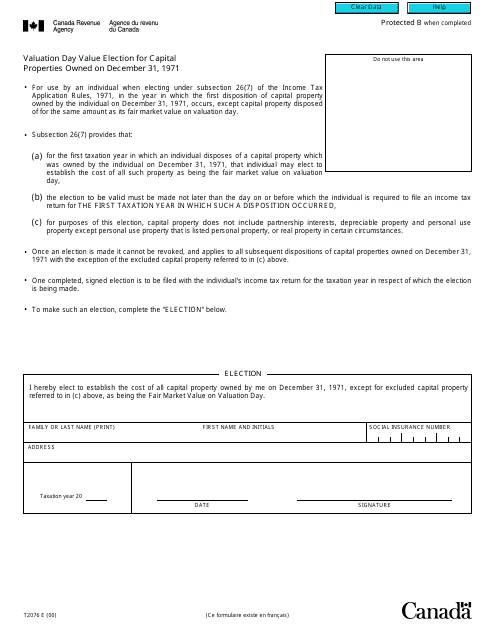

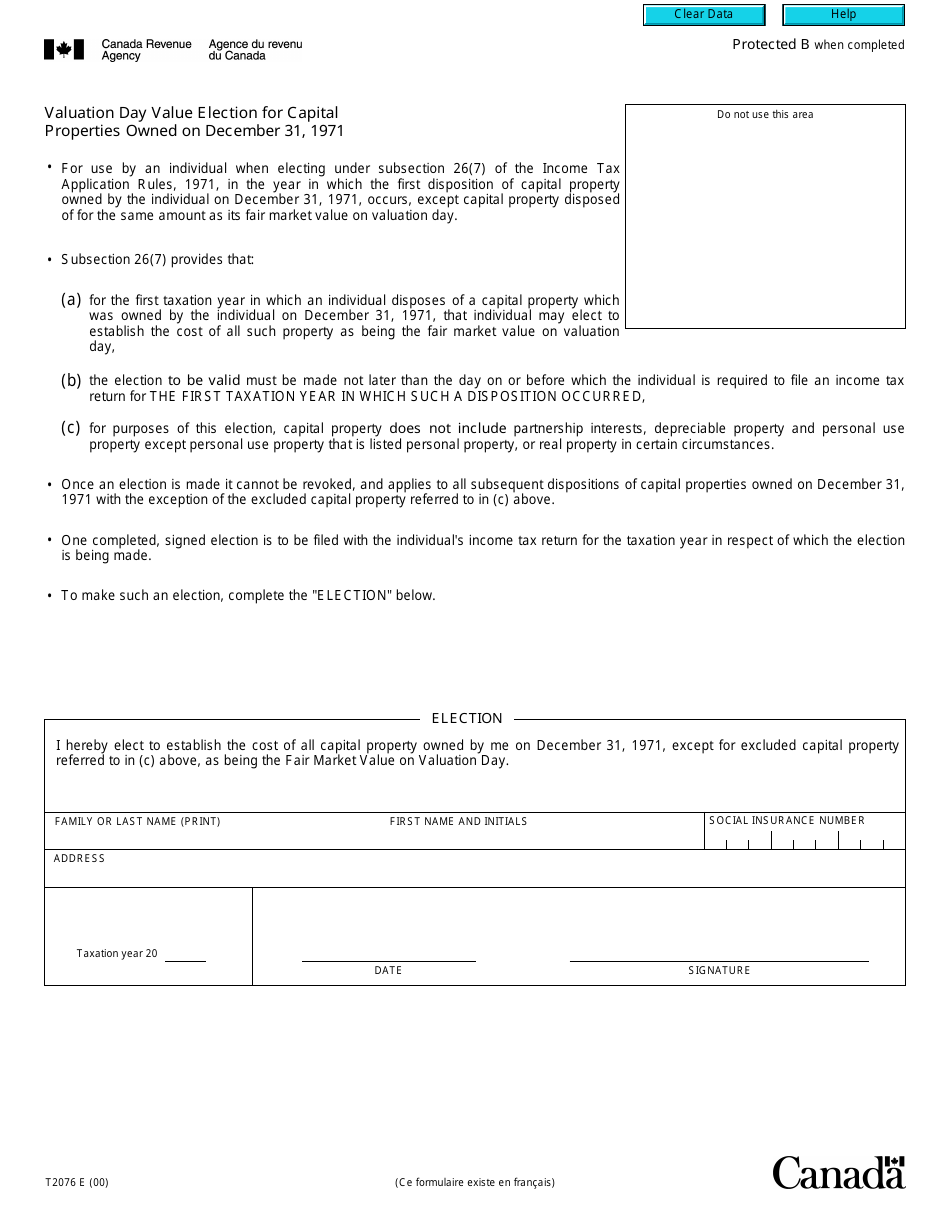

Form T2076 Valuation Day Value Election for Capital Properties Owned on December 31, 1971 - Canada

Form T2076 is a Canadian Revenue Agency form also known as the "Form T2076 "valuation Day Value Election For Capital Properties Owned On December 31, 1971" - Canada" . The latest edition of the form was released in January 1, 2000 and is available for digital filing.

Download an up-to-date Form T2076 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2076?

A: Form T2076 is the Valuation Day Value Election for Capital Properties Owned on December 31, 1971 in Canada.

Q: What is the purpose of Form T2076?

A: The purpose of Form T2076 is to elect to use the 1971 fair market value as the cost of capital properties for tax purposes.

Q: Who needs to fill out Form T2076?

A: Individuals or corporations who owned capital properties in Canada on December 31, 1971 and want to elect to use the 1971 fair market value as the cost for tax purposes need to fill out Form T2076.

Q: When should Form T2076 be filed?

A: Form T2076 should be filed within the prescribed time limit, which is usually the due date of your income tax return for the year in which you dispose of the property.

Q: What information is required on Form T2076?

A: On Form T2076, you will need to provide information such as your name, address, social insurance number or business number, and details about the capital property for which you are electing the valuation day value.

Q: Are there any penalties for not filing Form T2076?

A: Yes, there can be penalties for not filing Form T2076 or for filing it late. It is important to file the form within the prescribed time limit to avoid any penalties or potential tax issues.