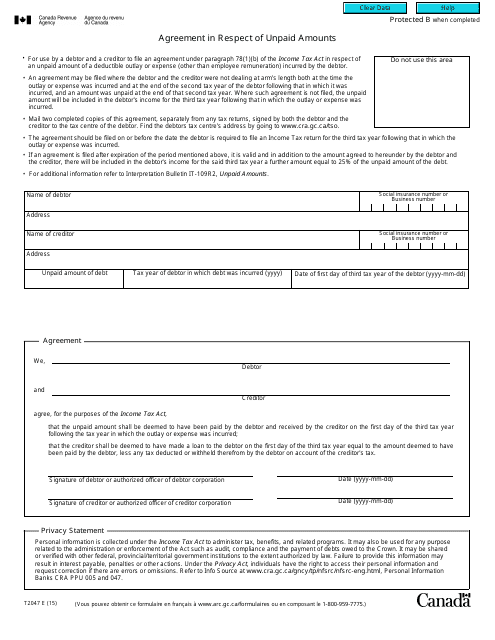

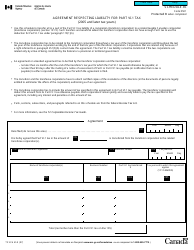

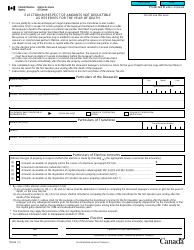

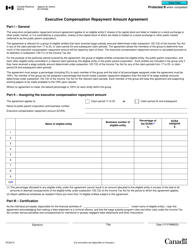

Form T2047 Agreement in Respect of Unpaid Amounts - Canada

Form T2047 or the "Form T2047 "agreement In Respect Of Unpaid Amounts" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2047 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2047?

A: Form T2047 is a form used in Canada to make an agreement in respect of unpaid amounts.

Q: Who needs to use Form T2047?

A: Anyone who wants to make an agreement in respect of unpaid amounts in Canada needs to use Form T2047.

Q: What is the purpose of Form T2047?

A: The purpose of Form T2047 is to formalize an agreement between a debtor and a creditor regarding unpaid amounts.

Q: What information is required on Form T2047?

A: Form T2047 requires information such as the names and addresses of the debtor and creditor, details of the unpaid amounts, and the terms of the agreement.

Q: Are there any fees associated with filing Form T2047?

A: No, there are no fees associated with filing Form T2047.

Q: Is Form T2047 mandatory?

A: Form T2047 is not mandatory, but it is recommended for parties who want to formalize their agreement in respect of unpaid amounts.

Q: What should I do with Form T2047 after completing it?

A: After completing Form T2047, you should keep a copy for your records and provide a copy to the other party involved in the agreement.