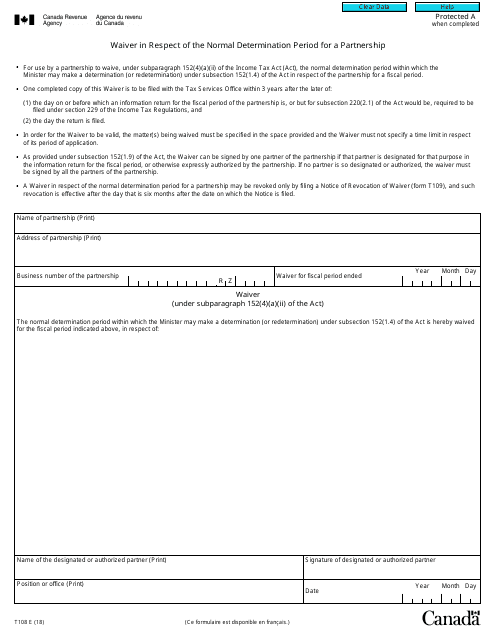

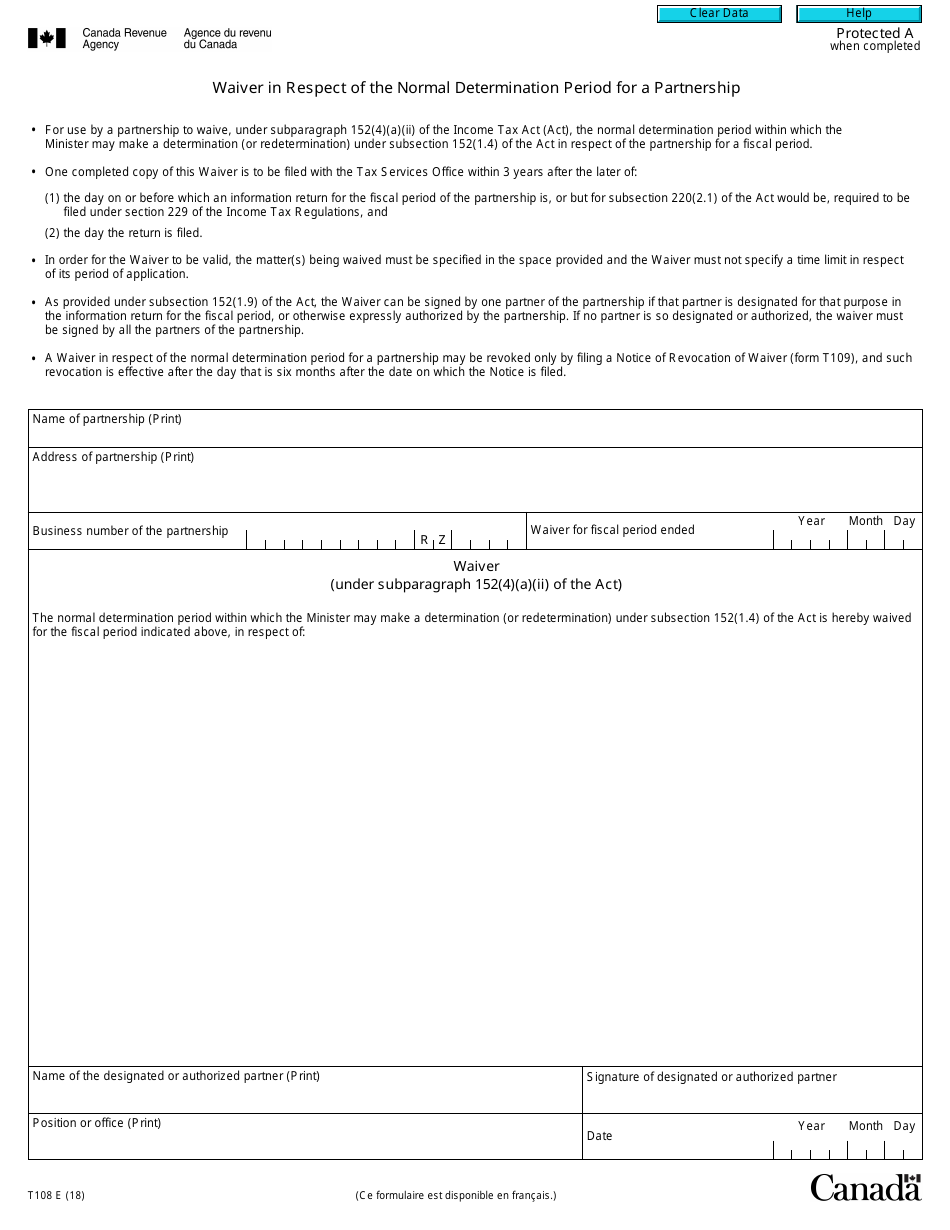

Form T108 Waiver in Respect of the Normal Determination Period for a Partnership - Canada

Form T108 Waiver in Respect of the Normal Determination Period for a Partnership in Canada is used to extend the time limit for the Canada Revenue Agency (CRA) to review the partnership's tax return. It allows the partnership to request a longer period for the CRA to complete their assessment. By filing this form, the partnership acknowledges that any potential tax refund may be delayed until the assessment is finalized.

The partnership itself would file the Form T108 Waiver in respect of the normal determination period.

FAQ

Q: What is Form T108?

A: Form T108 is a waiver in respect of the normal determination period for a partnership in Canada.

Q: What is the normal determination period for a partnership?

A: The normal determination period for a partnership is usually five years.

Q: When is Form T108 required?

A: Form T108 is required when a partnership requests a waiver to extend the normal determination period.

Q: Is there a fee for filing Form T108?

A: There is no fee for filing Form T108.