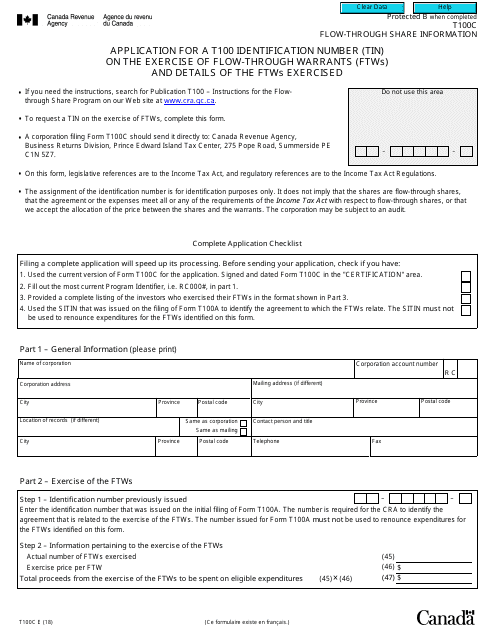

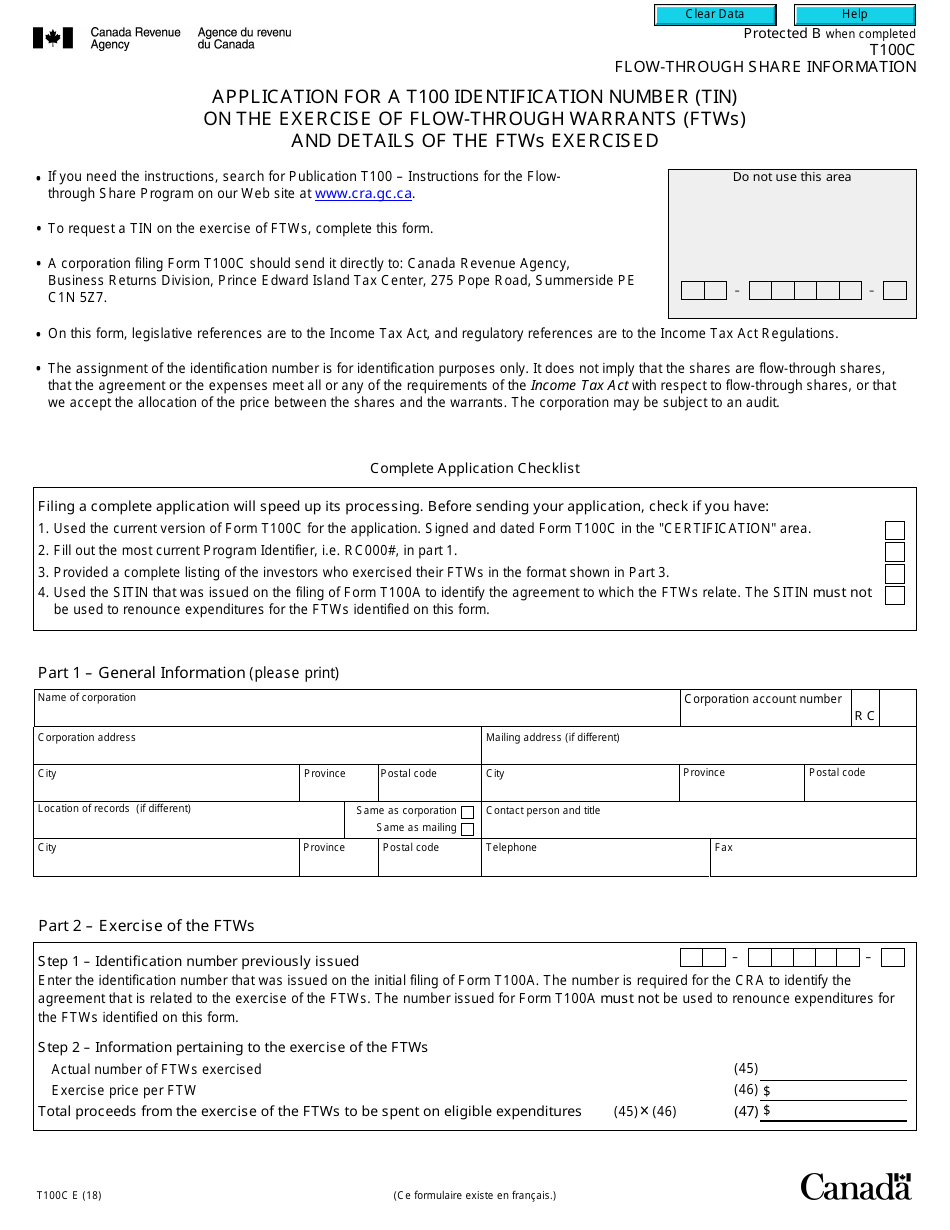

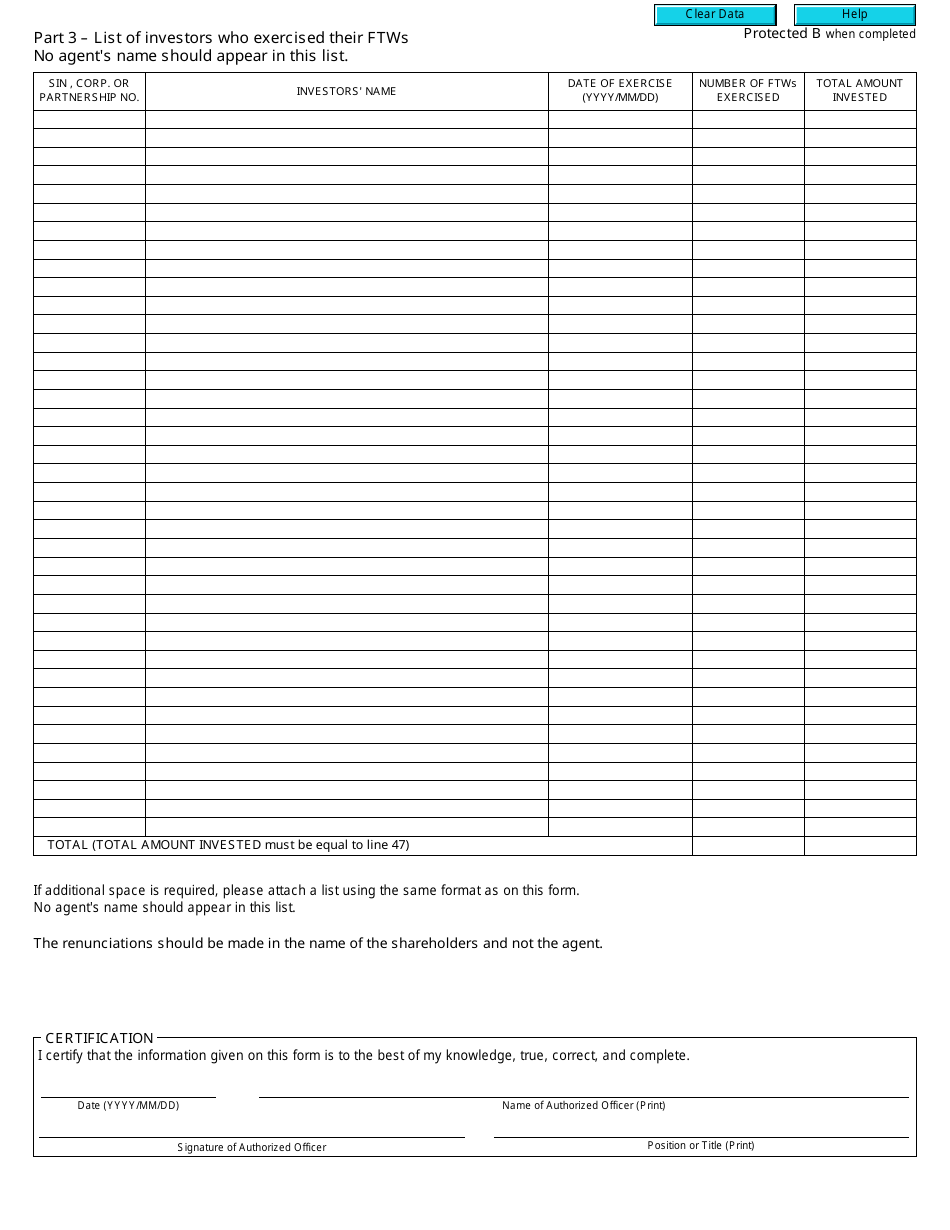

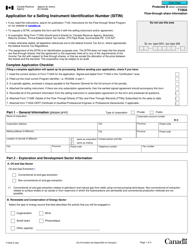

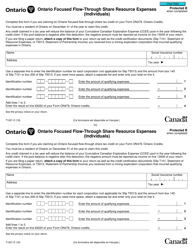

Form T100C Flow-Through Share Information - Application for a T100 Identification Number (Tin) on the Exercise of Flow-Through Warrants (Ftws) and Details of the Ftws Exercised - Canada

Form T100C Flow-Through Share Information is an application used in Canada to request a T100 Identification Number (TIN) for the exercise of Flow-Through Warrants (FTWs) and to provide details about the FTWs that have been exercised. It is specifically related to the taxation aspects of flow-through shares in Canada.

The form T100C Flow-Through Share Information is filed by the taxpayer who exercises flow-through warrants (FTWs) and wants to report details about the FTWs exercised.

FAQ

Q: What is Form T100C?

A: Form T100C is an application for a T100 Identification Number (TIN) for the exercise of Flow-Through Warrants (FTWs) and details of the FTWs exercised in Canada.

Q: What is a T100 Identification Number (TIN)?

A: A T100 Identification Number (TIN) is a unique identification number assigned to a taxpayer in Canada.

Q: What are Flow-Through Warrants (FTWs)?

A: Flow-Through Warrants (FTWs) are securities that give the holder the right to acquire flow-through shares at a future date.

Q: What is the purpose of Form T100C?

A: Form T100C is used to apply for a T100 Identification Number (TIN) and provide details of the Flow-Through Warrants (FTWs) exercised in Canada.

Q: Who needs to fill out Form T100C?

A: Anyone who exercises Flow-Through Warrants (FTWs) in Canada needs to fill out Form T100C.

Q: Are there any fees for submitting Form T100C?

A: No, there are no fees for submitting Form T100C.

Q: When should Form T100C be filed?

A: Form T100C should be filed within 30 days of the date of issue of the Flow-Through Warrants (FTWs) or the date of exercise of the FTWs, whichever occurs first.