This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1134-1

for the current year.

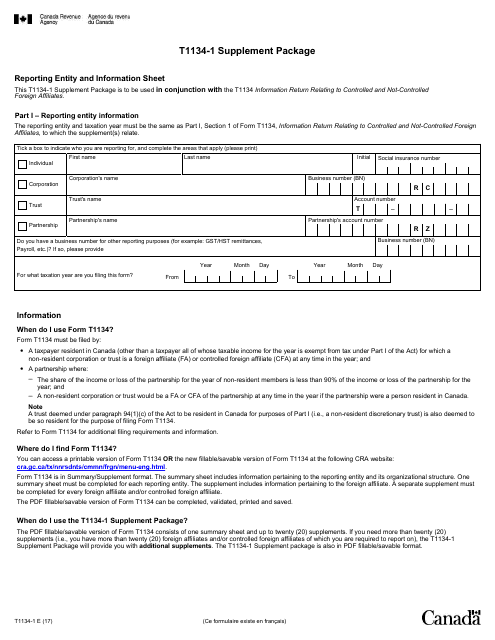

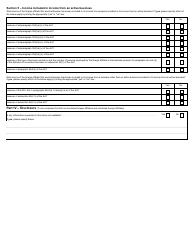

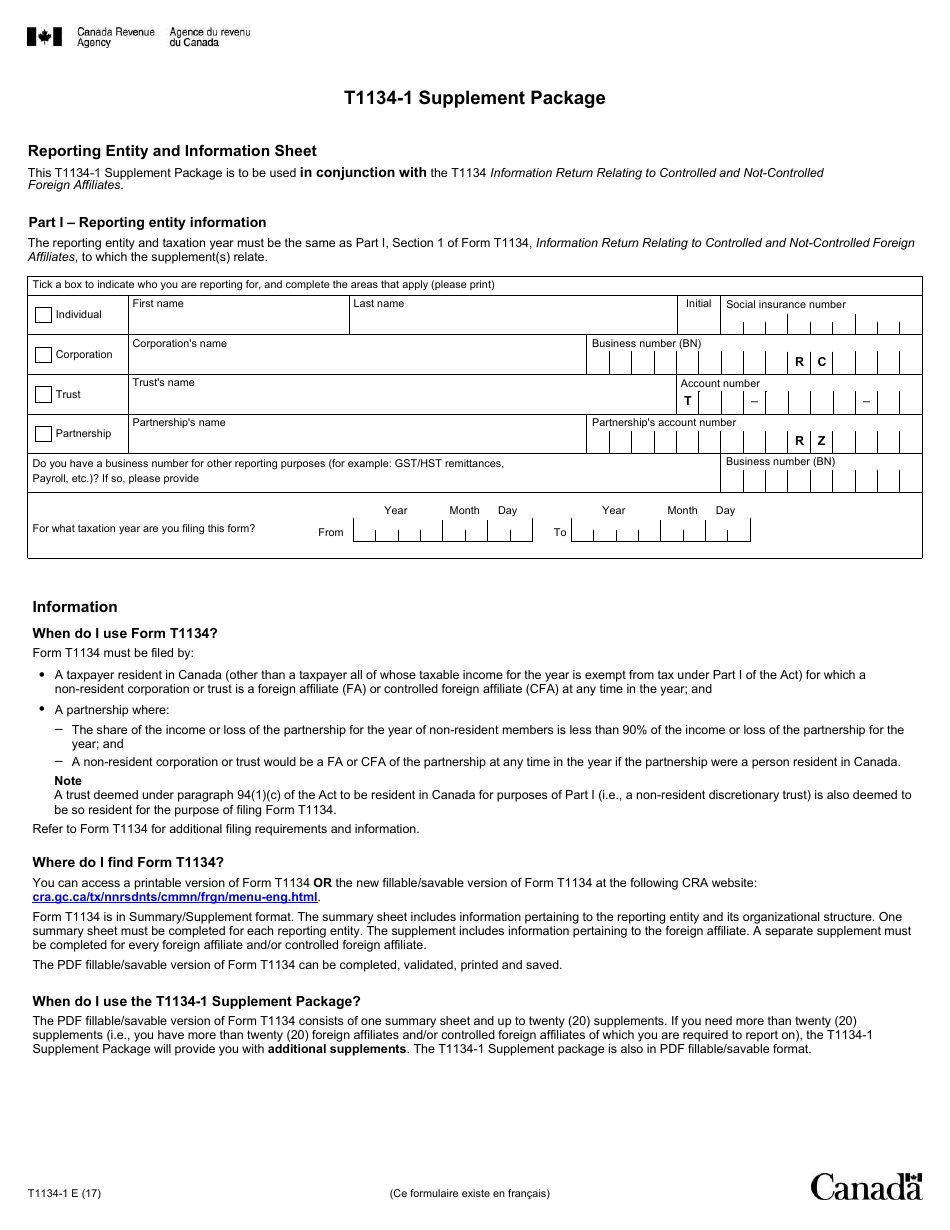

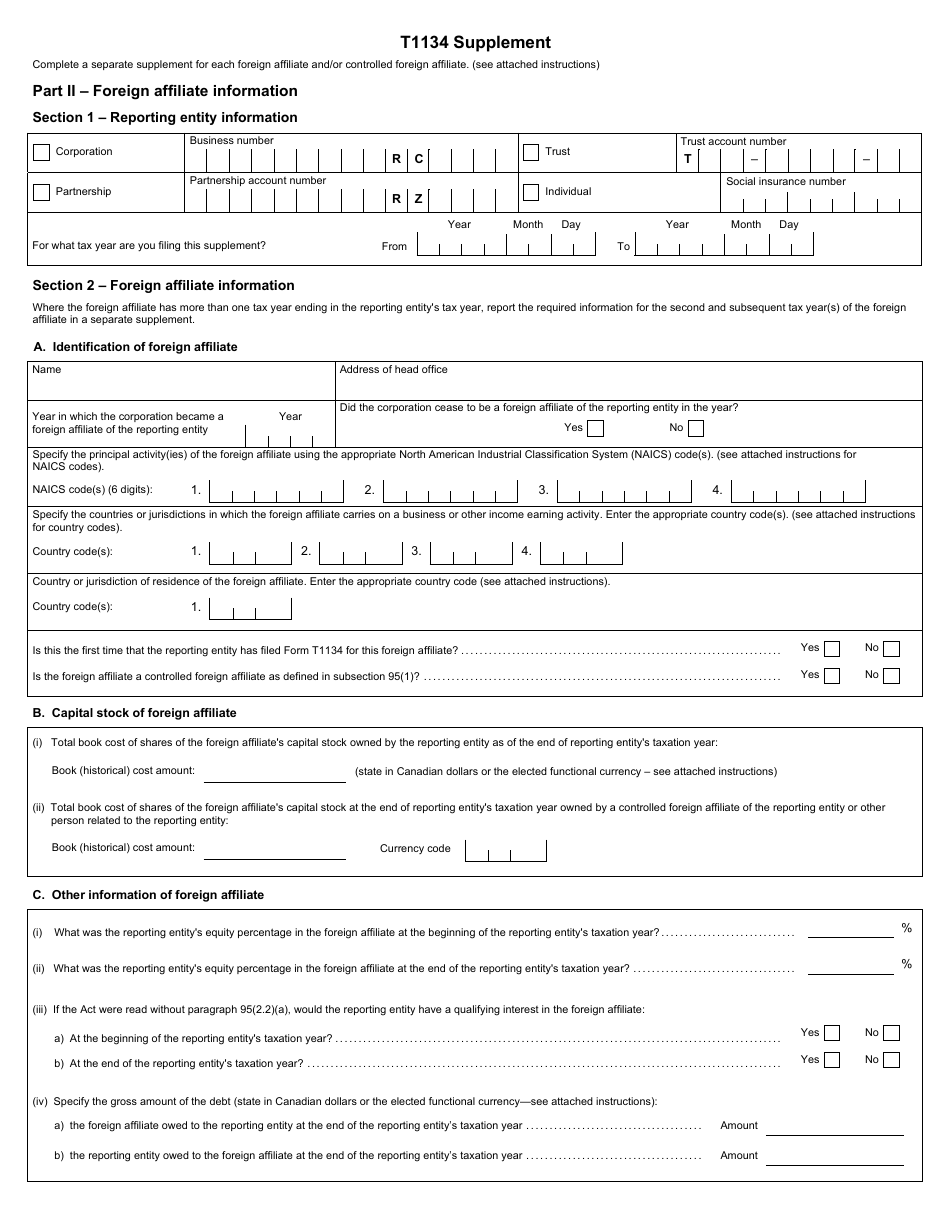

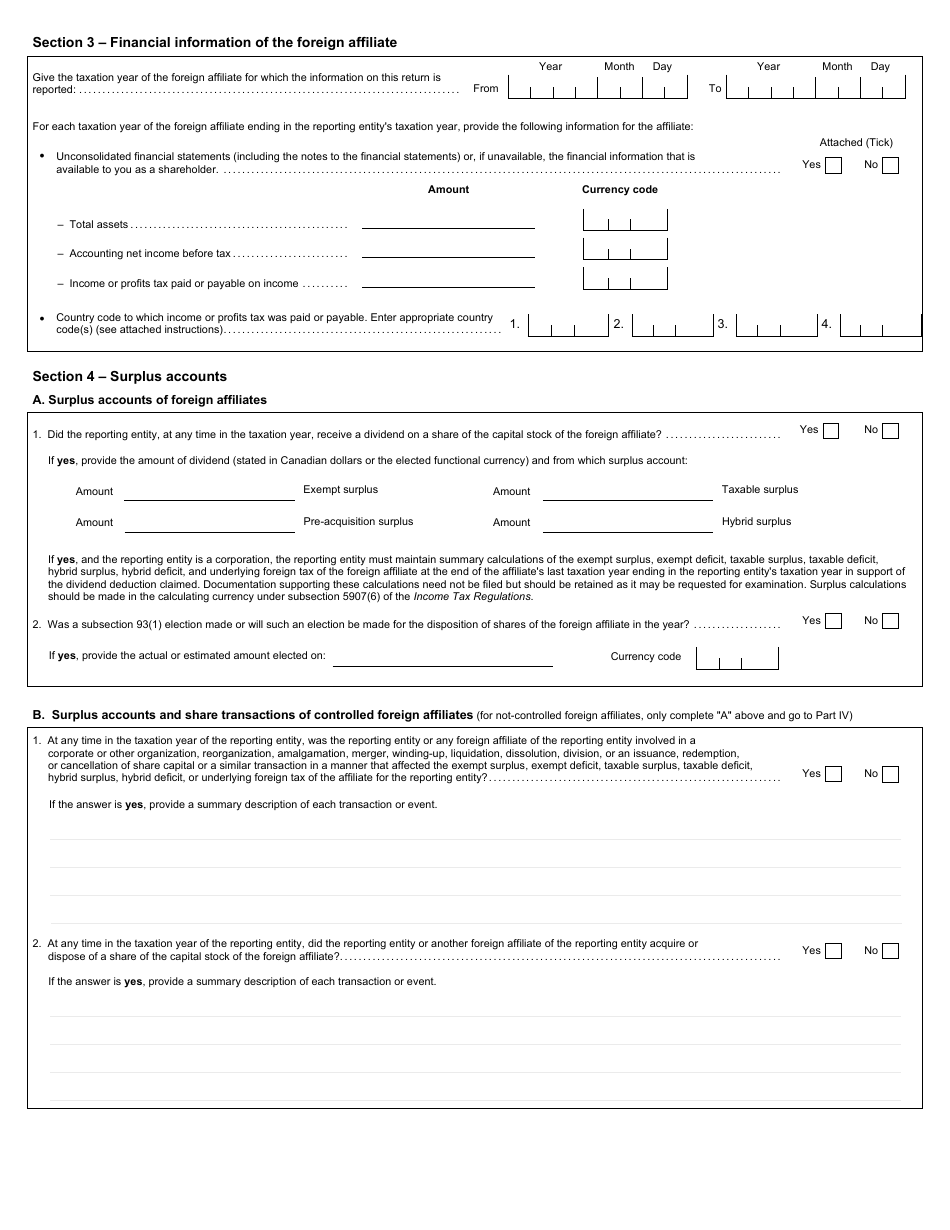

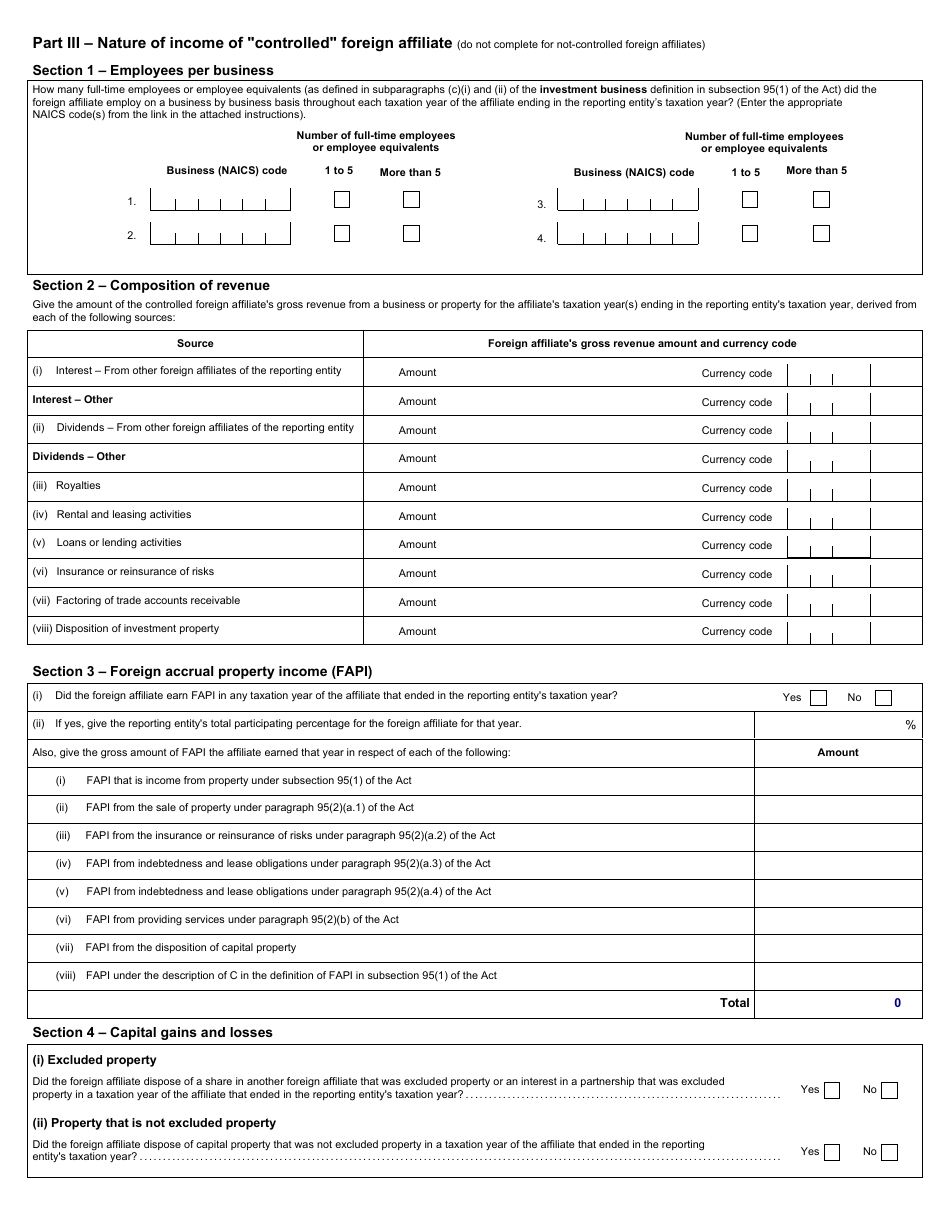

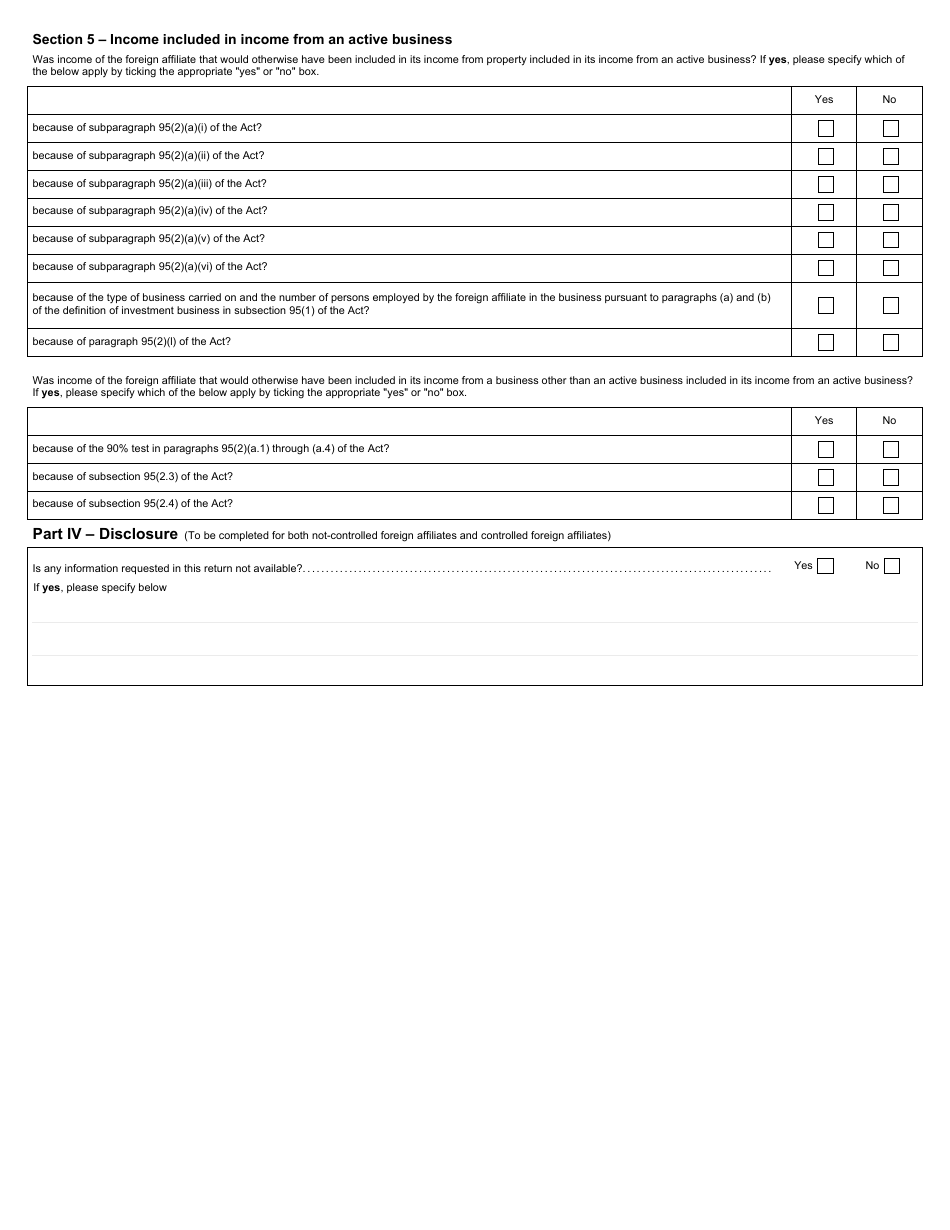

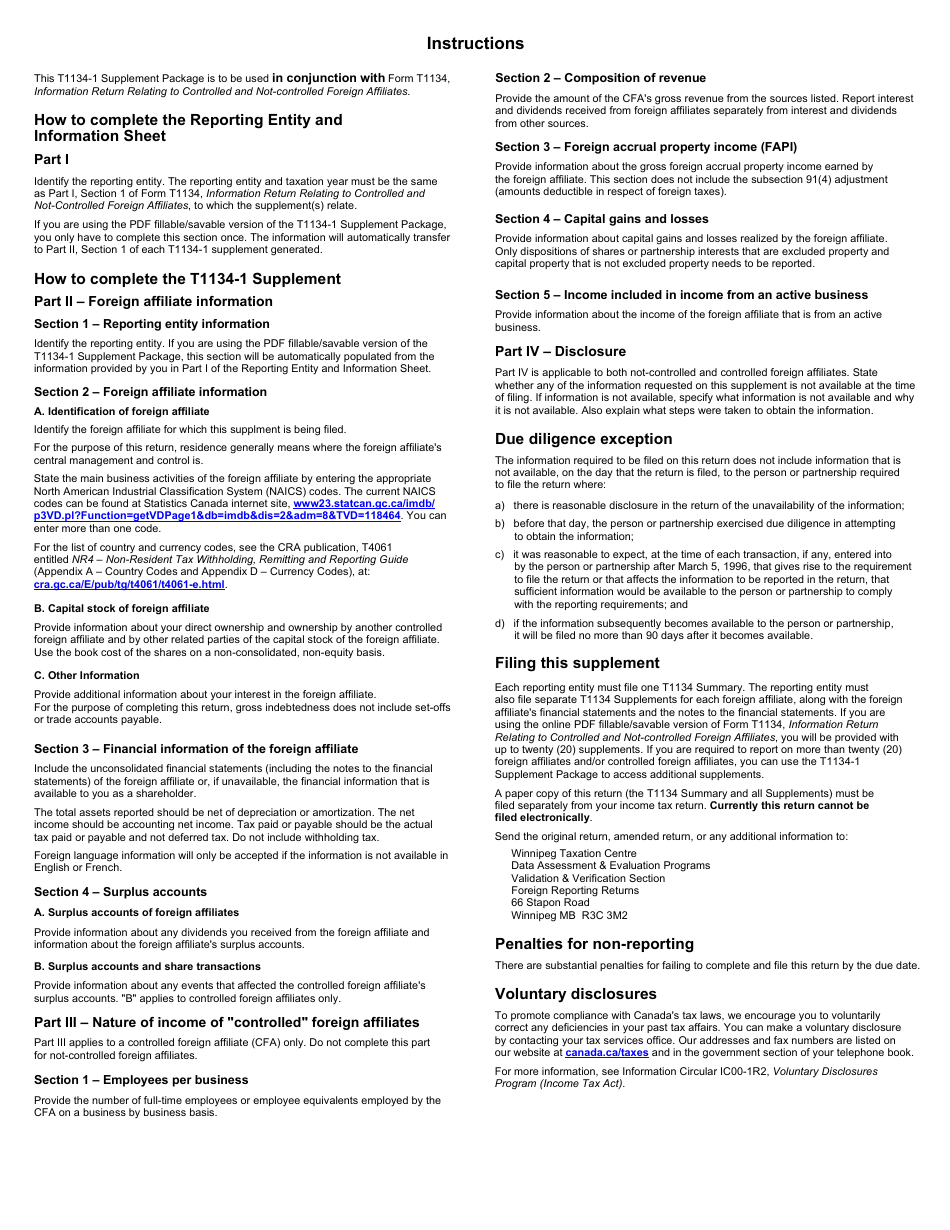

Form T1134-1 Supplement Package - Canada

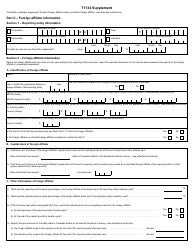

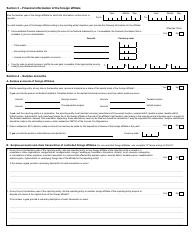

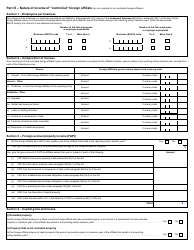

The Form T1134-1 Supplement Package in Canada is used to report information about foreign affiliates of a Canadian resident for tax purposes.

The Form T1134-1 Supplement Package in Canada is typically filed by Canadian taxpayers who have specified foreign property holdings.

FAQ

Q: What is Form T1134-1?

A: Form T1134-1 is a supplemental form for Canadian residents to report certain transactions with non-residents.

Q: Who needs to file Form T1134-1?

A: Canadian residents who have engaged in certain specified transactions with non-residents need to file Form T1134-1.

Q: What are the specified transactions that need to be reported on Form T1134-1?

A: Specified transactions include loans, transfers, acquisitions, dispositions, and other transactions with non-residents, subject to certain thresholds.

Q: Is Form T1134-1 only for individuals?

A: Form T1134-1 is not only for individuals. It is also applicable to corporations, trusts, and partnerships.

Q: When does Form T1134-1 need to be filed?

A: Form T1134-1 must be filed within 15 months after the end of the taxpayer's taxation year.

Q: Are there any penalties for not filing Form T1134-1?

A: Yes, there are penalties for failure to file Form T1134-1, ranging from $2,500 to $24,000, based on the taxpayer's gross negligence and the number of transactions not reported.

Q: Can I file Form T1134-1 electronically?

A: No, Form T1134-1 cannot be filed electronically. It must be filed in paper format.

Q: Are there any exceptions to filing Form T1134-1?

A: Yes, there are certain exceptions to filing Form T1134-1, such as when the reporting entity is a specified entity or when the total cost amount of specified foreign property is below the threshold.