This version of the form is not currently in use and is provided for reference only. Download this version of

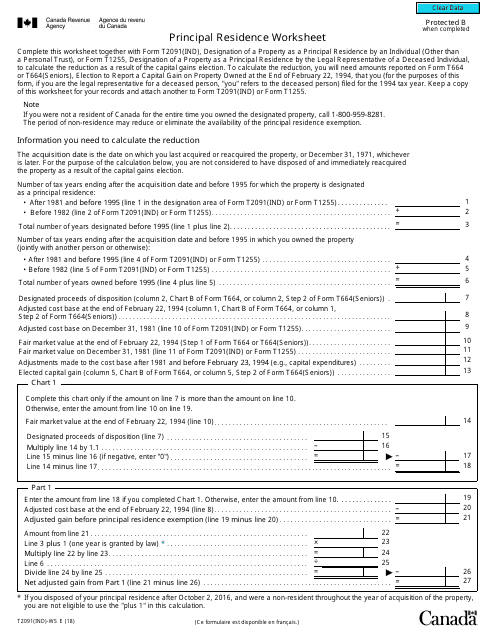

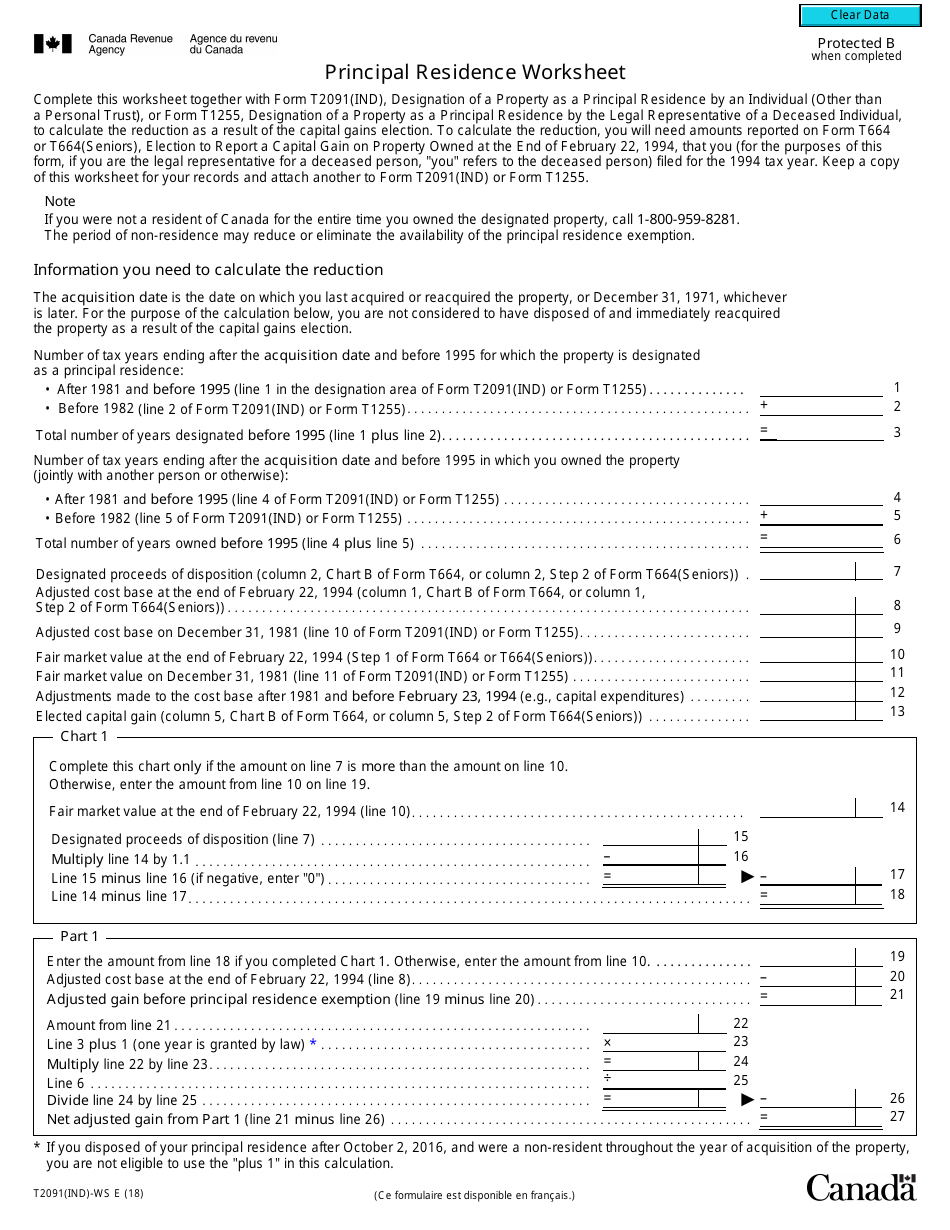

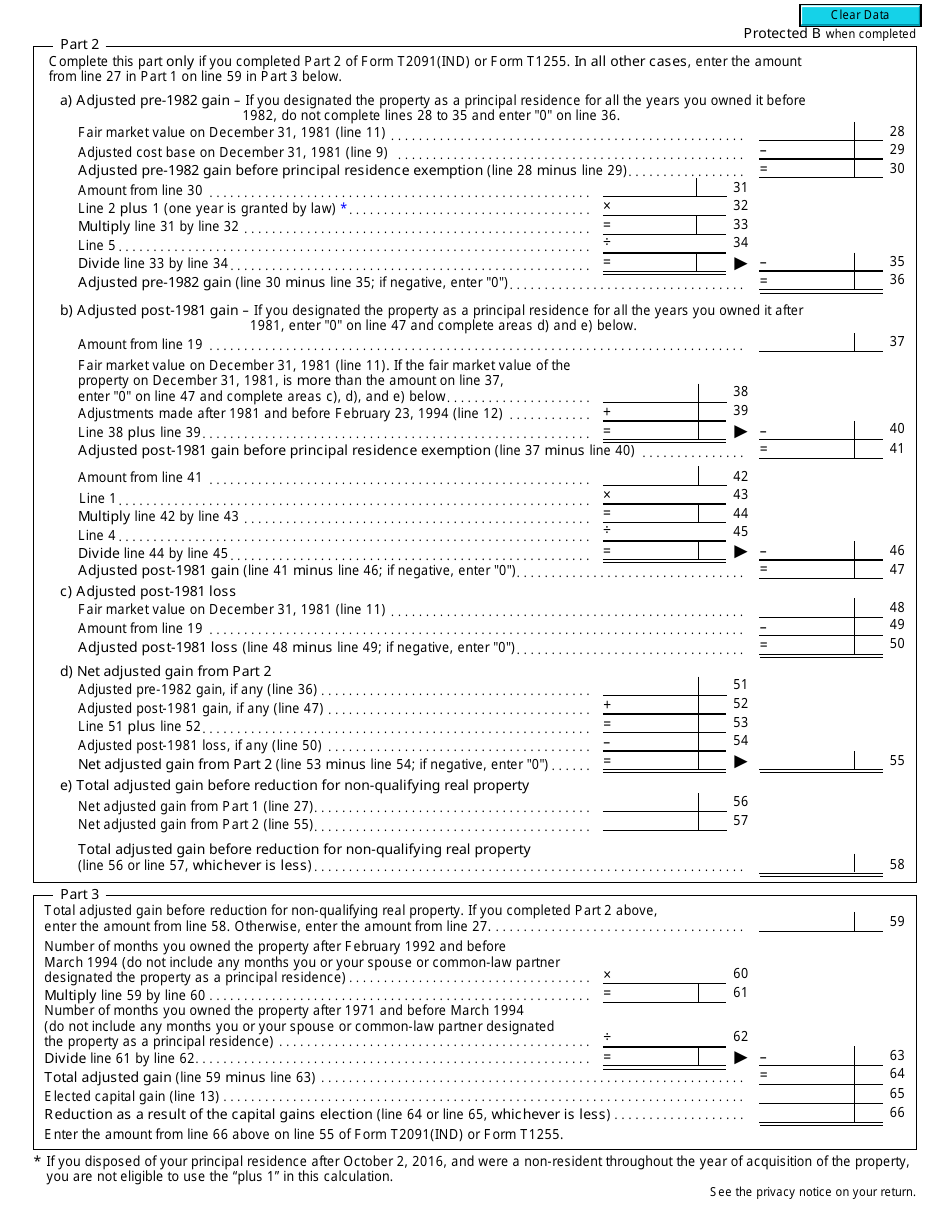

Form T2091(IND)-WS

for the current year.

Form T2091(IND)-WS Principal Residence Worksheet - Canada

Form T2091(IND)-WS or the "Form T2091(ind)-ws "principal Residence Worksheet" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2018 and is available for digital filing. Download an up-to-date Form T2091(IND)-WS in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2091(IND)-WS?

A: Form T2091(IND)-WS is a worksheet used in Canada to calculate the principal residence exemption for tax purposes.

Q: What is the principal residence exemption?

A: The principal residence exemption is a tax provision that allows Canadian residents to claim an exemption on the capital gains from the sale of their principal residence.

Q: Who needs to fill out Form T2091(IND)-WS?

A: Canadian residents who are selling their principal residence need to fill out Form T2091(IND)-WS.

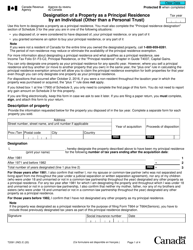

Q: What information is required on Form T2091(IND)-WS?

A: Form T2091(IND)-WS requires information about the property, including the address, the purchase price, the sale price, and any improvements made to the property.

Q: When should Form T2091(IND)-WS be filed?

A: Form T2091(IND)-WS should be filed when a Canadian resident sells their principal residence and wants to claim the principal residence exemption.

Q: What happens if Form T2091(IND)-WS is not filed?

A: If Form T2091(IND)-WS is not filed, the taxpayer may lose out on the opportunity to claim the principal residence exemption and may be subject to capital gains tax on the sale of their principal residence.

Q: Is Form T2091(IND)-WS only for Canadian residents?

A: Yes, Form T2091(IND)-WS is specifically for Canadian residents.

Q: Can I claim the principal residence exemption for multiple properties?

A: No, the principal residence exemption can only be claimed for one property per tax year.

Q: Is there a deadline to file Form T2091(IND)-WS?

A: Form T2091(IND)-WS should be filed within the prescribed deadline for filing income tax returns in Canada.