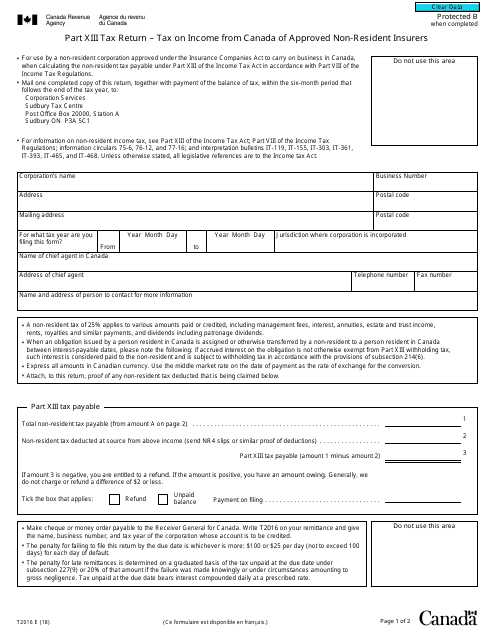

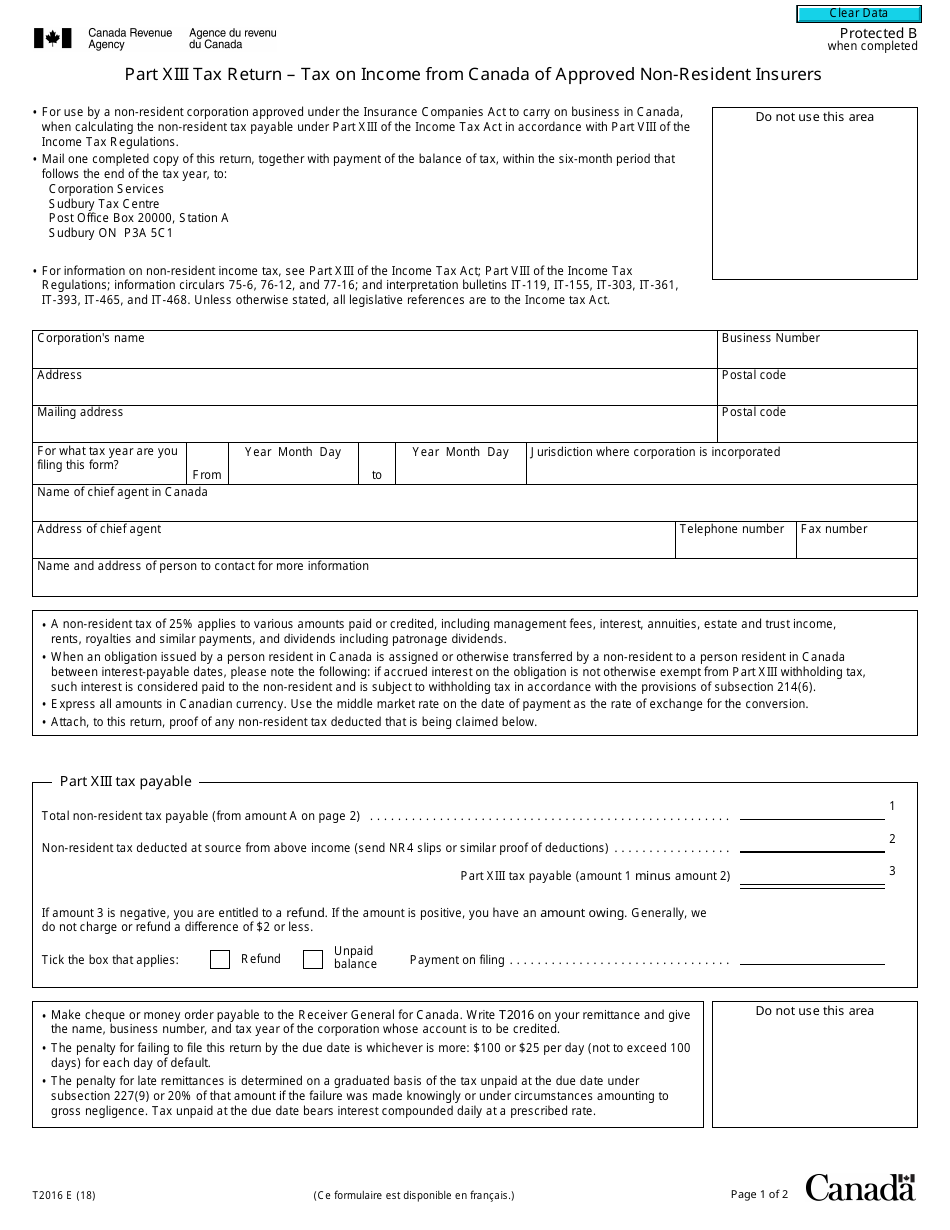

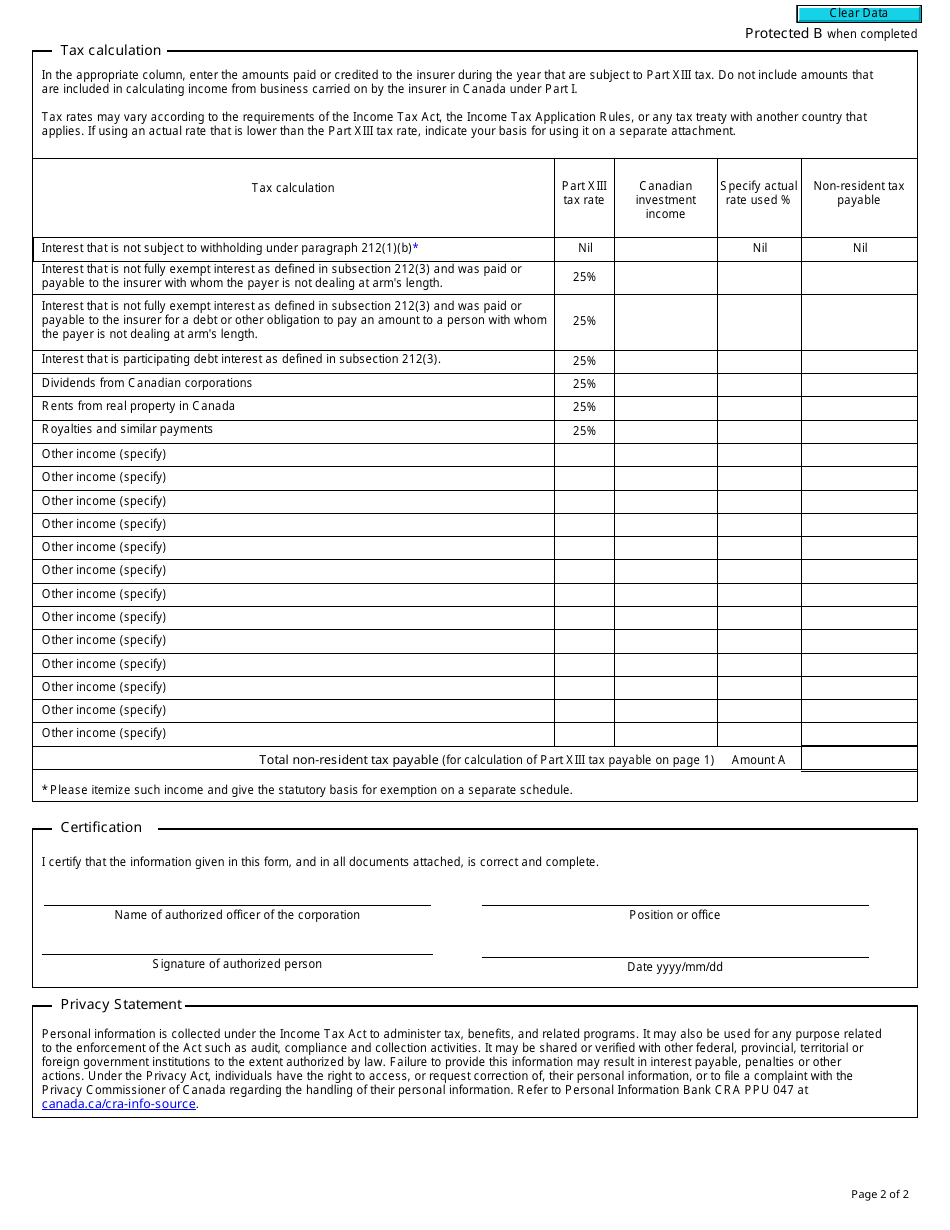

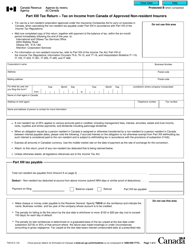

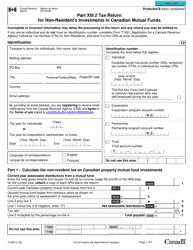

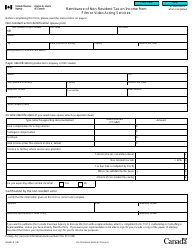

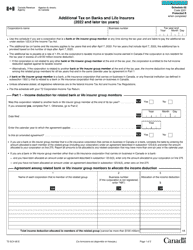

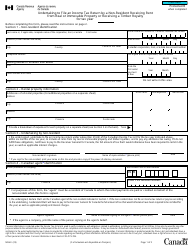

Form T2016 Part XIII Tax on Income From Canada of Approved Non-resident Insurers - Canada

Form T2016 or the "Form T2016 Part Xiii "tax On Income From Canada Of Approved Non-resident Insurers" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2016 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2016?

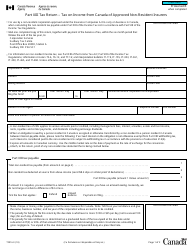

A: Form T2016 is a form used by approved non-resident insurers to report and pay tax on income earned in Canada.

Q: Who needs to file Form T2016?

A: Approved non-resident insurers who earn income in Canada are required to file Form T2016.

Q: What is Part XIII tax?

A: Part XIII tax is a tax imposed on non-resident insurers for income earned in Canada.

Q: What is an approved non-resident insurer?

A: An approved non-resident insurer is an insurer that meets certain criteria and has been approved by the Canada Revenue Agency.

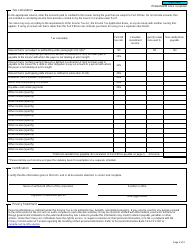

Q: What income is subject to Part XIII tax?

A: Part XIII tax applies to a variety of types of income earned by non-resident insurers in Canada, including premiums, profits, and interest.

Q: How is Part XIII tax calculated?

A: Part XIII tax is generally calculated at a flat rate of 15% on the gross amount of income subject to tax.

Q: When is Form T2016 due?

A: Form T2016 is due on or before the last day of the sixth month following the end of the insurer's tax year.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the requirements of Form T2016. It is important to file on time and meet all the necessary obligations.