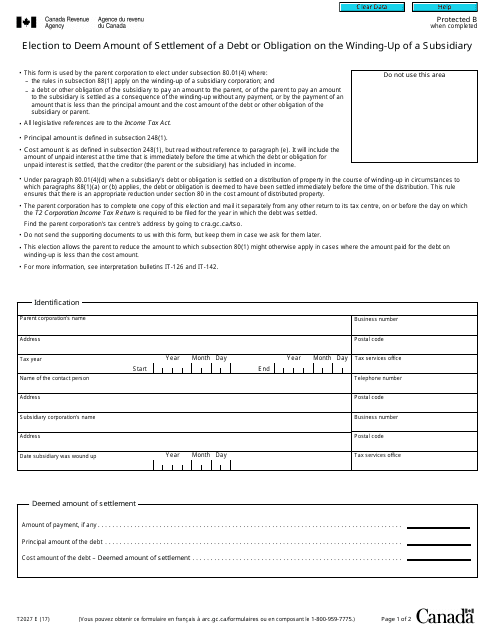

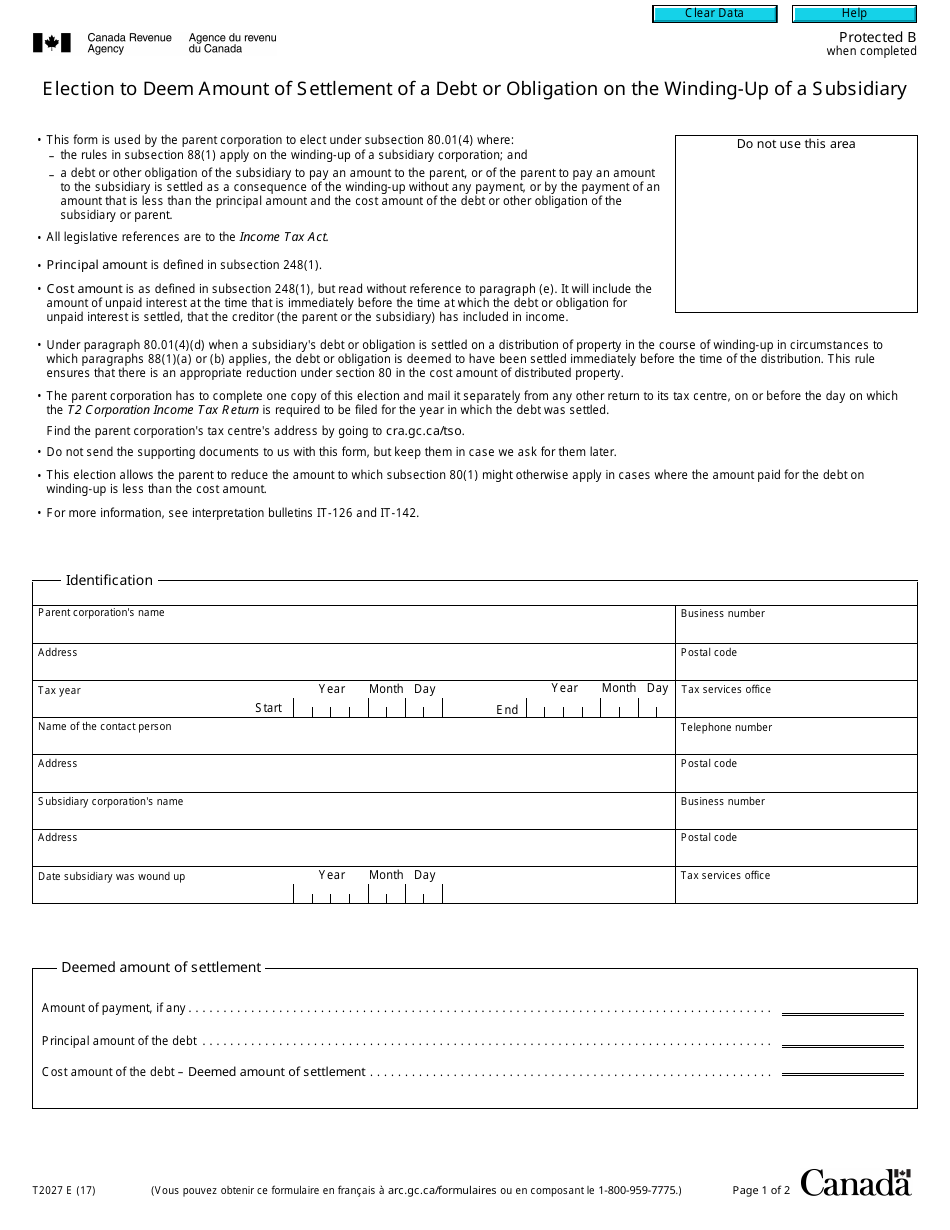

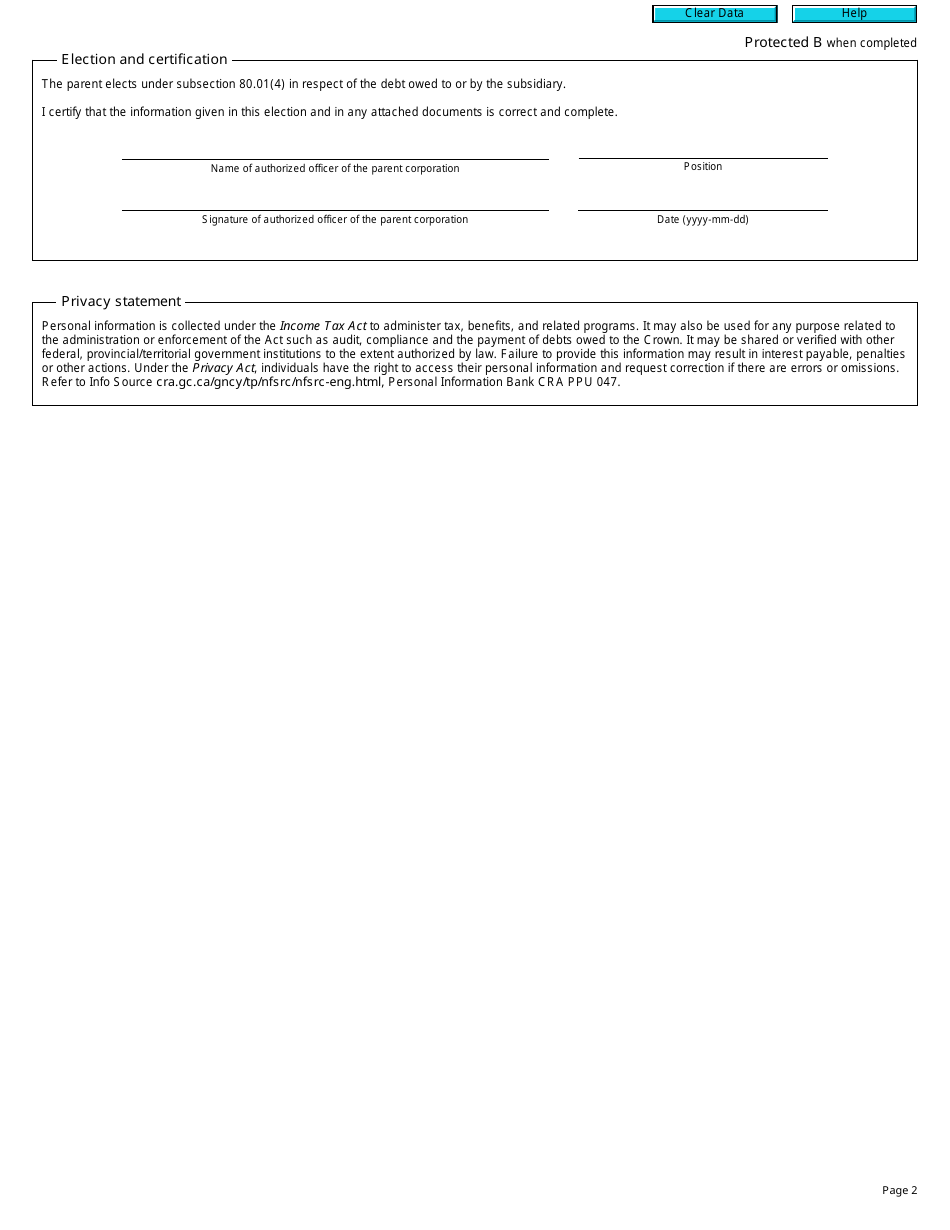

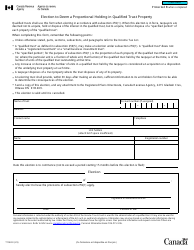

Form T2027 Election to Deem Amount of Settlement of a Debt or Obligation on the Winding-Up of a Subsidiary - Canada

Form T2027 is a Canadian Revenue Agency form also known as the "Form T2027 "election To Deem Amount Of Settlement Of A Debt Or Obligation On The Winding-up Of A Subsidiary" - Canada" . The latest edition of the form was released in January 1, 2017 and is available for digital filing.

Download an up-to-date Form T2027 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2027?

A: Form T2027 is a tax form in Canada used to elect to deem the amount of settlement of a debt or obligation on the winding-up of a subsidiary.

Q: When is Form T2027 used?

A: Form T2027 is used when a subsidiary is being wound up and there is a debt or obligation that needs to be settled.

Q: What does it mean to deem the amount of settlement?

A: Deeming the amount of settlement means treating it as if it had been settled for its fair market value.

Q: Who should use Form T2027?

A: Form T2027 should be used by taxpayers in Canada who are winding up a subsidiary and need to settle a debt or obligation.