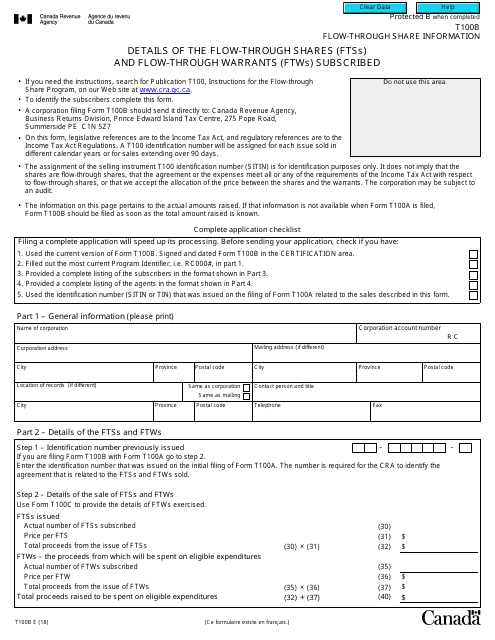

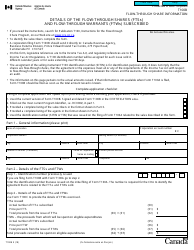

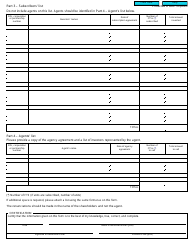

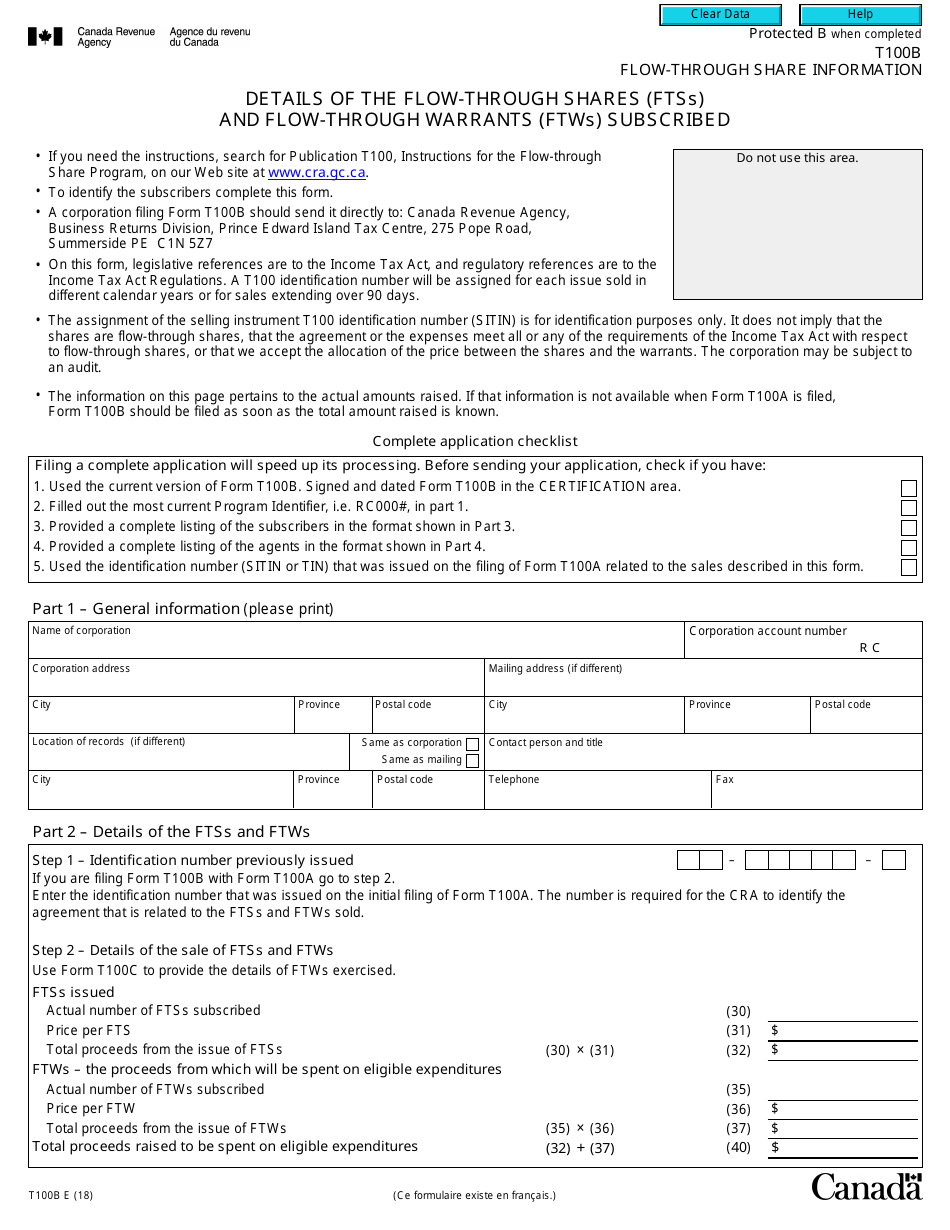

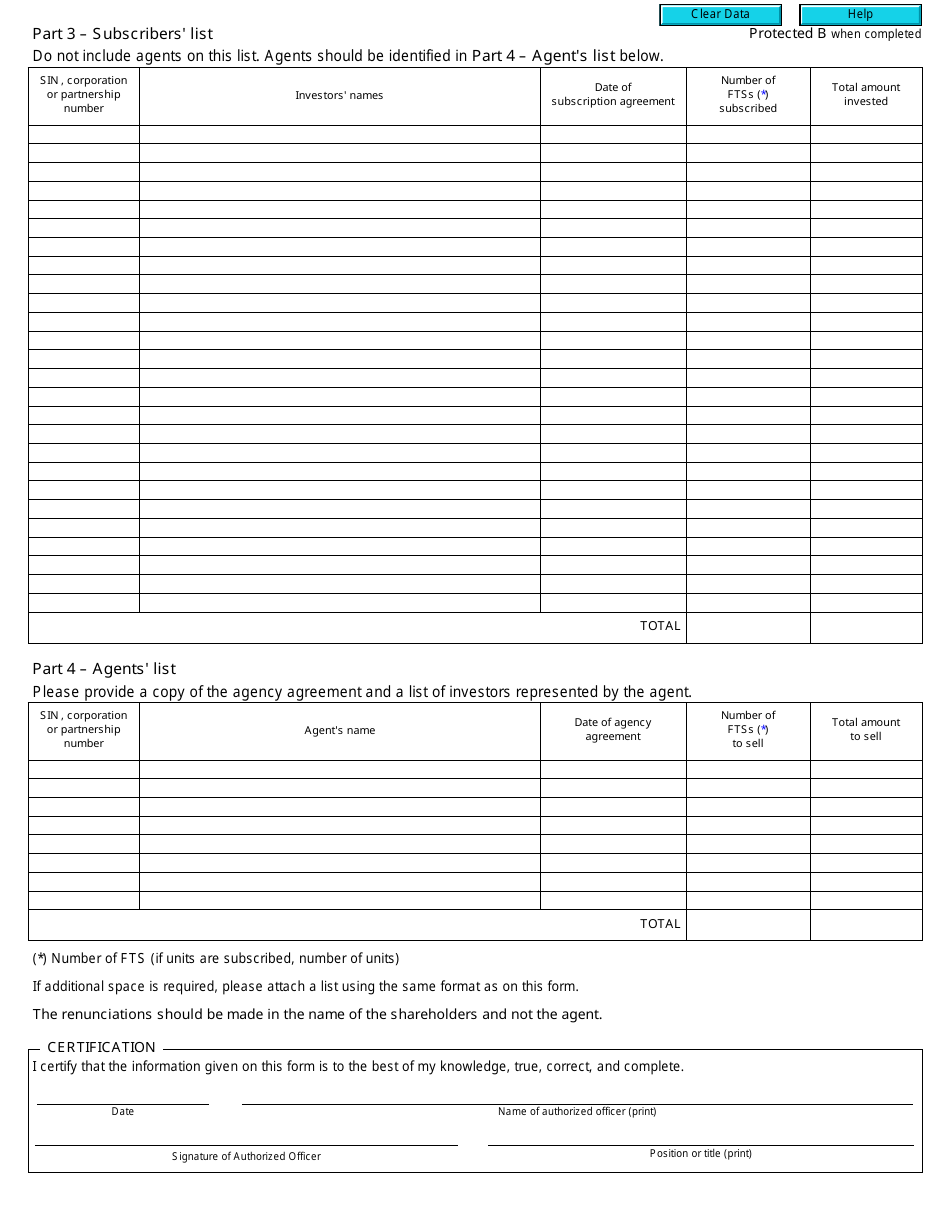

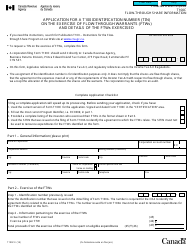

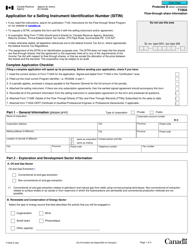

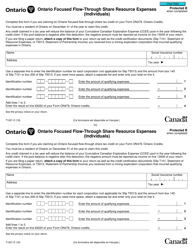

Form T100B Flow-Through Share Information - Details of the Flow-Through Shares (Ftss) and Flow-Through Warrants (Ftws) Subscribed - Canada

Form T100B Flow-Through Share Information is used in Canada to provide details about the flow-through shares (FTSs) and flow-through warrants (FTWs) that have been subscribed. It helps track the investments made in flow-through shares and the associated tax benefits.

The issuer of the flow-through shares (FTSs) and flow-through warrants (FTWs) files the Form T100B in Canada.

FAQ

Q: What is Form T100B?

A: Form T100B is a document that provides information about Flow-Through Shares (FTSs) and Flow-Through Warrants (FTWs) subscribed in Canada.

Q: What are Flow-Through Shares (FTSs)?

A: Flow-Through Shares (FTSs) are common shares issued by resource companies to individuals and organizations to finance eligible resource exploration and development activities.

Q: What are Flow-Through Warrants (FTWs)?

A: Flow-Through Warrants (FTWs) give the holder the right to purchase additional Flow-Through Shares (FTSs) at a specified price and within a certain time period.

Q: What is the purpose of Form T100B?

A: The purpose of Form T100B is to provide detailed information about the Flow-Through Shares (FTSs) and Flow-Through Warrants (FTWs) subscribed in Canada.

Q: Who needs to file Form T100B?

A: Companies or individuals who have issued Flow-Through Shares (FTSs) or Flow-Through Warrants (FTWs) in Canada need to file Form T100B.

Q: What information is required in Form T100B?

A: Form T100B requires information about the number of Flow-Through Shares (FTSs) and Flow-Through Warrants (FTWs) issued, the subscription price, and the resource exploration or development activities financed.

Q: What are the deadlines for filing Form T100B?

A: The deadline for filing Form T100B is usually within six months after the end of the taxation year in which the Flow-Through Shares (FTSs) or Flow-Through Warrants (FTWs) were issued.