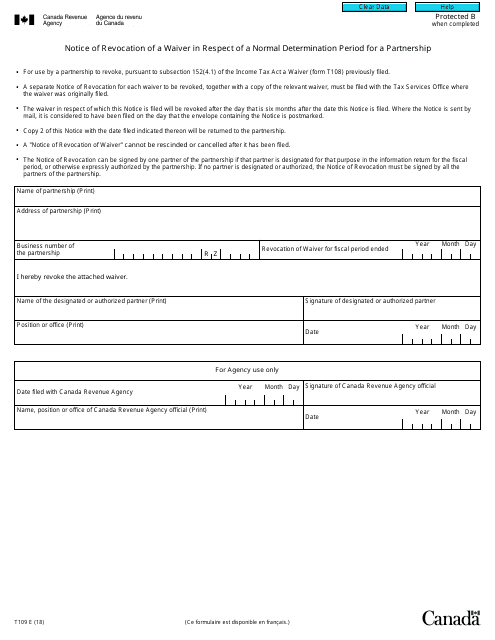

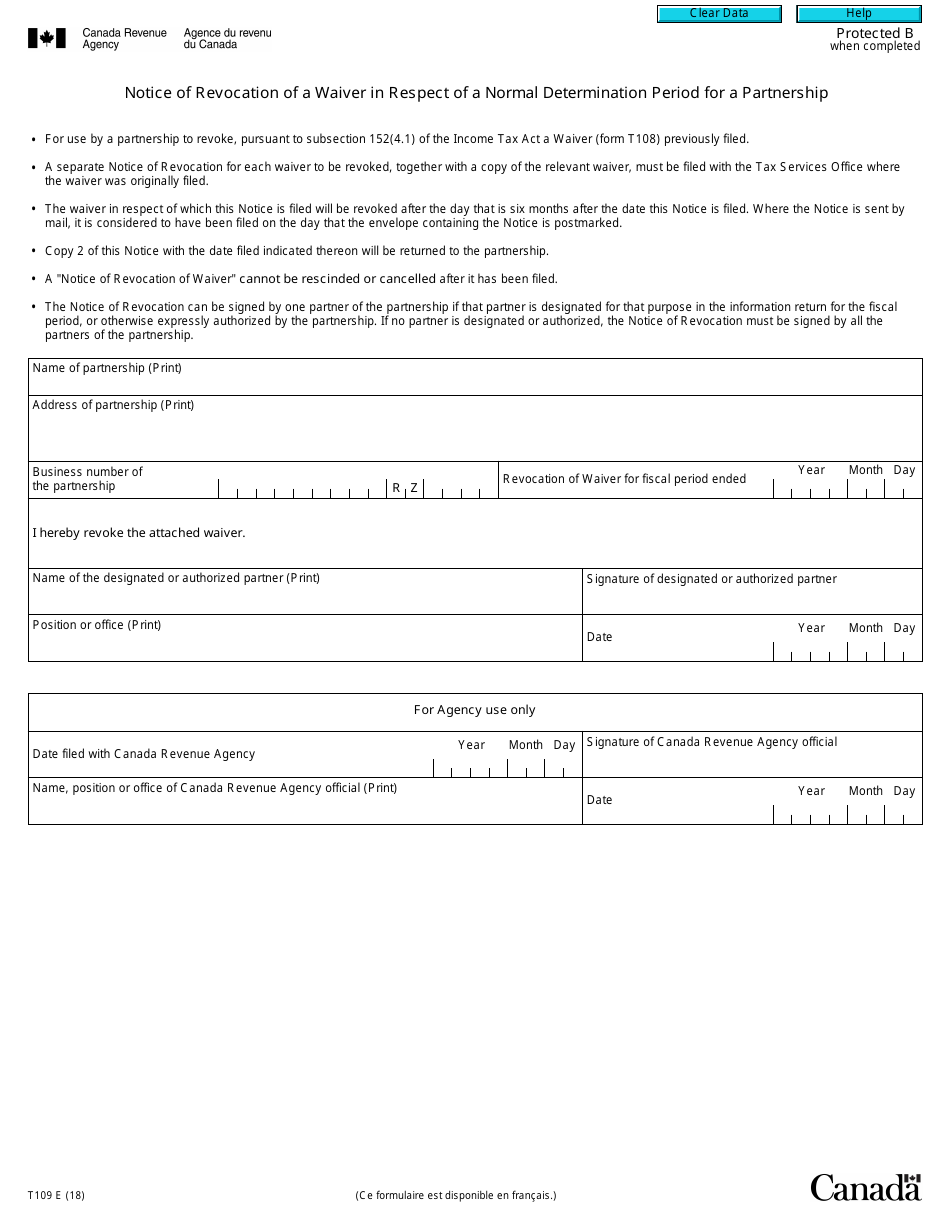

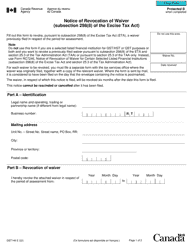

Form T109 Notice of Revocation of a Waiver in Respect of a Normal Determination Period for a Partnership - Canada

Form T109 Notice of Revocation of a Waiver in Respect of a Normal Determination Period for a Partnership in Canada is used to notify the Canada Revenue Agency (CRA) that a partnership is revoking its waiver to have a normal determination period for tax purposes. This means that the partnership is choosing to have a different determination period than the standard one specified by the CRA.

FAQ

Q: What is Form T109?

A: Form T109 is a Notice of Revocation of a Waiver in Respect of a Normal Determination Period for a Partnership in Canada.

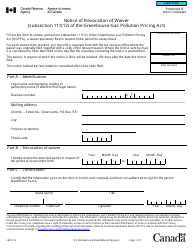

Q: What is a waiver in respect of a normal determination period for a partnership?

A: A waiver in respect of a normal determination period for a partnership is a document that allows a partnership in Canada to have a taxation year that is different from the standard fiscal year.

Q: When would you use Form T109?

A: You would use Form T109 when you want to revoke a previously granted waiver in respect of a normal determination period for a partnership in Canada.

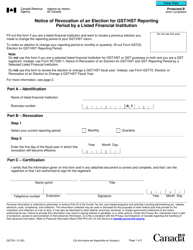

Q: Is there a fee to submit Form T109?

A: No, there is no fee to submit Form T109.

Q: Are there any penalties for not filing Form T109?

A: Failure to file Form T109 or provide false or misleading information may result in penalties or other consequences as prescribed by the tax laws in Canada.

Q: How long does it take to process Form T109?

A: Processing times for Form T109 may vary. It is recommended to submit the form well in advance of any filing deadlines to ensure timely processing.

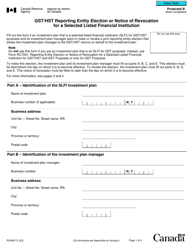

Q: What should I do after filing Form T109?

A: After filing Form T109, it is important to keep a copy of the form for your records and ensure compliance with any additional requirements or instructions provided by the CRA.

Q: Can I amend or cancel Form T109 after it has been filed?

A: Yes, you can amend or cancel Form T109 after it has been filed by submitting a new form with the updated information or a request for cancellation to the CRA.