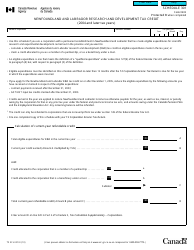

This version of the form is not currently in use and is provided for reference only. Download this version of

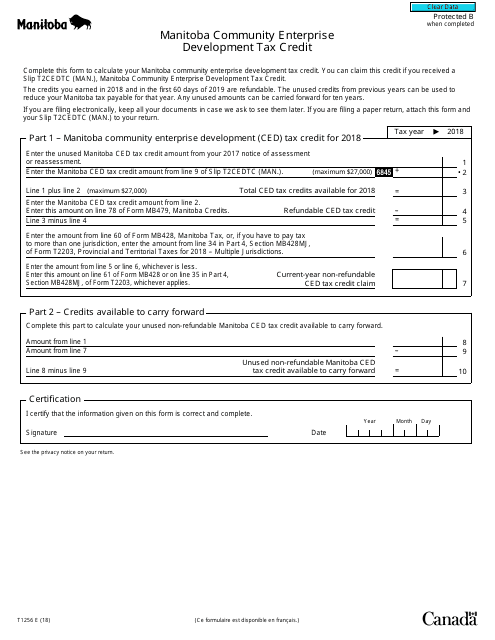

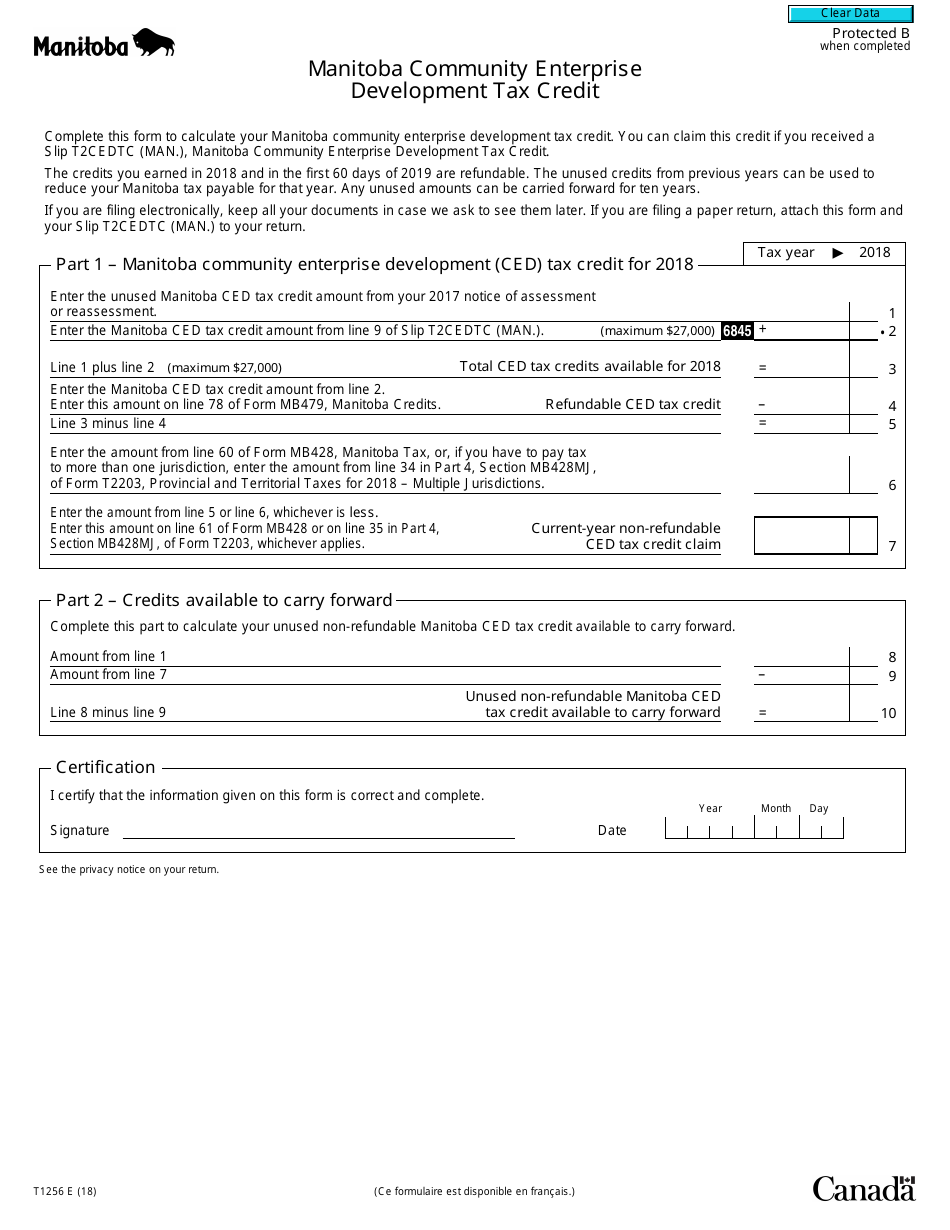

Form T1256

for the current year.

Form T1256 Manitoba Community Enterprise Development Tax Credit - Canada

Form T1256 is a Canadian Revenue Agency form also known as the "Form T1256 "manitoba Community Enterprise Development Tax Credit" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form T1256 down below or find it on Canadian Revenue Agency Forms website.

FAQ

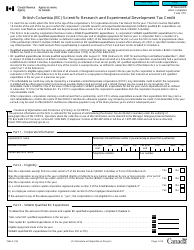

Q: What is Form T1256?

A: Form T1256 is a tax form used in Canada for claiming the Manitoba Community Enterprise Development Tax Credit.

Q: What is the Manitoba Community Enterprise Development Tax Credit?

A: The Manitoba Community Enterprise Development Tax Credit is a tax credit available to individuals and corporations who invest in certain community enterprises in Manitoba.

Q: Who can claim the tax credit?

A: Both individuals and corporations can claim the Manitoba Community Enterprise Development Tax Credit.

Q: What is a community enterprise?

A: A community enterprise is a business or organization that operates for the benefit of a community in Manitoba.

Q: How much tax credit can be claimed?

A: The tax credit is equal to 30% of the eligible amount invested in a community enterprise.

Q: Is there a maximum amount that can be claimed?

A: Yes, there is a maximum annual limit on the amount of tax credit that can be claimed.