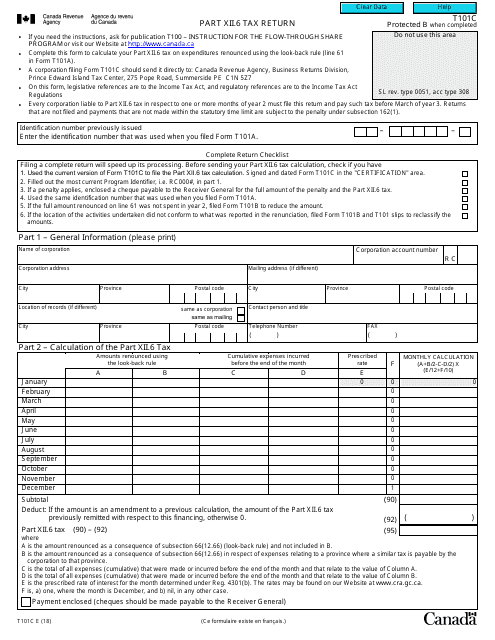

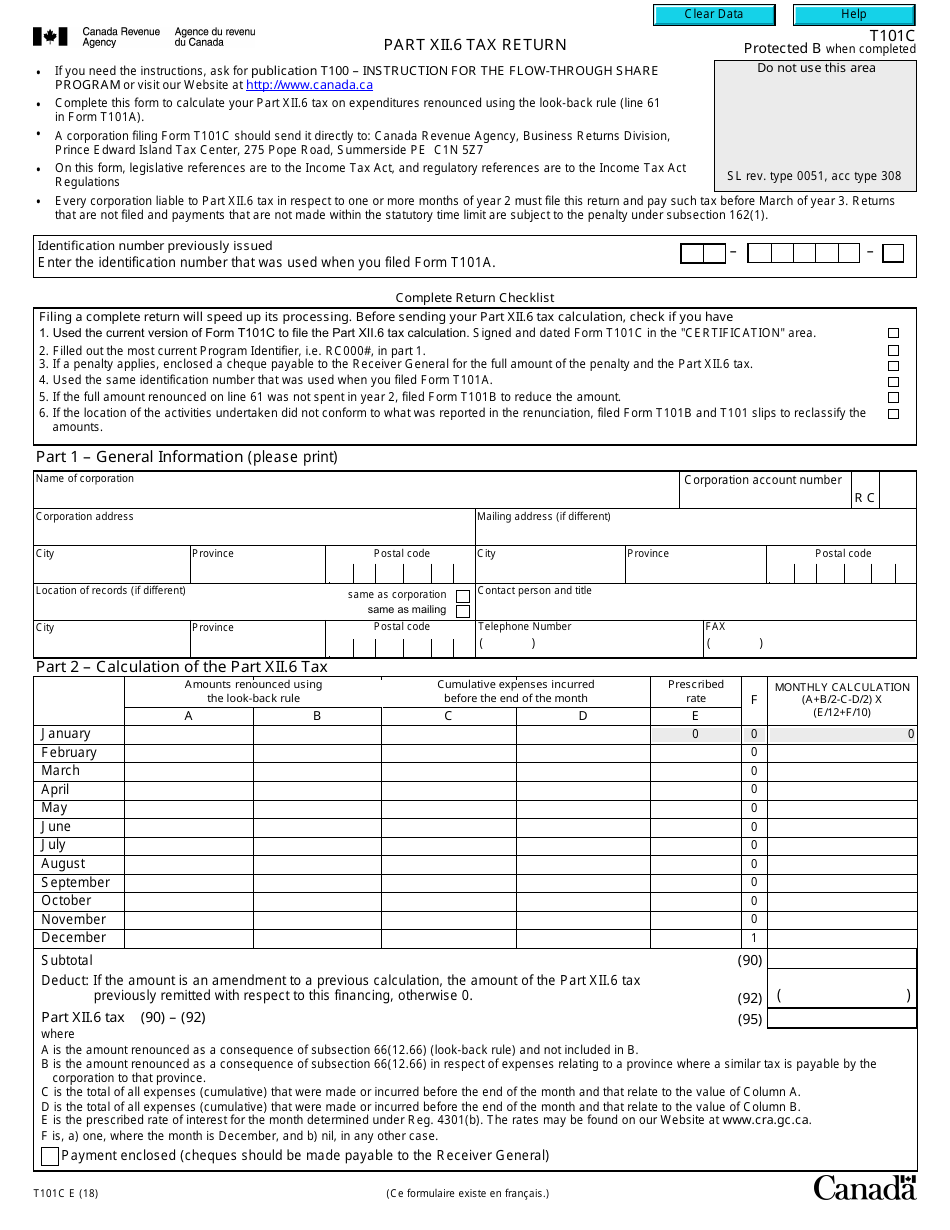

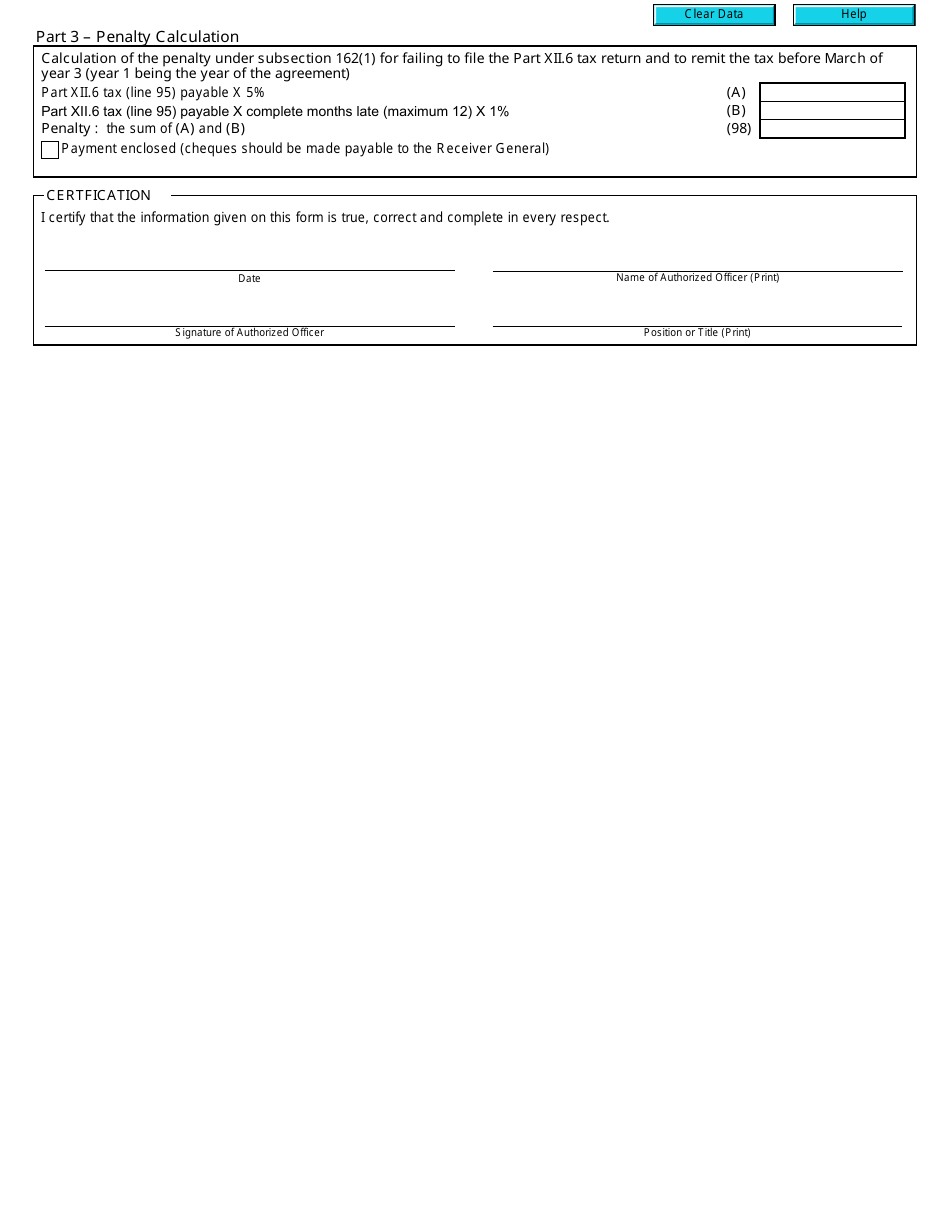

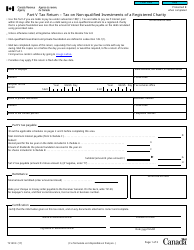

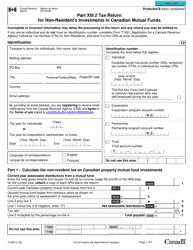

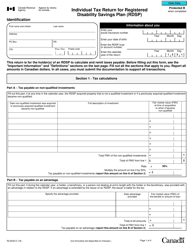

Form T101C Part XII. 6 Tax Return - Canada

Form T101C Part XII.6 is used for reporting certain types of income for Canadian tax purposes. It is specifically designed for reporting income from countries with which Canada has a tax treaty.

FAQ

Q: What is Form T101C?

A: Form T101C is a part of the Canadian tax return.

Q: What does Part XII.6 refer to on Form T101C?

A: Part XII.6 on Form T101C refers to a specific section of the tax return.

Q: What is the purpose of Form T101C?

A: Form T101C is used for reporting certain tax information in Canada.

Q: What is included in Part XII.6 of Form T101C?

A: Part XII.6 of Form T101C includes specific details related to the tax return.

Q: Who is required to fill out Form T101C?

A: Individuals who need to report certain tax information in Canada are required to fill out Form T101C.

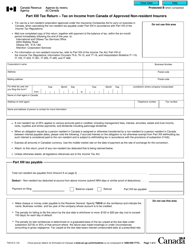

Q: Is Form T101C only for residents of Canada?

A: Yes, Form T101C is specifically for residents of Canada.

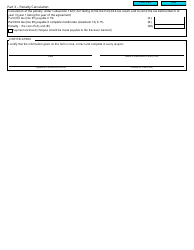

Q: Do I need to file Form T101C if I don't have any specific tax information to report?

A: If you don't have any specific tax information to report, you generally don't need to file Form T101C. However, it is always recommended to consult with a tax professional or the CRA for accurate advice.

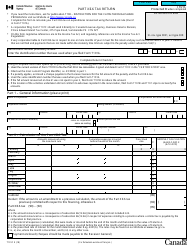

Q: Are there any deadlines for filing Form T101C?

A: The deadlines for filing Form T101C are typically the same as the general Canadian tax filing deadlines. It is important to check with the CRA for the specific deadlines each year.

Q: What happens if I don't file Form T101C when required?

A: If you are required to file Form T101C and fail to do so, you may face penalties or consequences imposed by the CRA. It is important to comply with all tax filing requirements.