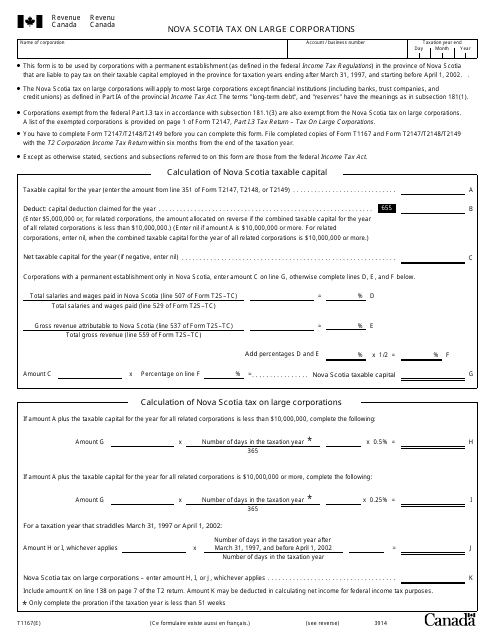

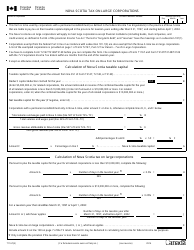

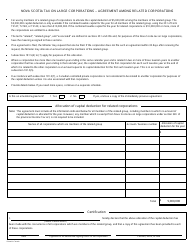

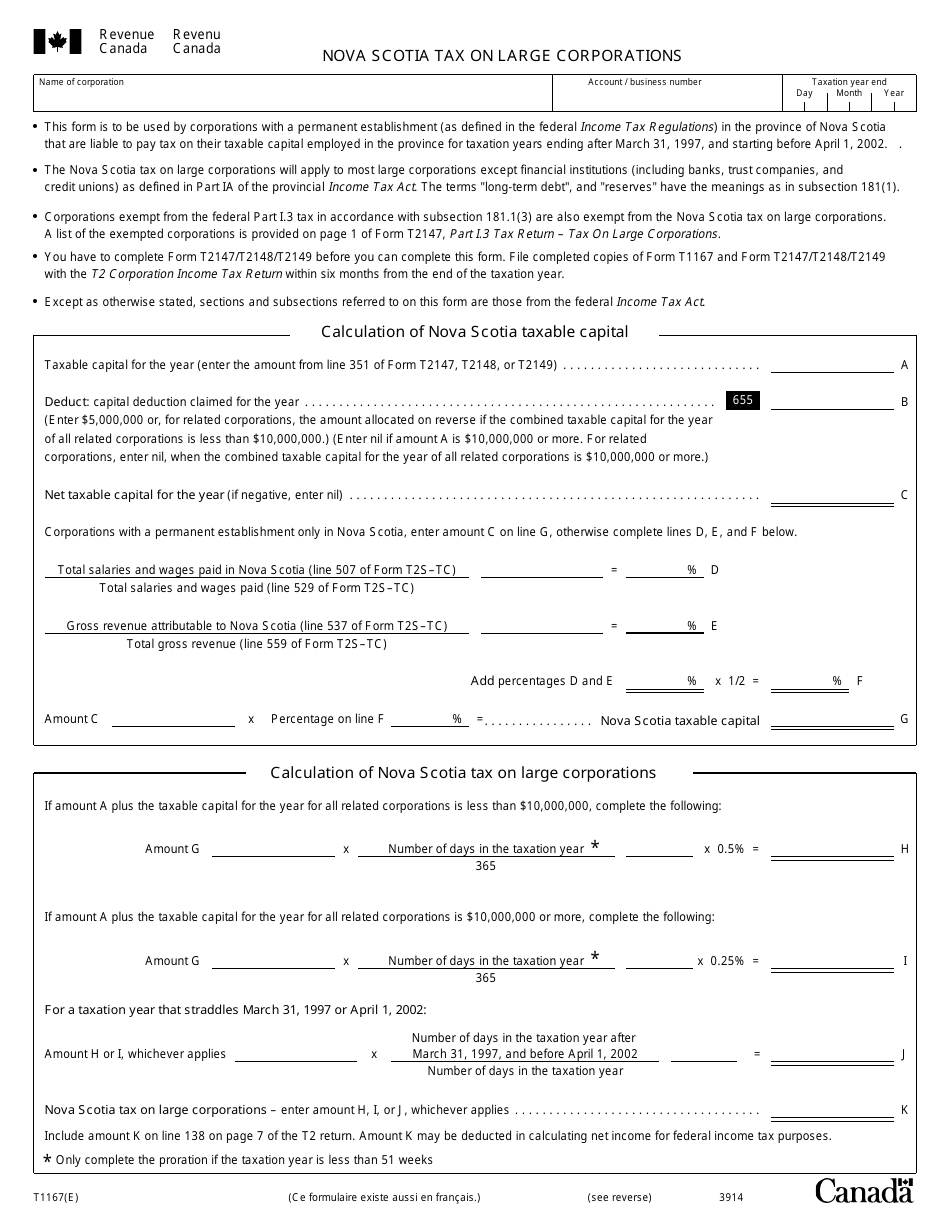

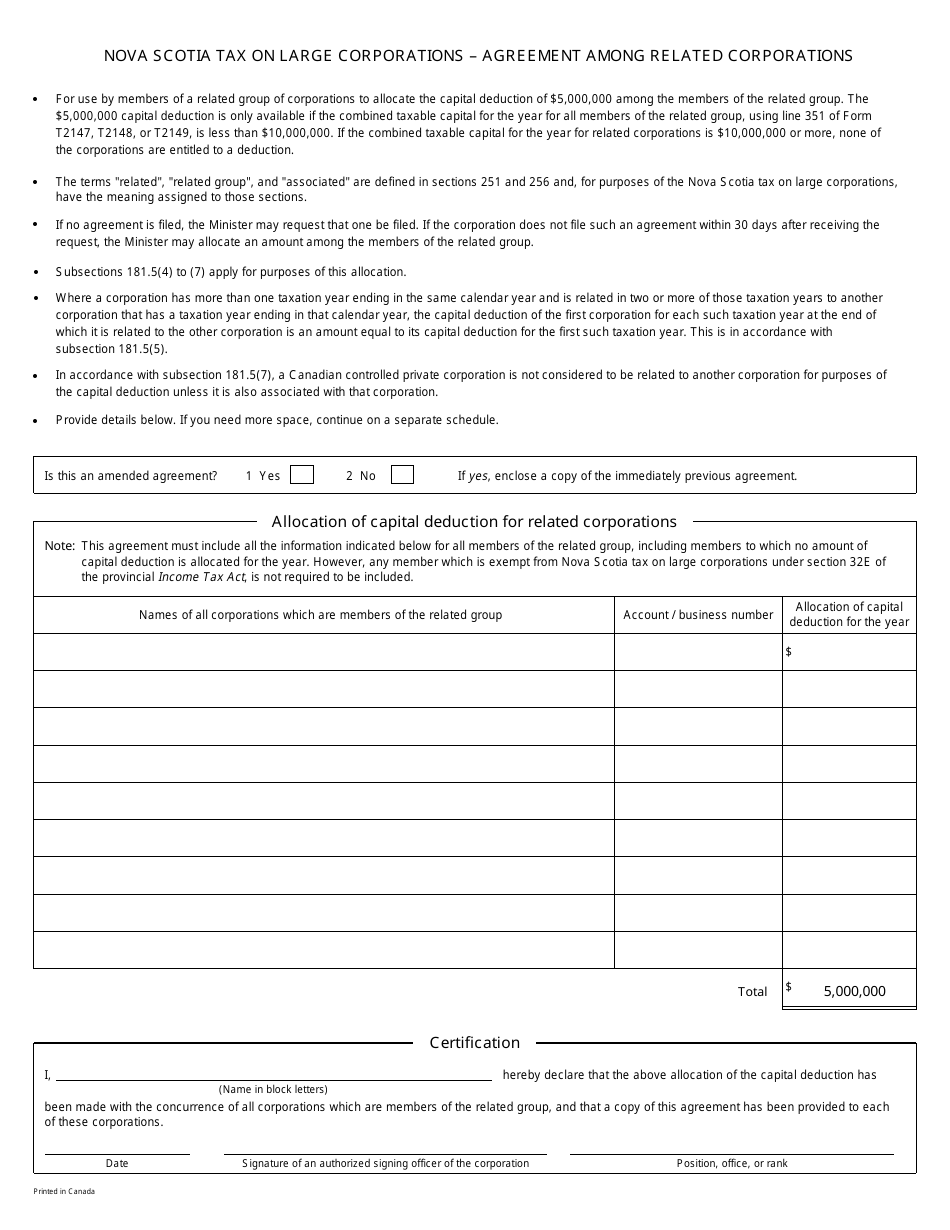

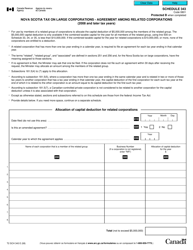

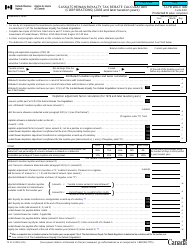

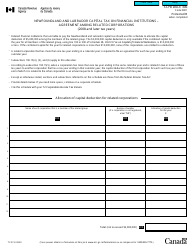

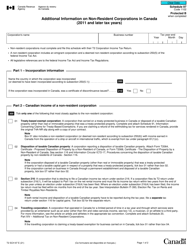

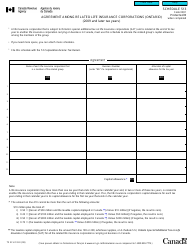

Form T1167 Nova Scotia Tax on Large Corporations - Canada

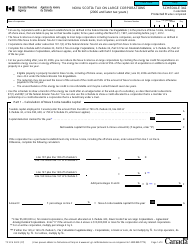

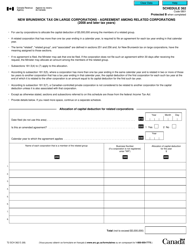

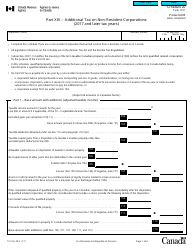

Form T1167, Nova Scotia Tax on Large Corporations, is used by large corporations in Nova Scotia, Canada, to report and pay their provincial tax obligations. This form helps ensure that businesses meet their tax requirements and contribute to the funding of provincial programs and services in Nova Scotia.

The Form T1167 Nova Scotia Tax on Large Corporations in Canada is filed by large corporations operating in the province of Nova Scotia.

FAQ

Q: What is Form T1167?

A: Form T1167 is the tax form used in Nova Scotia to report and calculate taxes for large corporations.

Q: Who needs to file Form T1167?

A: Large corporations operating in Nova Scotia are required to file Form T1167.

Q: What is the purpose of Form T1167?

A: The purpose of Form T1167 is to calculate and report the Nova Scotia tax on large corporations.

Q: What is the Nova Scotia tax on large corporations?

A: The Nova Scotia tax on large corporations is a tax imposed on the income of corporations operating in Nova Scotia.

Q: What information is required to complete Form T1167?

A: To complete Form T1167, you need to provide details of your corporation's income, deductions, and other relevant financial information.

Q: When is Form T1167 due?

A: Form T1167 is typically due on or before the last day of the corporation's fiscal year.

Q: Are there any penalties for late filing of Form T1167?

A: Yes, there may be penalties for late filing of Form T1167, so it is important to file it on time.