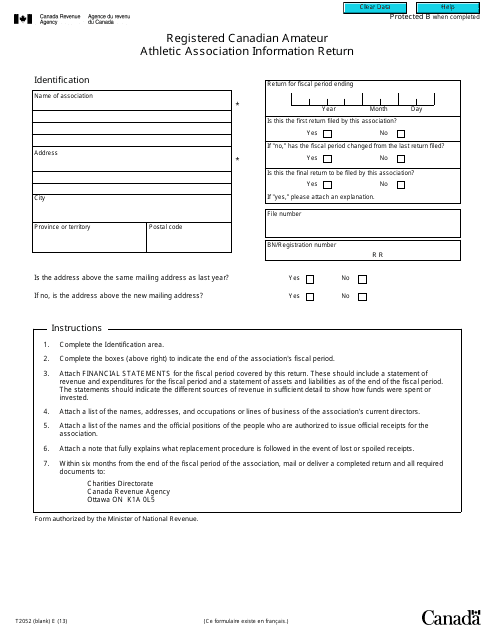

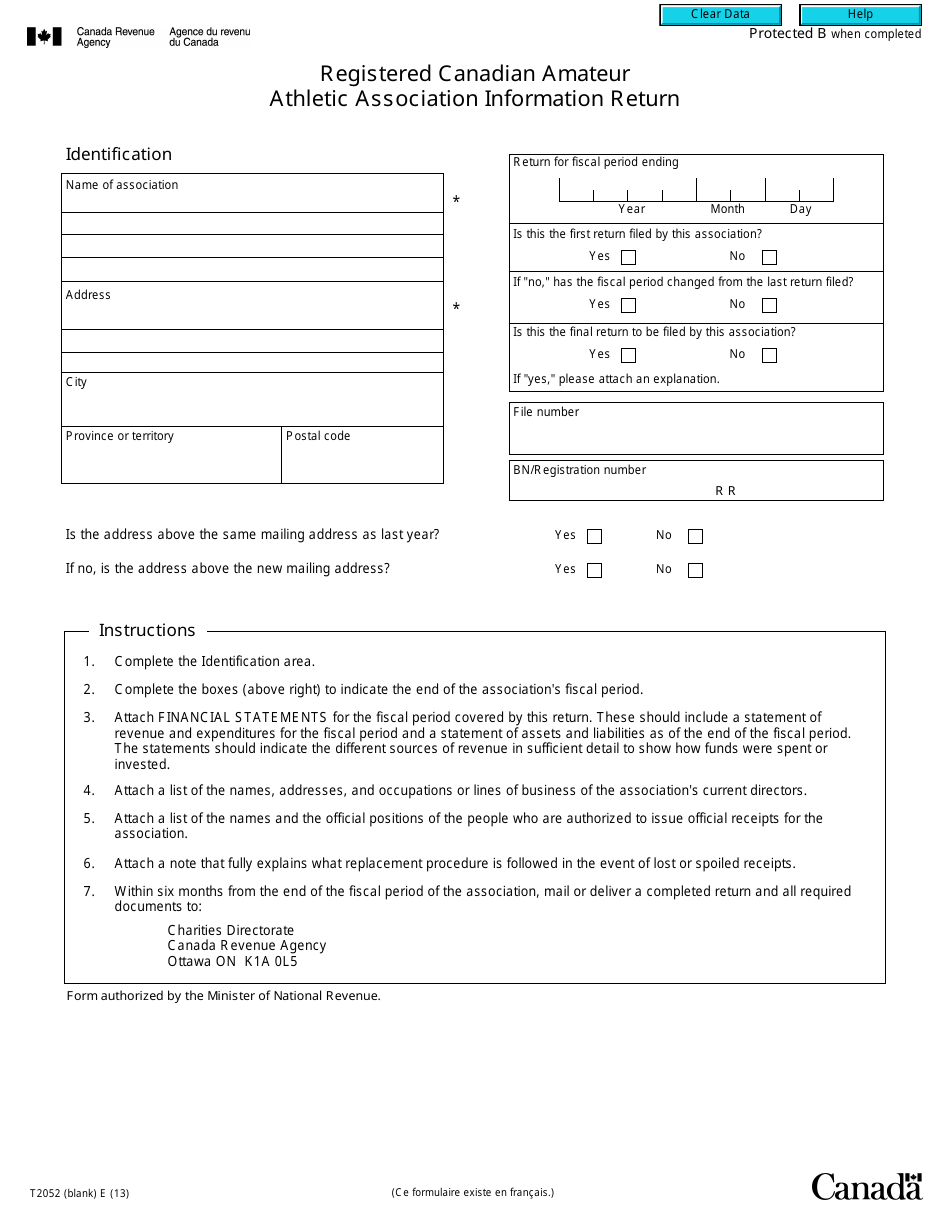

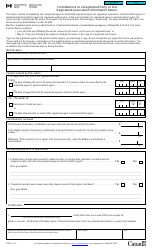

Form T2052 Registered Canadian Amateur Athletic Association Information Return - Canada

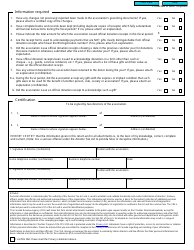

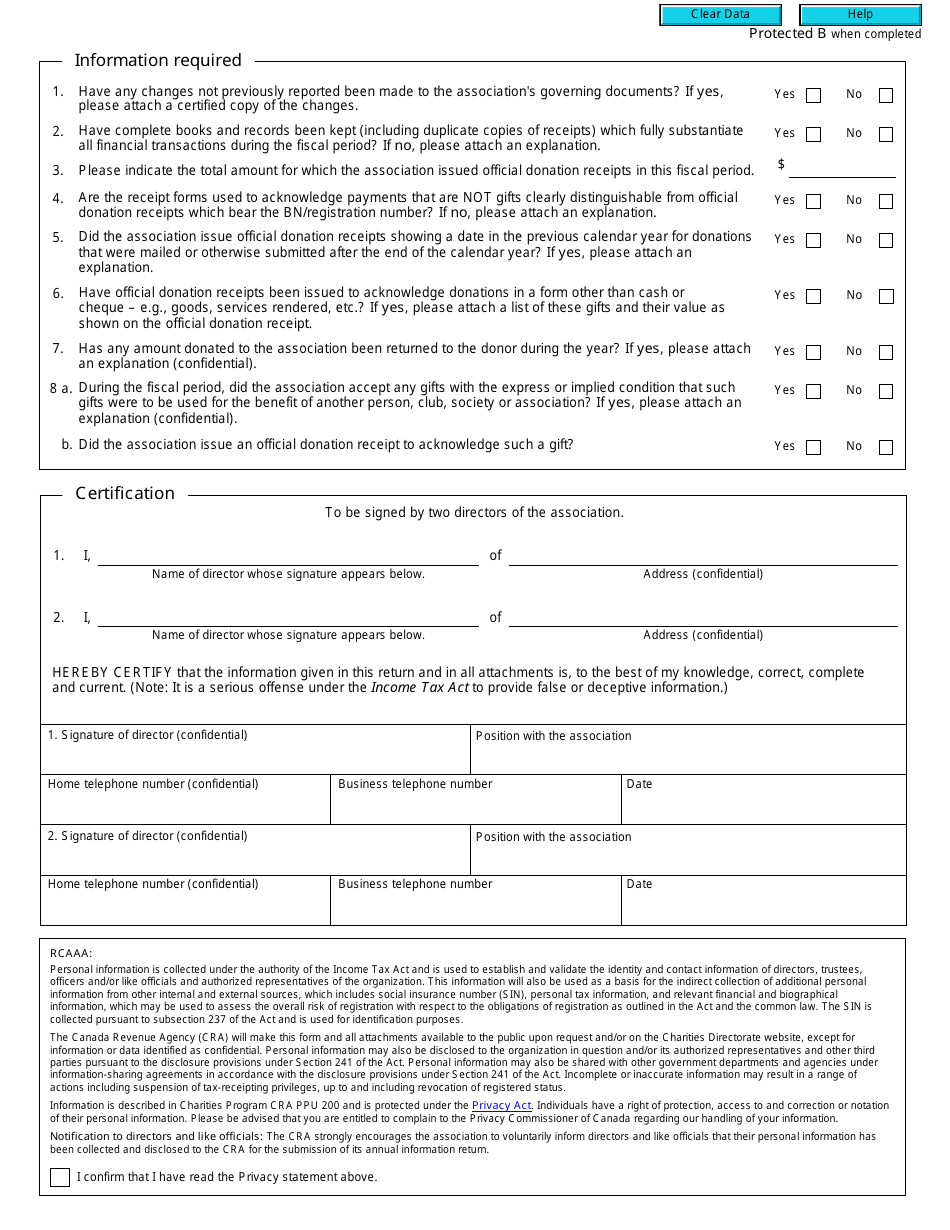

Form T2052 Registered Canadian Amateur Athletic Association Information Return is used by registered Canadian amateur athletic associations (RCAAAs) to provide information about their activities and finances to the Canada Revenue Agency (CRA). It helps the CRA determine whether an organization qualifies for tax-exempt status.

The Registered Canadian Amateur Athletic Association (RCAAA) is responsible for filing the Form T2052, which is the Information Return for registered RCAAA organizations in Canada.

FAQ

Q: What is Form T2052?

A: Form T2052 is the Registered Canadian Amateur Athletic Association Information Return.

Q: Who needs to file Form T2052?

A: Registered Canadian Amateur Athletic Associations need to file Form T2052.

Q: What is the purpose of Form T2052?

A: The purpose of Form T2052 is to provide information about the activities and financial affairs of a Registered Canadian Amateur Athletic Association.

Q: When is Form T2052 due?

A: Form T2052 is due within six months of the end of the association's fiscal period.