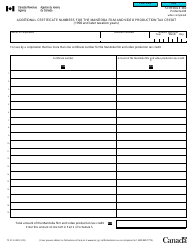

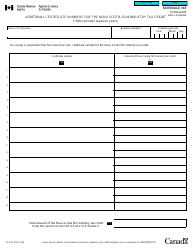

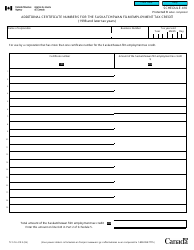

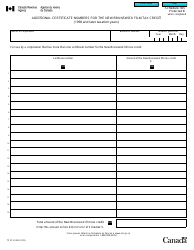

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1196

for the current year.

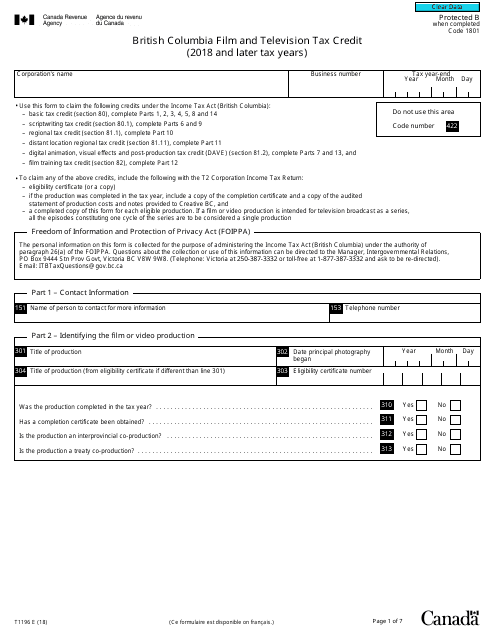

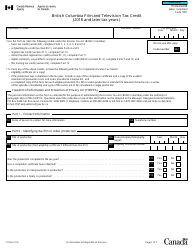

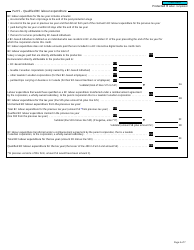

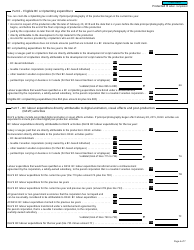

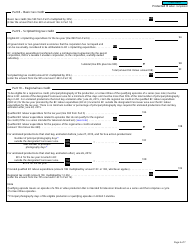

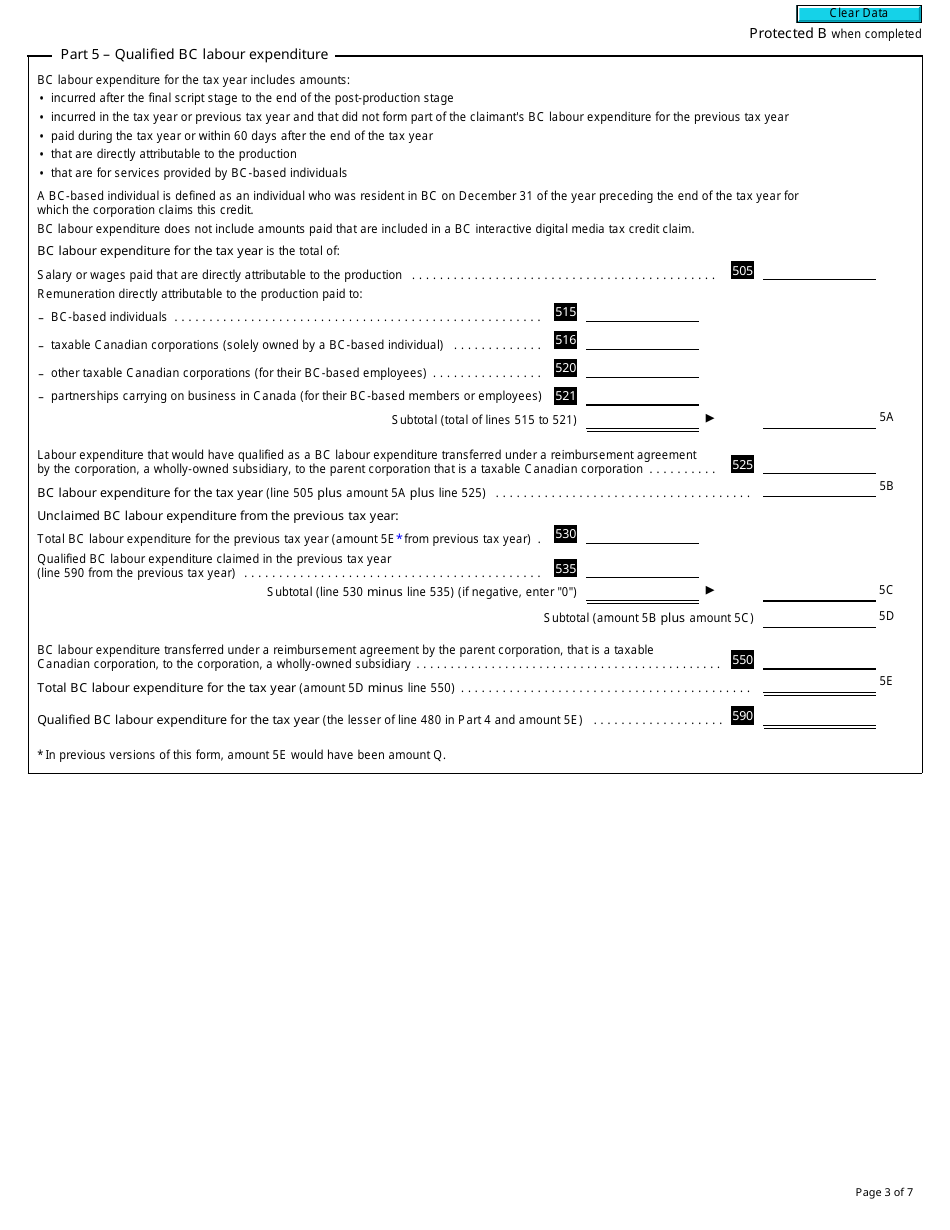

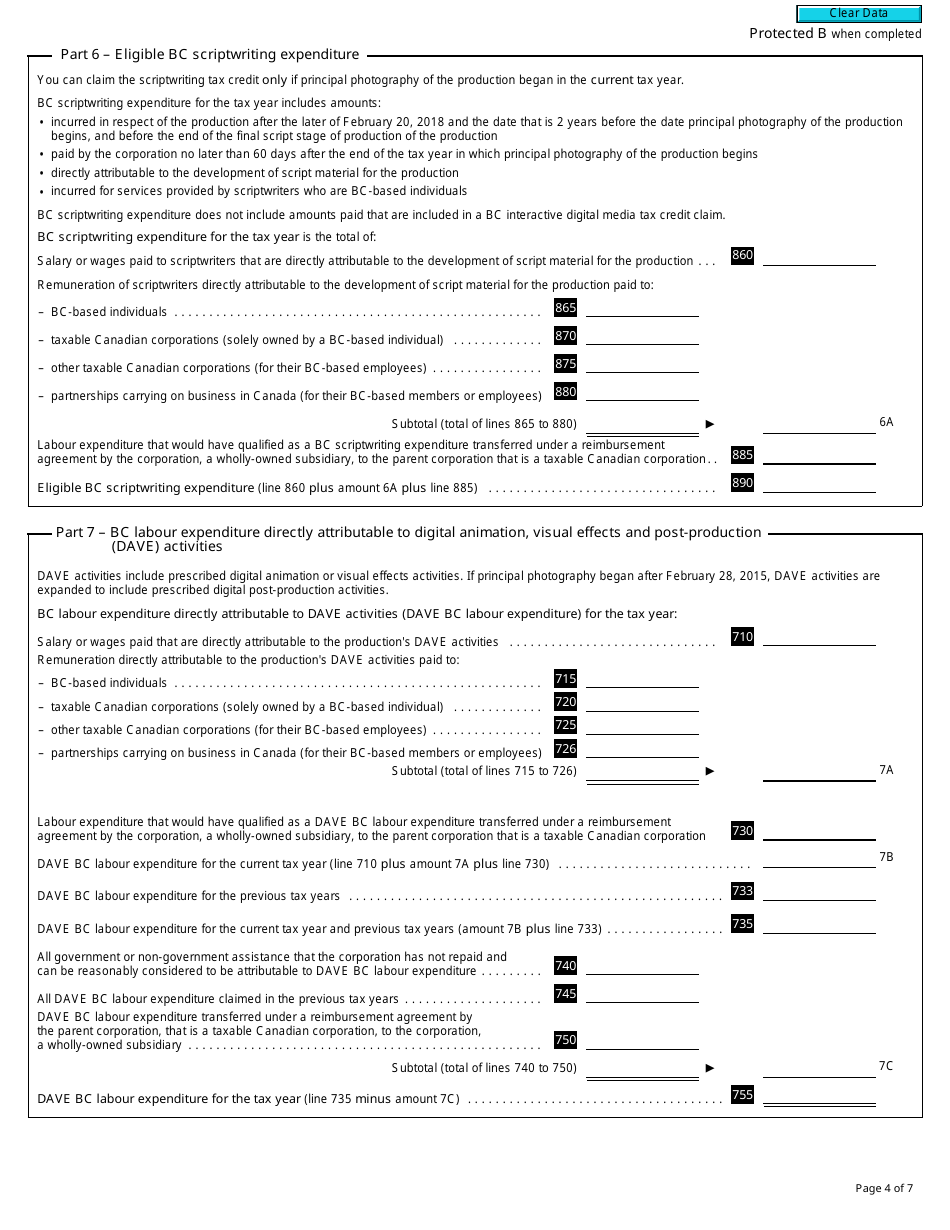

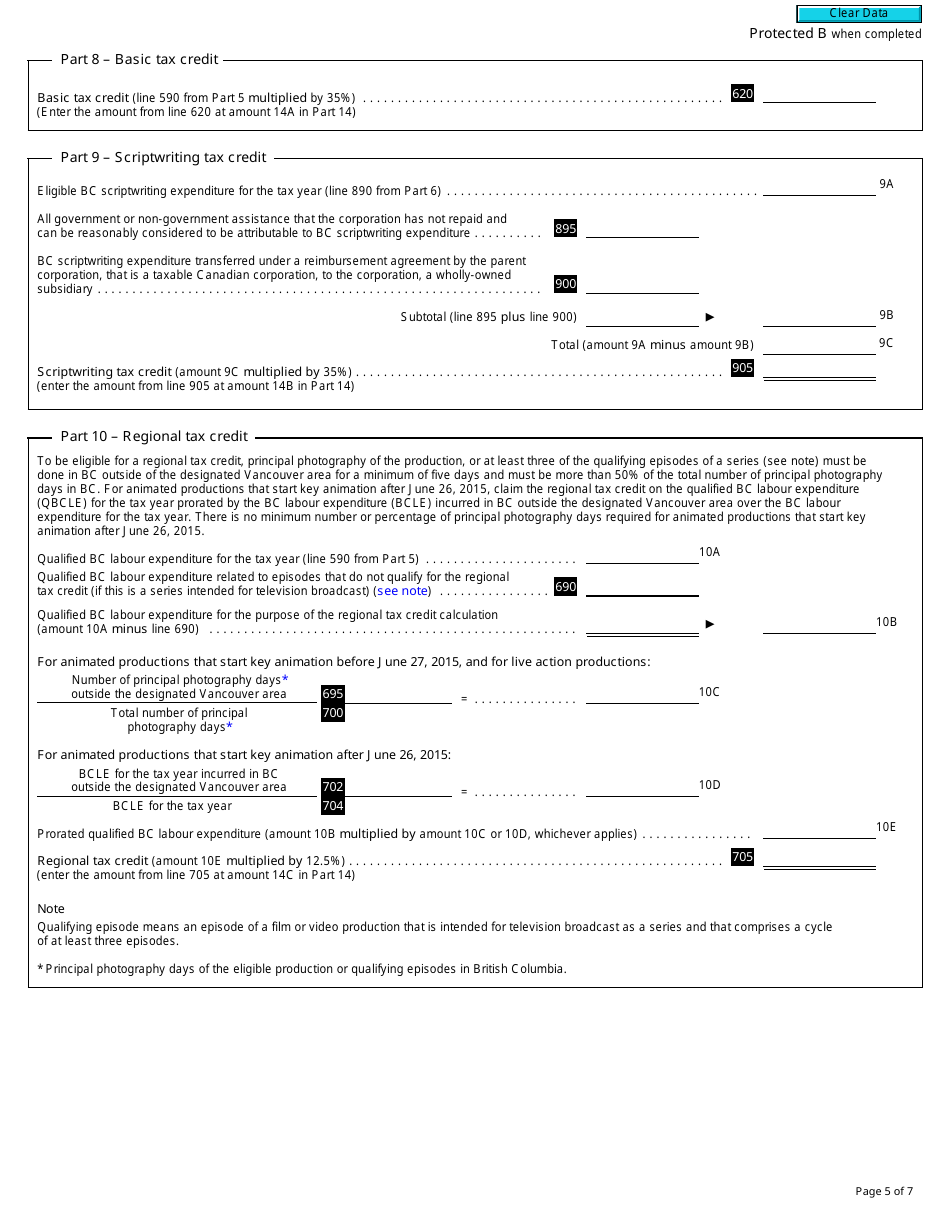

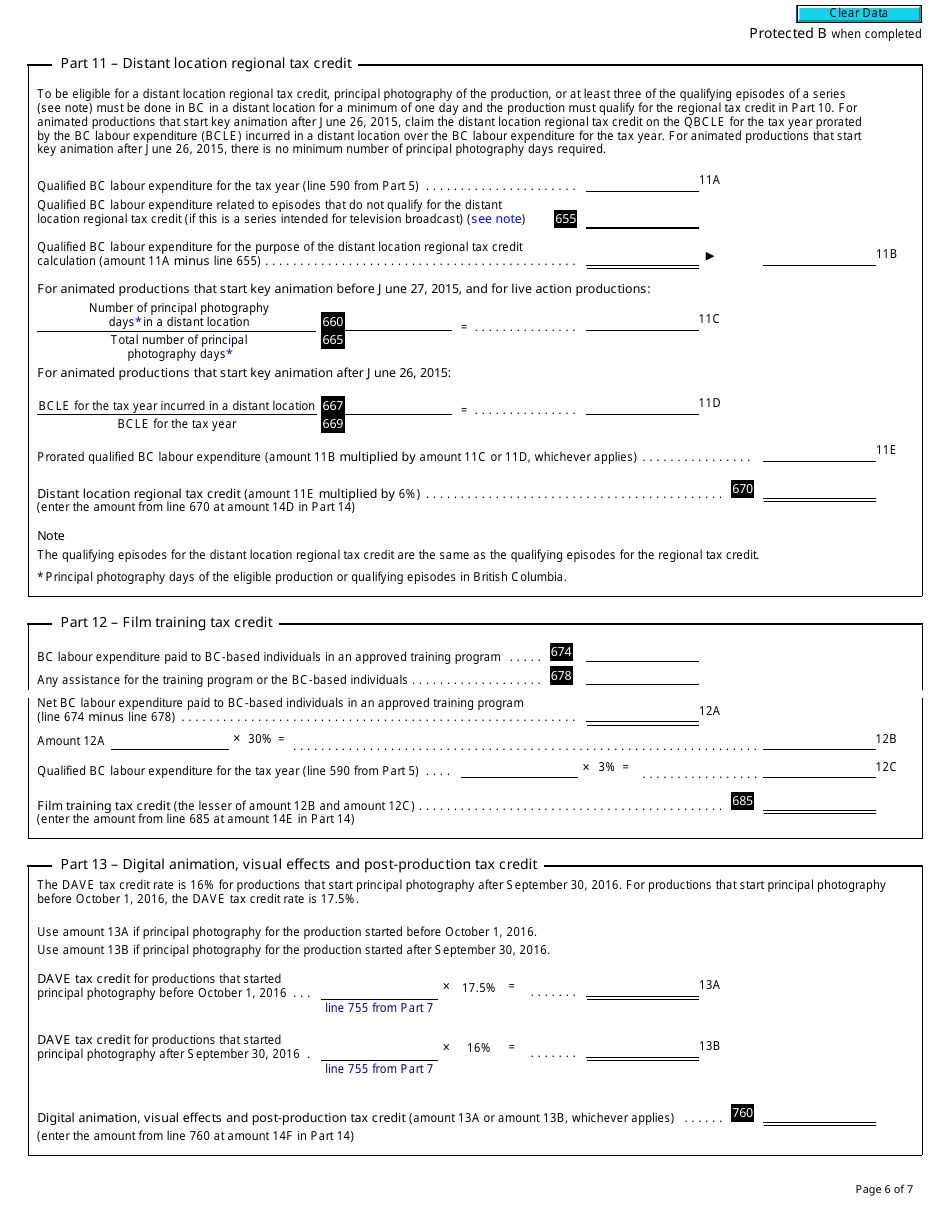

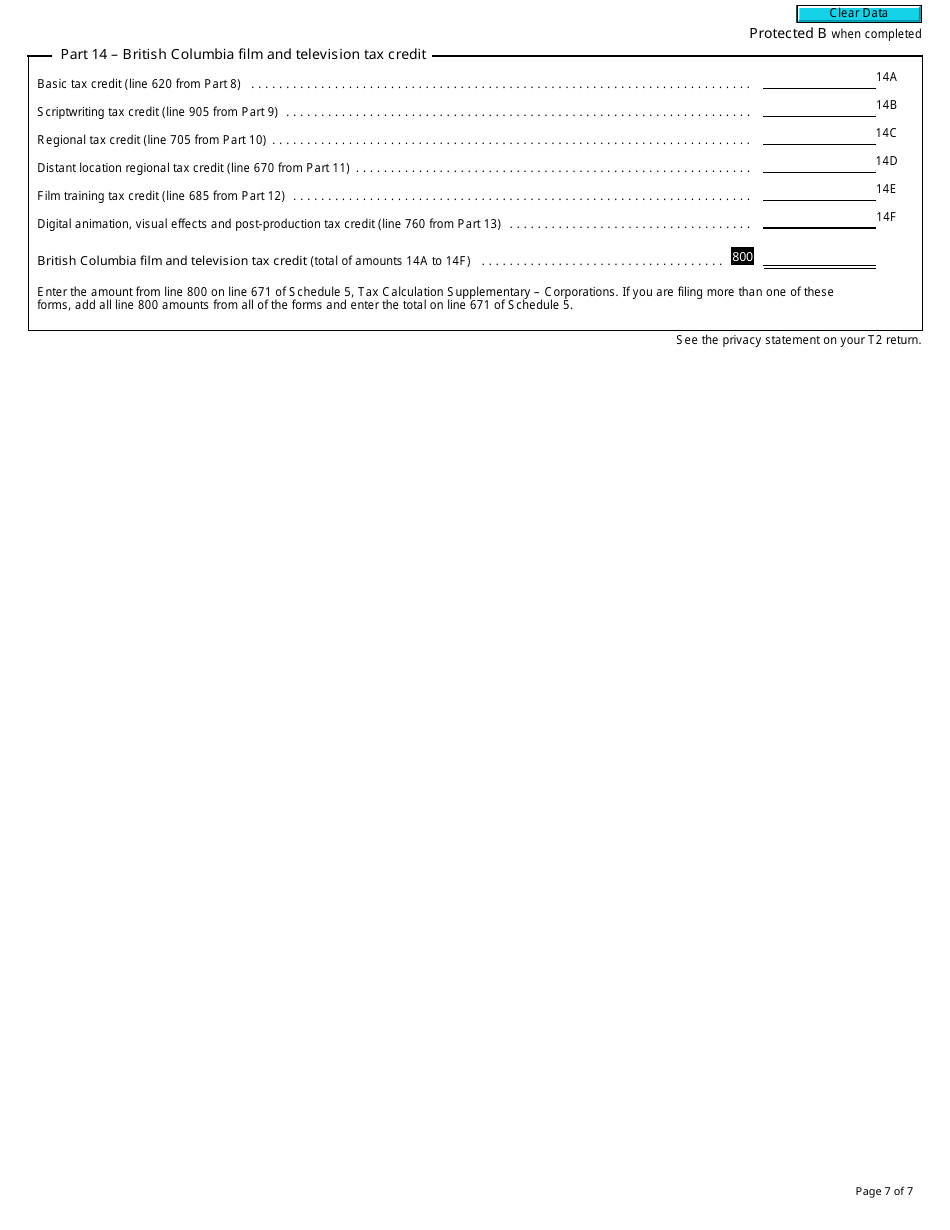

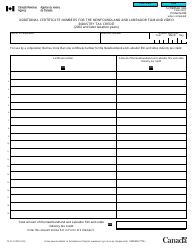

Form T1196 British Columbia Film and Television Tax Credit (2018 and Later Tax Years) - Canada

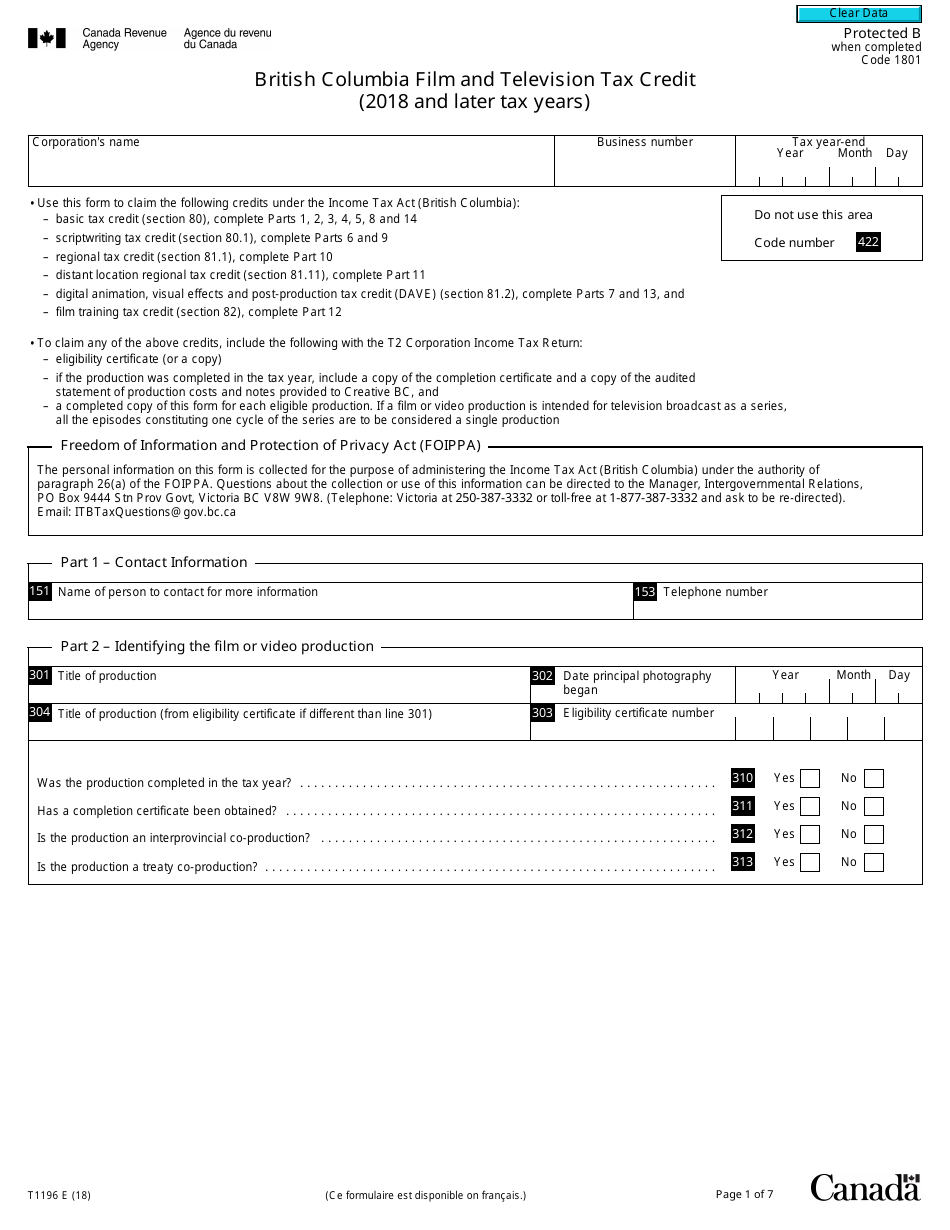

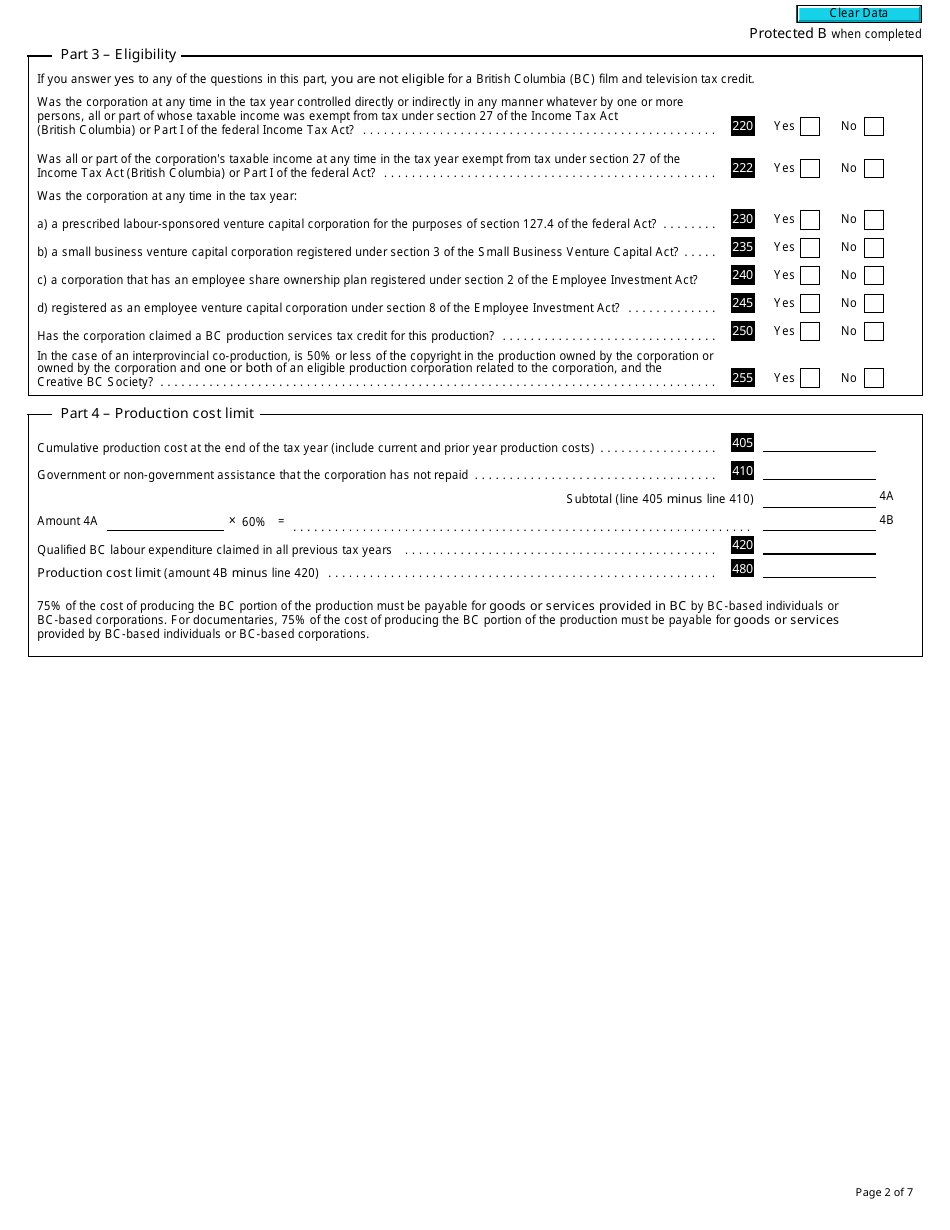

Form T1196 is used by individuals and corporations in the province of British Columbia, Canada to calculate and claim the Film and Television Tax Credit. It is designed to provide a tax credit for certain expenditures incurred in the production of eligible film and television projects in British Columbia for tax years starting in 2018 and onwards. This credit encourages and supports the film and television industry in the province.

The Form T1196 for the British Columbia Film and Television Tax Credit in Canada is filed by the production company or the person responsible for claiming the tax credit.

FAQ

Q: What is Form T1196?

A: Form T1196 is a tax form used in Canada for claiming the British Columbia Film and Television Tax Credit.

Q: What is the purpose of the British Columbia Film and Television Tax Credit?

A: The purpose of this tax credit is to support and encourage film and television production in British Columbia.

Q: Who is eligible to claim the British Columbia Film and Television Tax Credit?

A: Producers or production companies that meet the eligibility requirements set by the British Columbia government.

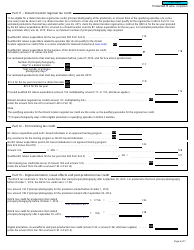

Q: What are the eligibility requirements for claiming the tax credit?

A: The eligibility requirements include having a qualifying project, incurring eligible expenditures, and meeting other criteria specified by the British Columbia government.

Q: How do I claim the British Columbia Film and Television Tax Credit?

A: You need to complete and file Form T1196 along with your Canadian tax return.

Q: When can I claim the tax credit?

A: You can claim the British Columbia Film and Television Tax Credit for eligible expenditures incurred in the 2018 tax year and later.

Q: What is the benefit of claiming the tax credit?

A: The tax credit can reduce your overall tax liability and potentially provide a refund.