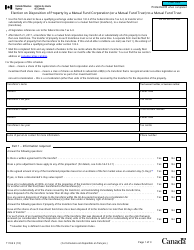

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2073

for the current year.

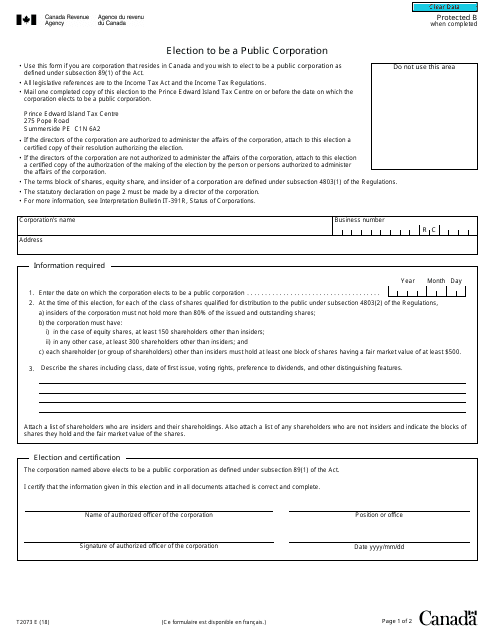

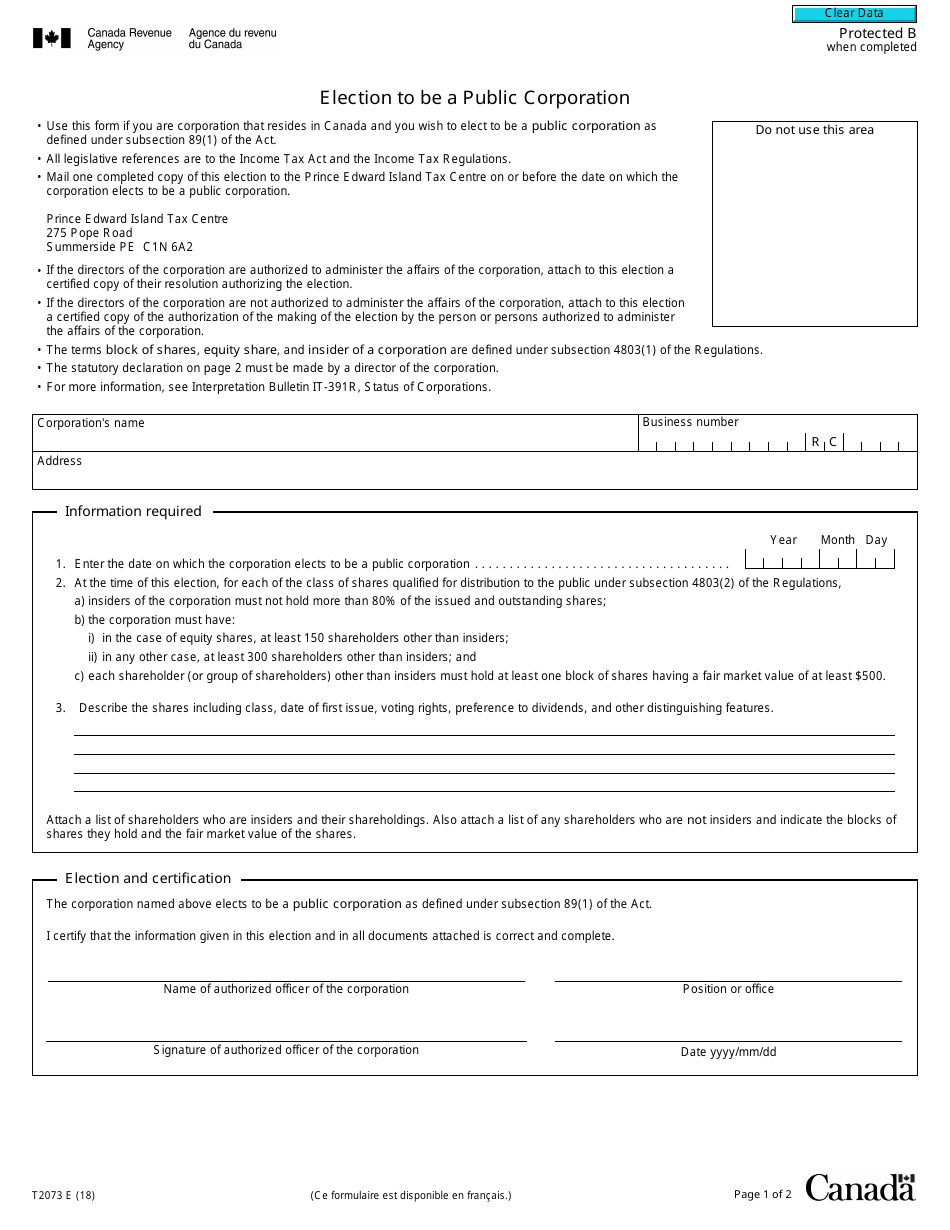

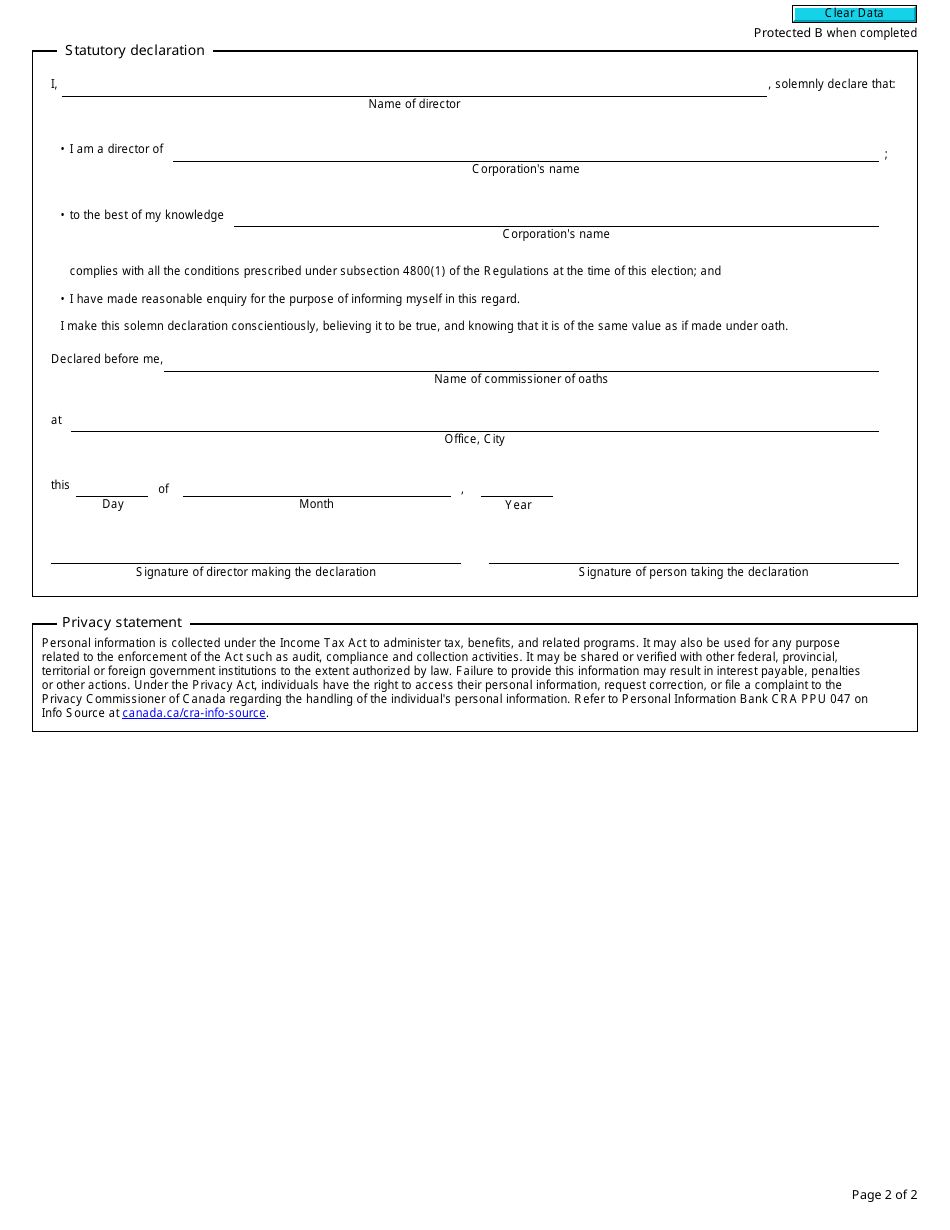

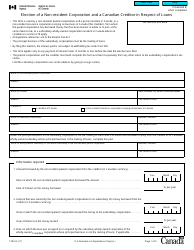

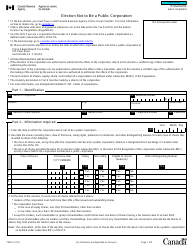

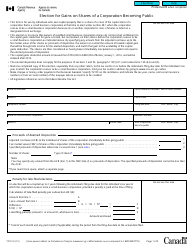

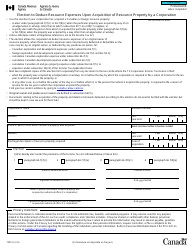

Form T2073 Election to Be a Public Corporation - Canada

Form T2073 or the "Form T2073 "election To Be A Public Corporation" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2018 and is available for digital filing. Download an up-to-date Form T2073 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

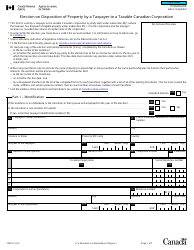

Q: What is Form T2073?

A: Form T2073 is an election form for individuals or partnerships in Canada to convert to a public corporation.

Q: Who can use Form T2073?

A: Individuals or partnerships in Canada who want to convert to a public corporation can use Form T2073.

Q: What is the purpose of Form T2073?

A: The purpose of Form T2073 is to allow individuals or partnerships to elect to be treated as a public corporation for tax purposes.

Q: What information is required on Form T2073?

A: Form T2073 requires information such as the name of the individual or partnership, business number, and details of the election.

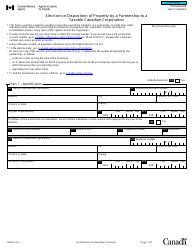

Q: Are there any deadlines for filing Form T2073?

A: Yes, there are deadlines for filing Form T2073. The election must generally be filed within the time limit for the individual or partnership's income tax return for the tax year.

Q: Are there any fees associated with filing Form T2073?

A: No, there are no fees associated with filing Form T2073.

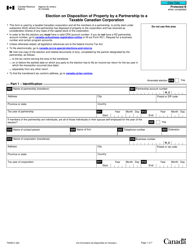

Q: Can I make changes to the election after filing Form T2073?

A: Generally, once the election is made using Form T2073, it cannot be changed or revoked.