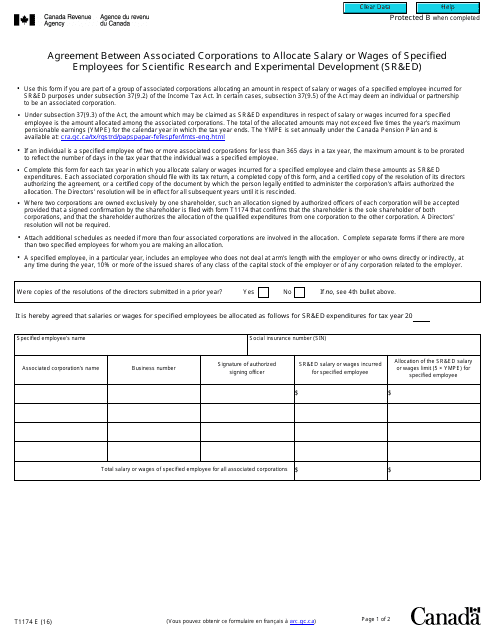

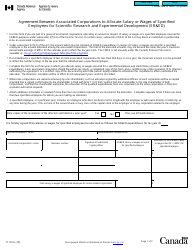

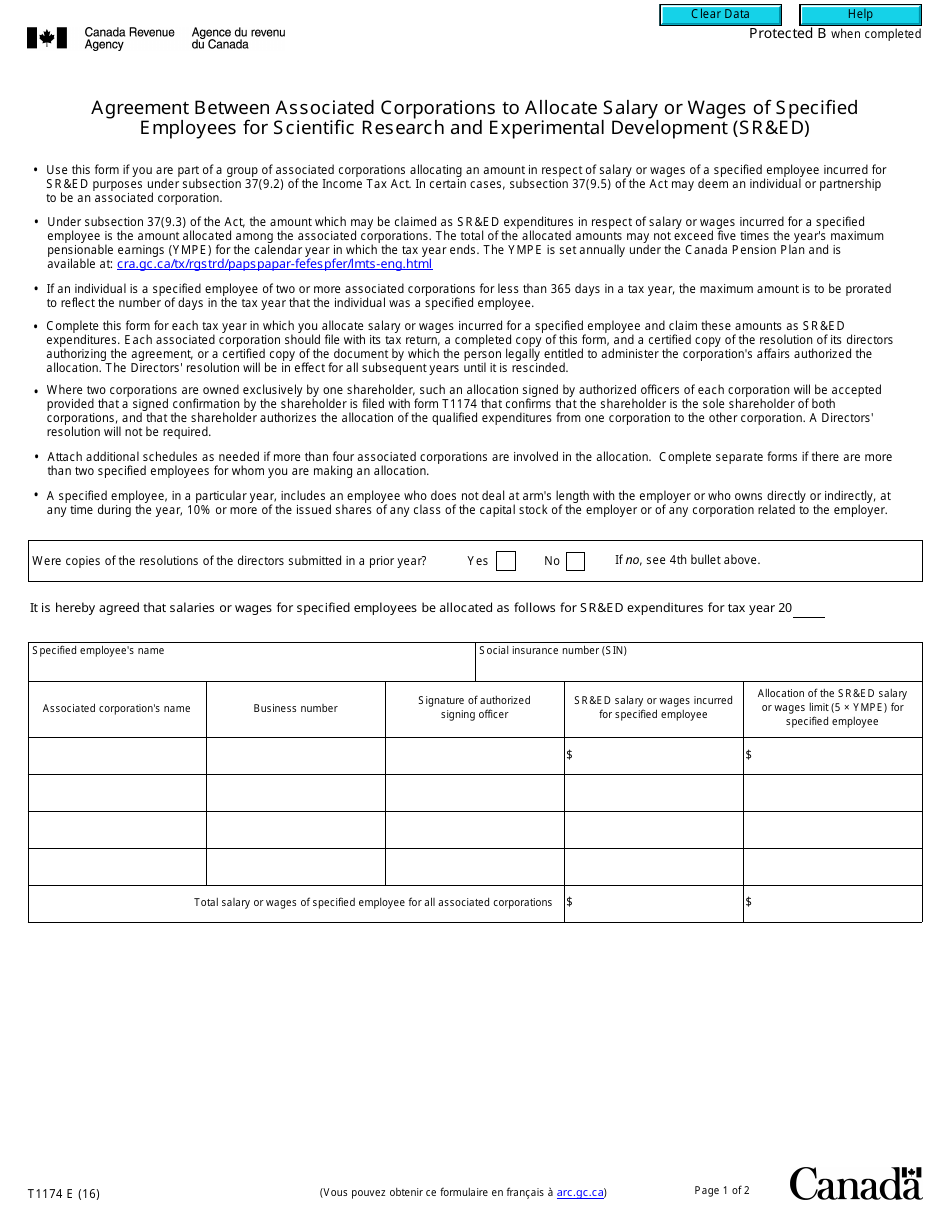

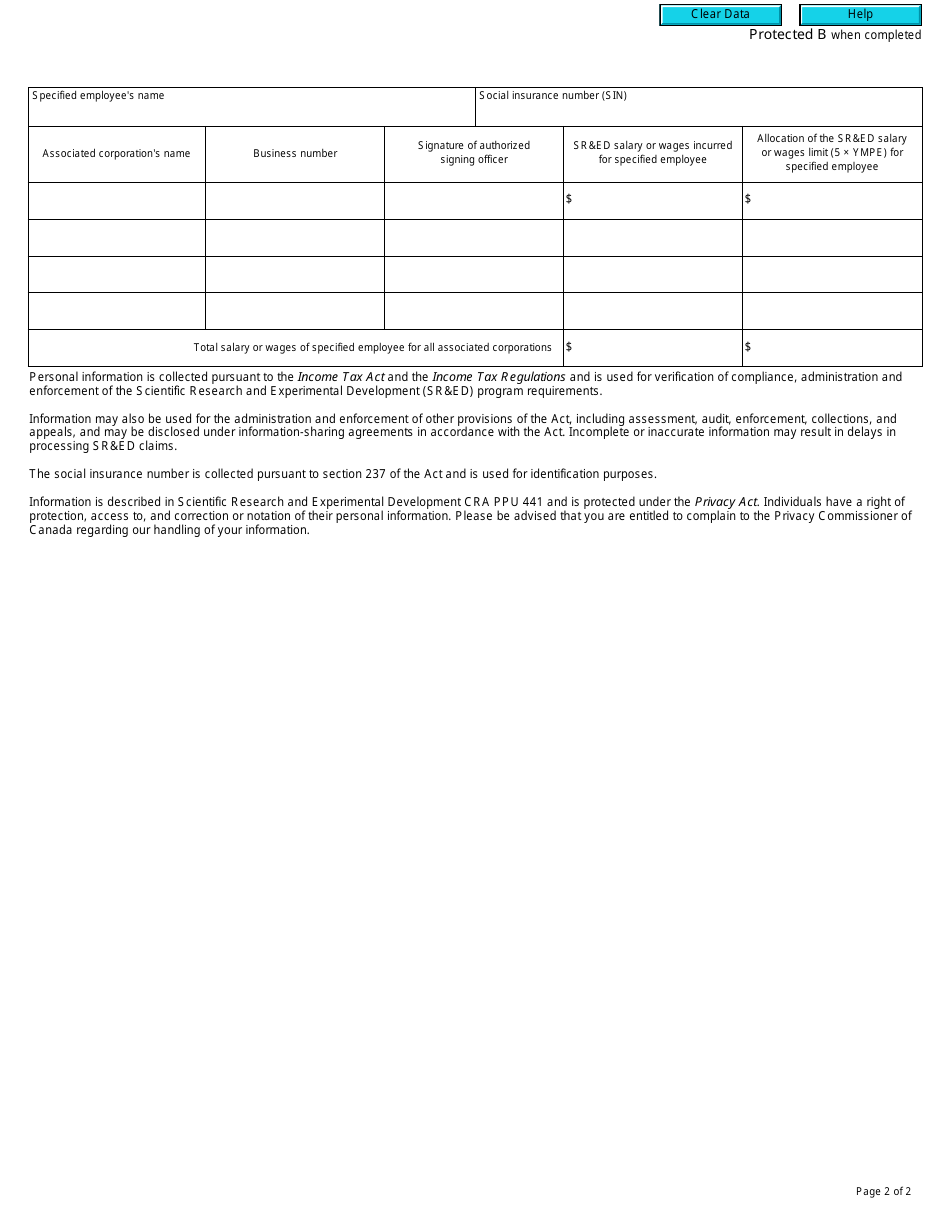

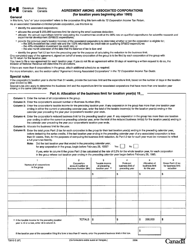

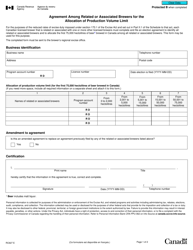

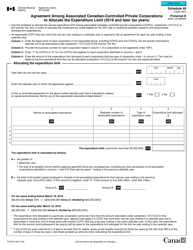

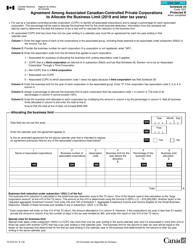

Form T1174 Agreement Between Associated Corporations to Allocate Salary or Wages of Specified Employees for Scientific Research and Experimental Development (Sr&ed) - Canada

Form T1174 Agreement Between Associated Corporations to Allocate Salary or Wages of Specified Employees for Scientific Research and Experimental Development (SR&ED) in Canada is used to establish an agreement between associated corporations to allocate the salary or wages of specified employees for the purpose of claiming tax credits related to SR&ED activities.

In Canada, the associated corporations involved in scientific research and experimental development (SR&ED) would file the Form T1174 Agreement between Associated Corporations to Allocate Salary or Wages of Specified Employees for SR&ED.

FAQ

Q: What is Form T1174?

A: Form T1174 is an agreement between associated corporations to allocate salary or wages of specified employees for scientific research and experimental development (SR&ED) in Canada.

Q: What is SR&ED?

A: SR&ED stands for Scientific Research and Experimental Development. It is a program in Canada that provides tax incentives for research and development activities.

Q: Who can use Form T1174?

A: Form T1174 can be used by associated corporations in Canada to allocate salary or wages of specified employees for SR&ED.

Q: What is the purpose of Form T1174?

A: The purpose of Form T1174 is to allocate the salary or wages of specified employees between associated corporations that are involved in SR&ED.

Q: How does Form T1174 work?

A: Form T1174 allows associated corporations to agree on how to allocate the salary or wages of specified employees for SR&ED. This helps in determining the eligible expenses for tax incentives.

Q: Are there any eligibility criteria to use Form T1174?

A: Yes, to use Form T1174, the associated corporations must meet certain criteria defined by the Canada Revenue Agency.

Q: Is Form T1174 mandatory for claiming SR&ED expenses?

A: No, Form T1174 is not mandatory, but it is recommended for proper allocation of SR&ED expenses among associated corporations.

Q: Can Form T1174 be used for other purposes?

A: No, Form T1174 is specifically designed for the allocation of salary or wages of specified employees for SR&ED.

Q: What are the consequences of not using Form T1174?

A: Not using Form T1174 may result in incorrect allocation of SR&ED expenses and could lead to potential issues with tax incentives.

Q: Are there any penalties for incorrect allocation of SR&ED expenses?

A: Yes, incorrect allocation of SR&ED expenses can result in penalties and potential audits by the Canada Revenue Agency.