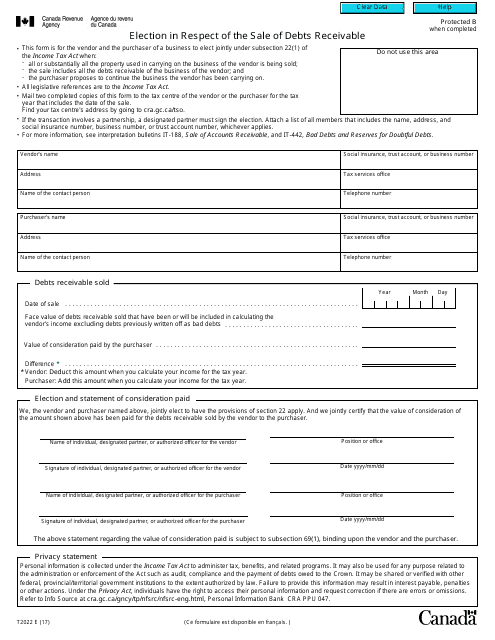

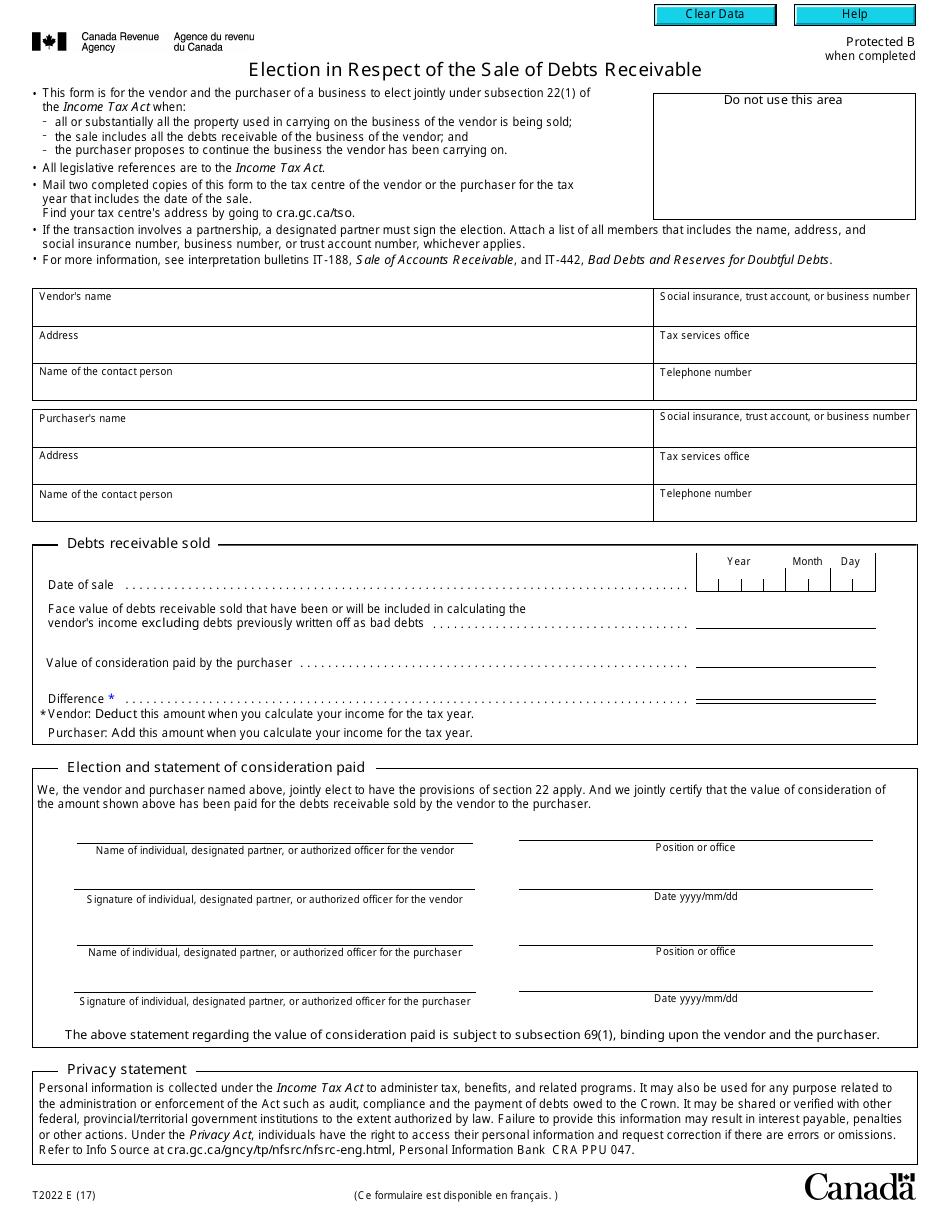

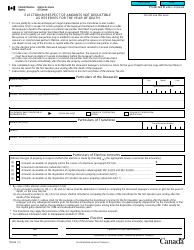

Form T2022 Election in Respect of the Sale of Debts Receivable - Canada

Form T2022 or the "Form T2022 "election In Respect Of The Sale Of Debts Receivable" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2017 and is available for digital filing. Download an up-to-date Form T2022 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2022?

A: Form T2022 is a form used in Canada in respect of the sale of debts receivable.

Q: What is the purpose of Form T2022?

A: The purpose of Form T2022 is to report the sale of debts receivable and calculate the eligible deductions.

Q: Who needs to file Form T2022?

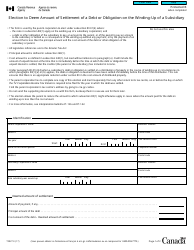

A: Anyone in Canada who has sold debts receivable needs to file Form T2022.

Q: When is Form T2022 due?

A: Form T2022 is due within six months after the end of the tax year in which the sale occurred.

Q: What information is required on Form T2022?

A: Form T2022 requires information such as the names and addresses of the buyer and seller, details of the debt sold, and the purchase price.

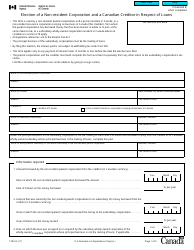

Q: Are there any eligible deductions for the sale of debts receivable?

A: Yes, there may be eligible deductions related to the sale of debts receivable. Form T2022 helps calculate these deductions.

Q: What happens if I don't file Form T2022?

A: Failure to file Form T2022 can result in penalties and fines imposed by the Canada Revenue Agency.

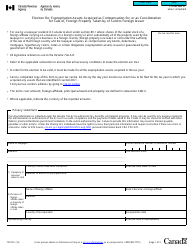

Q: Can I claim a tax credit for the sale of debts receivable?

A: No, the sale of debts receivable does not qualify for a tax credit, but it may result in eligible deductions.