods and services tax (GST), harmonized sales tax (HST), and payroll deductions. It provides a record of the amount deposited, the tax period, and other relevant details.

The Form RC79 Deposit Advice in Canada is filed by individuals or businesses who are making a payment to the Canada Revenue Agency, such as a tax payment or a deposit.

FAQ

Q: What is Form RC79 Deposit Advice?

A: Form RC79 Deposit Advice is a document used by the Canada Revenue Agency (CRA) to notify individuals or organizations of the amount of money they have deposited in trust for the CRA.

Q: Who receives Form RC79 Deposit Advice?

A: Form RC79 Deposit Advice is typically sent to individuals or organizations who have made a deposit on behalf of the CRA, such as payments for payroll deductions, GST/HST, or income tax.

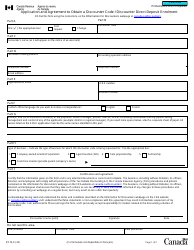

Q: What information is included in Form RC79 Deposit Advice?

A: Form RC79 Deposit Advice includes details such as the deposit amount, the period covered by the deposit, and the recipient's name and address.

Q: Why is Form RC79 Deposit Advice important?

A: Form RC79 Deposit Advice is important as it serves as a confirmation of the deposit made and helps individuals or organizations keep track of their payments to the CRA.

Q: How should I use Form RC79 Deposit Advice?

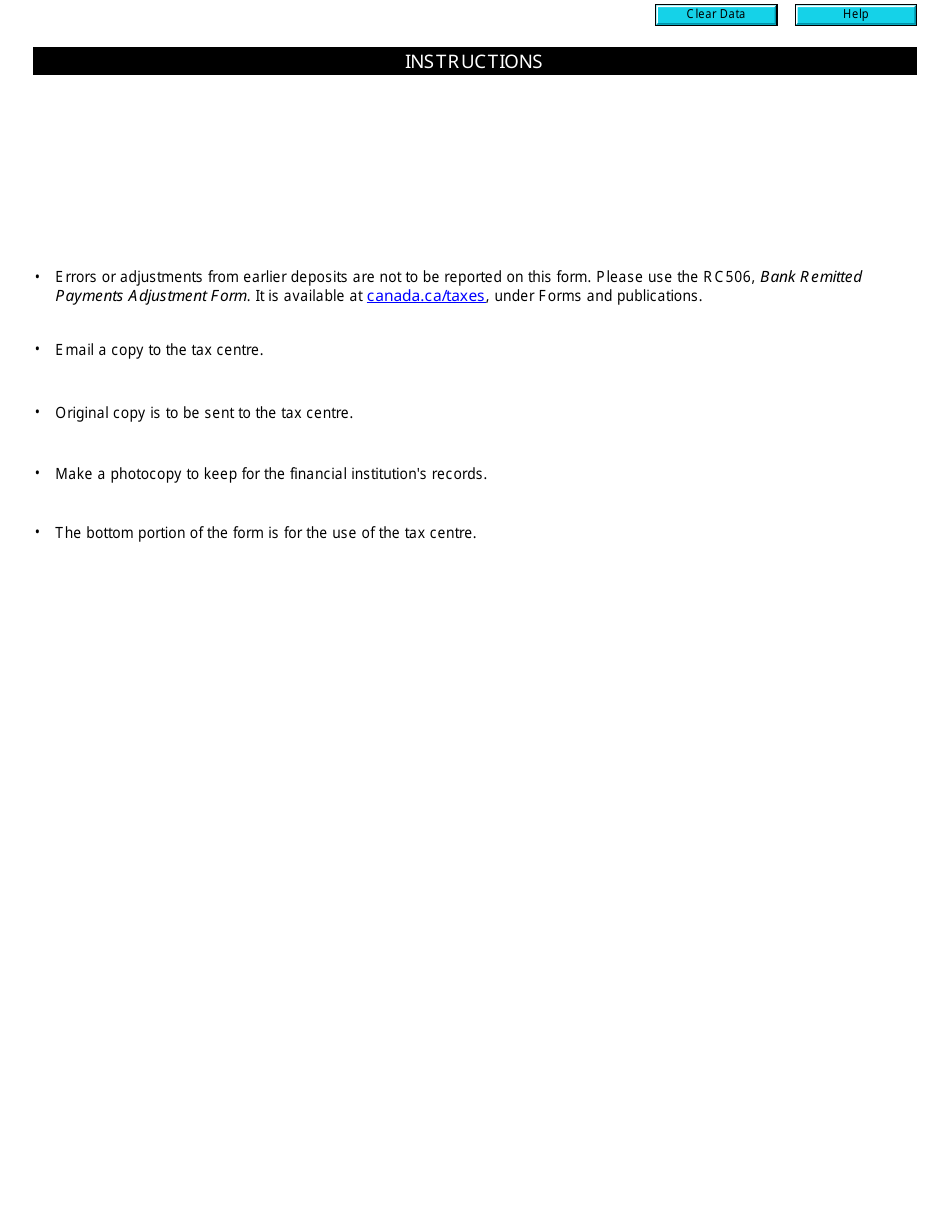

A: Once you receive Form RC79 Deposit Advice, you should review the information for accuracy and keep it for your records. If there are any discrepancies, you may need to contact the CRA to resolve them.

Q: Can I request a copy of Form RC79 Deposit Advice if I did not receive one?

A: Yes, if you did not receive Form RC79 Deposit Advice or have misplaced it, you can contact the CRA to request a copy.