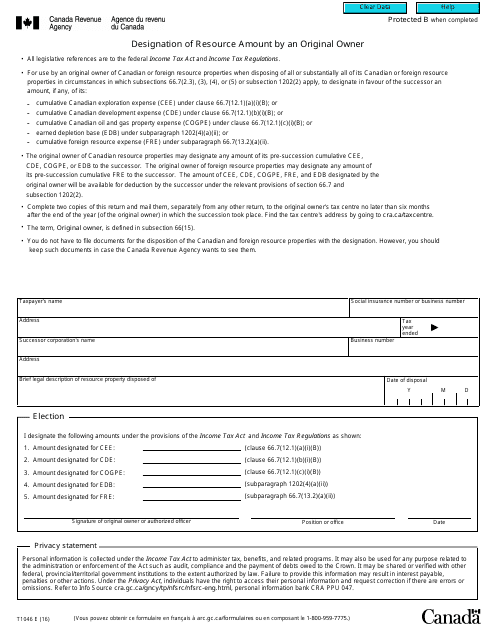

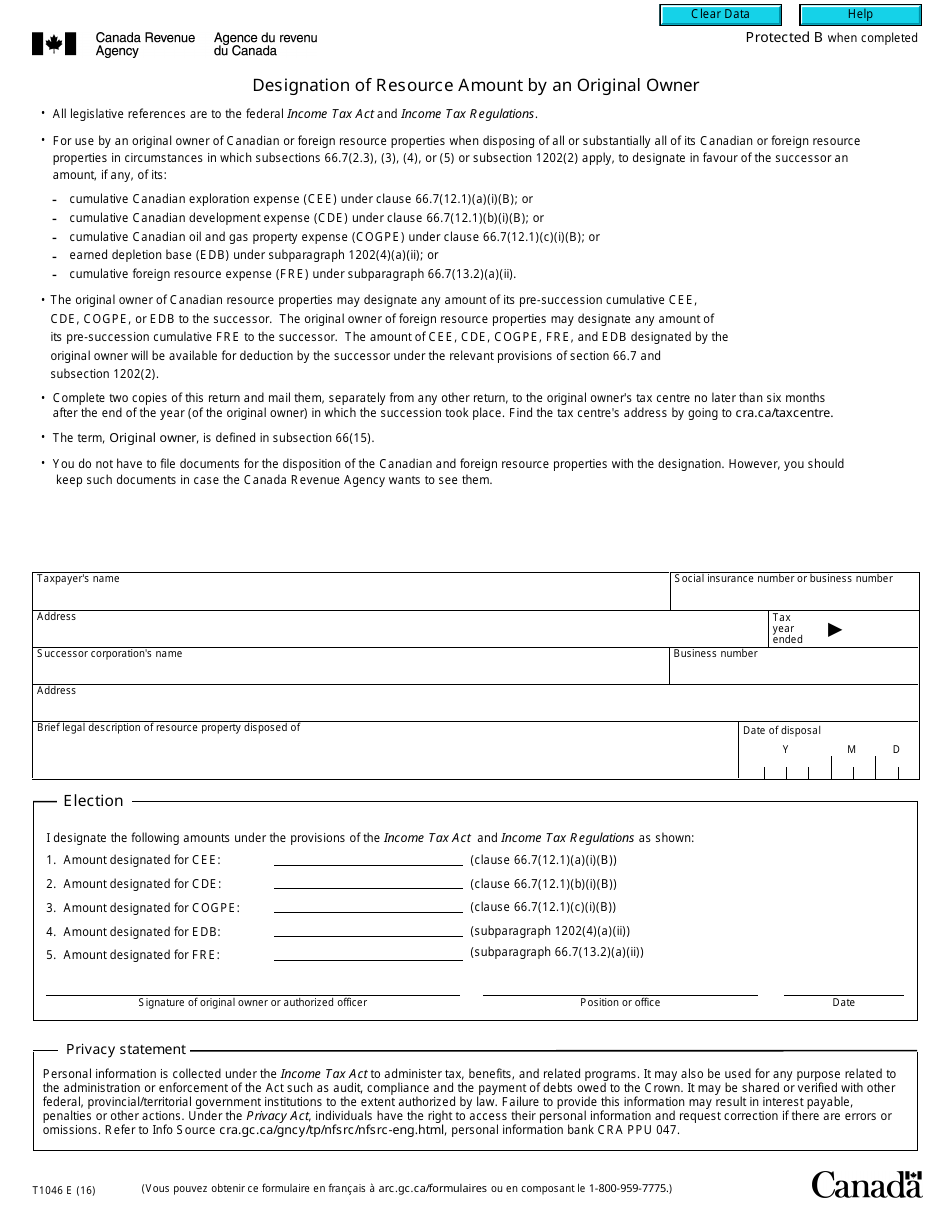

Form T1046 Designation of Resource Amount by an Original Owner - Canada

Form T1046 Designation of Resource Amount by an Original Owner is used in Canada to designate the amount of eligible resource expenses that can be deducted by the original owner of certain properties. It allows the taxpayer to allocate expenses related to Canadian oil and gas properties to different classes for tax purposes.

In Canada, the Form T1046 Designation of Resource Amount is filed by the original owner of the resource.

FAQ

Q: What is Form T1046?

A: Form T1046 is a document in Canada used for designating a resource amount by an original owner.

Q: Who is the original owner?

A: The original owner refers to an individual or a partnership that owns a resource.

Q: What is a resource amount?

A: A resource amount is the fair market value of a resource at a specific time.

Q: Why would someone use Form T1046?

A: Form T1046 is used to designate a resource amount to a particular resource property.

Q: When should Form T1046 be filed?

A: Form T1046 should be filed within two years after the end of the year in which the designation is being made.

Q: Are there any penalties for not filing Form T1046?

A: Yes, there may be penalties for not filing Form T1046. It is important to contact the CRA for more information.

Q: Can Form T1046 be filed electronically?

A: No, Form T1046 cannot be filed electronically. It must be filed by mail or in person.