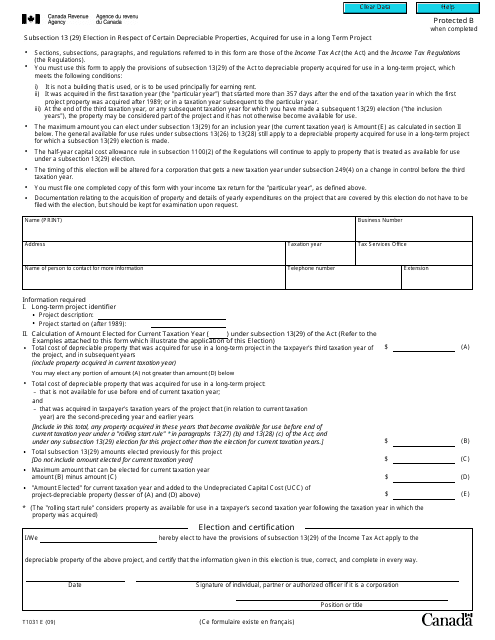

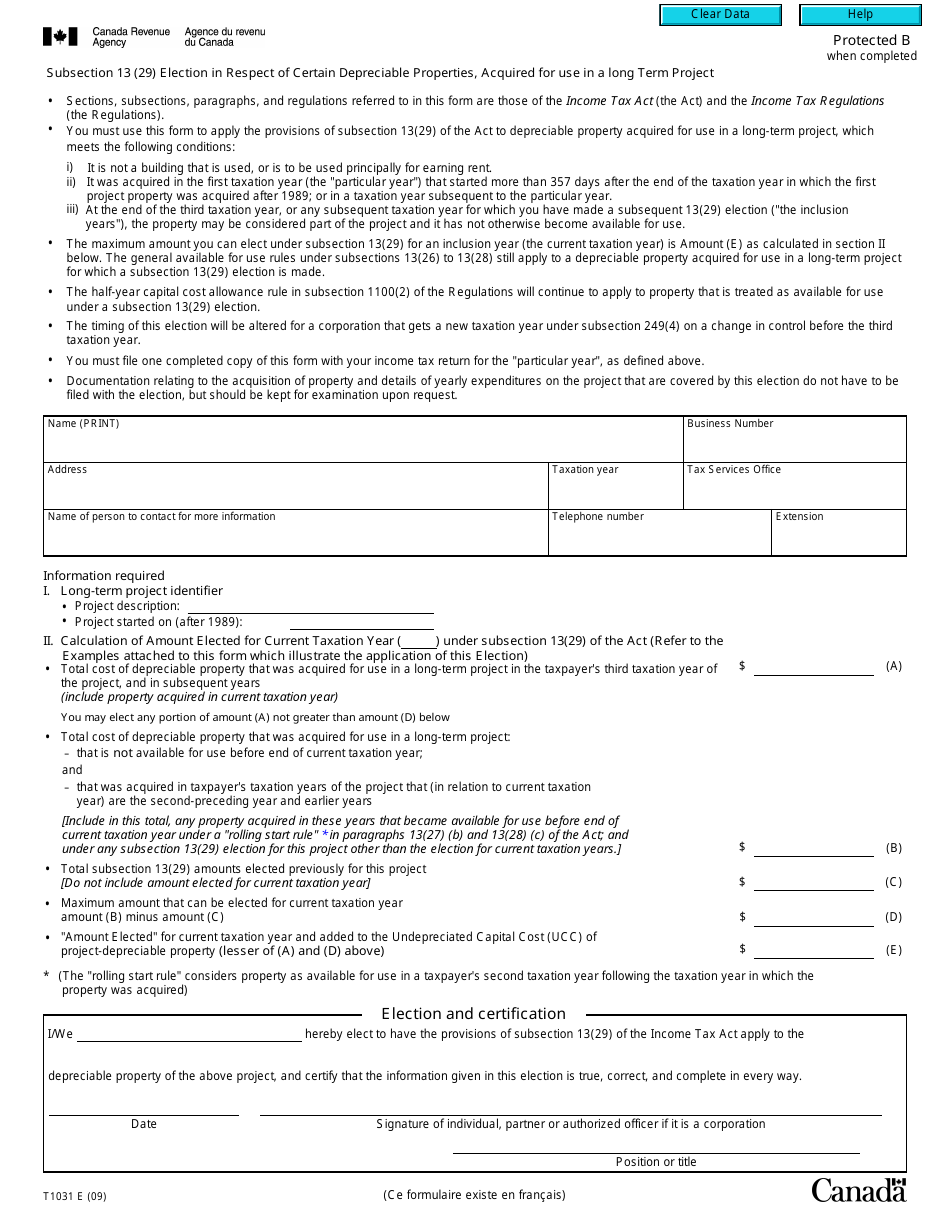

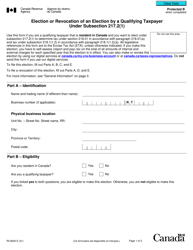

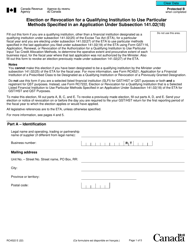

Form T1031 Subsection 13(29) Election in Respect of Certain Depreciable Properties, Acquired for Use in a Long Term Project - Canada

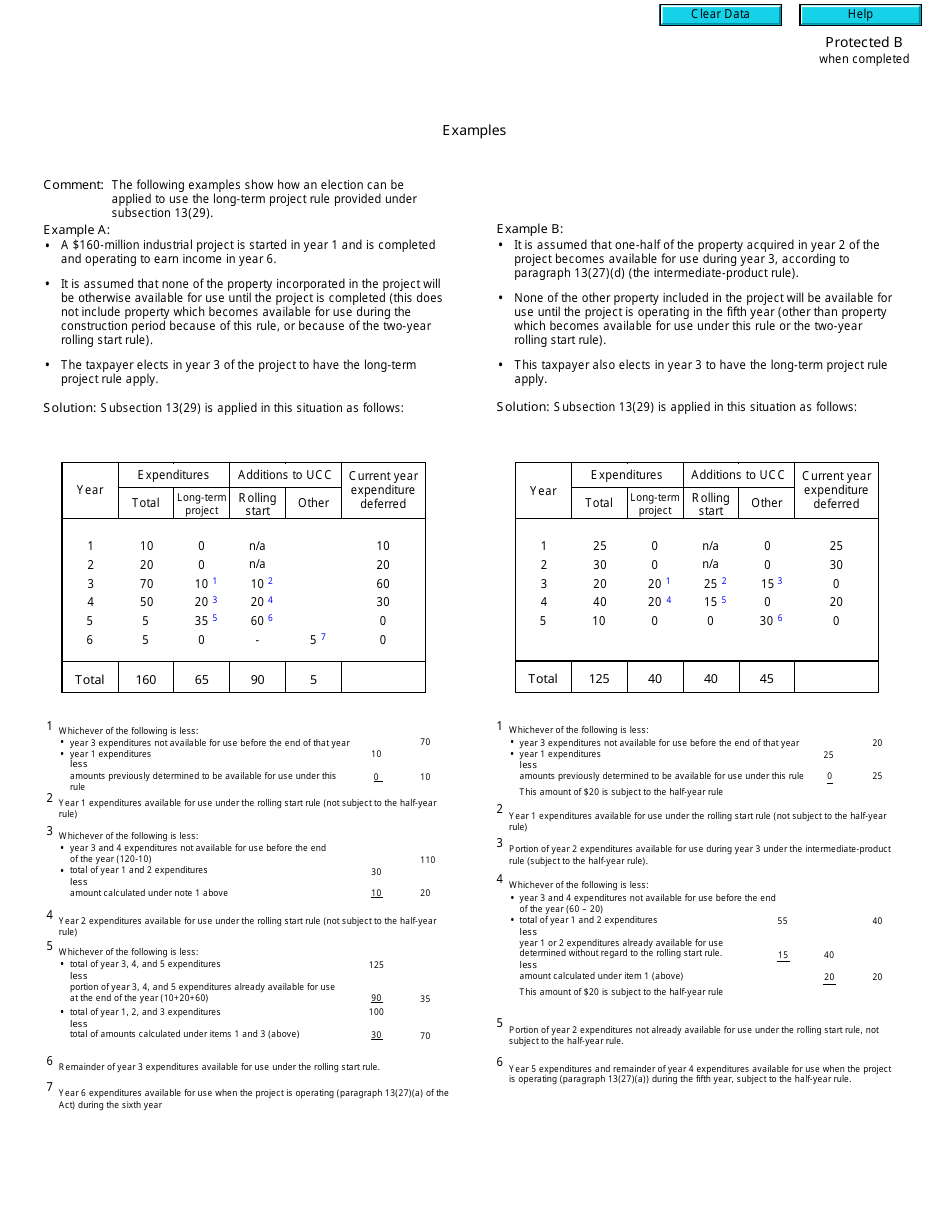

Form T1031 Subsection 13(29) Election in Respect of Certain Depreciable Properties is a specific form used in Canada for making an election related to certain depreciable properties acquired for use in a long-term project. This form allows taxpayers to elect to treat the acquisition of depreciable property as part of a single long-term project rather than as separate acquisitions. This election can have various tax implications and should be completed according to the specific guidelines provided by the Canada Revenue Agency (CRA).

The person or entity acquiring certain depreciable properties for use in a long-term project files the Form T1031 Subsection 13(29) Election in Canada.

FAQ

Q: What is Form T1031 Subsection 13(29) Election?

A: Form T1031 Subsection 13(29) Election is a tax form used in Canada for electing to defer or not claim capital cost allowance (depreciation) on certain depreciable properties acquired for use in a long term project.

Q: What is the purpose of Form T1031?

A: The purpose of Form T1031 is to allow taxpayers to defer or choose not to claim depreciation on certain depreciable properties acquired for use in a long term project.

Q: What is Subsection 13(29) of the Income Tax Act?

A: Subsection 13(29) of the Income Tax Act is a specific provision that allows taxpayers to elect to defer or not claim depreciation on certain depreciable properties.

Q: When should Form T1031 be filed?

A: Form T1031 should be filed with your tax return for the taxation year in which the election is made.

Q: What are the benefits of filing Form T1031?

A: Filing Form T1031 allows taxpayers to defer or choose not to claim depreciation on certain depreciable properties, which can provide tax benefits by reducing taxable income.

Q: Who is eligible to use Form T1031?

A: Taxpayers who have acquired depreciable properties for use in a long term project and wish to defer or not claim depreciation on those properties may be eligible to use Form T1031.

Q: Is Form T1031 applicable in the United States?

A: No, Form T1031 is specific to Canada and its tax laws. It does not apply to the United States.