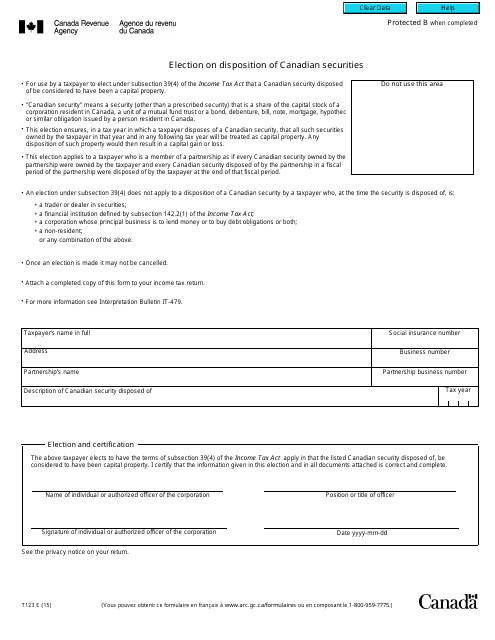

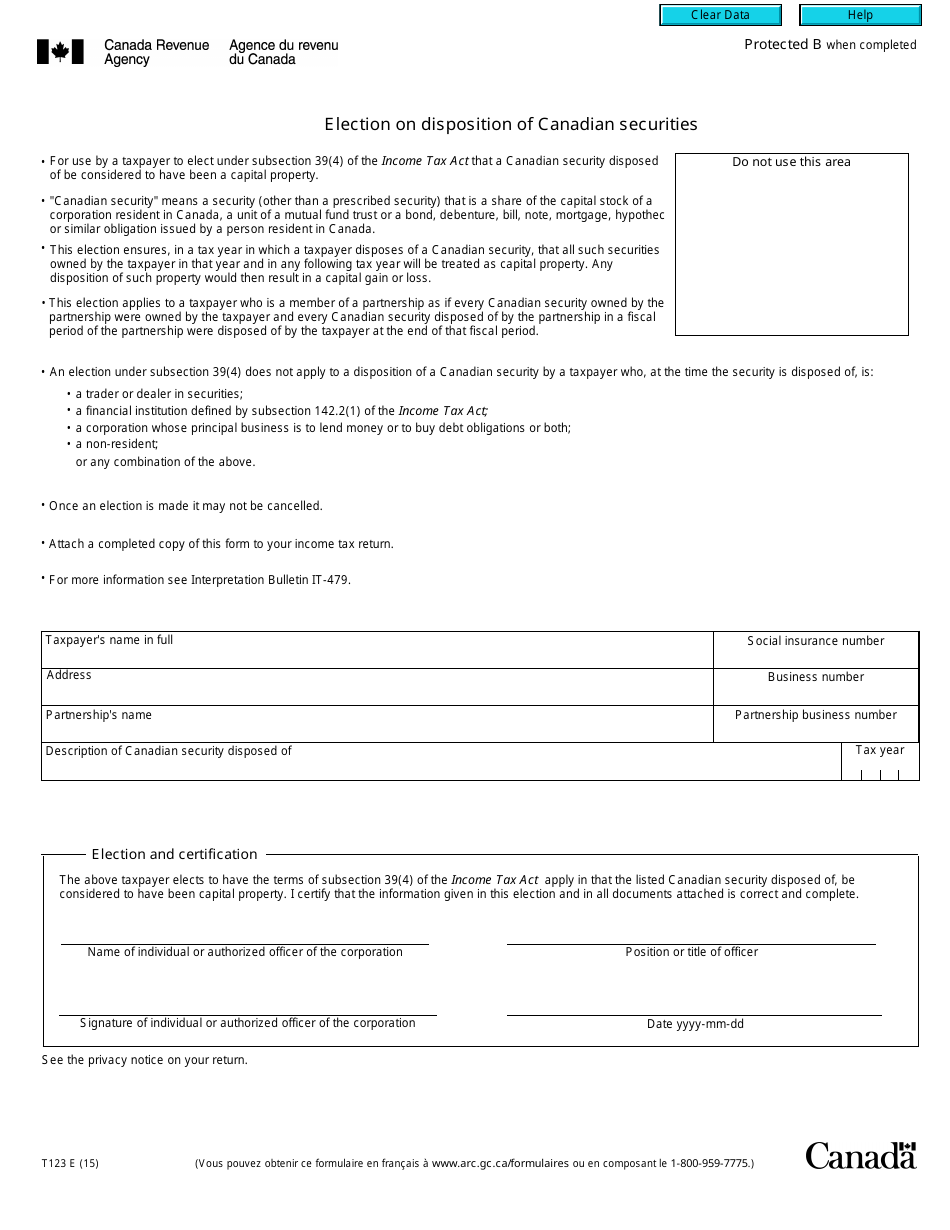

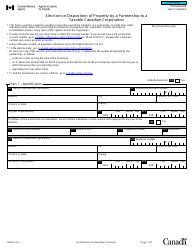

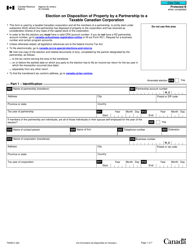

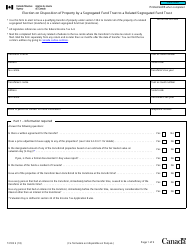

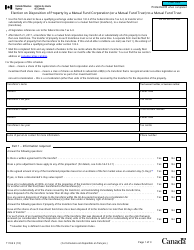

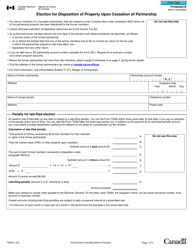

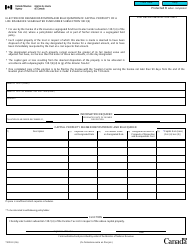

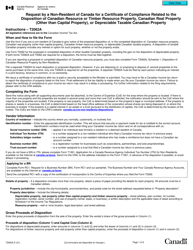

Form T123 Election on Disposition of Canadian Securities - Canada

Form T123 Election on Disposition of Canadian Securities - Canada is used to report and claim the disposition of Canadian securities by non-residents of Canada. It allows non-residents to elect to treat the disposition as either a capital gain or a business income, depending on their circumstances.

The Form T123 Election on Disposition of Canadian Securities in Canada is filed by the taxpayer who holds the Canadian securities and wishes to make a specific tax election related to the disposition of those securities.

FAQ

Q: What is Form T123?

A: Form T123 is a tax form used in Canada to report the election on the disposition of Canadian securities.

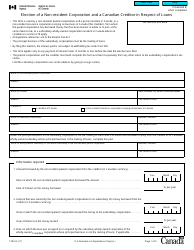

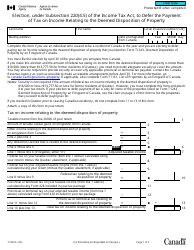

Q: What is meant by "election on the disposition of Canadian securities"?

A: The election on the disposition of Canadian securities refers to the option that Canadian residents have to choose how they want to be taxed when they sell or dispose of certain Canadian securities.

Q: Who needs to file Form T123?

A: Canadian residents who have sold or disposed of certain Canadian securities and wish to make the election on the disposition of those securities need to file Form T123.

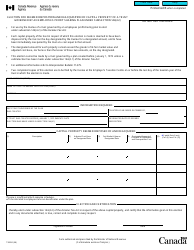

Q: What information is required to complete Form T123?

A: To complete Form T123, you will need to provide details about the Canadian securities you have sold or disposed of, as well as information about the election you are making.

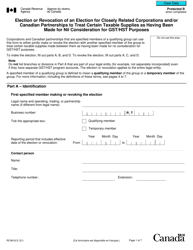

Q: When is the deadline to file Form T123?

A: The deadline to file Form T123 is generally the same as the deadline to file your Canadian income tax return, which is April 30th.

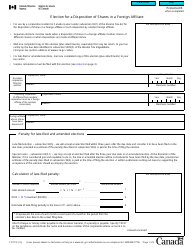

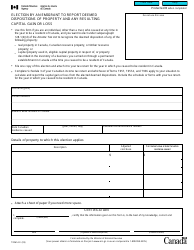

Q: Are there any penalties for not filing Form T123?

A: Yes, if you are required to file Form T123 and fail to do so, you may be subject to penalties and interest charges imposed by the CRA.

Q: Can I electronically file Form T123?

A: At the moment, electronic filing of Form T123 is not available. You must file a paper copy with the CRA.

Q: Can I make changes to Form T123 after filing it?

A: If you need to make changes or corrections to Form T123 after filing it, you will need to file an amended return using Form T1-ADJ.