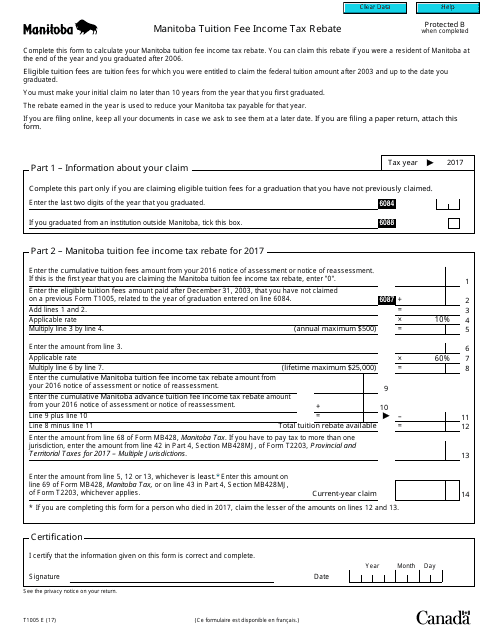

Form T1005 Manitoba Tuition Fee Income Tax Rebate - Canada

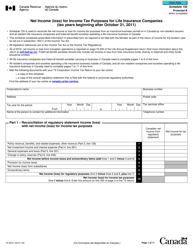

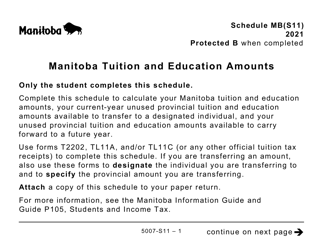

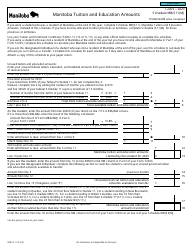

Form T1005 is used in Manitoba, Canada for claiming the Tuition Fee Income Tax Rebate. This rebate provides financial assistance to eligible post-secondary students who have paid tuition fees. The form is used to calculate the eligible amount for rebate and to claim it on your income tax return.

The Form T1005 Manitoba Tuition Fee Income Tax Rebate in Canada is filed by individuals who have paid eligible tuition fees in Manitoba.

FAQ

Q: What is Form T1005?

A: Form T1005 is a tax form used in Canada to claim the Manitoba Tuition Fee Income Tax Rebate.

Q: What is the Manitoba Tuition Fee Income Tax Rebate?

A: The Manitoba Tuition Fee Income Tax Rebate is a program in which residents of Manitoba can claim a rebate on their provincial income taxes for tuition fees paid.

Q: Who is eligible to claim the rebate?

A: Residents of Manitoba who paid tuition fees for post-secondary education are eligible to claim the rebate.

Q: How do I claim the rebate?

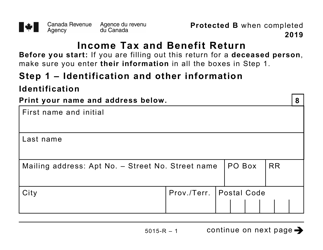

A: To claim the rebate, you need to fill out Form T1005 and include it with your income tax return.

Q: Are there any limitations to the rebate?

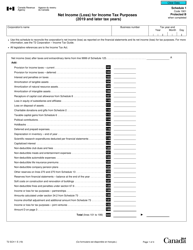

A: Yes, there are limitations to the rebate, such as a maximum eligible amount and income restrictions. It is best to review the specific guidelines and requirements provided by the government.

Q: When is the deadline to claim the rebate?

A: The deadline to claim the rebate is typically the same as the deadline for filing your income tax return, which is April 30th of each year.

Q: Is the rebate taxable?

A: No, the Manitoba Tuition Fee Income Tax Rebate is not taxable.