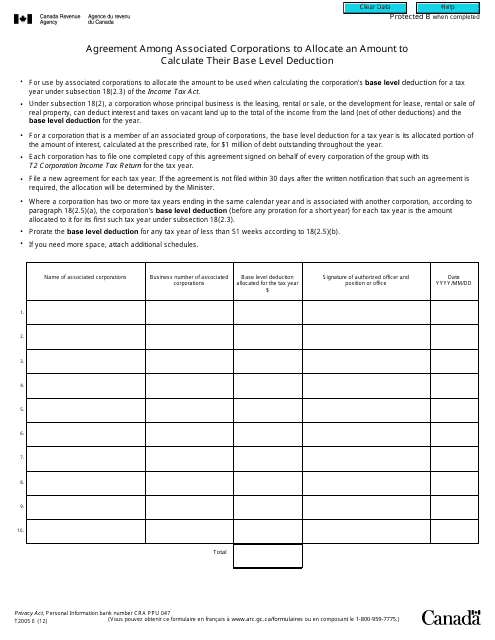

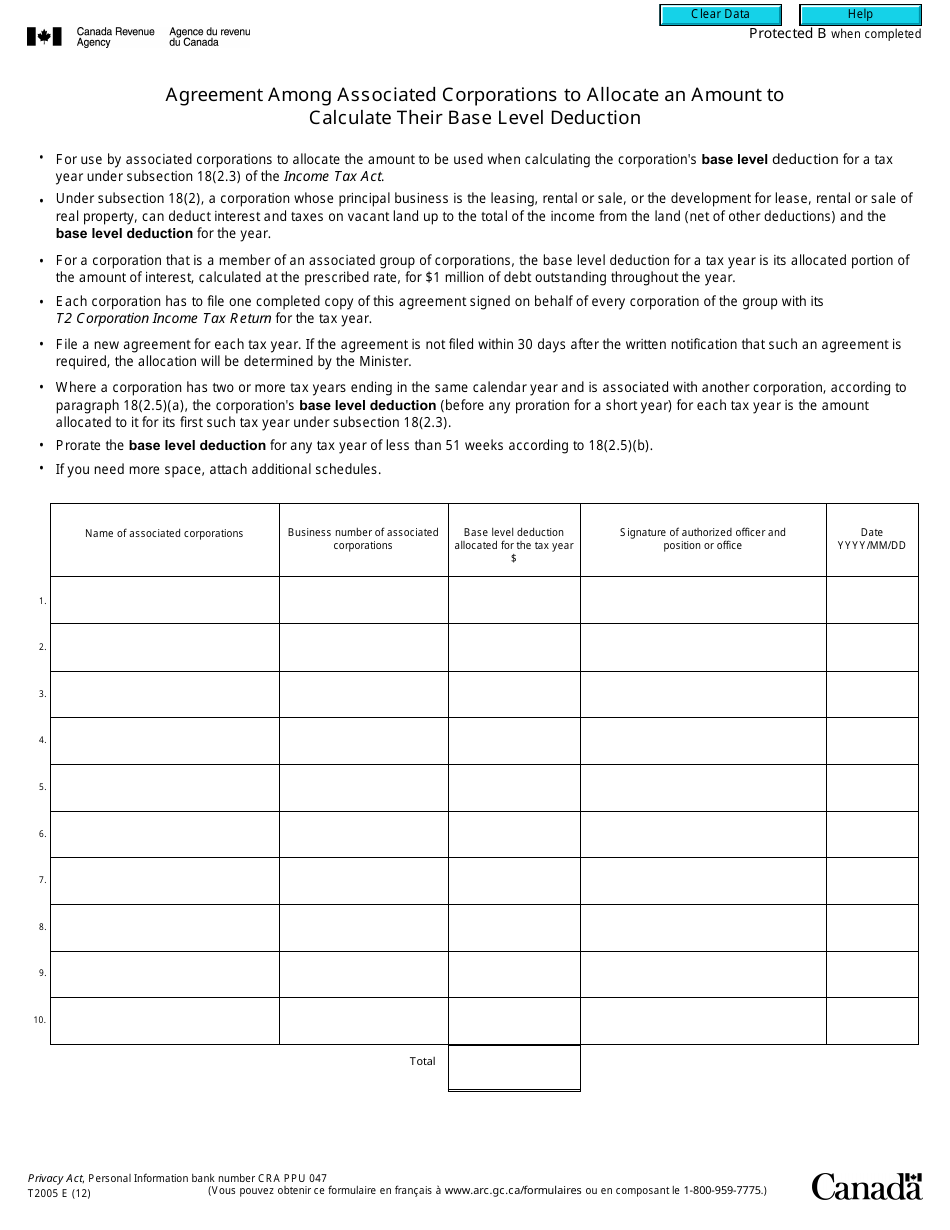

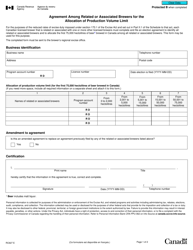

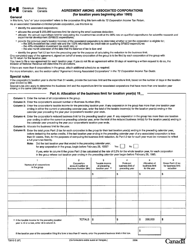

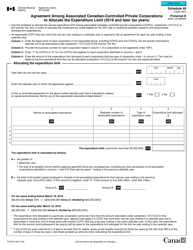

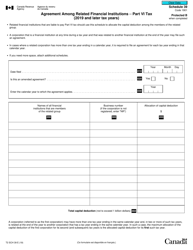

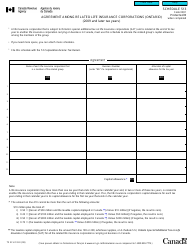

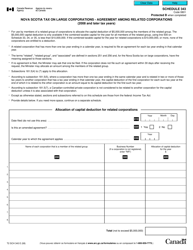

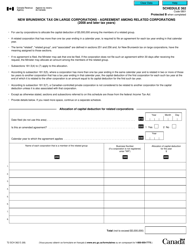

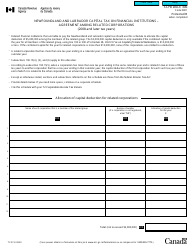

Form T2005 Agreement Among Associated Corporations to Allocate an Amount to Calculate Their Base Level Deduction - Canada

Form T2005 or the "Form T2005 "agreement Among Associated Corporations To Allocate An Amount To Calculate Their Base Level Deduction" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2012 and is available for digital filing. Download an up-to-date Form T2005 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2005?

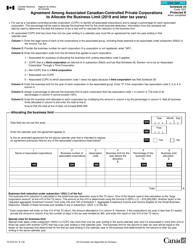

A: Form T2005 is an agreement among associated corporations in Canada to allocate an amount to calculate their base level deduction.

Q: What is the purpose of Form T2005?

A: The purpose of Form T2005 is to allow associated corporations in Canada to allocate an amount to calculate their base level deduction for tax purposes.

Q: Who needs to fill out Form T2005?

A: Associated corporations in Canada who want to allocate an amount to calculate their base level deduction need to fill out Form T2005.

Q: What is the base level deduction?

A: The base level deduction is a deduction that can be claimed by associated corporations in Canada.

Q: Why would associated corporations want to allocate an amount to calculate their base level deduction?

A: Allocating an amount to calculate their base level deduction can help associated corporations reduce their taxable income and therefore minimize their tax liability.

Q: Are there any specific requirements or conditions for using Form T2005?

A: Yes, there are specific requirements and conditions for using Form T2005. Please consult the Canada Revenue Agency or a tax professional for more information.

Q: Is Form T2005 only applicable in Canada?

A: Yes, Form T2005 is specifically designed for use by associated corporations in Canada.

Q: Are there any deadlines for submitting Form T2005?

A: The deadline for submitting Form T2005 may vary. It is important to check with the Canada Revenue Agency or a tax professional for the specific deadline.

Q: What happens if Form T2005 is not submitted or if it is submitted late?

A: Failure to submit Form T2005 or late submission may result in penalties or interest charges. It is crucial to adhere to the deadlines set by the Canada Revenue Agency.