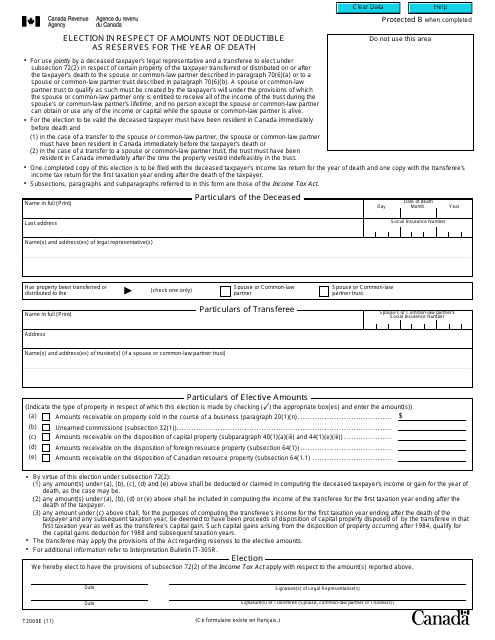

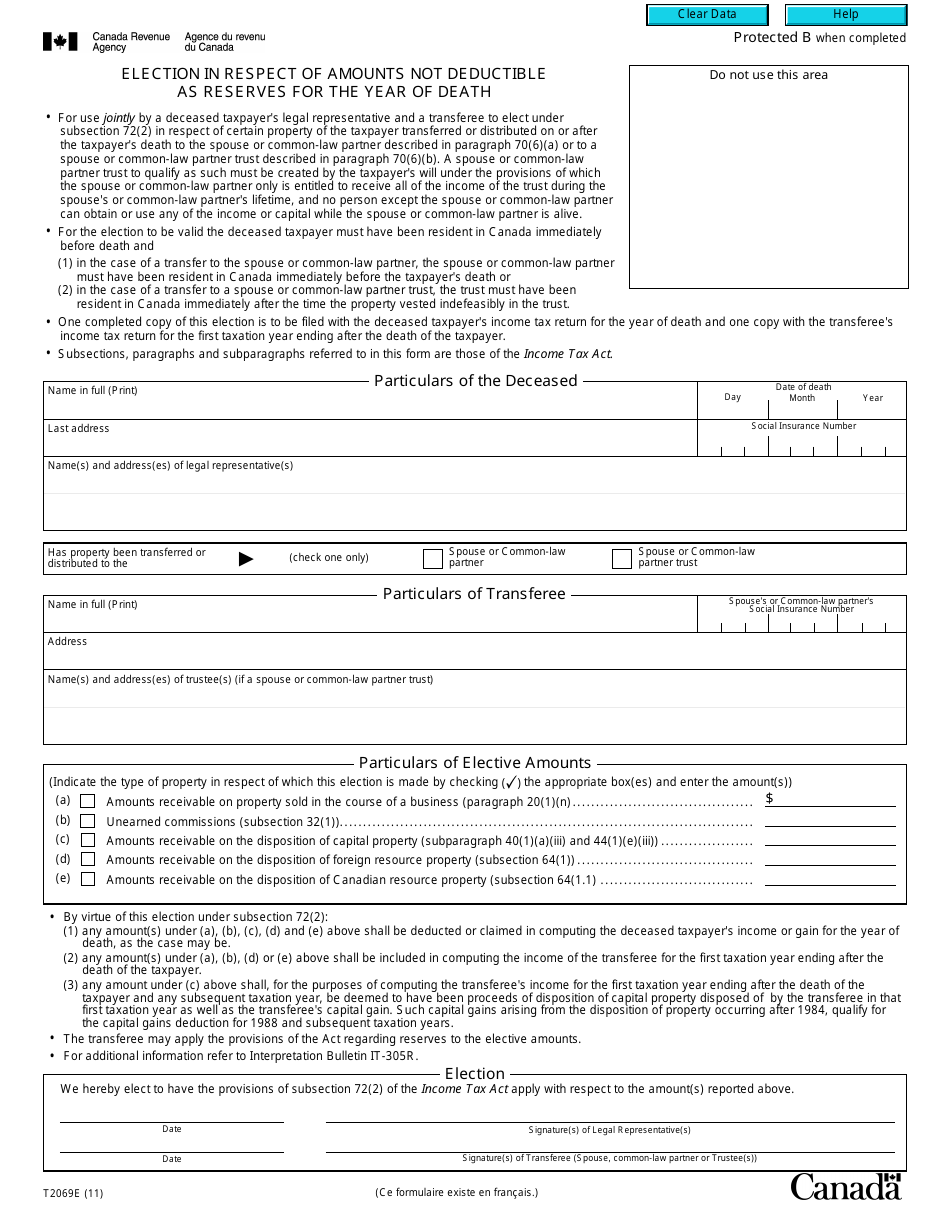

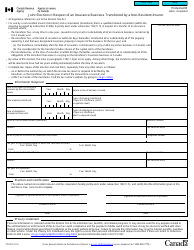

Form T2069 Election in Respect of Amounts Not Deductible as Reserves for the Year of Death - Canada

Form T2069 is a Canadian Revenue Agency form also known as the "Form T2069 "election In Respect Of Amounts Not Deductible As Reserves For The Year Of Death" - Canada" . The latest edition of the form was released in January 1, 2011 and is available for digital filing.

Download an up-to-date Form T2069 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2069?

A: Form T2069 is a tax form used in Canada.

Q: What does Form T2069 allow you to do?

A: Form T2069 allows you to make an election in respect of amounts not deductible as reserves for the year of death.

Q: Who needs to fill out Form T2069?

A: Individuals in Canada who have amounts not deductible as reserves for the year of their death may need to fill out Form T2069.

Q: What is the purpose of Form T2069?

A: The purpose of Form T2069 is to allow individuals to elect to include certain amounts in their income for the year of their death.

Q: Is Form T2069 mandatory?

A: No, Form T2069 is not mandatory. It is only required if you want to make an election in respect of amounts not deductible as reserves for the year of your death.

Q: Are there any deadlines for filing Form T2069?

A: Yes, Form T2069 must be filed within certain time limits specified by the CRA.

Q: Can I e-file Form T2069?

A: No, as of now, Form T2069 cannot be e-filed. It must be filed in paper format.

Q: Is there a fee to file Form T2069?

A: No, there is no fee to file Form T2069.

Q: What should I do if I have questions about Form T2069?

A: If you have questions about Form T2069, you can contact the CRA or consult a tax professional.