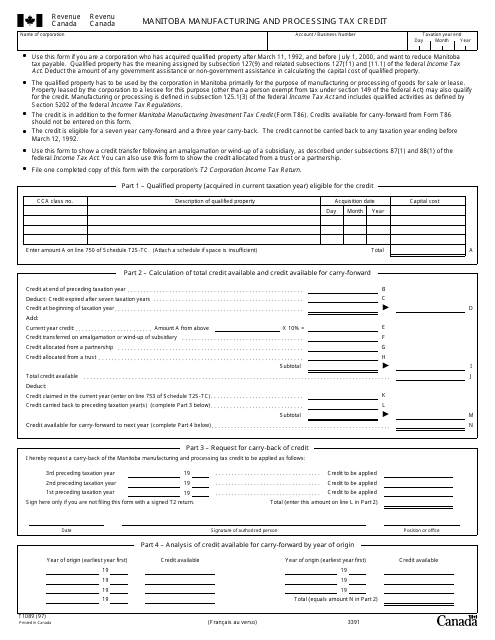

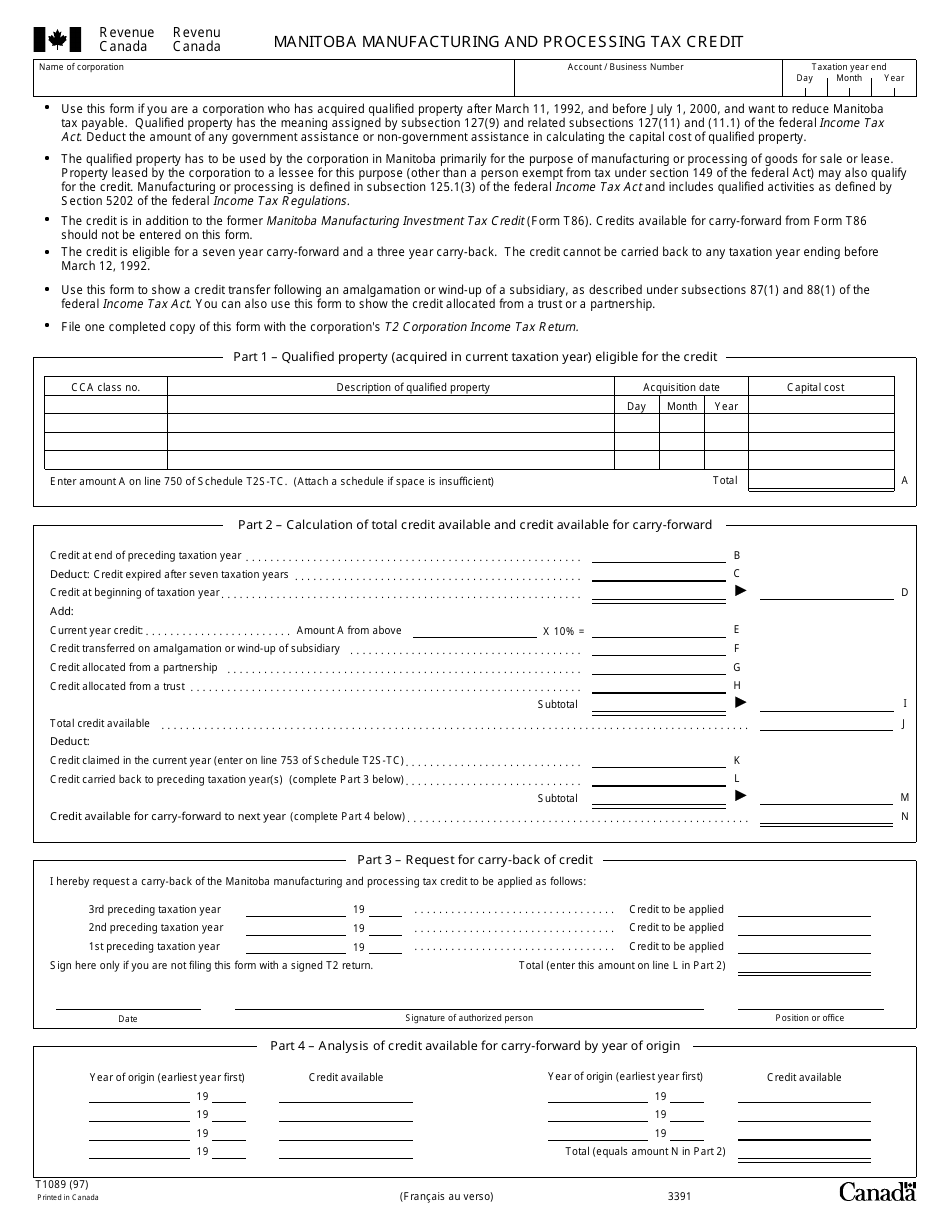

Form T1089 Manitoba Manufacturing and Processing Tax Credit - Canada

Form T1089 is used to claim the Manitoba Manufacturing and Processing Tax Credit in Canada. This credit is designed to support businesses that operate in the manufacturing and processing sectors in the province of Manitoba. It allows eligible businesses to reduce their taxes by claiming a credit based on the eligible costs incurred in these sectors.

The company or corporation engaged in manufacturing and processing activities in Manitoba files the Form T1089 Manitoba Manufacturing and Processing Tax Credit.

FAQ

Q: What is Form T1089?

A: Form T1089 is a tax form used in Canada.

Q: What is the Manitoba Manufacturing and Processing Tax Credit?

A: The Manitoba Manufacturing and Processing Tax Credit is a tax credit available to eligible businesses in Manitoba.

Q: Who is eligible for the Manitoba Manufacturing and Processing Tax Credit?

A: Eligible businesses in Manitoba engaged in manufacturing or processing activities may be eligible for the tax credit.

Q: How do I claim the Manitoba Manufacturing and Processing Tax Credit?

A: To claim the tax credit, businesses must complete and submit Form T1089 with their tax return.

Q: What expenses are eligible for the Manitoba Manufacturing and Processing Tax Credit?

A: Expenses related to manufacturing and processing activities, such as wages, materials, and machinery, may be eligible for the tax credit.

Q: Is the Manitoba Manufacturing and Processing Tax Credit refundable?

A: No, the tax credit is non-refundable and can only be used to reduce taxes owing.

Q: Are there any deadlines for claiming the Manitoba Manufacturing and Processing Tax Credit?

A: The tax credit must be claimed within the time limit set by the Canada Revenue Agency.