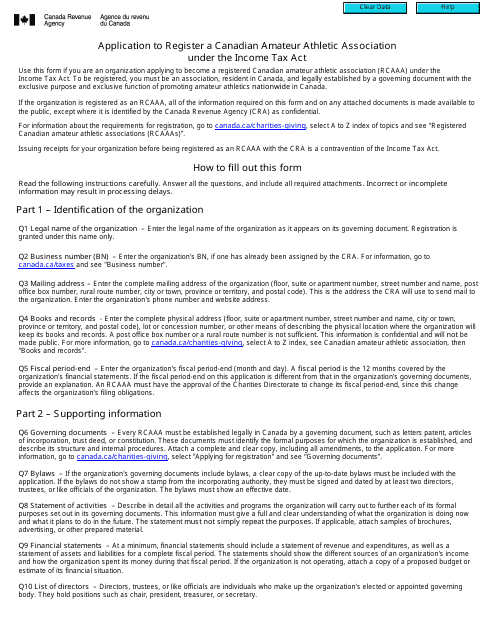

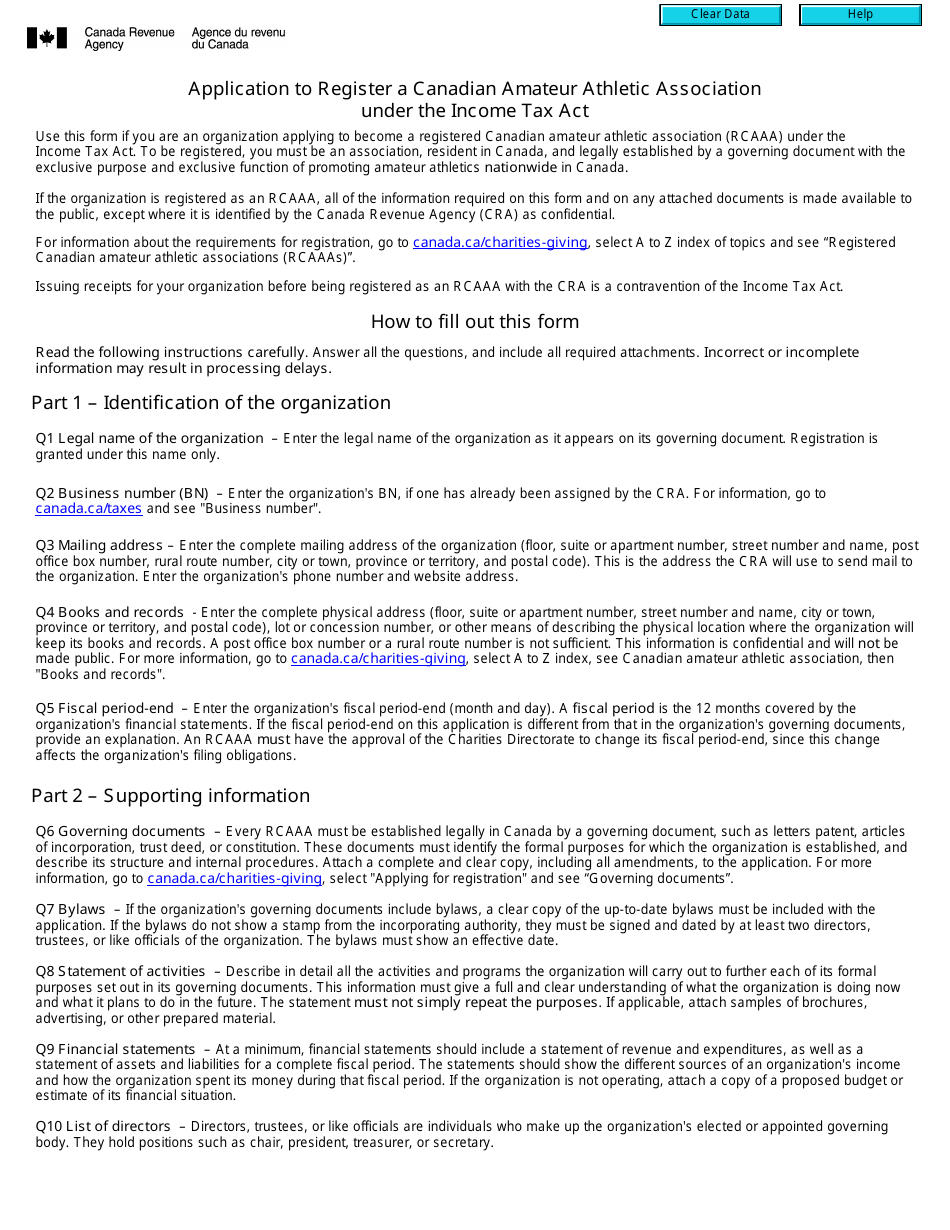

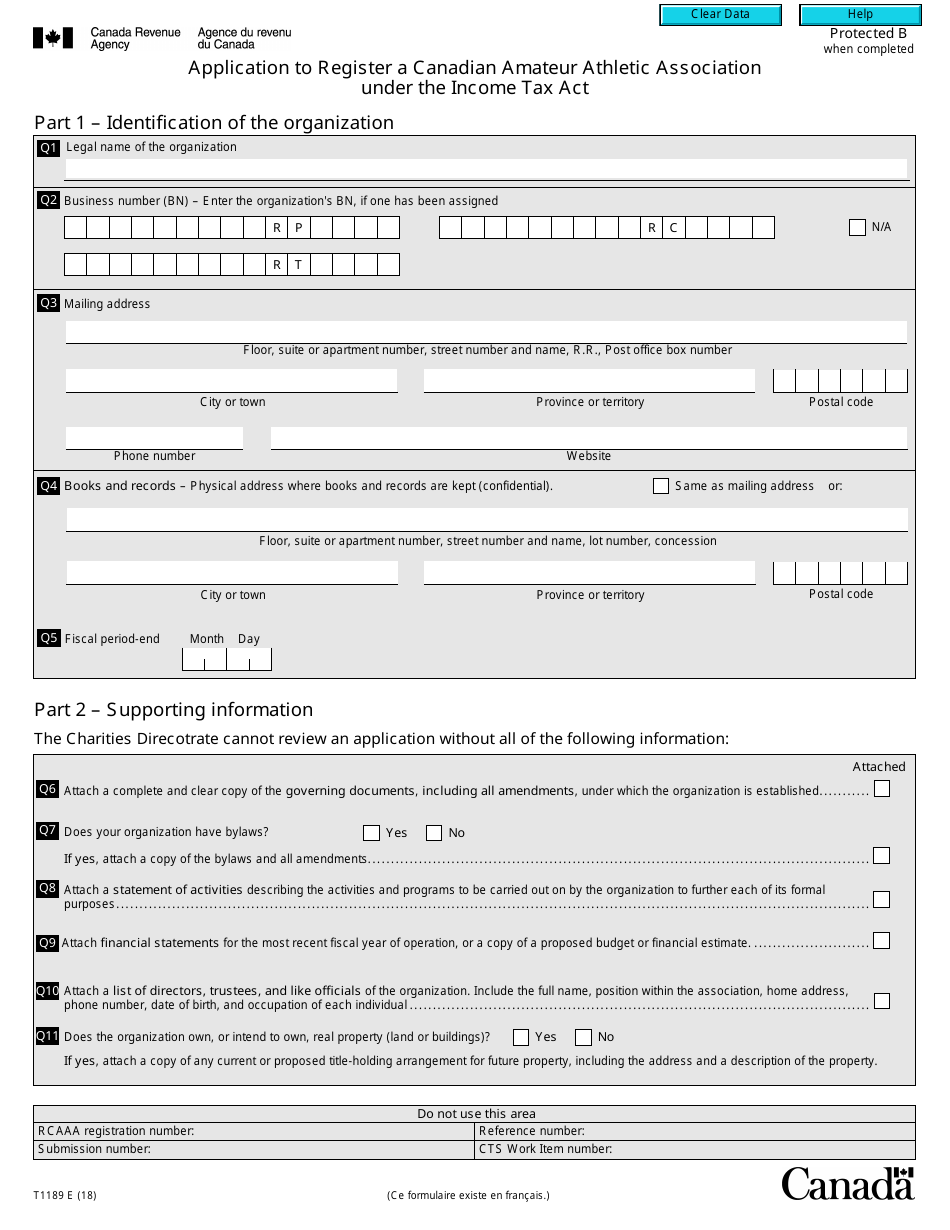

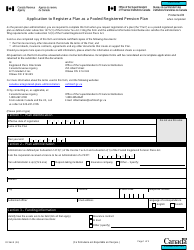

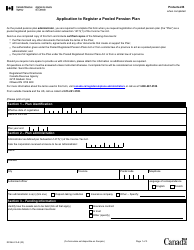

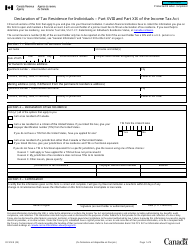

Form T1189 Application to Register a Canadian Amateur Athletic Association Under the Income Tax Act - Canada

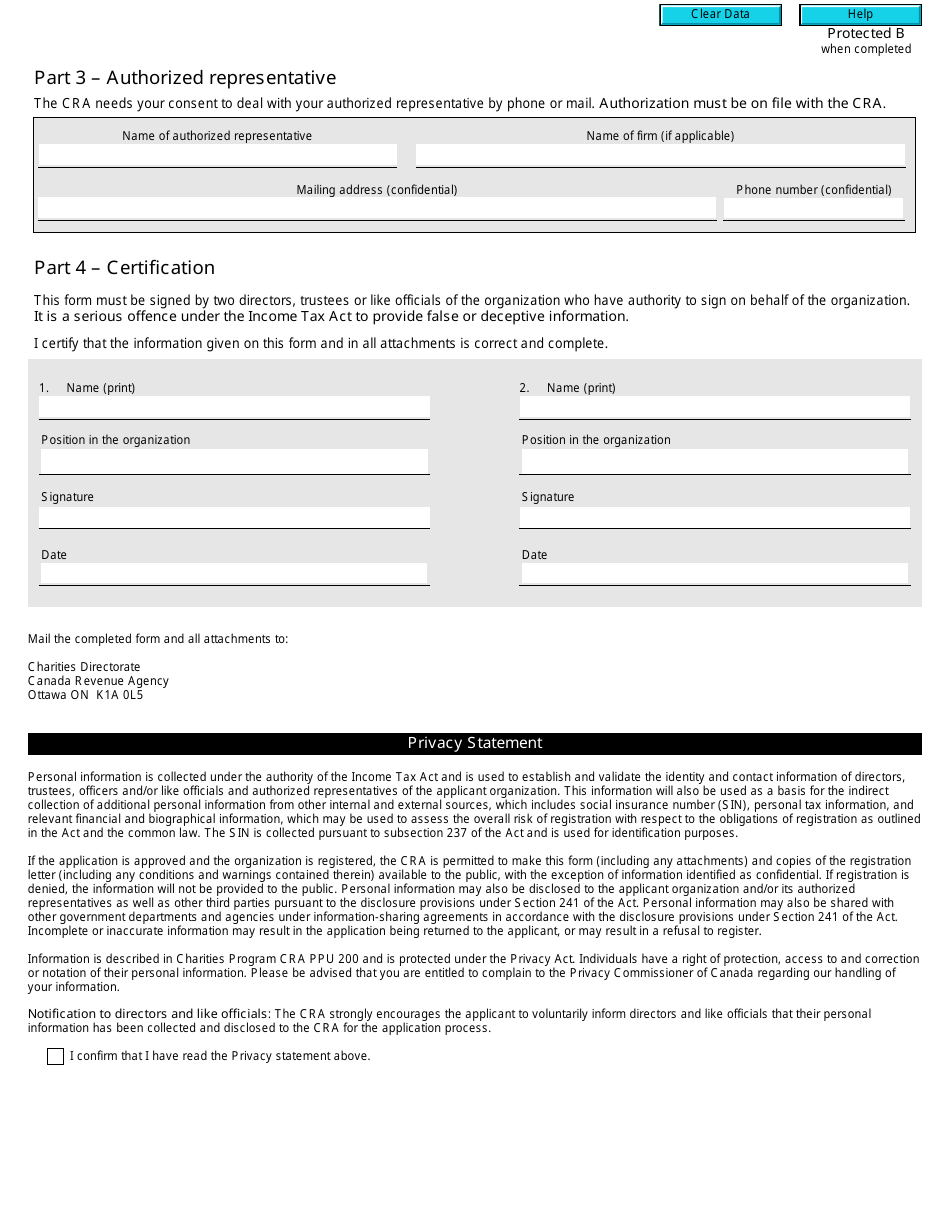

Form T1189 is used by Canadian amateur athletic associations to apply for registration under the Income Tax Act. This registration allows them to be eligible for certain tax benefits and exemptions.

The Canadian Amateur Athletic Association files the Form T1189 application under the Income Tax Act in Canada.

FAQ

Q: What is Form T1189?

A: Form T1189 is an application form used to register a Canadian Amateur Athletic Association under the Income Tax Act in Canada.

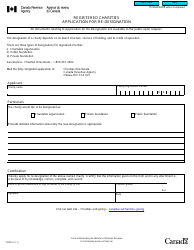

Q: What is a Canadian Amateur Athletic Association?

A: A Canadian Amateur Athletic Association is a non-profit organization that promotes amateur athletics in Canada.

Q: Why would an organization want to register as a Canadian Amateur Athletic Association?

A: By registering as a Canadian Amateur Athletic Association, the organization becomes eligible for certain tax benefits and exemptions.

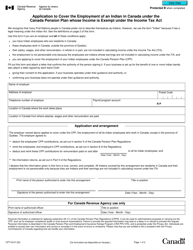

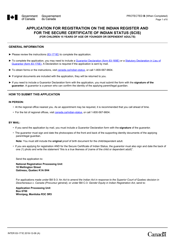

Q: Who is eligible to submit Form T1189?

A: Any organization that meets the requirements to be considered a Canadian Amateur Athletic Association can submit this form.

Q: What are the requirements to be considered a Canadian Amateur Athletic Association?

A: To be considered a Canadian Amateur Athletic Association, the organization must primarily promote amateur athletics, have Canadian residency, and meet certain other criteria outlined in the Income Tax Act.

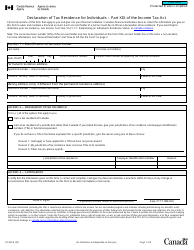

Q: What tax benefits and exemptions are available to registered Canadian Amateur Athletic Associations?

A: Registered Canadian Amateur Athletic Associations may be eligible for tax-exempt status, allowing them to receive donations and issue tax receipts to donors.

Q: How long does it take to process Form T1189?

A: The processing time for Form T1189 can vary. It is recommended to submit the form well in advance of any planned activities or events.

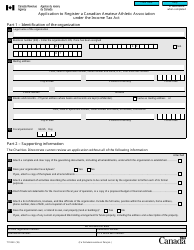

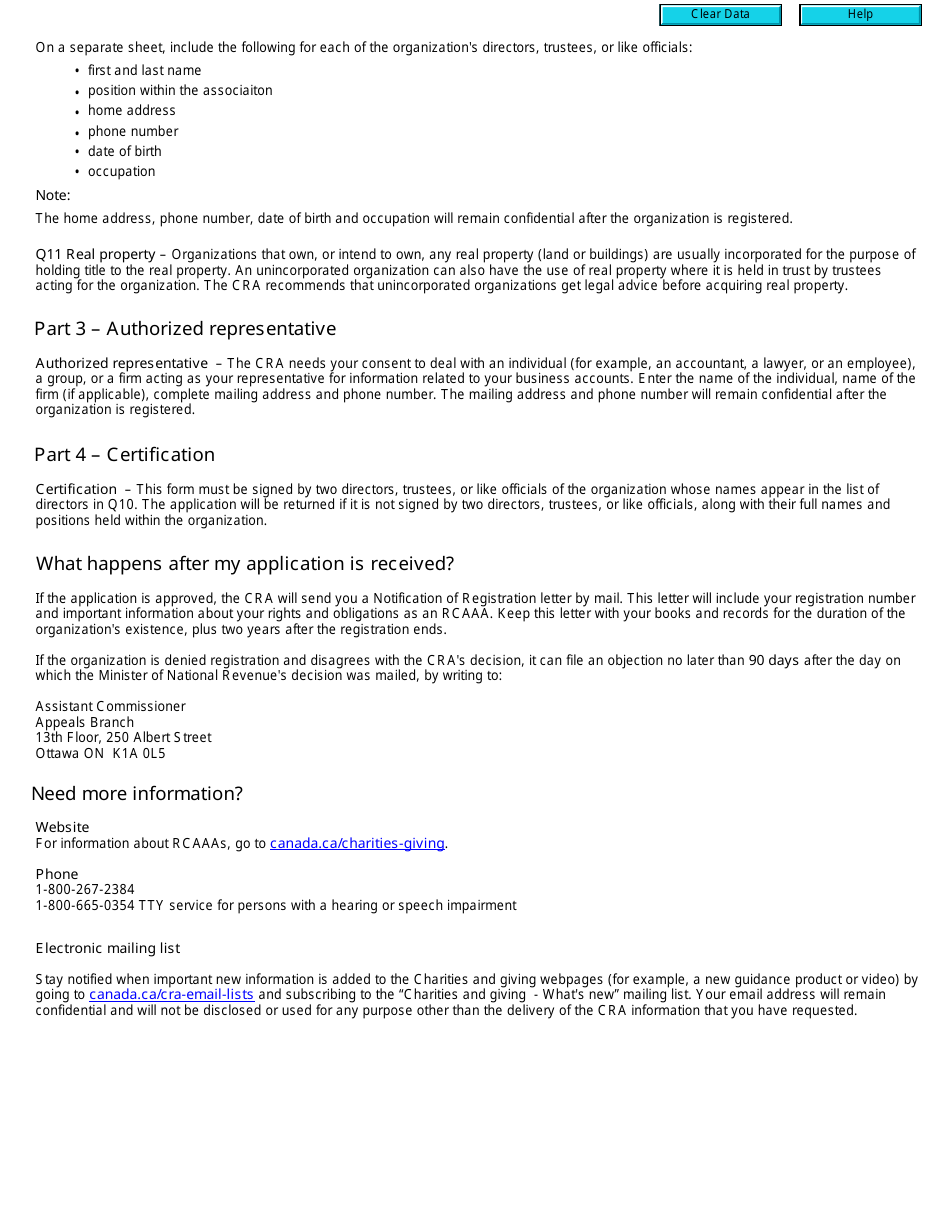

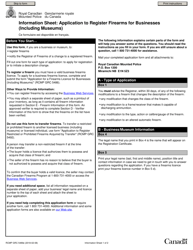

Q: Are there any specific guidelines or requirements for completing Form T1189?

A: Yes, there are specific guidelines and requirements outlined in the instructions accompanying the form. It is important to carefully review and follow these instructions when completing the form.