This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1145

for the current year.

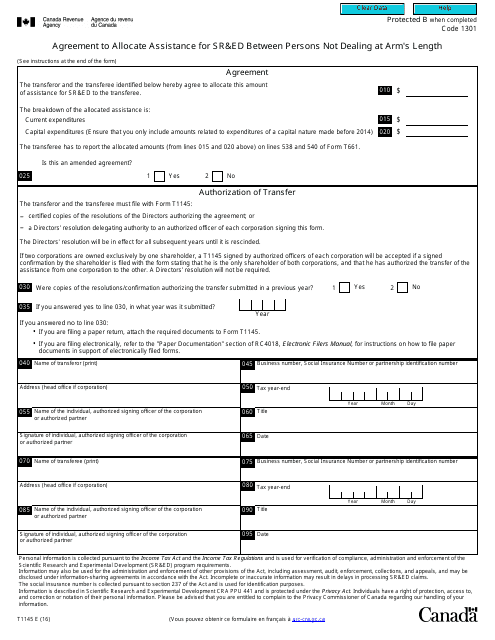

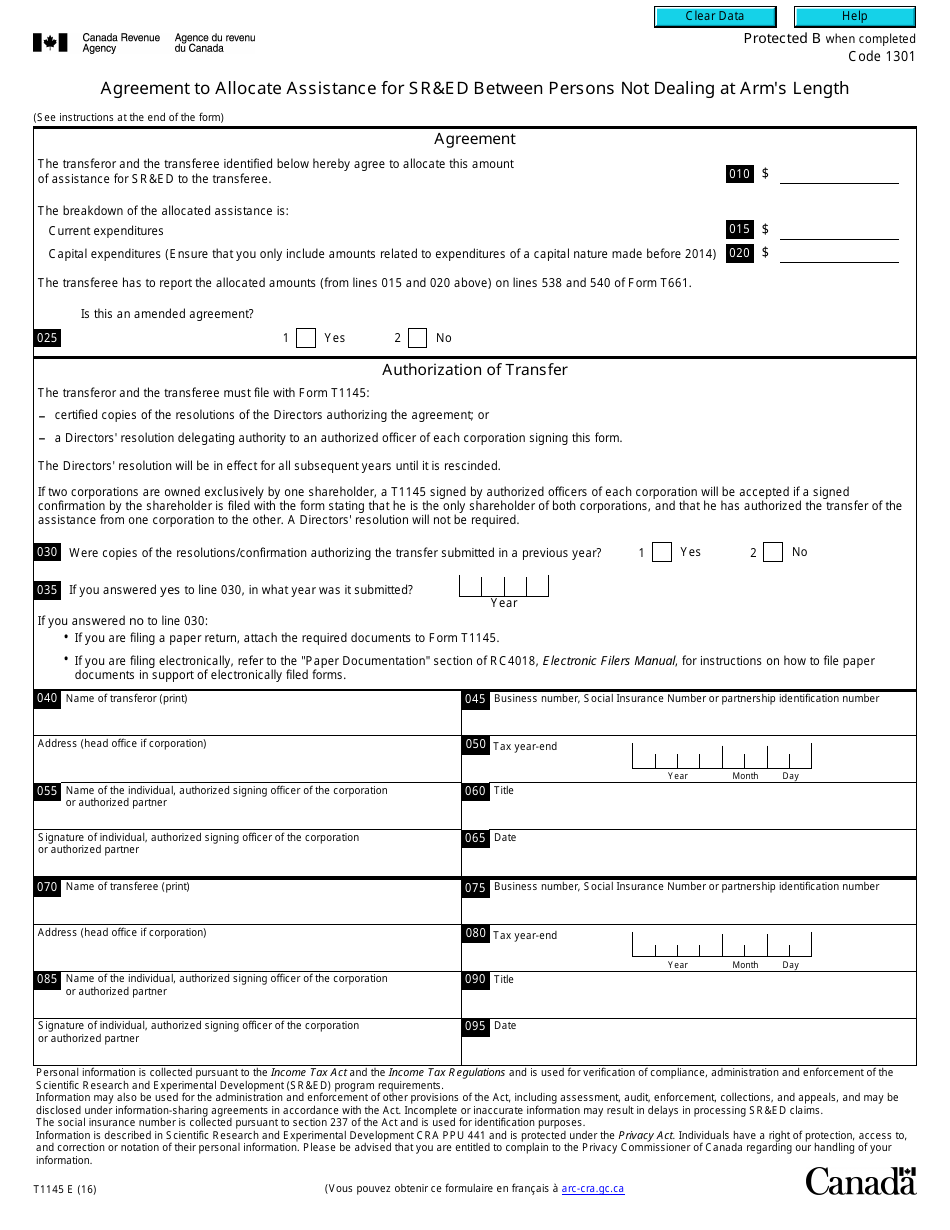

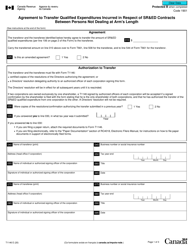

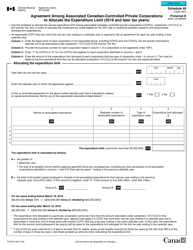

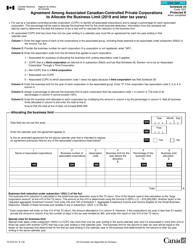

Form T1145 Agreement to Allocate Assistance for Sr&ed Between Persons Not Dealing at Arm's Length - Canada

Form T1145 Agreement to Allocate Assistance for SR&ED Between Persons Not Dealing at Arm's Length is used in Canada for allocating assistance for scientific research and experimental development (SR&ED) between individuals or entities who are not dealing with each other at arm's length. This form helps to determine the fair allocation of SR&ED assistance in situations where there may be related parties involved.

The form T1145 is filed by the party that is allocating assistance for SR&ED (Scientific Research and Experimental Development) between persons who are not dealing at arm's length in Canada.

FAQ

Q: What is Form T1145?

A: Form T1145 is the Agreement to Allocate Assistance for SR&ED between Persons Not Dealing at Arm's Length in Canada.

Q: What is SR&ED?

A: SR&ED stands for Scientific Research and Experimental Development. It is a Canadian tax incentive program for businesses that conduct research and development activities.

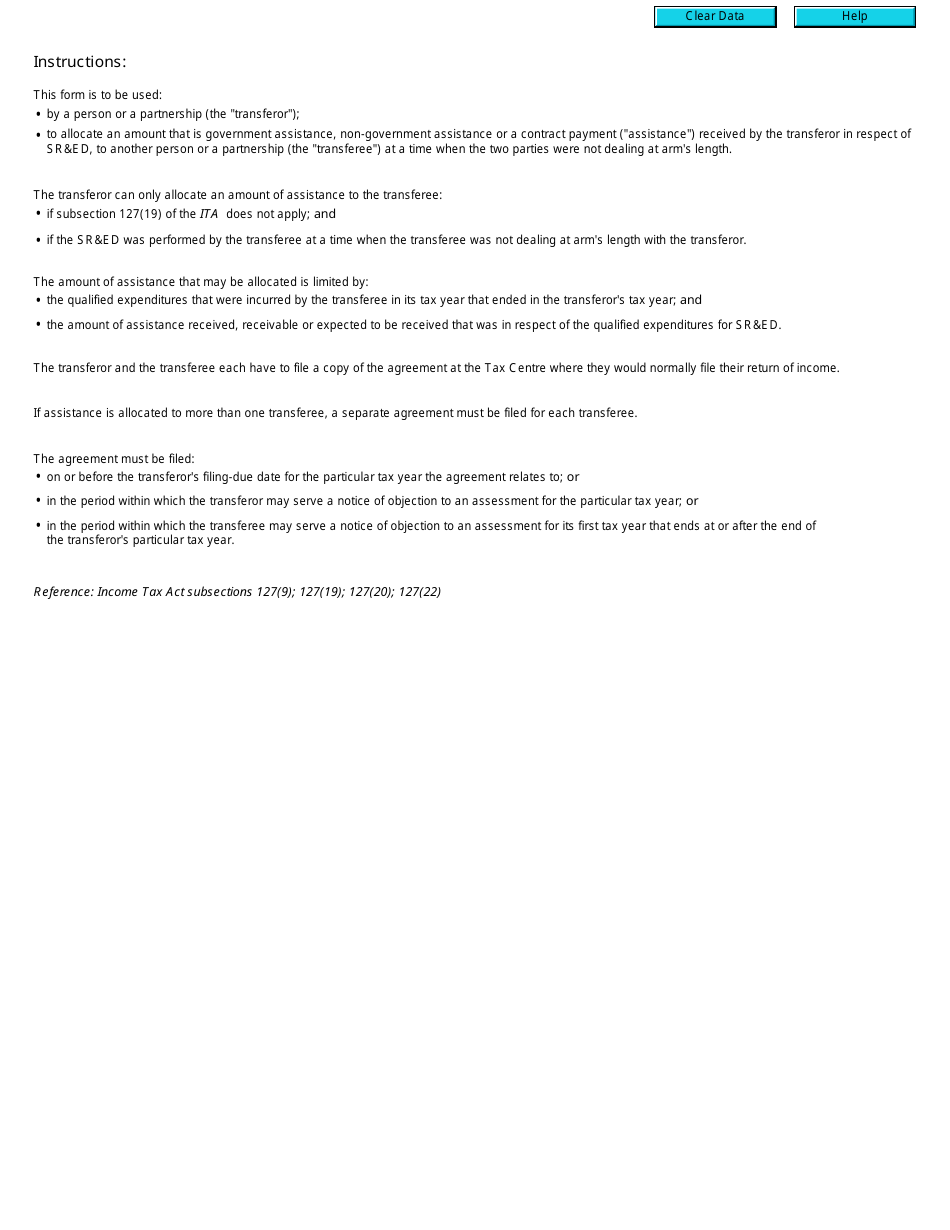

Q: Who needs to file Form T1145?

A: Form T1145 needs to be filed by Canadian taxpayers who have entered into an agreement to allocate SR&ED assistance with a person they are not dealing at arm's length with.

Q: What is the purpose of Form T1145?

A: The purpose of Form T1145 is to allocate SR&ED assistance credits between two parties who are not dealing at arm's length.

Q: What information is required on Form T1145?

A: Form T1145 requires information such as the names and contact information of both parties, details of the SR&ED project, and the amount of SR&ED assistance to be allocated.

Q: When is the deadline to file Form T1145?

A: Form T1145 must be filed by the due date of the tax return for the taxation year in which the SR&ED assistance was received.

Q: What happens if I don't file Form T1145?

A: Failure to file Form T1145 or providing false or misleading information on the form may result in penalties or denial of the SR&ED tax incentives.

Q: Can I amend Form T1145?

A: Yes, you can file an amended Form T1145 if there are changes to the allocation of SR&ED assistance between the parties involved.

Q: Do I need to keep a copy of Form T1145?

A: Yes, it is recommended to keep a copy of Form T1145 and any supporting documentation for at least six years in case of a CRA audit.