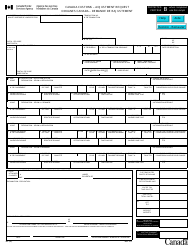

This version of the form is not currently in use and is provided for reference only. Download this version of

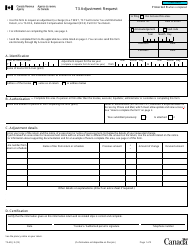

Form T1-ADJ

for the current year.

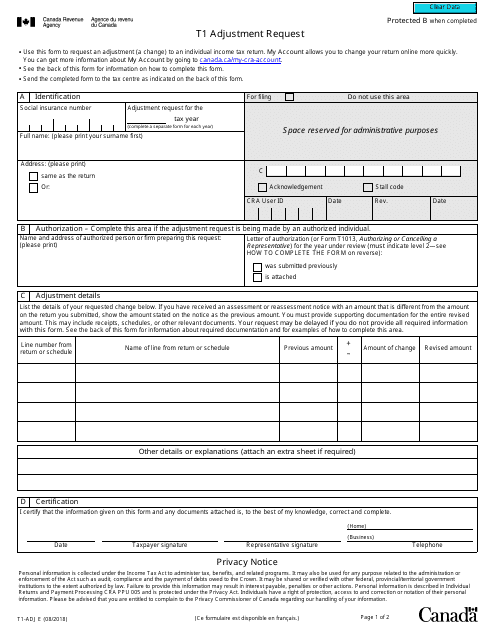

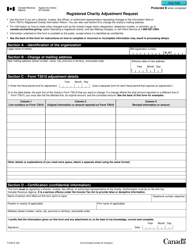

Form T1-ADJ T1 Adjustment Request - Canada

Form T1-ADJ is a Canadian Revenue Agency form also known as the "Form T1-adj "t1 Adjustment Request" - Canada" . The latest edition of the form was released in August 1, 2018 and is available for digital filing.

Download a PDF version of the Form T1-ADJ down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T1-ADJ?

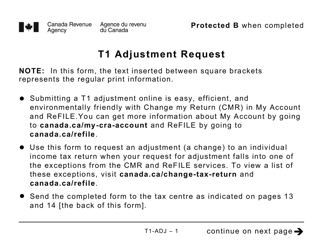

A: Form T1-ADJ is a form used in Canada to request adjustments to the personal income tax return.

Q: Who can use Form T1-ADJ?

A: Any taxpayer who needs to make changes or corrections to their previously filed T1 personal income tax return can use Form T1-ADJ.

Q: What types of adjustments can be requested using Form T1-ADJ?

A: Form T1-ADJ can be used to report changes in income, deductions, credits, or any other information that needs to be updated on the original tax return.

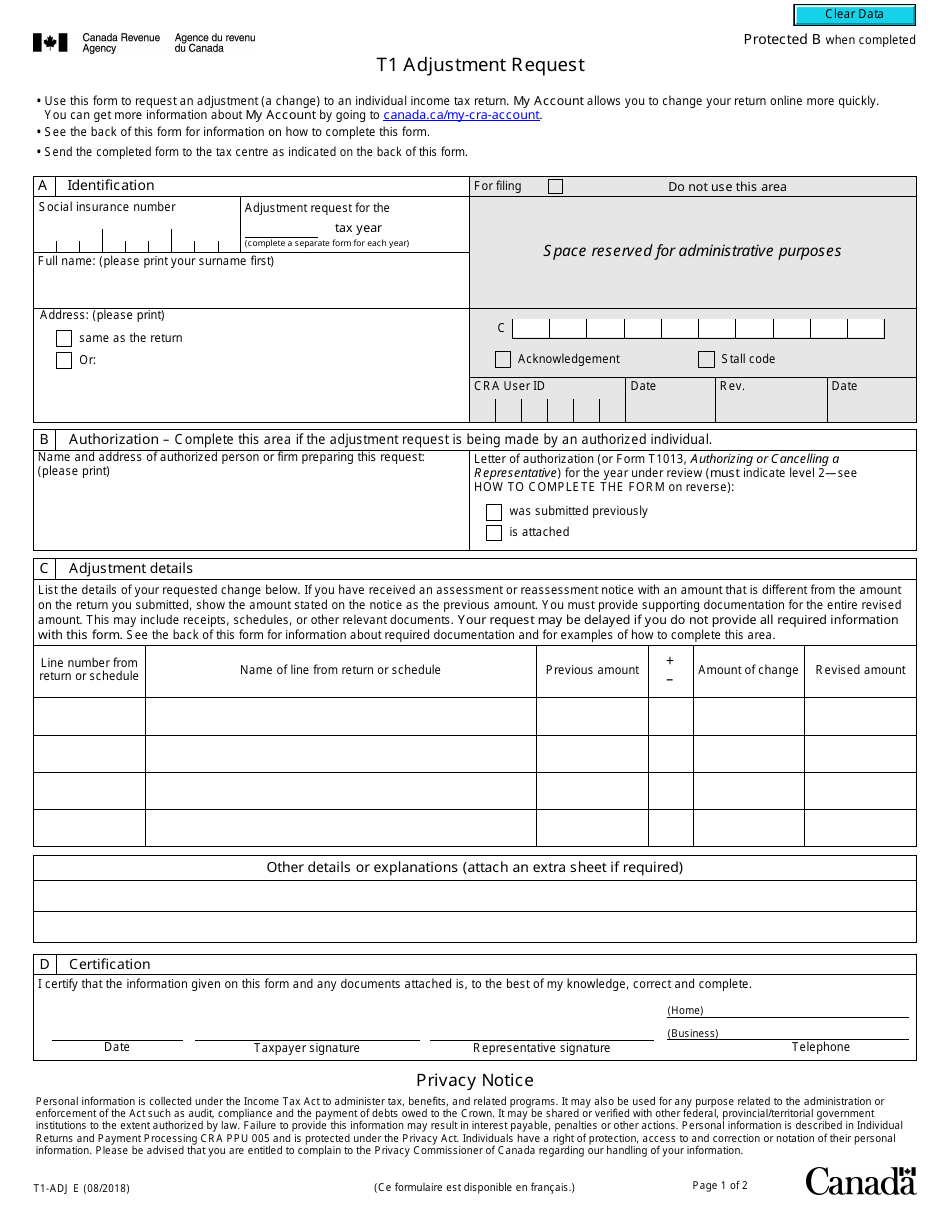

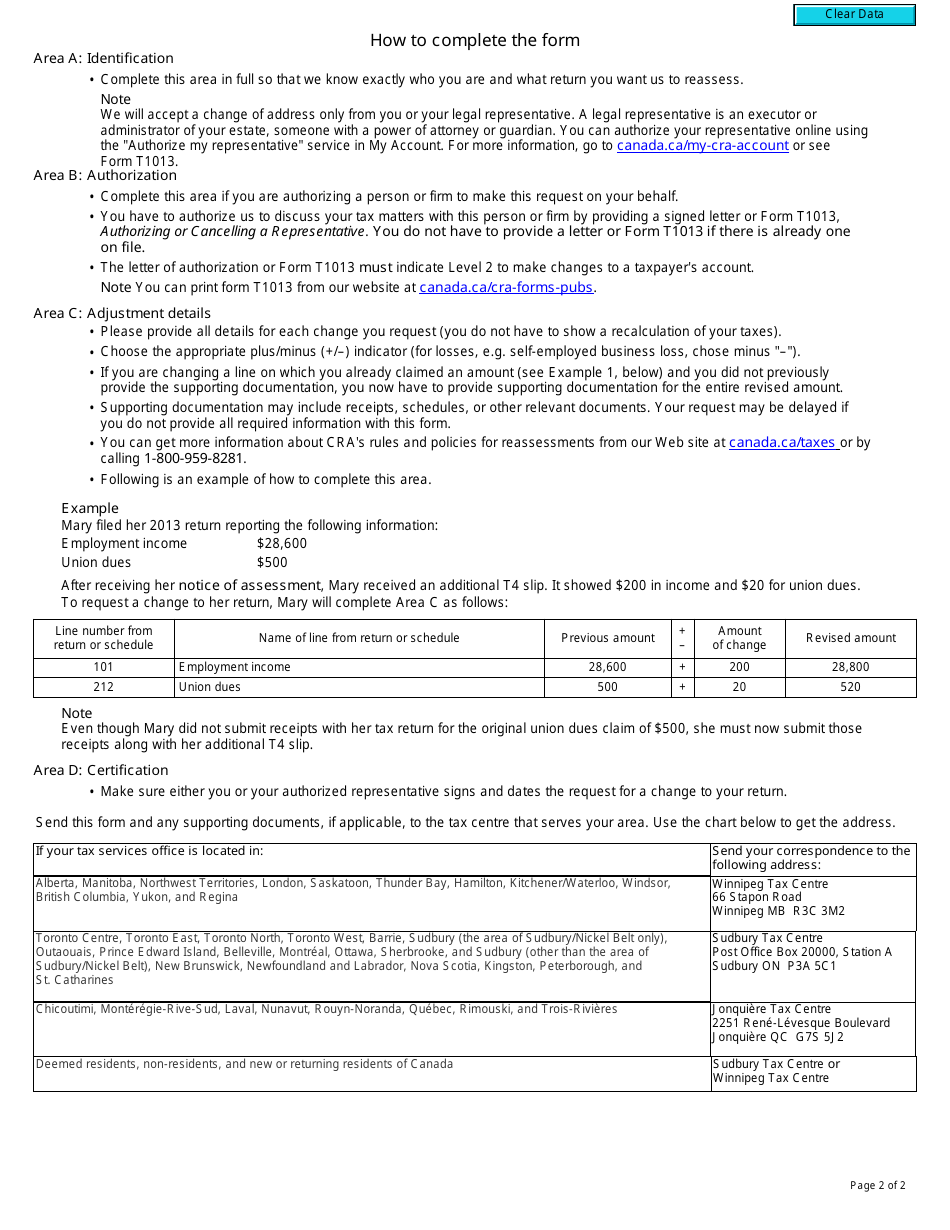

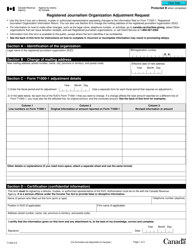

Q: How do I fill out Form T1-ADJ?

A: You need to provide your personal information, details of the original tax return, explanations for the requested adjustments, and supporting documents if necessary.

Q: What should I do after completing Form T1-ADJ?

A: You need to mail the completed form to the CRA along with any required supporting documents.

Q: How long does it take to process a T1-ADJ request?

A: The processing time can vary, but it usually takes around 8 weeks for the CRA to process a T1-ADJ request.

Q: Will there be any penalties for filing a T1-ADJ request?

A: There are no penalties for filing a T1-ADJ request, as long as the request is genuine and supported by appropriate documentation.

Q: Can I file a T1-ADJ request for previous tax years?

A: Yes, you can file a T1-ADJ request for any tax year within the last 10 years.