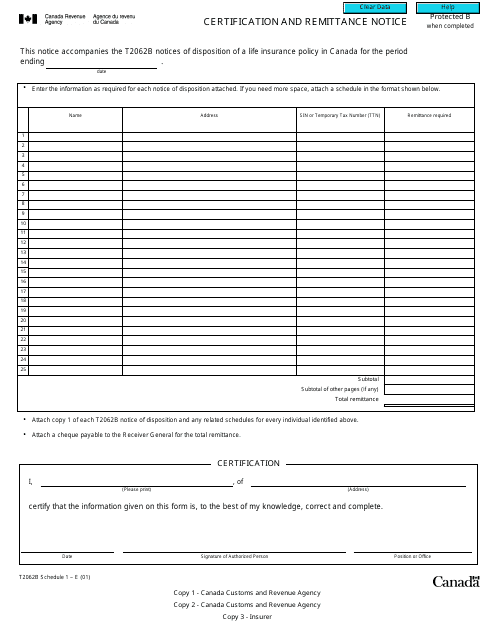

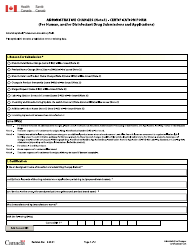

Form T2062B Schedule 1 Certification and Remittance Notice - Canada

Form T2062B is a Canadian Revenue Agency form also known as the "Form T2062b Schedule 1 "certification And Remittance Notice" - Canada" . The latest edition of the form was released in January 1, 2001 and is available for digital filing.

Download a PDF version of the Form T2062B down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2062B?

A: Form T2062B is a Schedule 1 Certification and Remittance Notice used in Canada.

Q: What is the purpose of Form T2062B?

A: The purpose of Form T2062B is to report the acquisition of Canadian property by a non-resident.

Q: Who needs to file Form T2062B?

A: Non-residents who acquire Canadian property need to file Form T2062B.

Q: What information is required on Form T2062B?

A: Form T2062B requires information about the non-resident, the Canadian property, and the purchase details.

Q: Is there a deadline for filing Form T2062B?

A: Yes, Form T2062B must be filed within 30 days after the acquisition of the Canadian property.

Q: Are there any fees associated with filing Form T2062B?

A: Yes, there is a fee for filing Form T2062B, which must be remitted with the form.

Q: Can Form T2062B be filed electronically?

A: Yes, Form T2062B can be filed electronically through the CRA's My Account service.

Q: What are the consequences of not filing Form T2062B?

A: Failure to file Form T2062B may result in penalties and interest charges.

Q: Is Form T2062B specific to non-residents acquiring property in Canada?

A: Yes, Form T2062B is specifically for non-residents acquiring property in Canada.