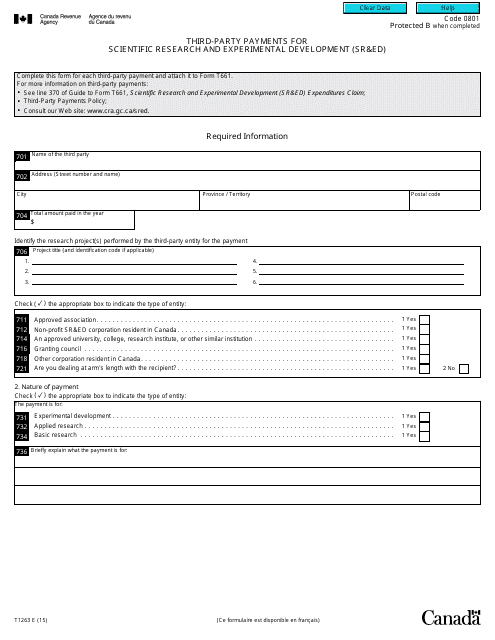

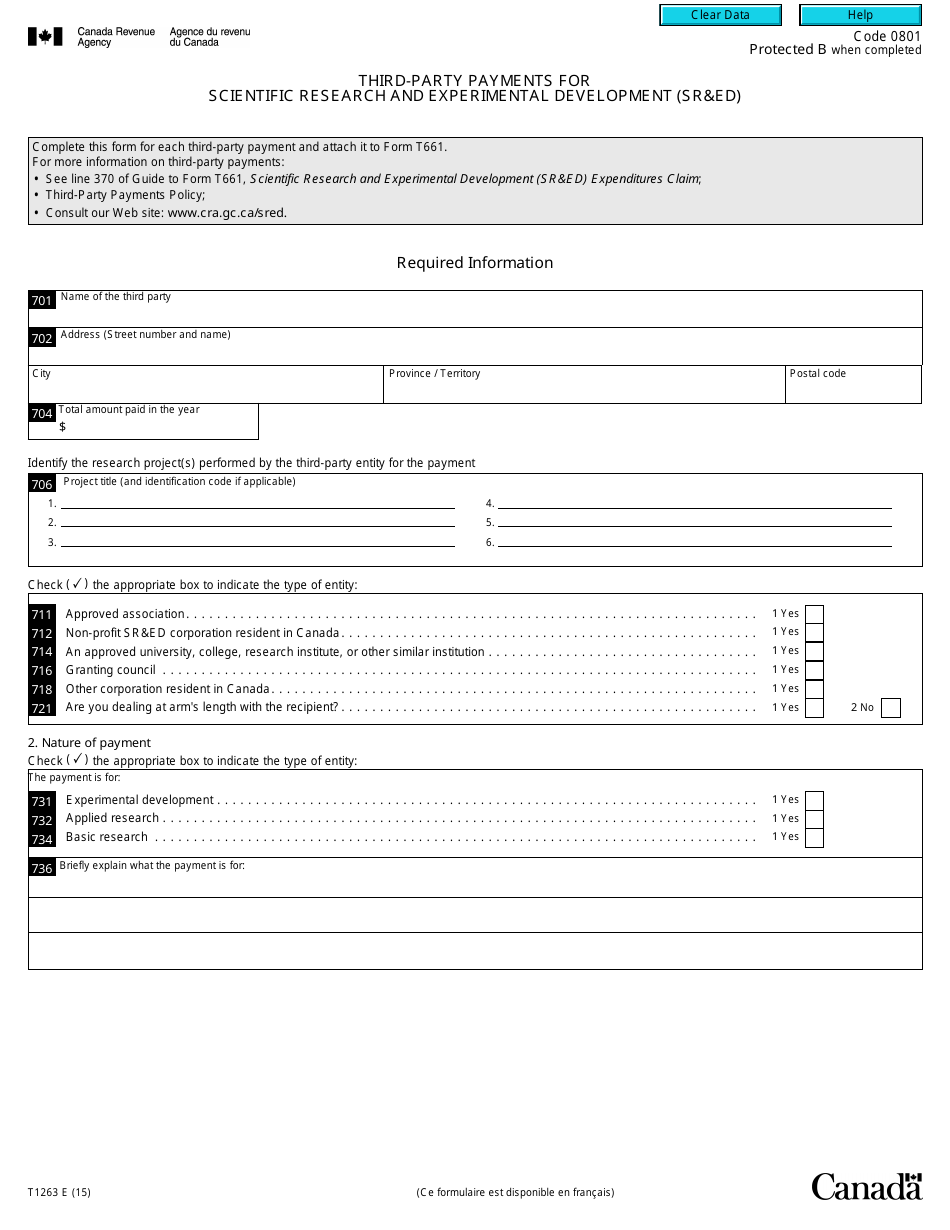

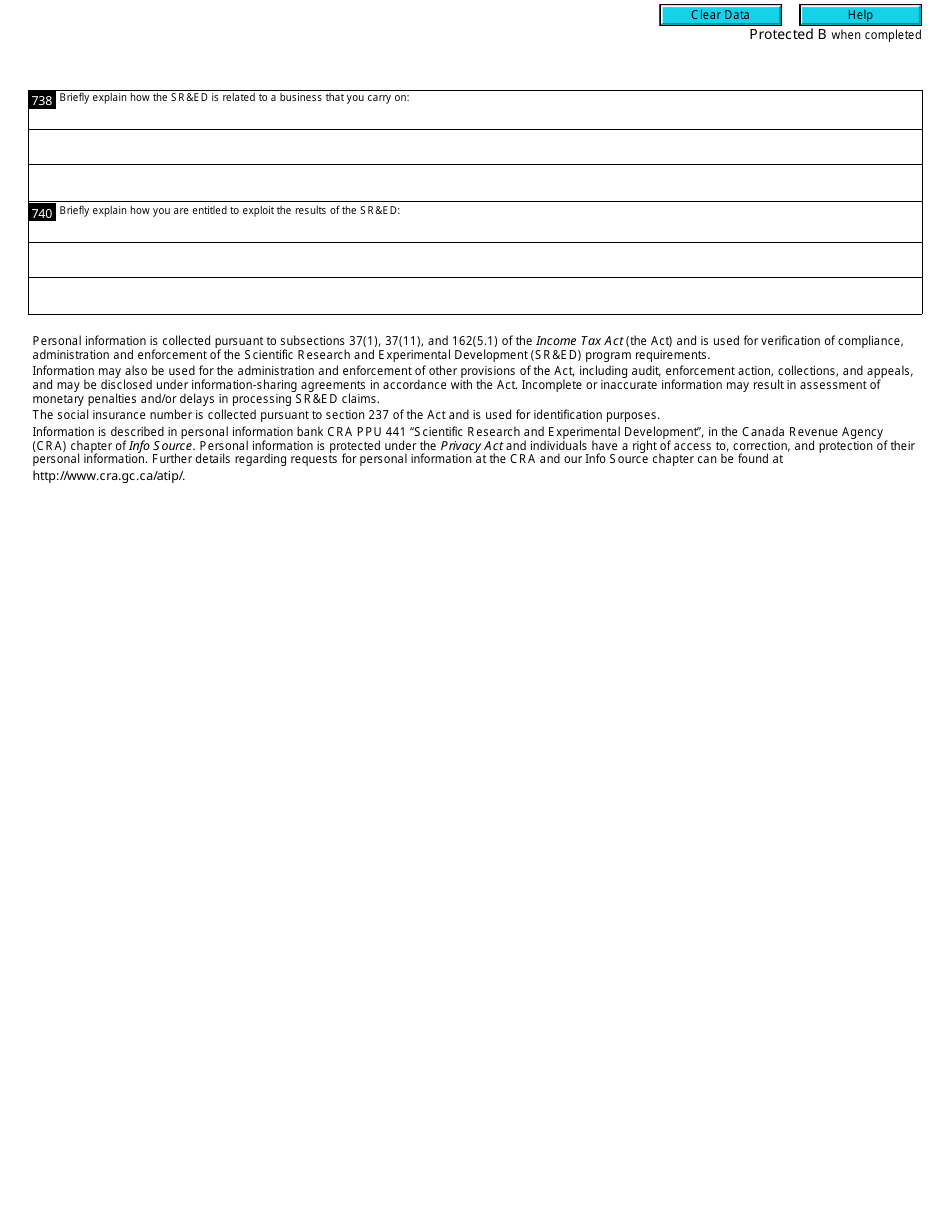

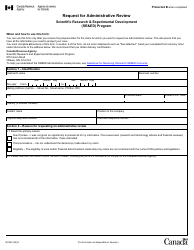

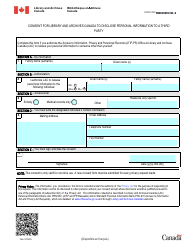

Form T1263 Third-Party Payments for Scientific Research and Experimental Development (Sr&ed) - Canada

Form T1263 is a Canadian Revenue Agency form also known as the "Form T1263 "third-party Payments For Experimental Development (sr&ed)" - Canada" . The latest edition of the form was released in January 1, 2015 and is available for digital filing.

Download an up-to-date Form T1263 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T1263?

A: Form T1263 is a tax form used in Canada for reporting third-party payments for scientific research and experimental development (SR&ED).

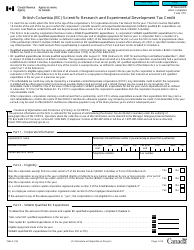

Q: What is SR&ED?

A: SR&ED stands for Scientific Research and Experimental Development. It is a program in Canada that provides tax incentives to businesses conducting research and development activities.

Q: Who needs to file Form T1263?

A: Anyone who makes third-party payments for SR&ED in Canada needs to file Form T1263.

Q: What information is required to fill out Form T1263?

A: The form requires information about the payer, the payee, the amount of the payment, and the nature of the SR&ED work.

Q: When is Form T1263 due?

A: Form T1263 is generally due within six months of the end of the calendar year in which the payment was made.

Q: Are there any penalties for not filing Form T1263?

A: Yes, there can be penalties for not filing Form T1263 or for filing it late. It is important to ensure timely and accurate filing.

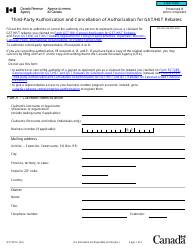

Q: Can I file Form T1263 electronically?

A: As of now, Form T1263 cannot be filed electronically and must be submitted by mail or in person.

Q: Can I claim tax credits for third-party payments for SR&ED?

A: No, the tax credits are generally claimed by the recipient of the payment, not the payer.

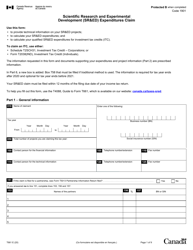

Q: Are there any other reporting requirements for SR&ED in Canada?

A: Yes, there are additional reporting requirements for businesses claiming SR&ED tax incentives, including filing the T661 form and supporting documents.