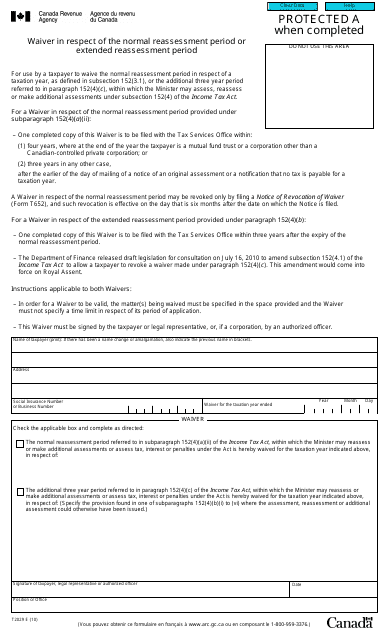

Form T2029 Waiver in Respect of the Normal Reassessment Period or Extended Reassessment Period - Canada

Form T2029 is a Canadian Revenue Agency form also known as the "Form T2029 "waiver In Respect Of The Normal Reassessment Period Or Extended Reassessment Period" - Canada" . The latest edition of the form was released in January 1, 2010 and is available for digital filing.

Download an up-to-date Form T2029 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2029?

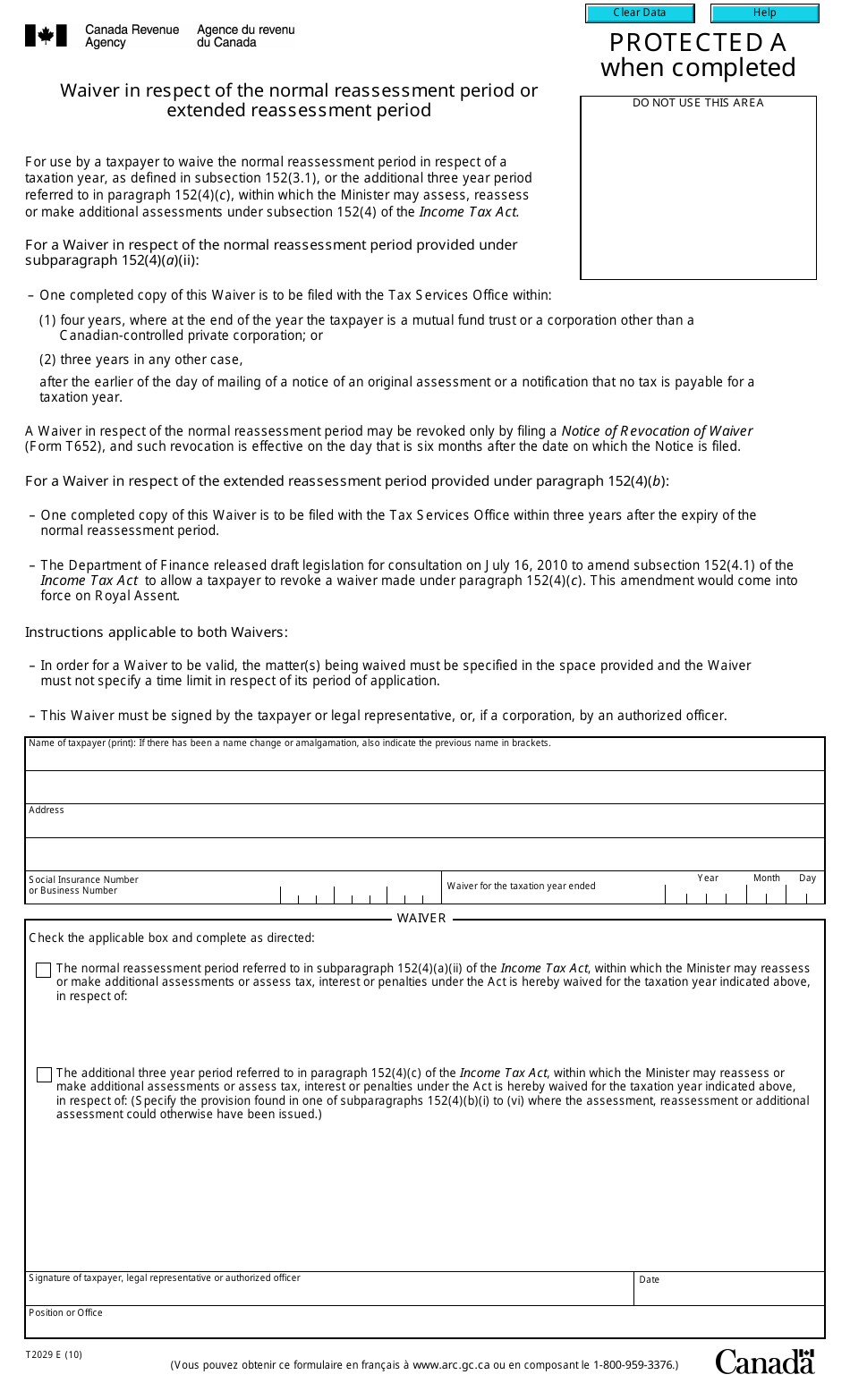

A: Form T2029 is a waiver in respect to the normal reassessment period or extended reassessment period in Canada.

Q: What does the normal reassessment period refer to?

A: The normal reassessment period is the timeframe during which the Canada Revenue Agency (CRA) can reassess a tax return without requiring a waiver.

Q: What is the extended reassessment period?

A: The extended reassessment period refers to the timeframe in which the CRA can reassess a tax return after the normal reassessment period has expired if a waiver is not signed.

Q: Why would someone need to complete Form T2029?

A: Someone may need to complete Form T2029 if they want to waive their rights to the normal reassessment period or extended reassessment period.