This version of the form is not currently in use and is provided for reference only. Download this version of

Form T101A

for the current year.

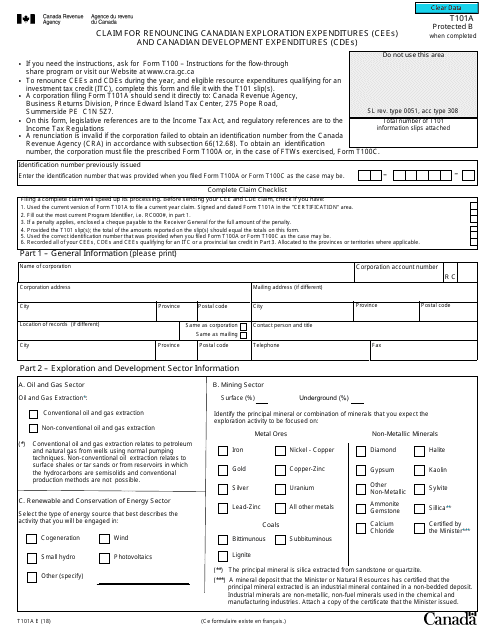

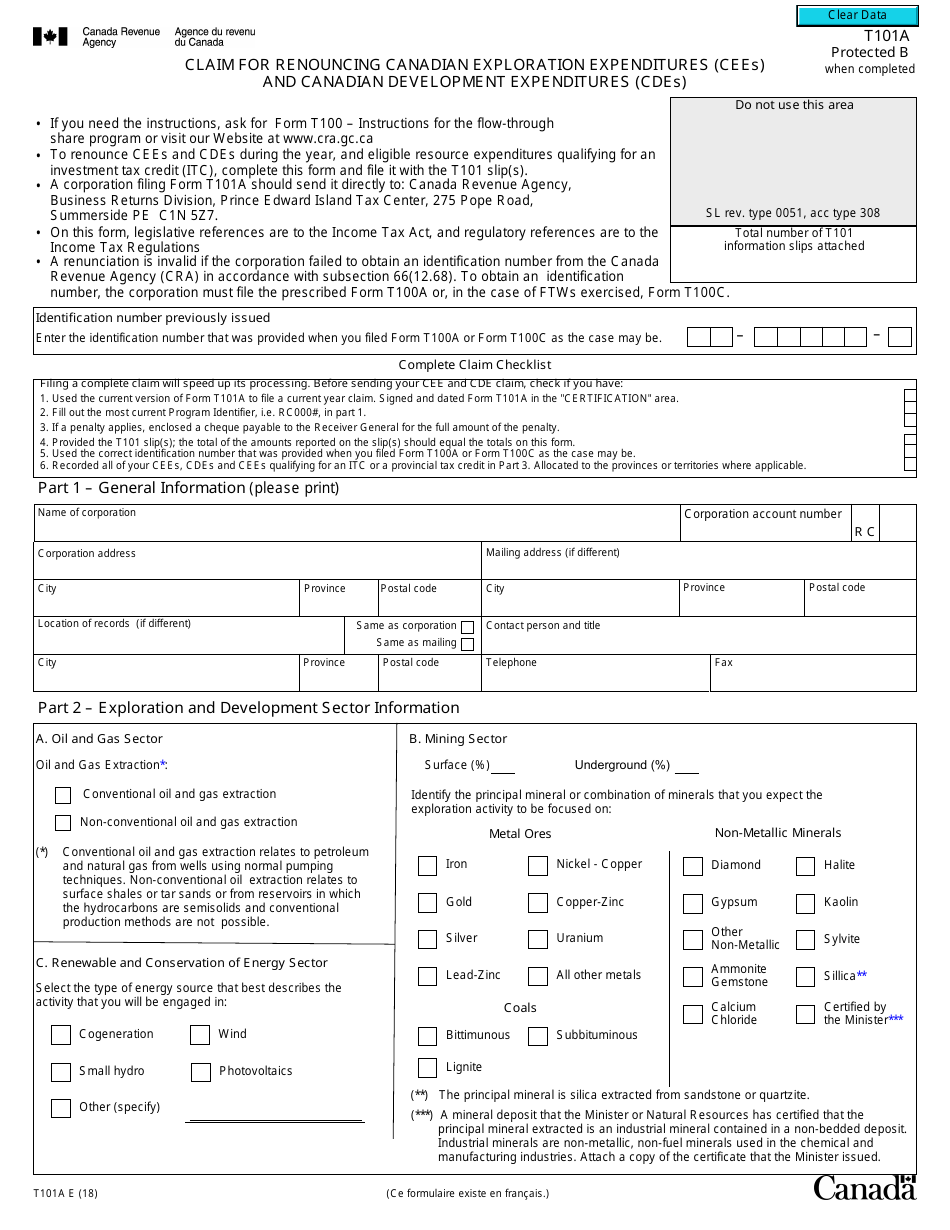

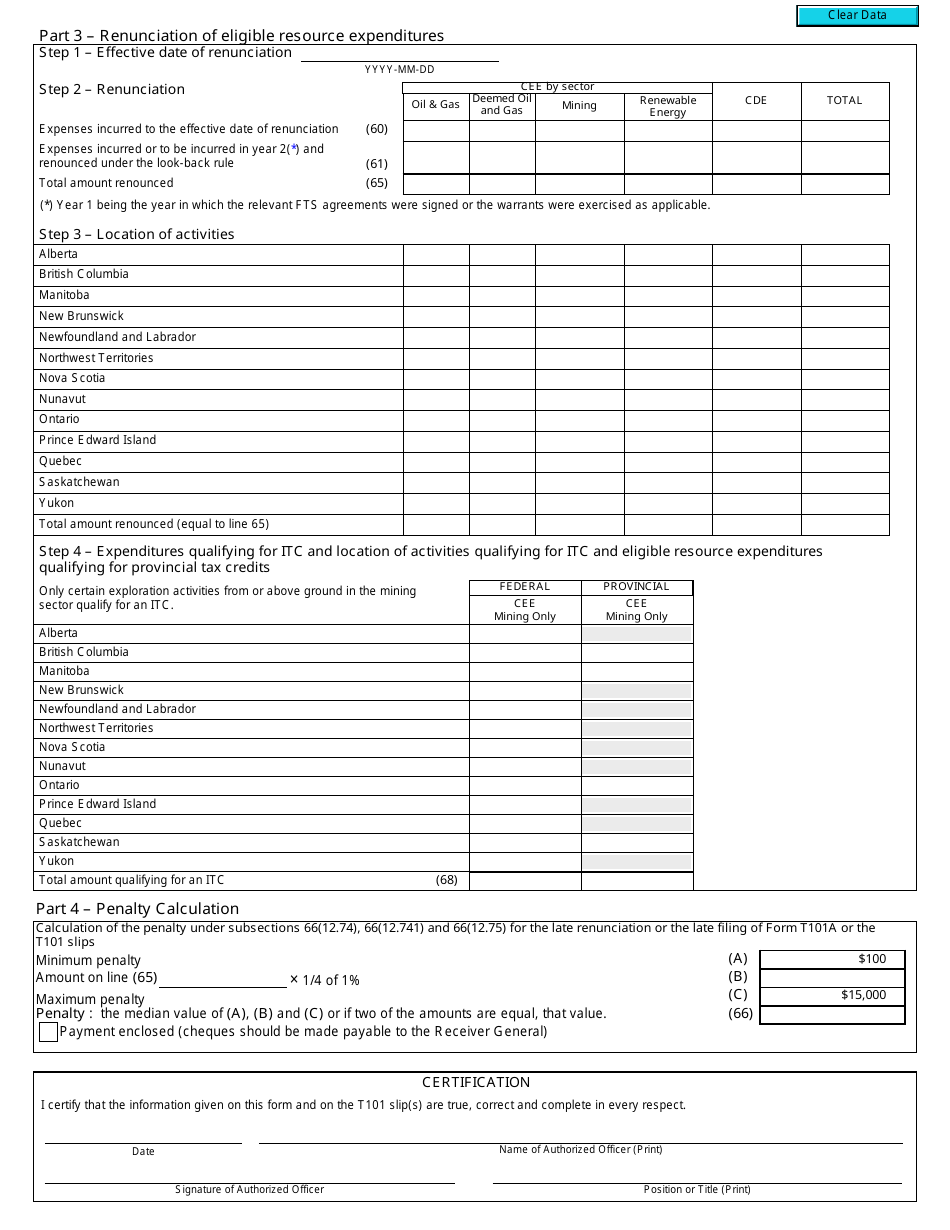

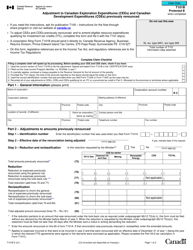

Form T101A Claim for Renouncing Canadian Exploration Expenditures (Cees) and Canadian Development Expenditures (Cdes) - Canada

Form T101A, Claim for Renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs), is a form used in Canada for certain tax purposes. It allows taxpayers who have incurred eligible expenses related to exploration and development activities in the country to renounce these expenses to another party, known as the renunciation recipient.

By renouncing these expenses, the renunciation recipient can deduct them against their own income for tax purposes. This can provide a financial benefit to the renunciation recipient, as they can reduce their taxable income and potentially lower their tax liability.

FAQ

Q: What is Form T101A?

A: Form T101A is a tax form used in Canada for claiming renunciation of Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs).

Q: What are Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs)?

A: Canadian Exploration Expenditures (CEEs) are expenses incurred by a taxpayer in the course of exploring for minerals in Canada. Canadian Development Expenditures (CDEs) are expenses incurred after the discovery of minerals in Canada.

Q: Who can use Form T101A?

A: Form T101A can be used by taxpayers who wish to renounce their Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) to another taxpayer.

Q: Why would someone renounce their CEEs and CDEs?

A: Taxpayers may renounce their CEEs and CDEs to another taxpayer who is actively engaged in mineral exploration or development activities and can make better use of the deductions.

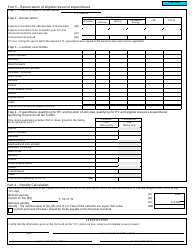

Q: What information is required on Form T101A?

A: Form T101A requires information such as the renouncing taxpayer's identification details, the recipient taxpayer's details, the amount being renounced, and any supporting documentation.

Q: When is Form T101A due?

A: Form T101A is generally due by the taxpayer's filing due date for the taxation year in which the renunciation is being claimed.

Q: Are there any penalties for not filing Form T101A?

A: Failure to file Form T101A by the due date may result in penalties and interest charges.

Q: Is there any limit to the amount of CEEs and CDEs that can be renounced?

A: There is no limit to the amount of CEEs and CDEs that can be renounced.

Q: Can I claim CEEs and CDEs on my personal tax return?

A: No, CEEs and CDEs can only be claimed by a taxpayer who is actively engaged in mineral exploration or development activities.