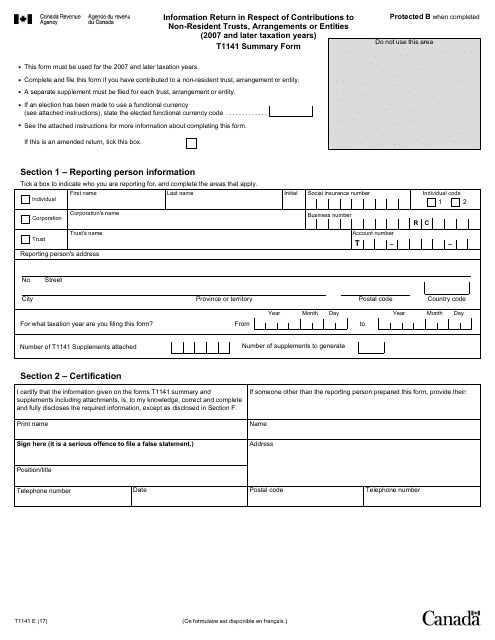

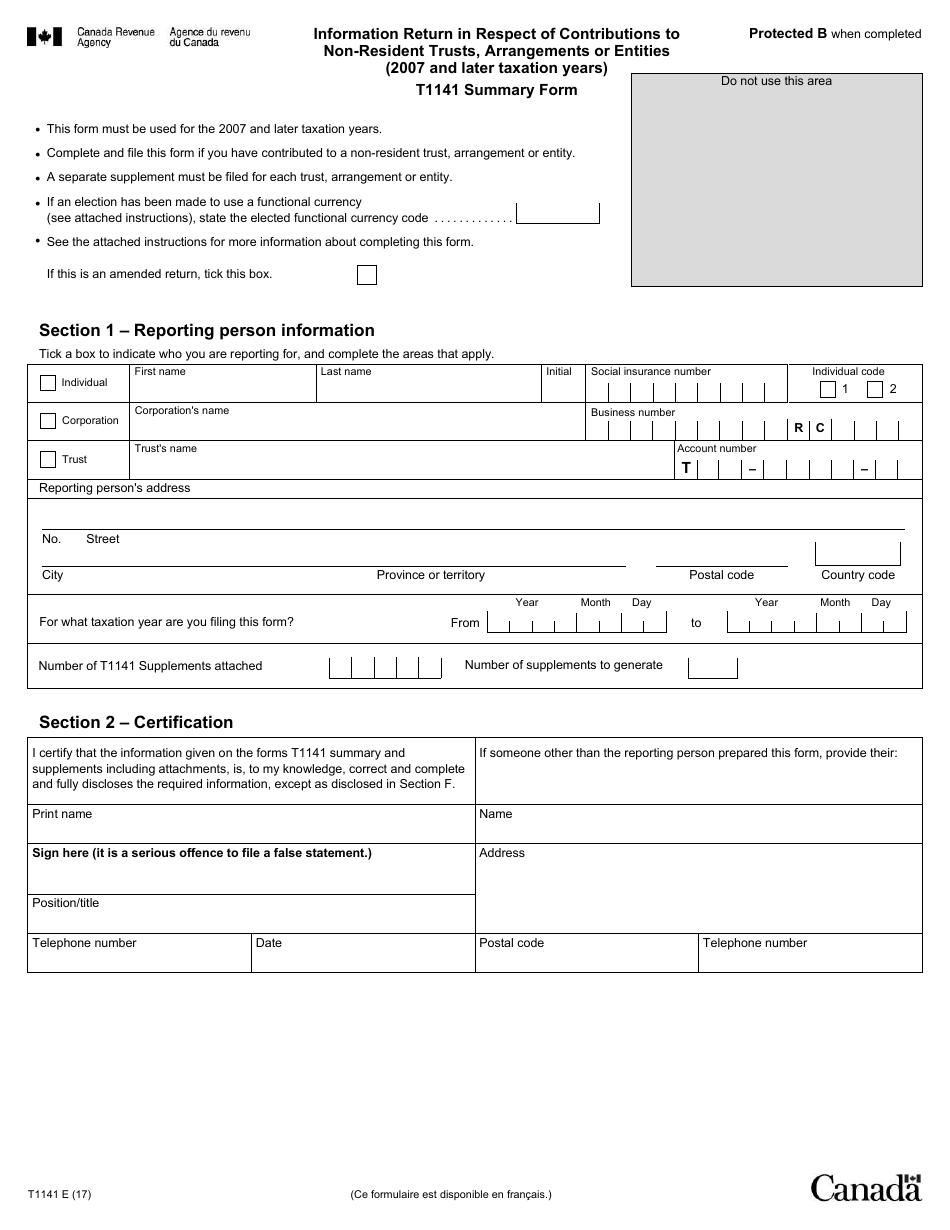

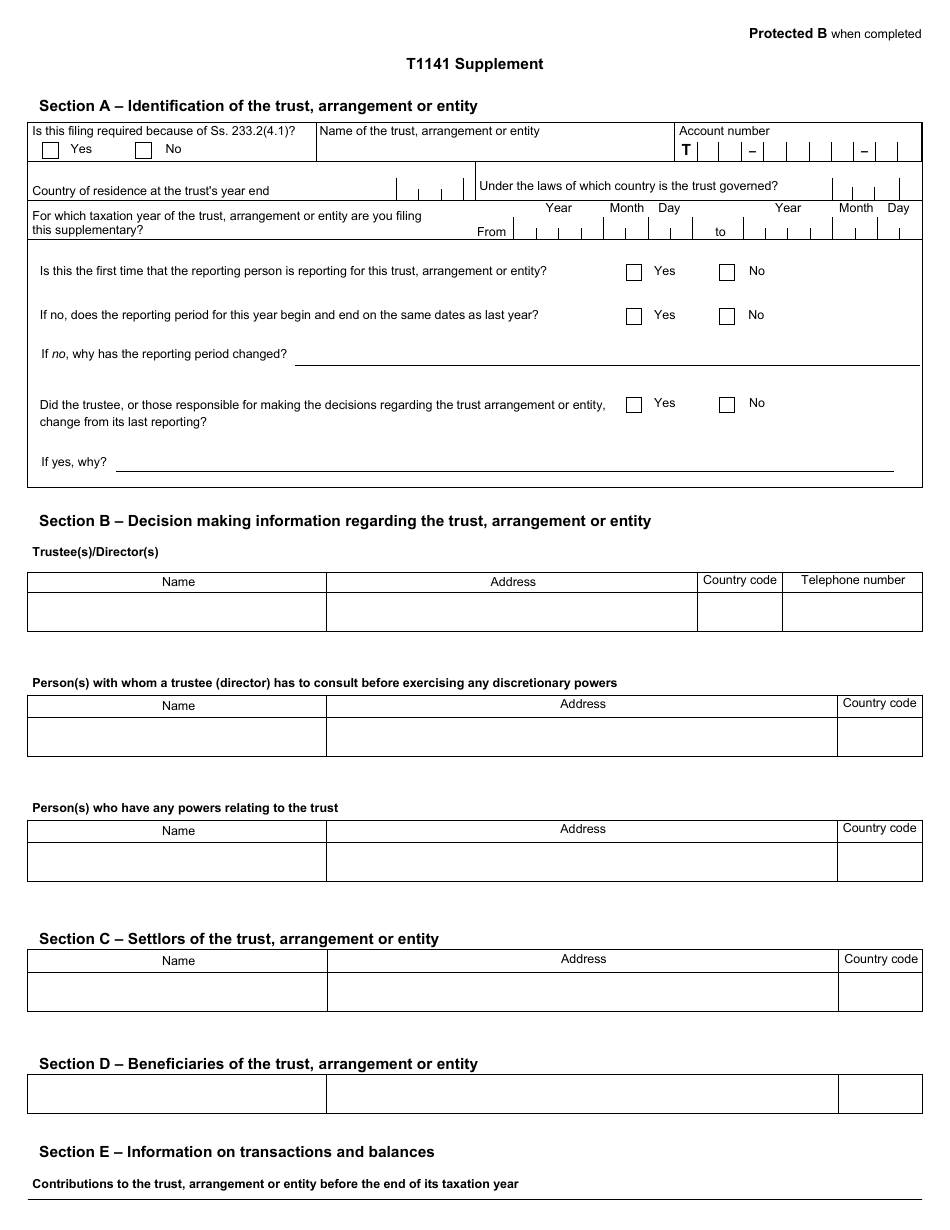

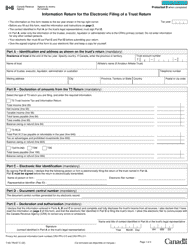

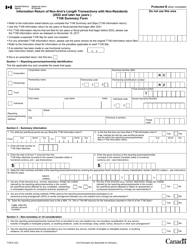

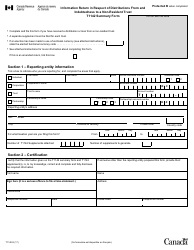

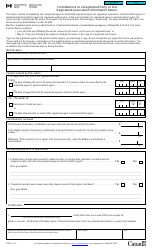

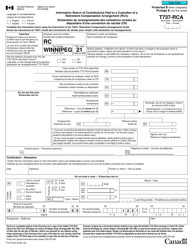

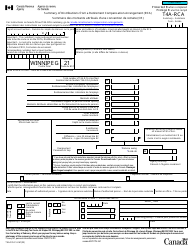

Form T1141 Information Return in Respect of Contributions to Non-resident Trusts, Arrangements or Entities - Canada

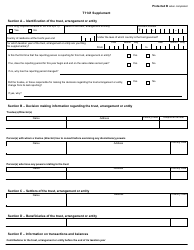

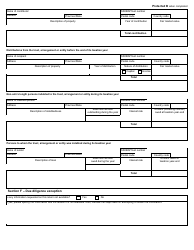

Form T1141 Information Return in Respect of Contributions to Non-resident Trusts, Arrangements or Entities is used in Canada to report any contributions made to non-resident trusts, arrangements, or entities by Canadian residents. It helps the Canadian government keep track of these contributions for tax and regulatory purposes.

The Form T1141 Information Return in respect of contributions to non-resident trusts, arrangements, or entities in Canada is filed by the resident contributor.

FAQ

Q: What is Form T1141?

A: Form T1141 is an Information Return in Respect of Contributions to Non-resident Trusts, Arrangements or Entities in Canada.

Q: Who needs to file Form T1141?

A: Anyone who makes contributions to non-resident trusts, arrangements, or entities in Canada needs to file Form T1141.

Q: What is the purpose of Form T1141?

A: The purpose of Form T1141 is to provide information to the Canadian government about contributions made to non-resident trusts, arrangements, or entities.

Q: When is Form T1141 due?

A: Form T1141 is usually due on or before the 90th day after the end of the year to which the contributions relate.

Q: Are there any penalties for not filing Form T1141?

A: Yes, there may be penalties for not filing Form T1141 or for providing incorrect or incomplete information on the form.

Q: Can I file Form T1141 electronically?

A: Currently, Form T1141 cannot be filed electronically and must be filed in paper format.

Q: What supporting documents are required with Form T1141?

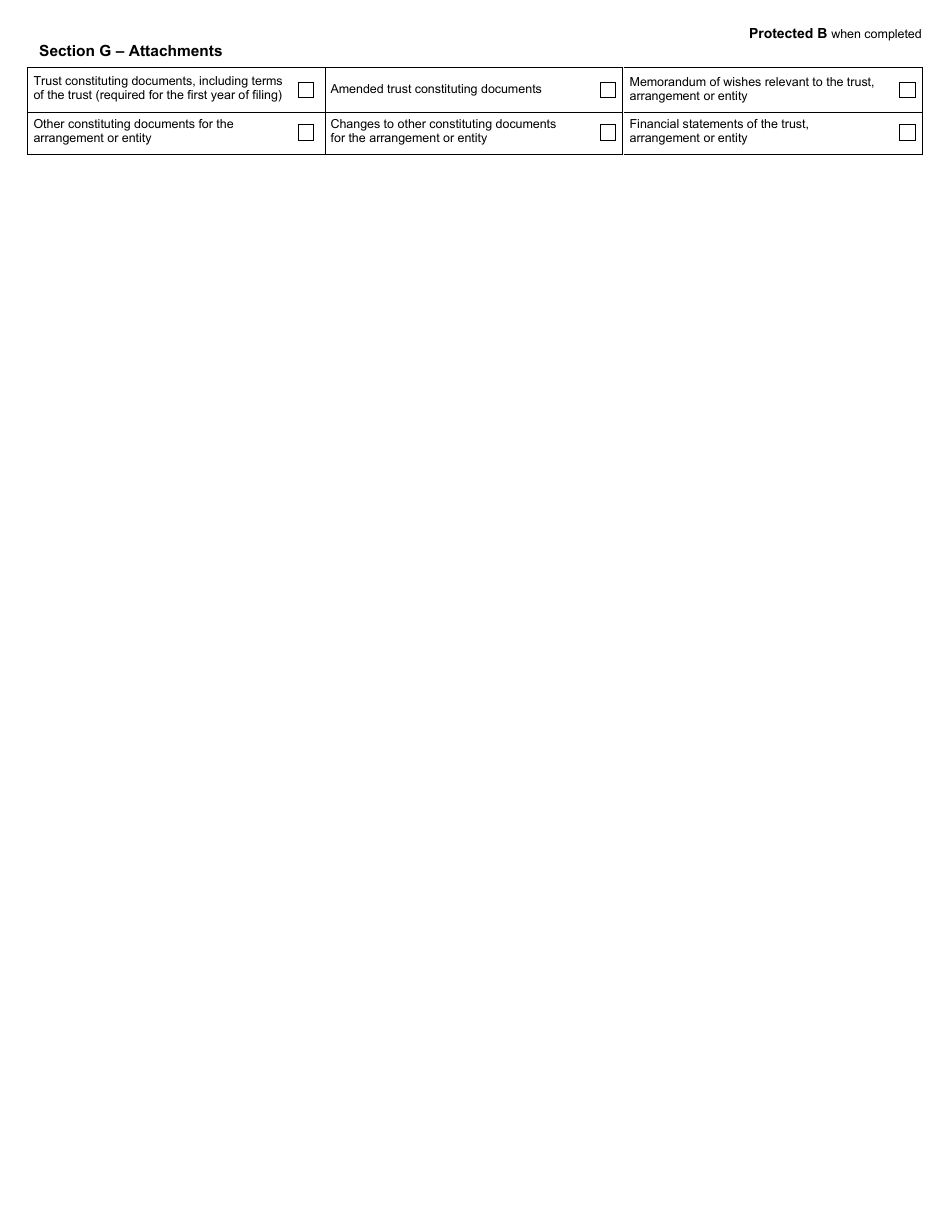

A: You may be required to provide certain documents, such as trust deeds or agreements, to support the information reported on Form T1141.

Q: What should I do if I have questions about Form T1141?

A: If you have questions about Form T1141, you can contact the Canada Revenue Agency or seek professional tax advice.