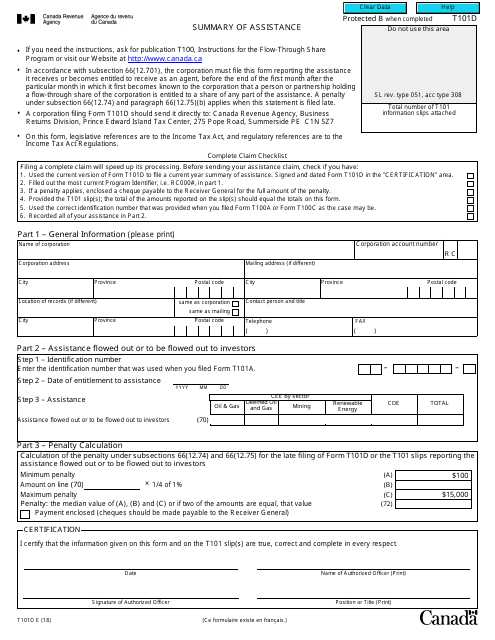

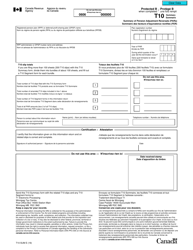

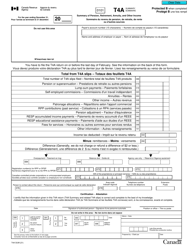

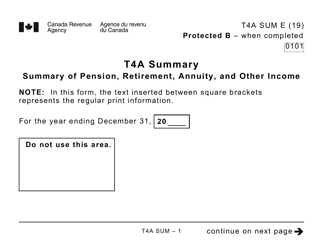

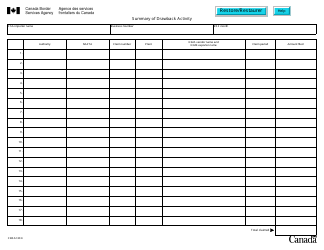

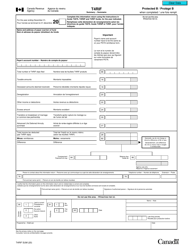

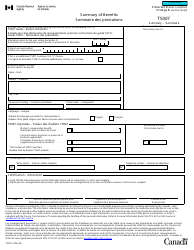

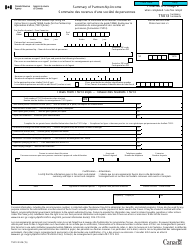

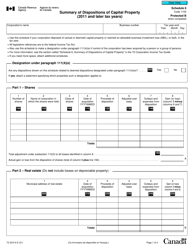

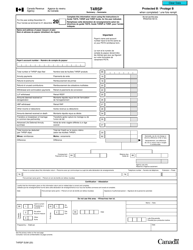

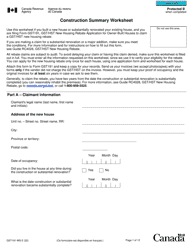

Form T101D Summary of Assistance - Canada

Form T101D Summary of Assistance - Canada is used to provide a summary of the financial assistance received by an individual or family in Canada. It is typically used for reporting purposes, such as for tax filing or government benefits eligibility assessments.

The Form T101D Summary of Assistance in Canada is filed by the social assistance provider or agency that provides financial assistance to individuals or families in need.

FAQ

Q: What is Form T101D?

A: Form T101D is a summary of assistance provided in Canada.

Q: Who needs to fill out Form T101D?

A: Form T101D needs to be filled out by individuals or organizations that have provided assistance.

Q: What is the purpose of Form T101D?

A: The purpose of Form T101D is to provide a summary of the assistance provided in Canada.

Q: What information is required on Form T101D?

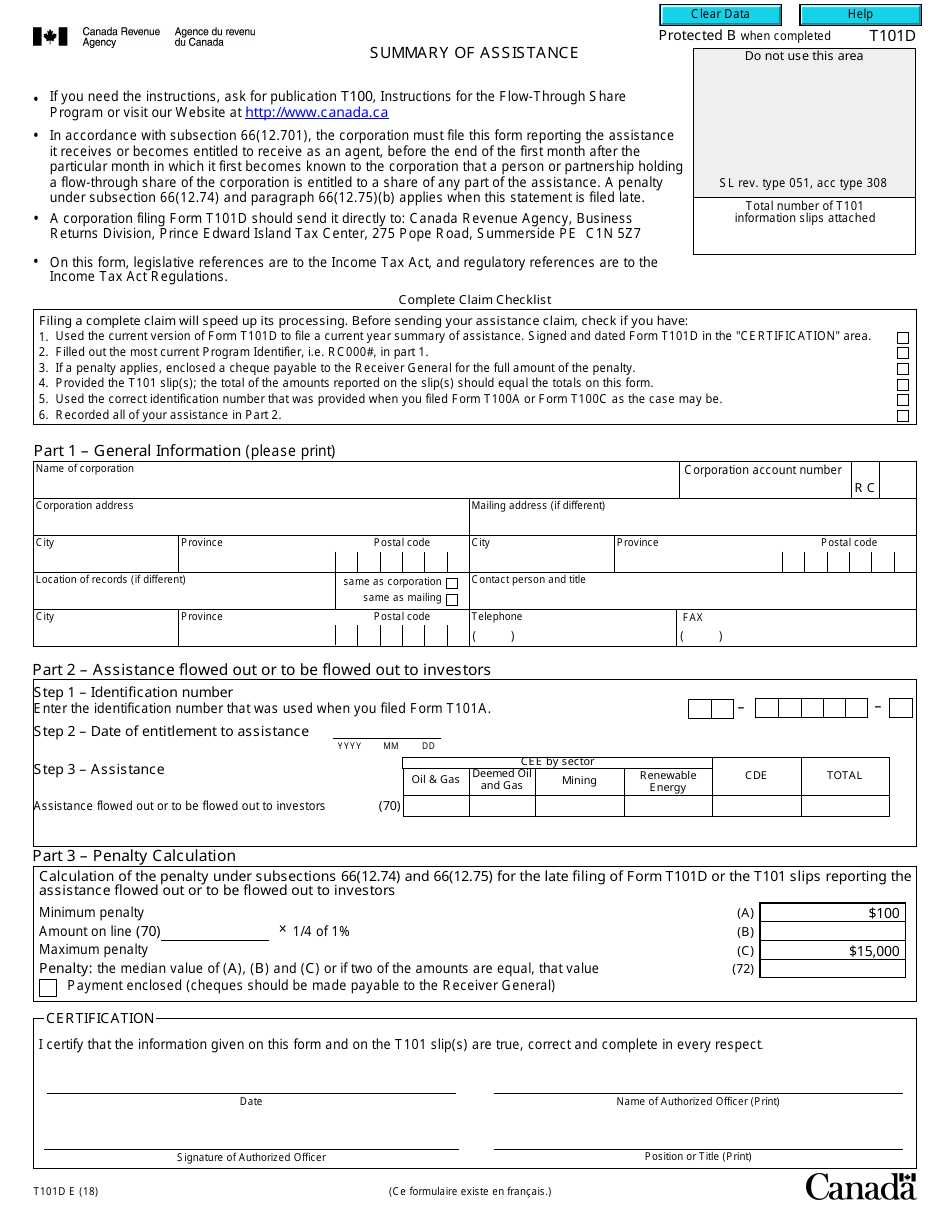

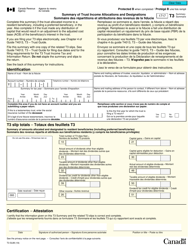

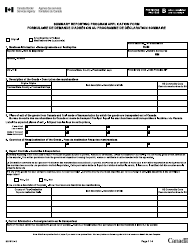

A: Form T101D requires information such as the type of assistance provided, the amount, the recipient, and the date.

Q: When is Form T101D due?

A: The due date for Form T101D varies depending on the type of assistance provided and the recipient. It is generally due within a specified time after the end of the year.

Q: Are there any penalties for not filing Form T101D?

A: Yes, there may be penalties for not filing Form T101D or for filing it late. It is important to comply with the filing requirements to avoid these penalties.