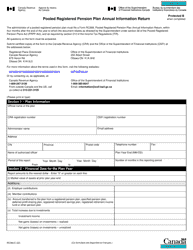

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2011

for the current year.

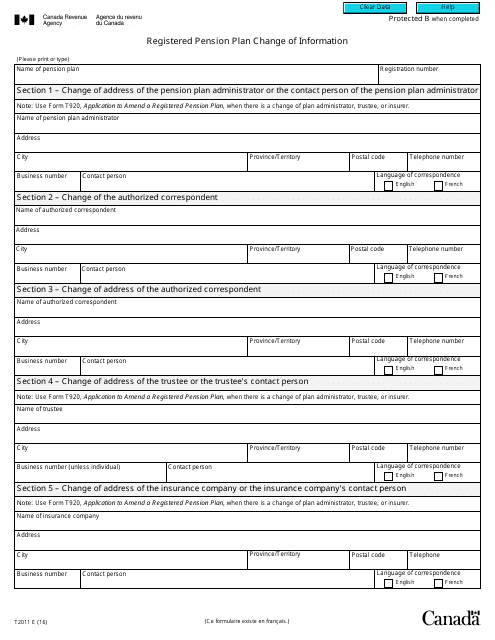

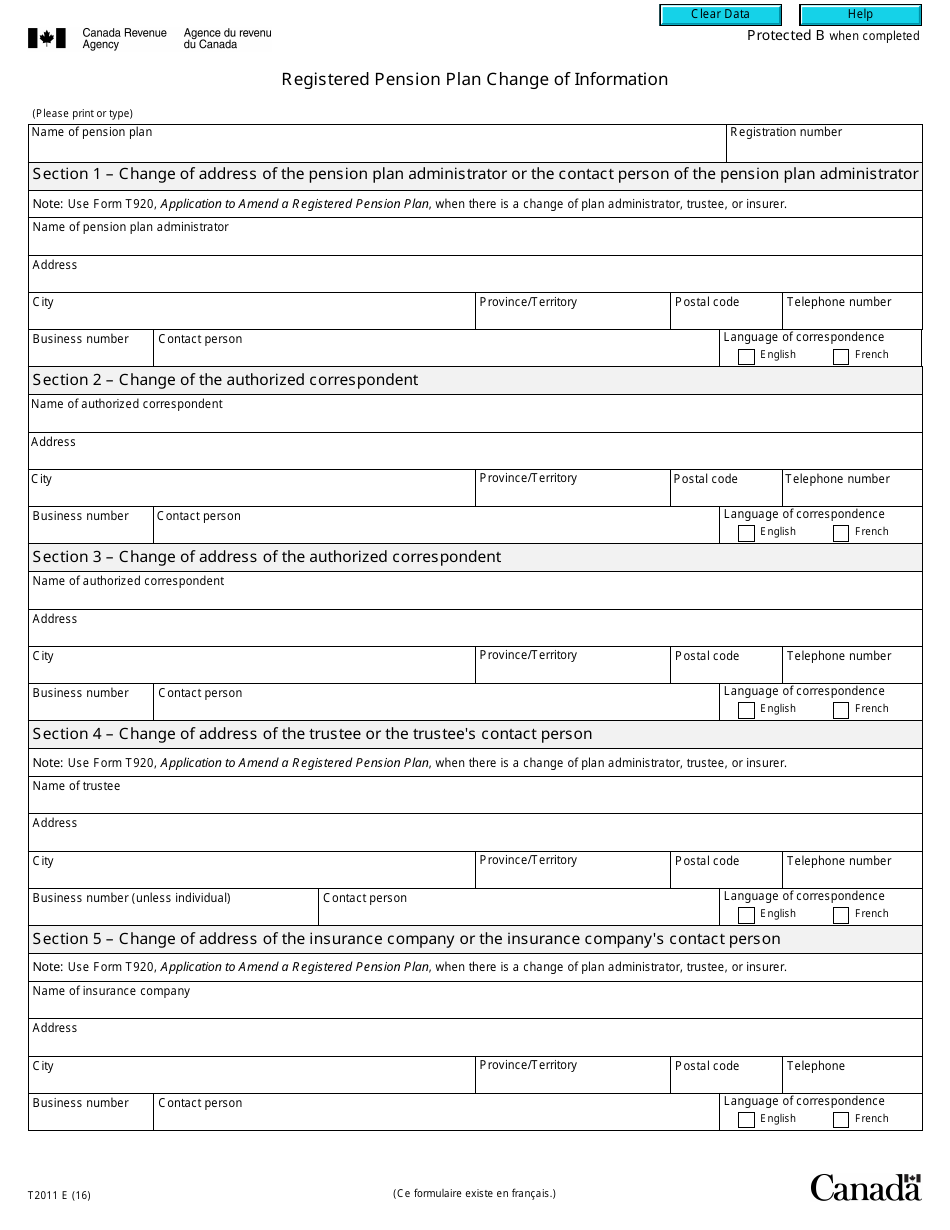

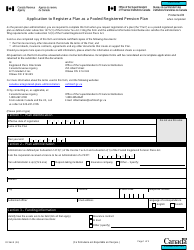

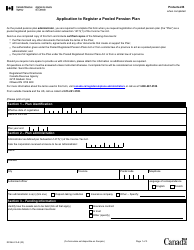

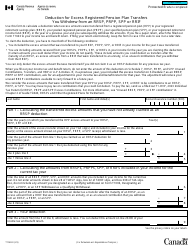

Form T2011 Registered Pension Plan Change of Information - Canada

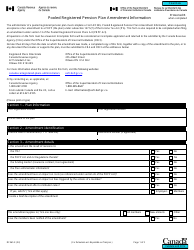

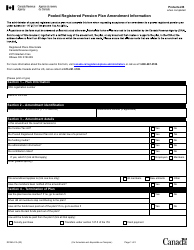

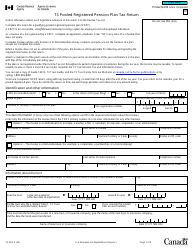

Form T2011 Registered Pension Plan Change of Information is used in Canada to notify the Canada Revenue Agency (CRA) about any changes or updates to a registered pension plan. It is important to keep the CRA informed of any changes such as plan administrators, contact information, plan amendments, or other important details to ensure compliance with tax regulations.

The employer or the plan administrator typically files the Form T2011 Registered Pension Plan Change of Information in Canada.

FAQ

Q: What is Form T2011?

A: Form T2011 is a form used in Canada for making changes to a registered pension plan.

Q: Who needs to fill out Form T2011?

A: Plan administrators or registered pension plan providers need to fill out Form T2011.

Q: What changes can be made using Form T2011?

A: Form T2011 can be used to report changes in the information related to a registered pension plan, such as changes in plan administrator, plan termination, or plan merger.

Q: Are there any fees associated with filing Form T2011?

A: No, there are no fees associated with filing Form T2011.

Q: Do I need to submit any supporting documents with Form T2011?

A: No, supporting documents are not required to be submitted with Form T2011. However, the CRA may request additional information if needed.